Texas Deed in Lieu of Foreclosure

Form popularity

FAQ

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

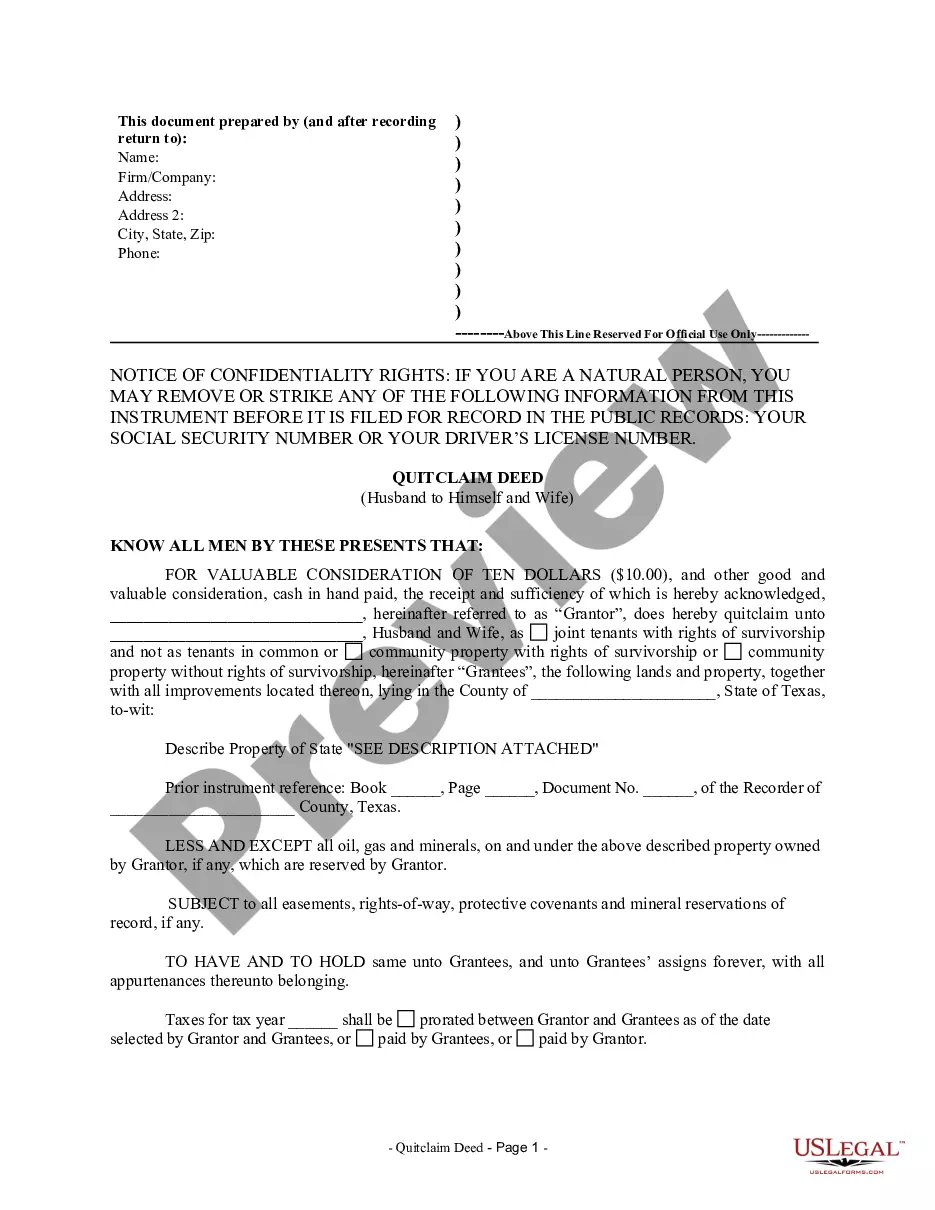

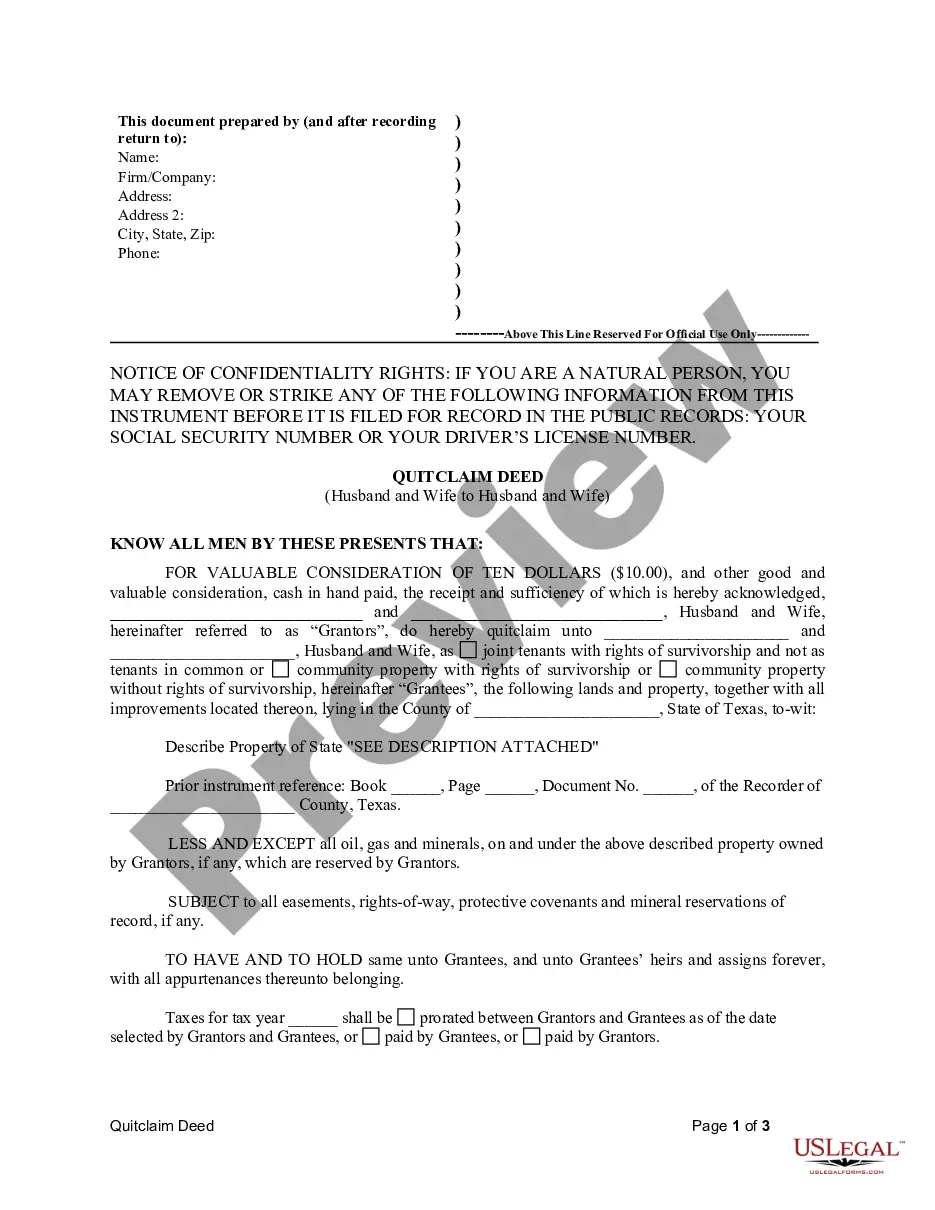

