Texas Application For Reinstatement And Request To Set Aside Tax Forfeiture

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Application For Reinstatement And Request To Set Aside Tax Forfeiture?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are checked by our specialists. So if you need to prepare Texas Application For Reinstatement And Request To Set Aside Tax Forfeiture, our service is the best place to download it.

Getting your Texas Application For Reinstatement And Request To Set Aside Tax Forfeiture from our library is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the proper template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Application For Reinstatement And Request To Set Aside Tax Forfeiture and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

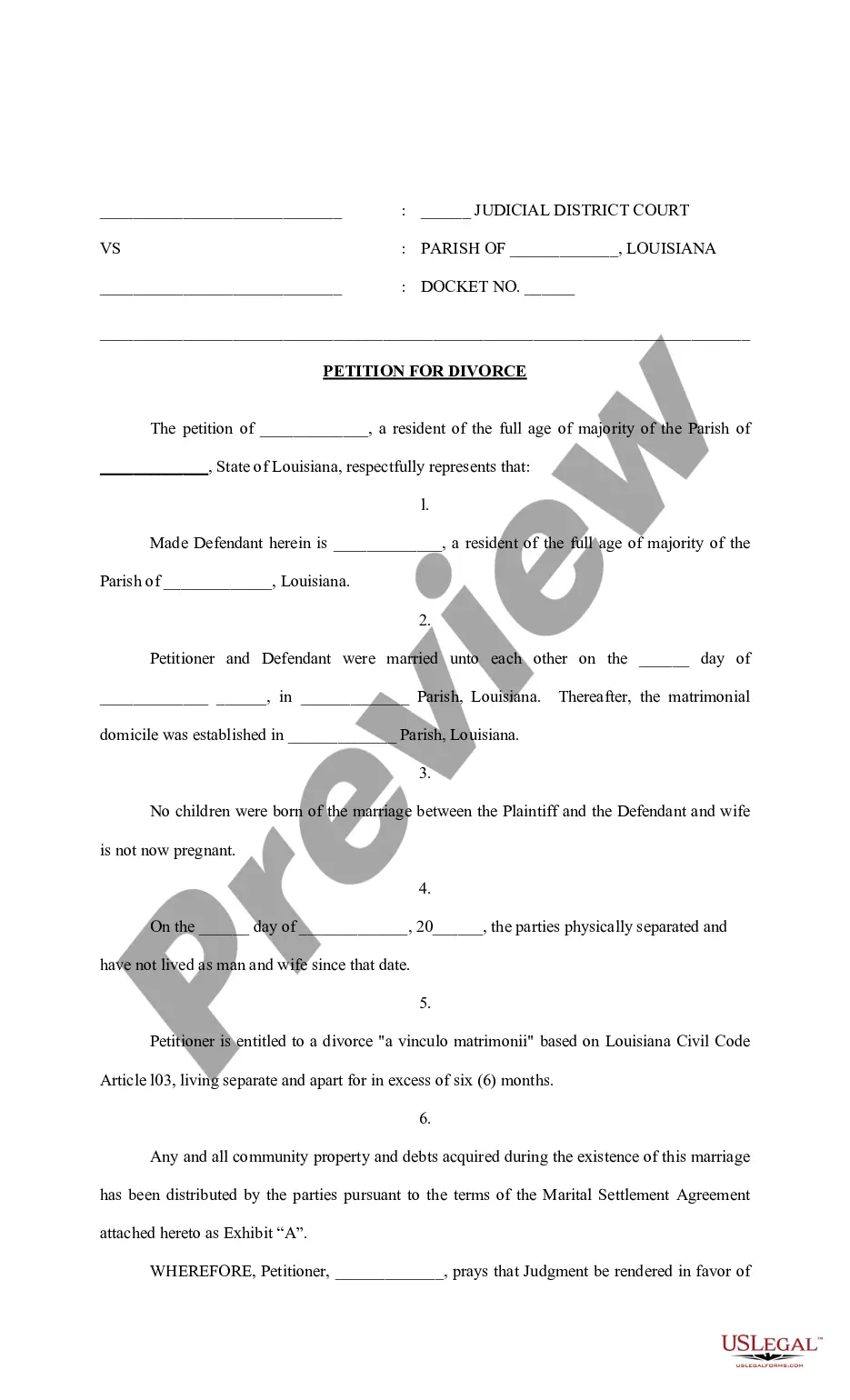

The Secretary of State may terminate an entity's existence if it fails to pay all required fees, or for failure to have a registered agent or registered office, Texas Business and Organizations Code, Section 11.251.

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb),

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb),

Within 120 days of the date of notice of forfeiture of privileges. § 171.252(1) states that a taxable entity that has forfeited its right to transact business is denied the right to sue or defend in a court in this state.

The Comptroller is required by law to forfeit a company's right to transact business in Texas if the company has not filed a franchise tax report or paid a franchise tax required under Chapter 171.

Forfeited Existence - An inactive status indicating that the corporation or limited liability company failed to file its franchise tax return or to pay the tax due thereunder. Status is changed by secretary of state when certification of the delinquency is received from the comptroller of public accounts.

How long does it take the Texas SOS to reinstate an LLC? The Texas Secretary of State's office typically processes filings in 5-7 business days. Expedited filings are usually processed in 1-2 business days.

Under the Texas Tax Code, Section 171.301?. 3015, the State Comptroller may cause the involuntary forfeiture of an entity for failure to pay its franchise tax. Under Section 171.309, the Texas Secretary of State may also forfeit an entity's charter, certificate, or registration for the same purpose.