Texas Warranty Deed from Individual to Husband and Wife

Understanding this form

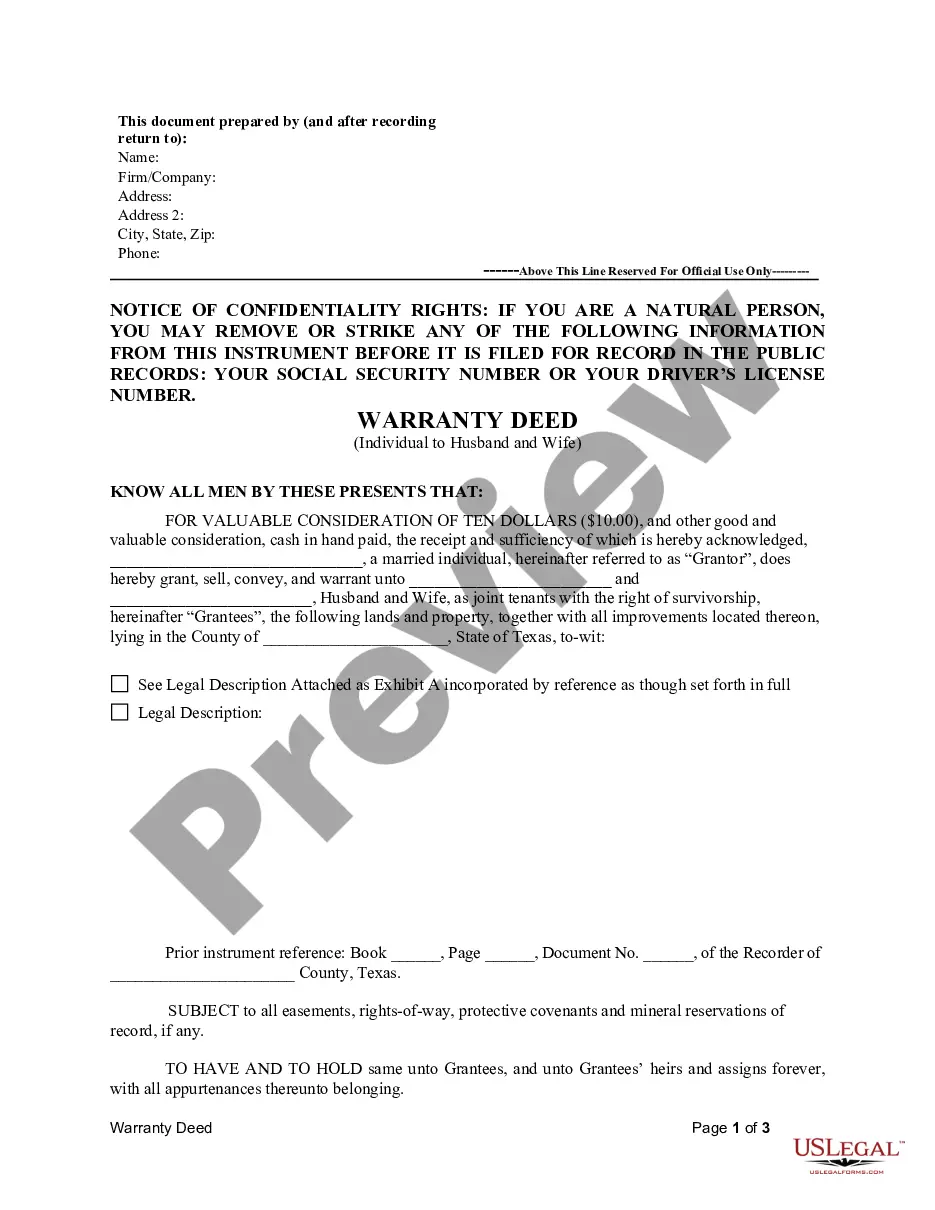

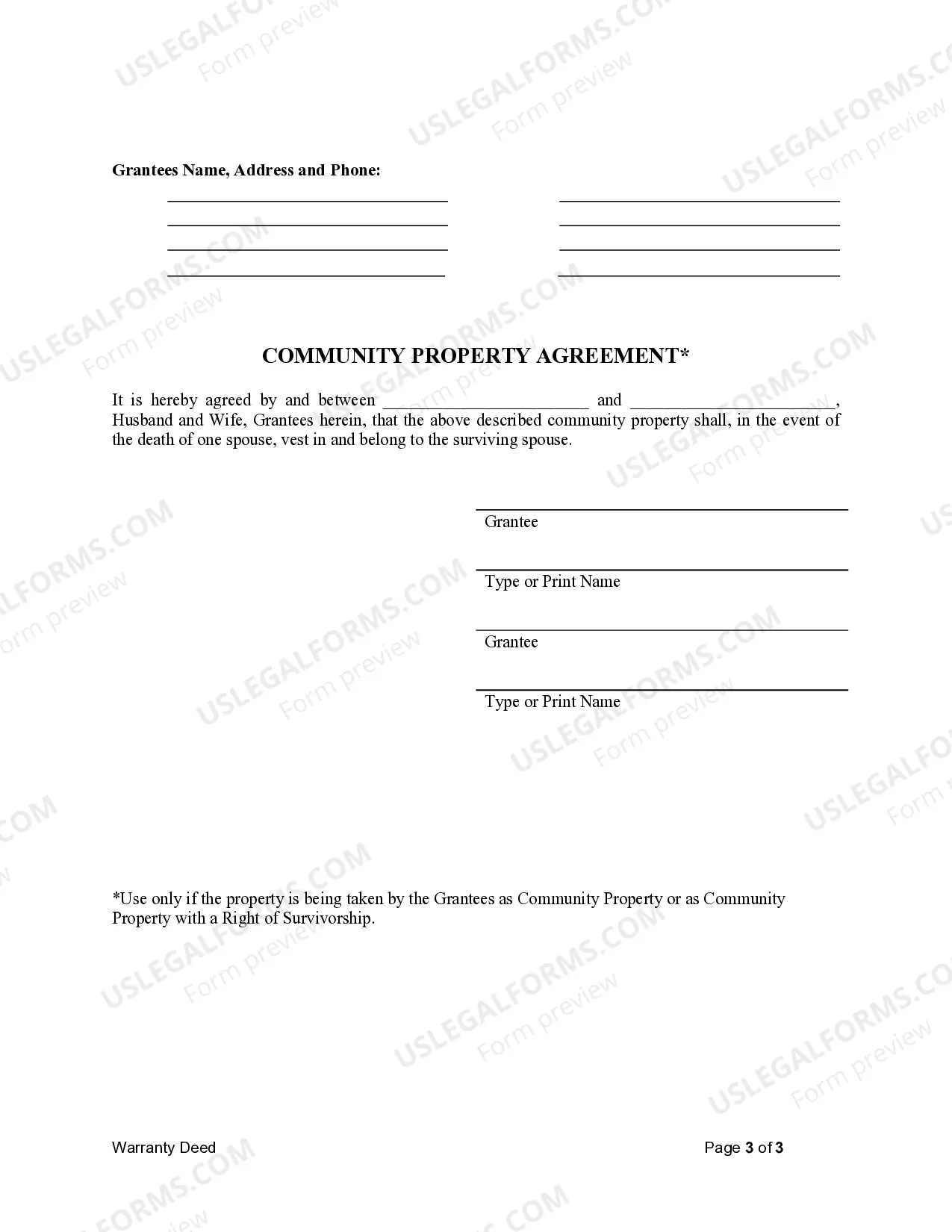

The Warranty Deed from Individual to Husband and Wife is a legal document that transfers property ownership from one individual (the Grantor) to a married couple (the Grantees). This specific form is essential for ensuring that the property is conveyed clearly, preserving the Grantor's rights while establishing the new ownership under both names. Unlike other types of deeds, this form specifically caters to an individual transferring property to a husband and wife, taking into account any reservations such as oil, gas, or mineral rights.

Main sections of this form

- Identification of the Grantor and Grantees.

- Legal description of the property being transferred.

- Statement of consideration, indicating the payment amount.

