Texas Balloon Rider Mortgage Amendment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Balloon Rider Mortgage Amendment?

Get access to quality Texas Balloon Rider Mortgage Amendment samples online with US Legal Forms. Steer clear of days of misused time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Get around 85,000 state-specific authorized and tax samples that you can download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Texas Balloon Rider Mortgage Amendment you’re looking at is suitable for your state.

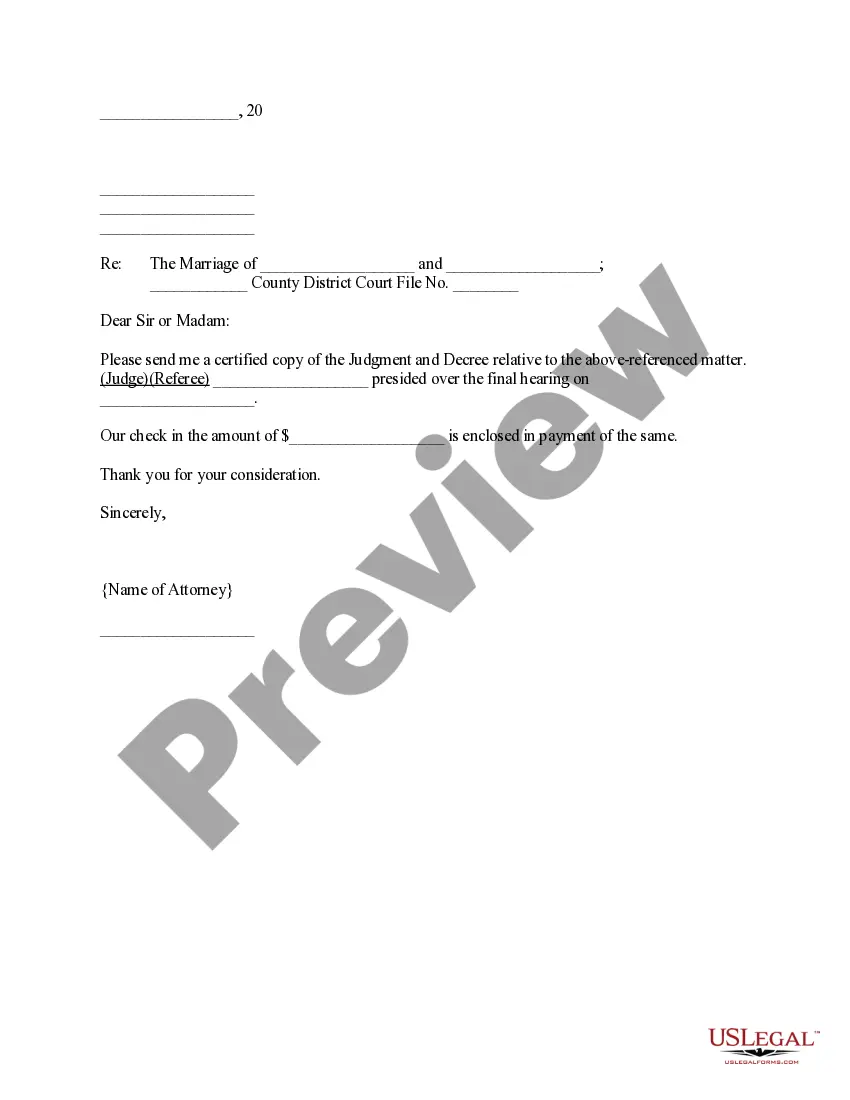

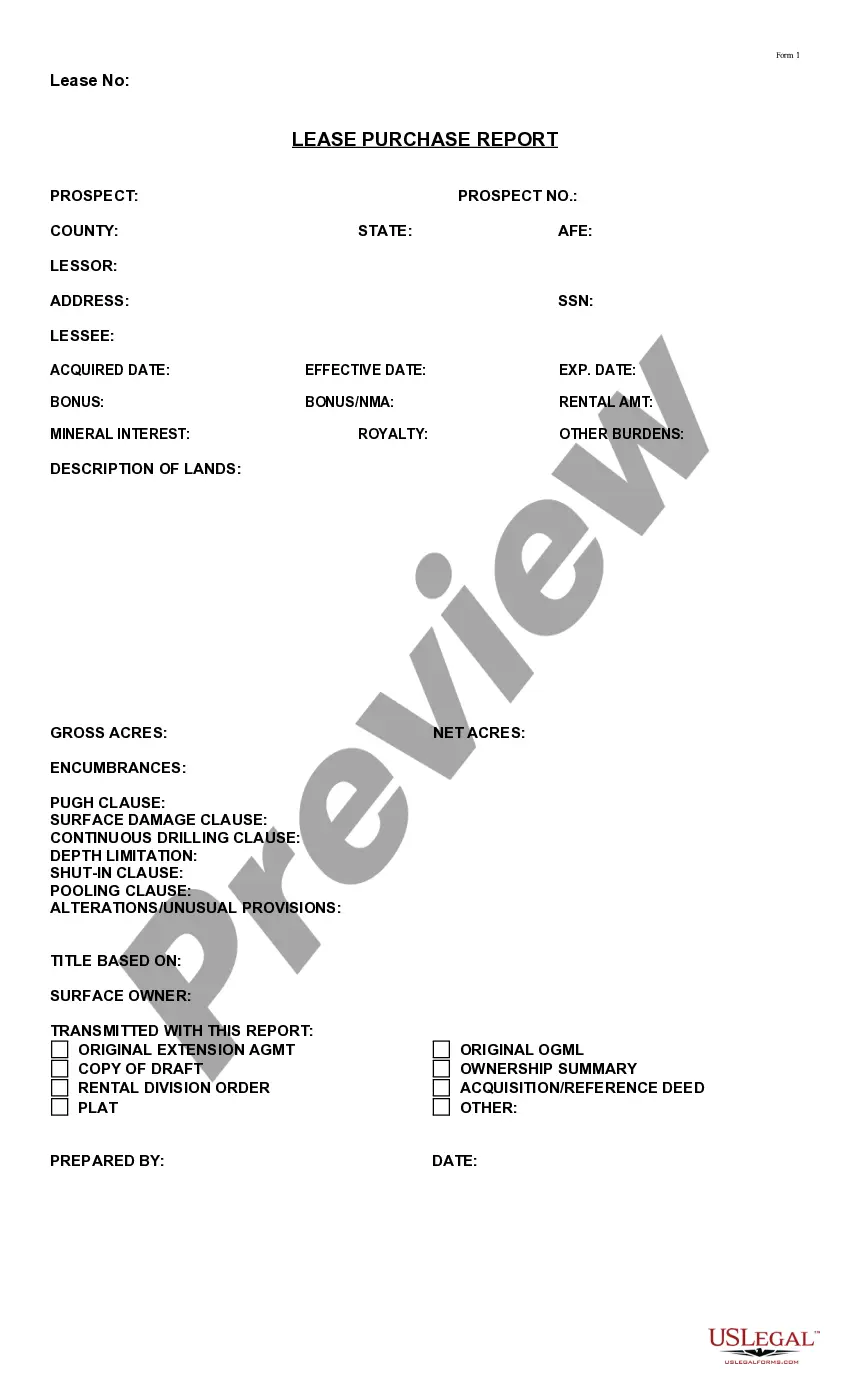

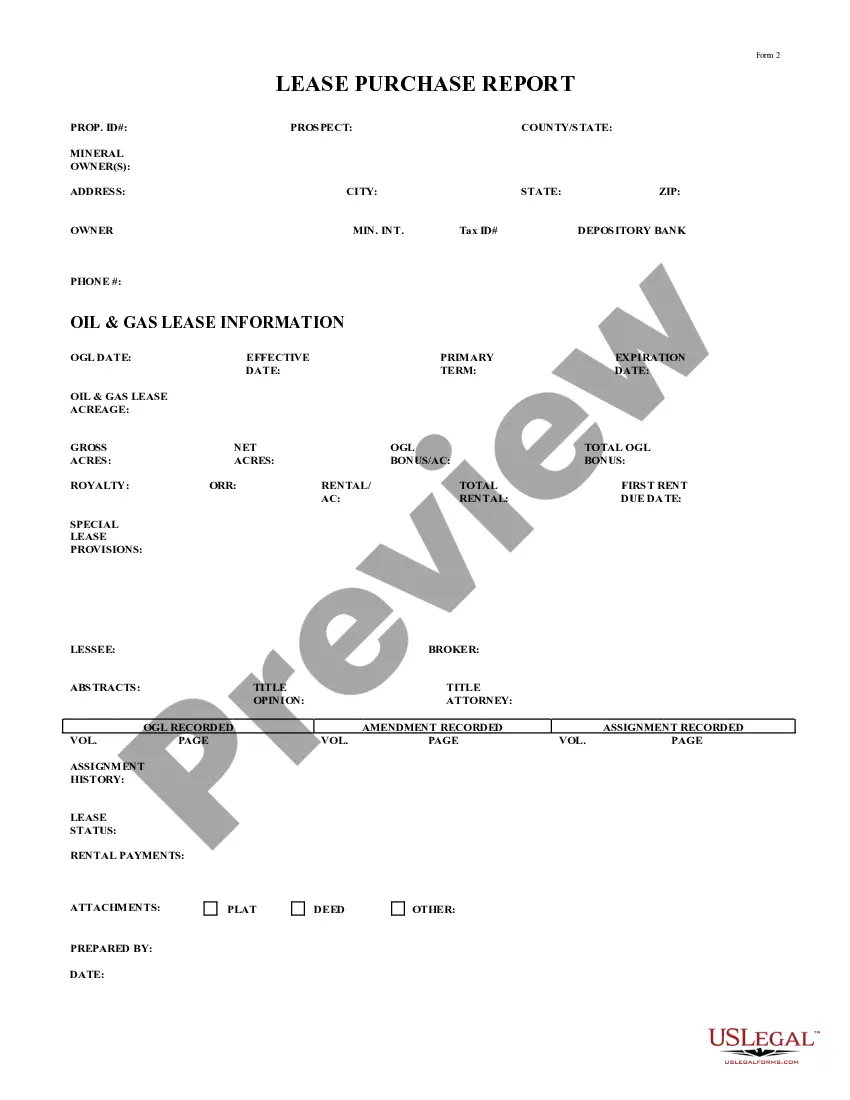

- See the form using the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish creating an account.

- Pick a preferred file format to download the document (.pdf or .docx).

You can now open the Texas Balloon Rider Mortgage Amendment template and fill it out online or print it out and do it yourself. Consider mailing the papers to your legal counsel to make sure things are filled in appropriately. If you make a error, print and complete sample once again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and access far more forms.

