Texas Warranty Deed from Individual to Husband and Wife

Definition and meaning

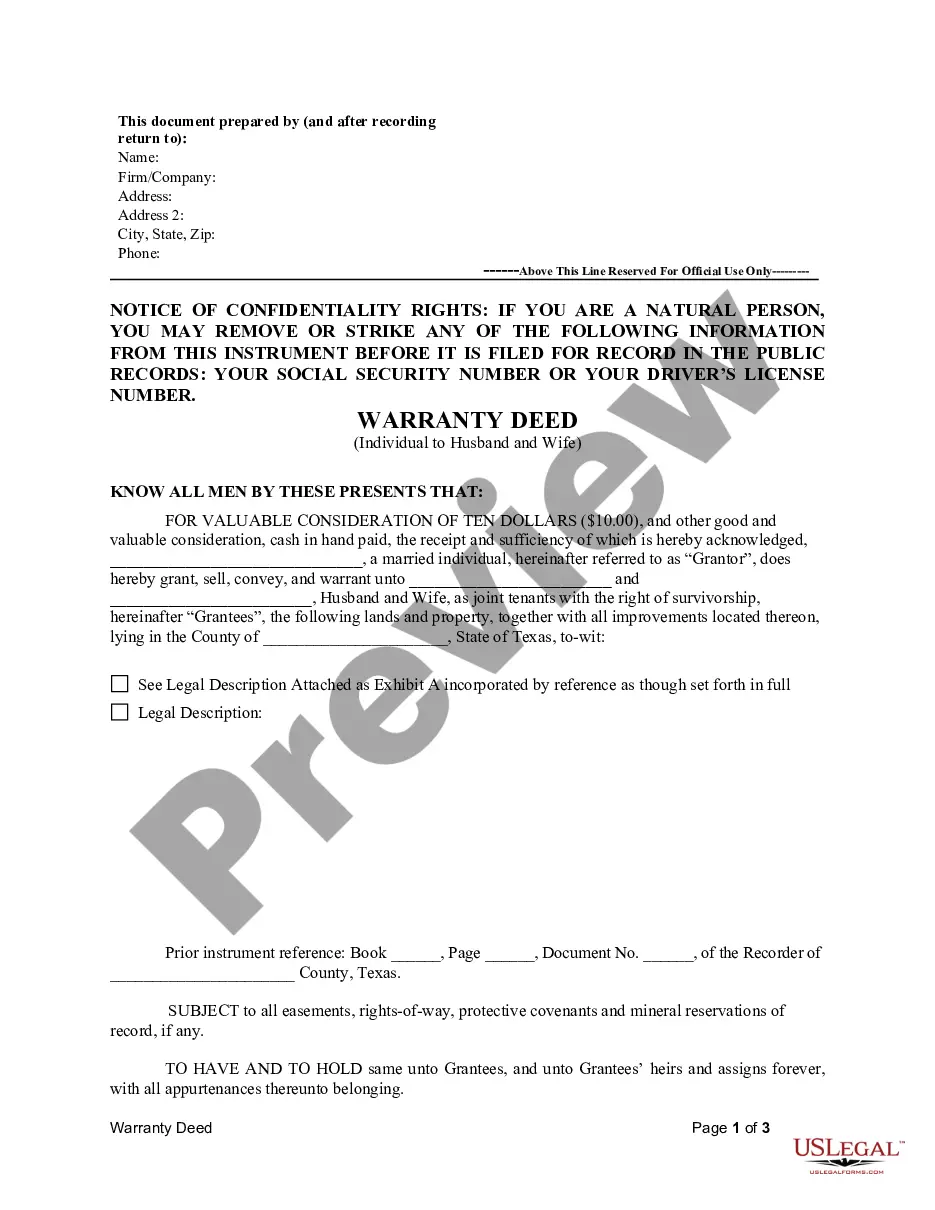

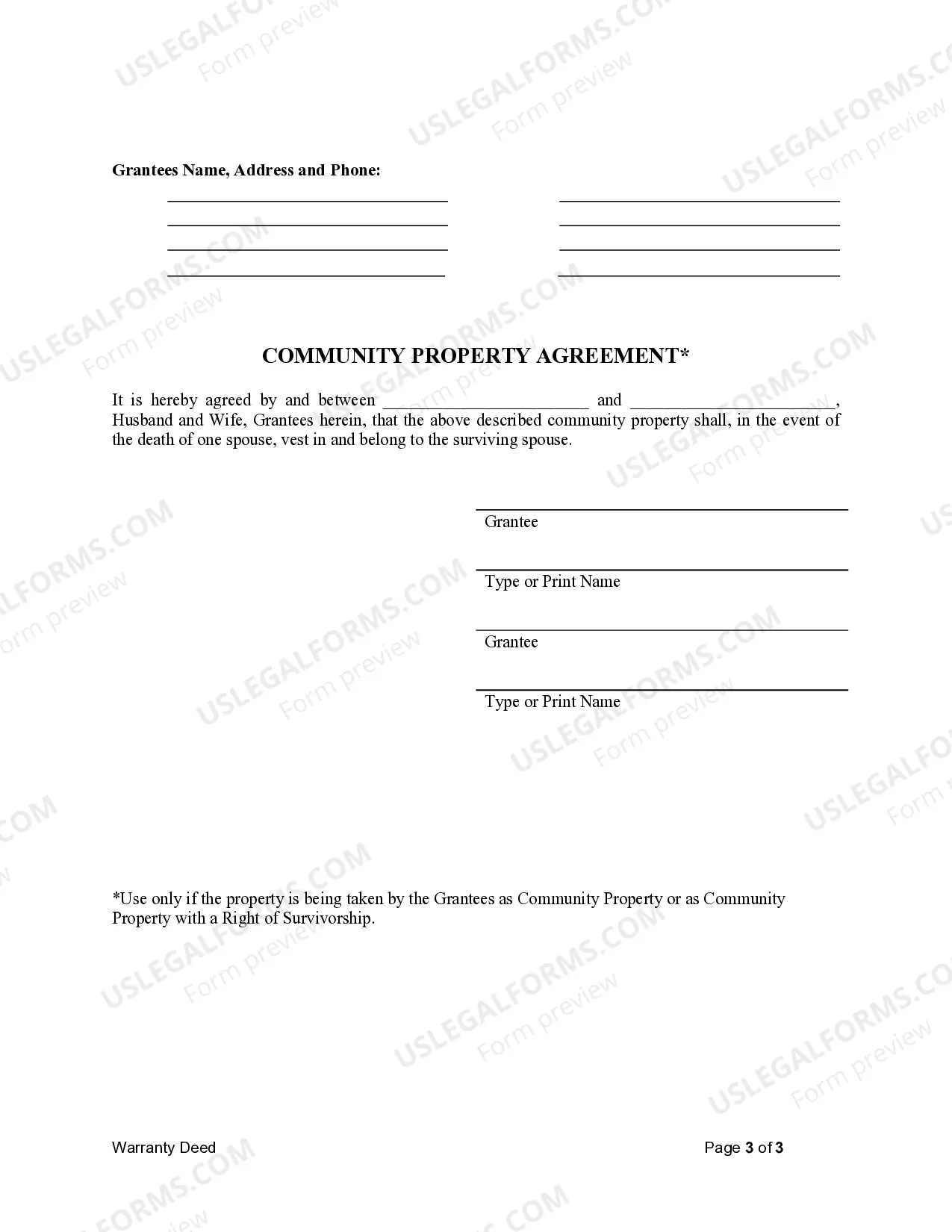

A Texas Warranty Deed from Individual to Husband and Wife is a legal document that allows an individual (referred to as the Grantor) to transfer property ownership to a married couple (referred to as Grantees) as joint tenants with the right of survivorship. This form ensures that the property is conveyed with a guarantee of clear title, meaning the Grantor affirms they own the property and that it is free of encumbrances, barring any exceptions noted in the deed. This type of deed is particularly important for married couples looking to hold property securely and ensures that the property can be transferred seamlessly to the surviving spouse in the event of one spouse's death.

How to complete a form

To complete the Texas Warranty Deed from Individual to Husband and Wife, follow these steps:

- Identify the Grantor: Fill in the name of the individual transferring the property.

- Identify the Grantees: Enter the names of both spouses as they will appear on the deed.

- Complete the legal description: Provide a detailed legal description of the property, often found in the previous deed.

- Indicate consideration: Specify any monetary value exchanged, usually a nominal amount like ten dollars.

- Check for encumbrances: Indicate any liens or claims against the property, if any exist.

- Sign and date the deed: The Grantor must sign the document in front of a notary public to validate the transfer.

Make sure all information is accurate and that the form adheres to Texas regulations to ensure enforceability.

Who should use this form

This form is ideal for individuals who are married and wish to transfer real estate property to themselves as a couple. It is particularly useful for those who aim to assure survivorship rights, allowing the surviving spouse to automatically inherit the property without going through probate. This form can be beneficial in various scenarios, including:

- Transferring family-owned property to enhance joint ownership.