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

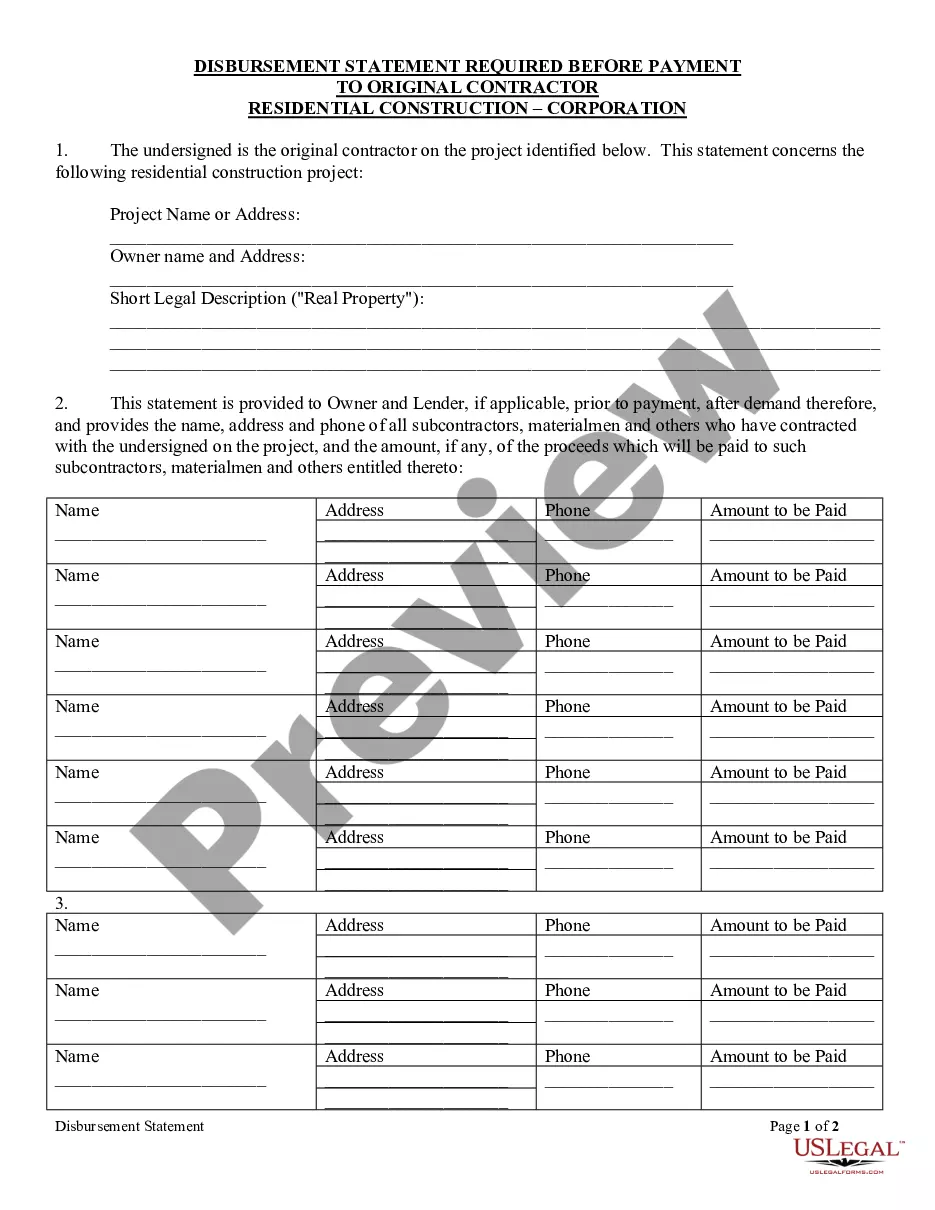

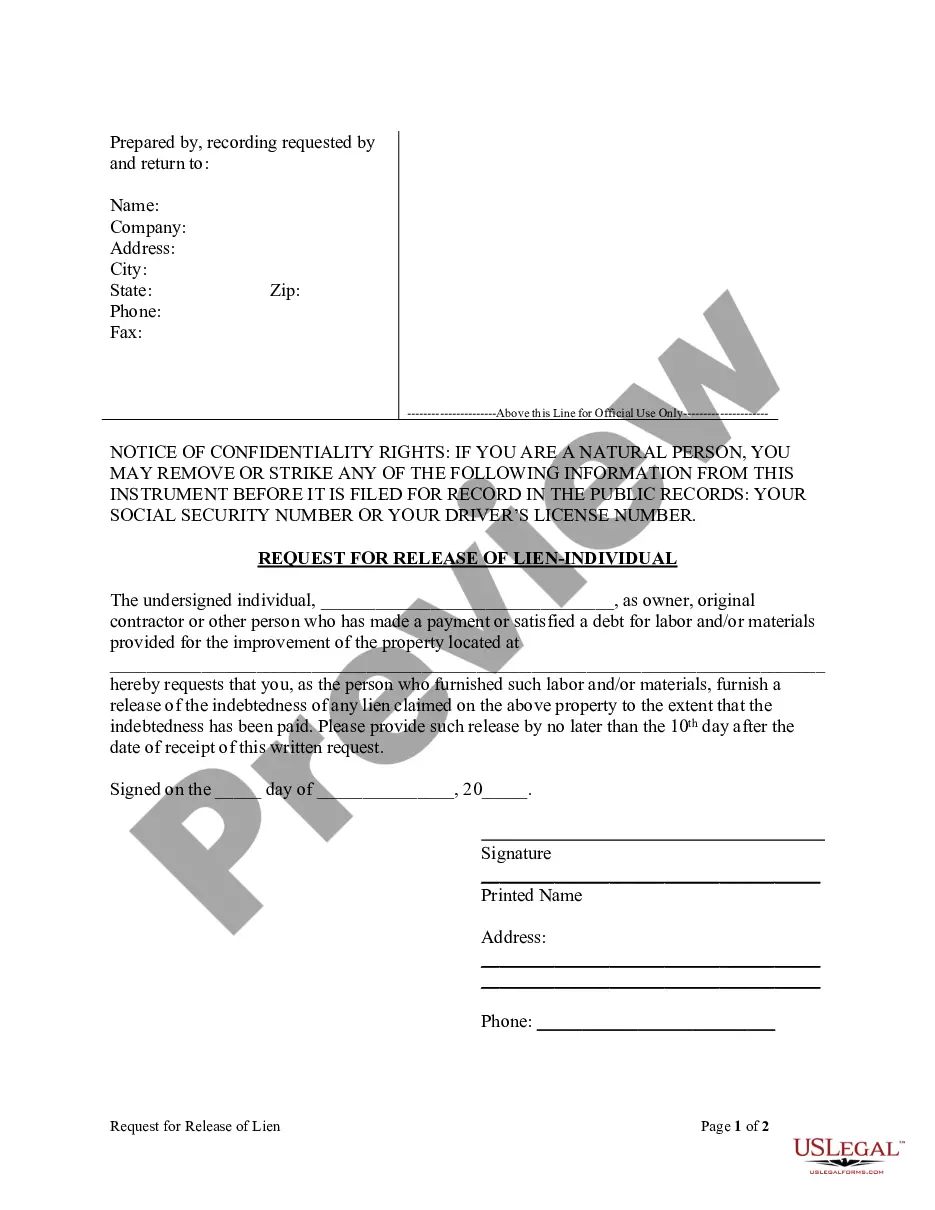

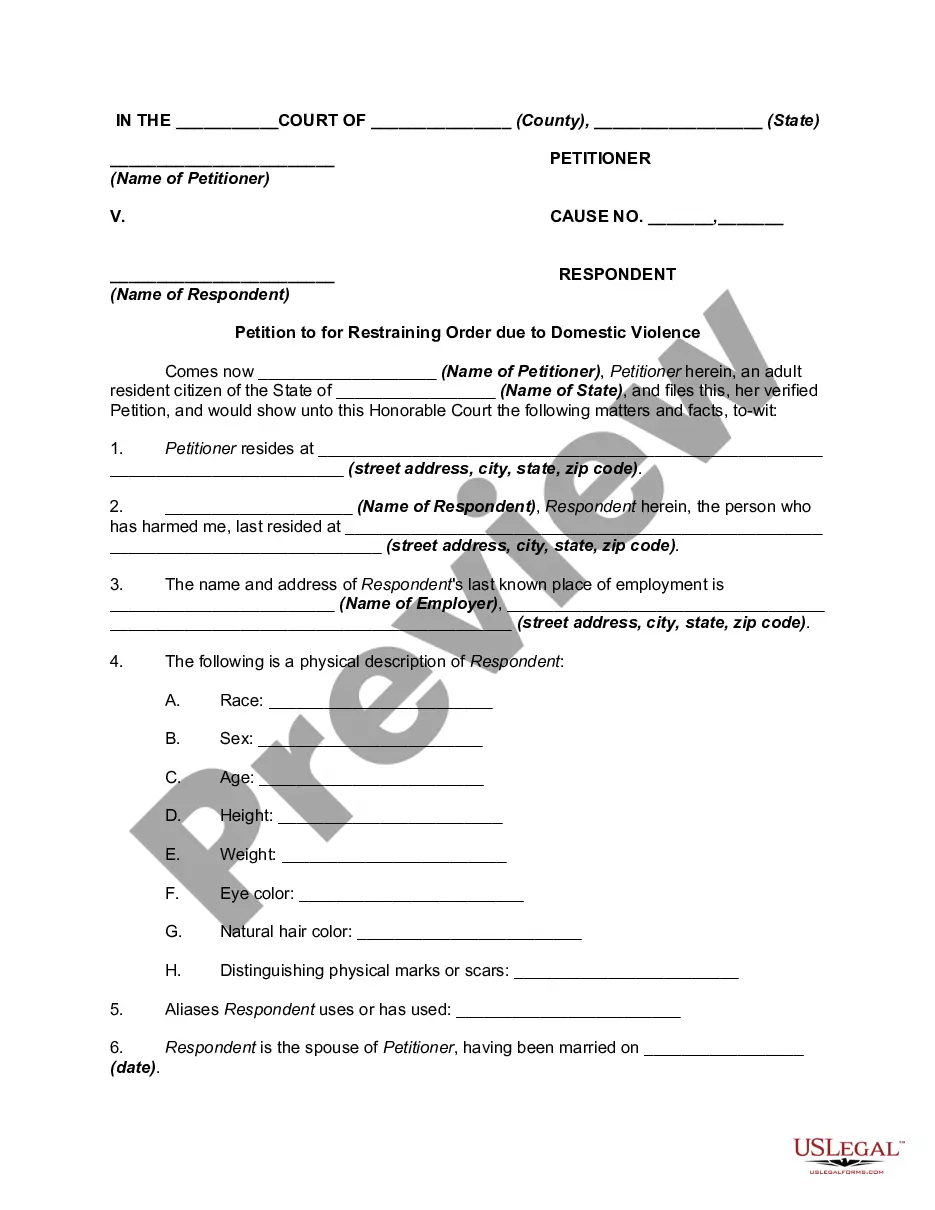

Disadvantages of a Deed in Lieu of Foreclosure. Perhaps the biggest disadvantage of a deed in lieu is that the Lender takes subject to all other encumbrances and interests in the Property. Therefore if there is a second mortgage, for example, a deed in lieu would likely not be a viable strategy.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

The waiting period on a conventional loan after a deed in lieu is 4 years, compared to 7 years on a conventional loan.

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.