Form popularity

FAQ

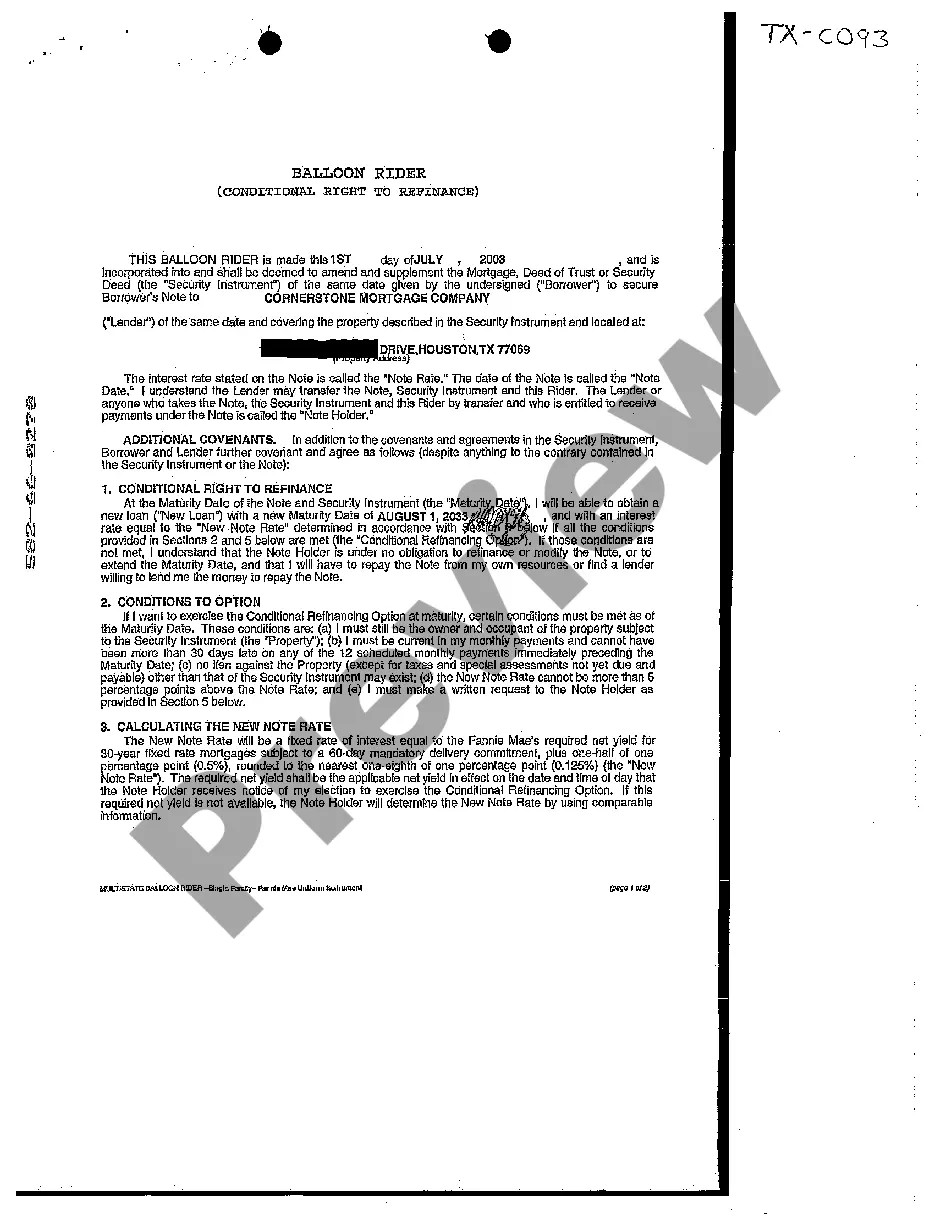

Balloon Riders If you can't afford to pay your final balloon mortgage balance, a balloon rider gives you the option to refinance or modify the mortgage instead and keep making monthly payments. If you use the balloon rider to refinance or modify the mortgage, you will have a new due date and interest rate.

Can you refinance a balloon mortgage? Thankfully, you can. And unless you're simply rolling in dough, you may be forced to refinance. A balloon mortgage is a home loan with a short term, often 5 - 7 years, after which the rest of the loan is due in one large payment, called a balloon payment.

Initially, interest rates on a balloon mortgage may end up being lower than comparable amortizing fixed or adjustable rate mortgages. If you combine that with the fact that you're paying either interest only or paying on a partially amortizing balance resulting in a lower payment, it sounds like a good deal.

A balloon mortgage is a loan that has an initial period of low or no monthly payments, at the end of which the borrower is required to pay off the full balance in a lump sum. The monthly payments, if any, may be interest-only and the interest rate offered is relatively low.

It is not uncommon for a consumer to be unable to pay the balloon payment when it is due.A balloon payment provision in a loan is not illegal per se. Federal and state legislatures have enacted various laws designed to protect consumers from being victimized by such a loan. The Federal TRUTH IN LENDING ACT (15U.

The biggest advantage of a balloon mortgage is it generally comes with lower interest rates, so you make smaller monthly mortgage payments. You also may qualify for a larger loan amount with a balloon mortgage than you would if you got an adjustable-rate or fixed-rate mortgage.

Simply put, a mortgage rider is an addition, also known as an addendum in legal terms, to a standard loan document. Riders are usually used when the mortgage has a non-standard feature.In short, the rider is used to highlight a unique or unusual loan feature to make sure you understand it.

A 1-4 Family Rider is typically used when the borrower purchases a rental property. The terms of this rider allow a lender to collect the property rent if you default on the loan. The rent the lender collects goes toward the outstanding loan balance.