- Securing a family home under the couple’s joint names.

- Allowing for easier management of property in the event of one partner's death.

Legal use and context

A Texas Warranty Deed is legally binding and serves to officially document the transfer of property ownership, making it essential in real estate transactions. This form should be recorded with the county clerk’s office in the county where the property is located to provide public notice of the ownership change. By doing so, all interested parties are informed of the legal ownership, which is crucial in any future transactions or disputes involving the property. Failure to record the warranty deed can result in challenges to the ownership and title of the property.

What to expect during notarization or witnessing

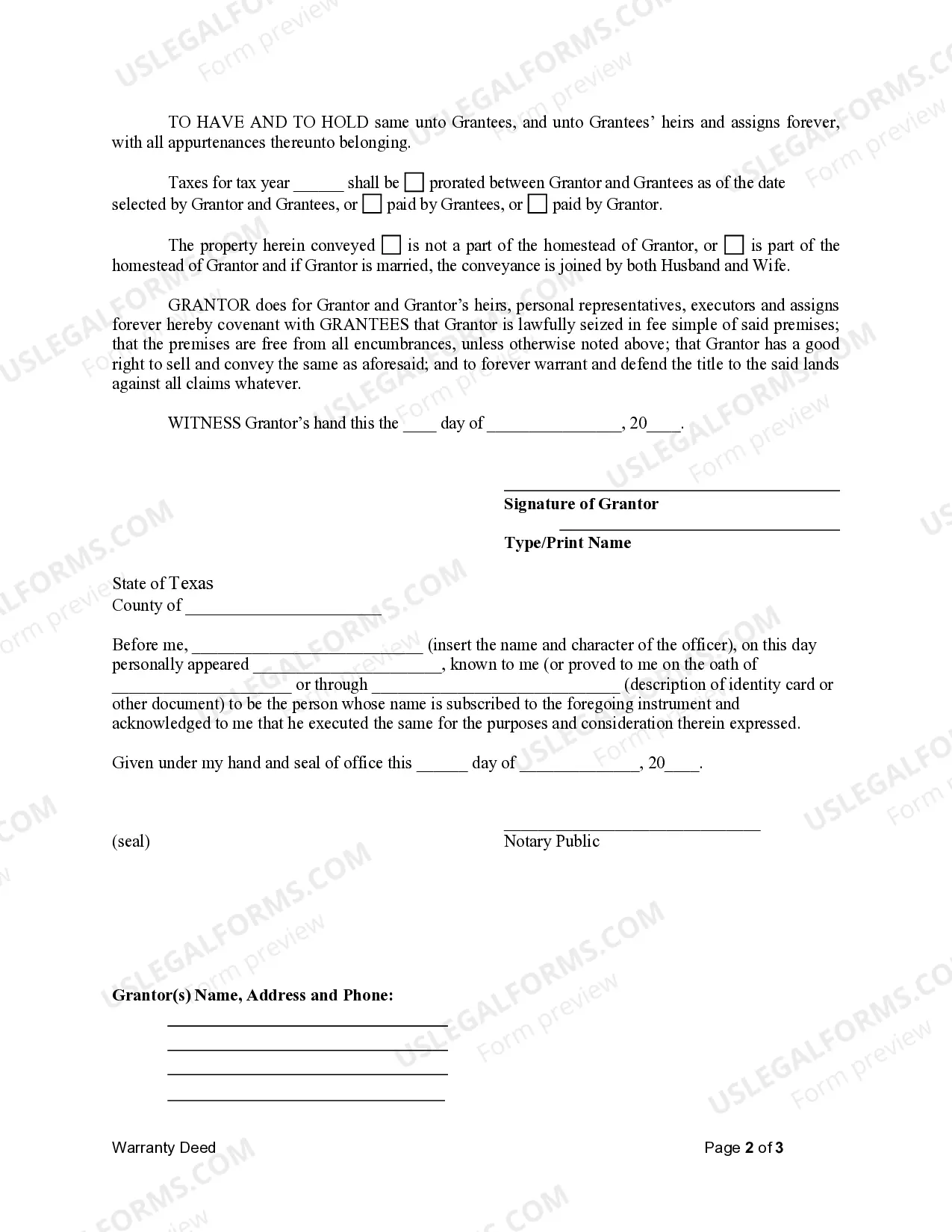

When signing the Texas Warranty Deed, the Grantor must do so in the presence of a notary public. The notary’s role is to verify the identity of the Grantor and ensure that they are signing the document willingly and under no duress. The following steps should be expected:

- Present valid identification to the notary public.

- Sign the warranty deed in front of the notary.

- Have the notary complete the acknowledgment section, which includes their signature, seal, and contact details.

It's important to arrange notarization before attempting to record the deed, as most counties require an officially notarized document for processing.

Benefits of using this form online

Using the Texas Warranty Deed from Individual to Husband and Wife in an online format has several advantages:

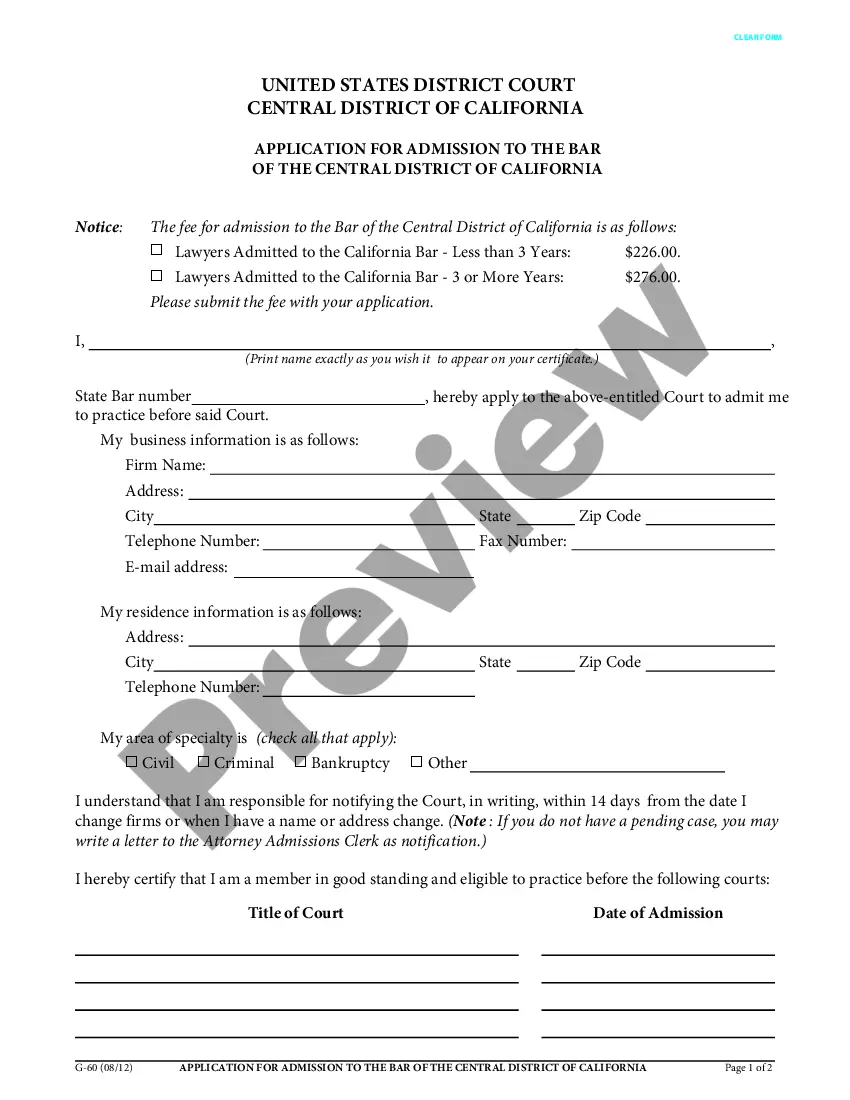

- Accessibility: Users can easily fill out the form at their convenience without needing to visit an attorney's office.

- Efficiency: Online templates can often be completed more quickly, helping to expedite the transfer process.

- Guided Instructions: Many online forms include step-by-step guidance, ensuring that users do not miss important details.

- Cost-effective: Utilizing an online form can alleviate the costs associated with hiring legal services for basic property transfers.

Common mistakes to avoid when using this form

While completing the Texas Warranty Deed, it is crucial to avoid common pitfalls that can render the document invalid:

- Failing to provide a complete legal description of the property.

- Not signing the document in front of a notary public or missing the notarization altogether.

- Omitting key details such as the consideration amount or encumbrances.

- Forgetting to record the deed with the appropriate county office after completion.

By being aware of and avoiding these mistakes, users can ensure a smoother property transfer process and uphold their legal rights.

Form popularity

FAQ

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

How do I add my spouse to the deed? In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.