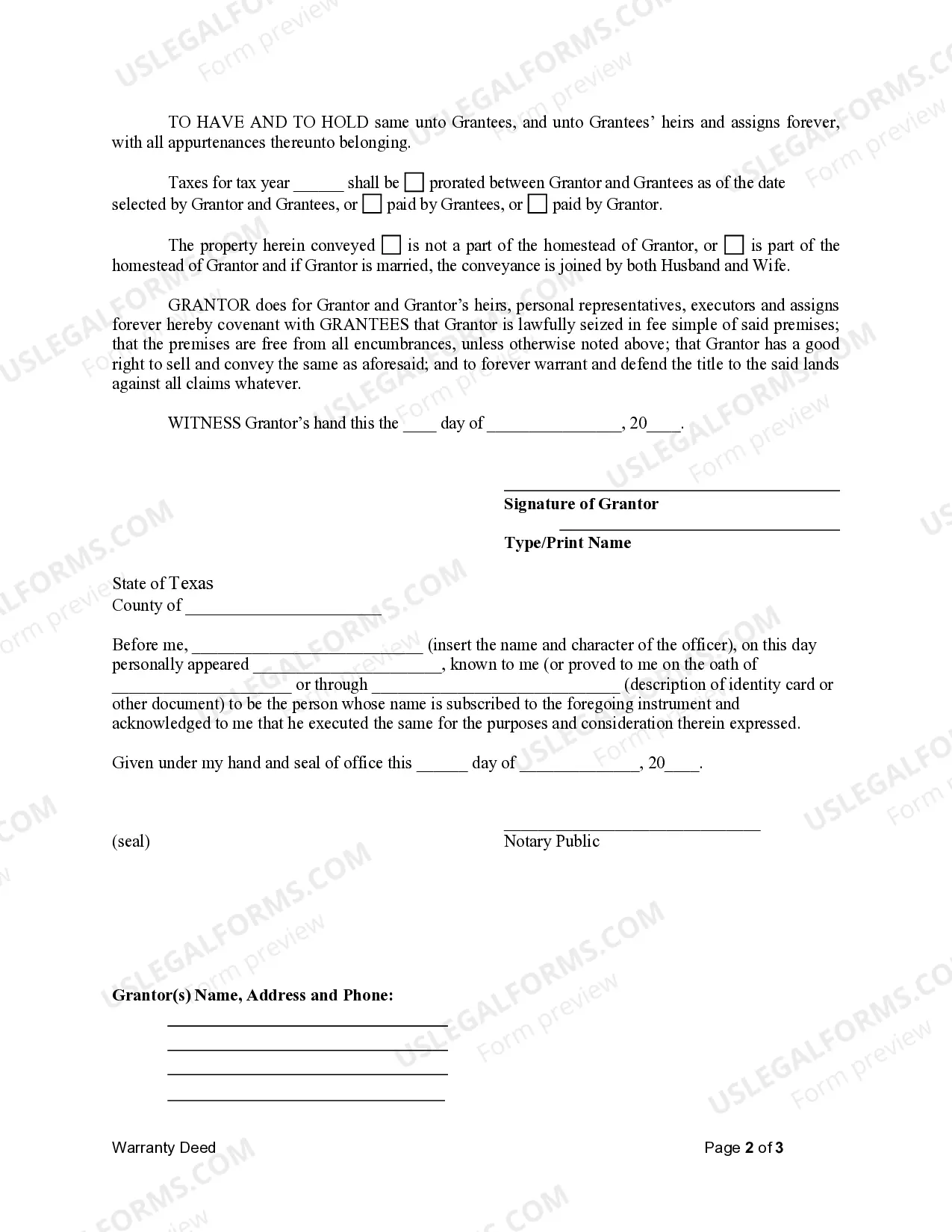

- Signatures and acknowledgment by a notary public.

- Proration of taxes between the Grantor and Grantees.

- Declaration of whether the property is part of the Grantor's homestead.

When to use this document

This Warranty Deed is particularly useful when an individual wishes to transfer property ownership to a spouse. It is commonly used during marriage, divorce, or estate planning situations where clear evidence of property ownership is required. This form is also appropriate in the context of gifting property among family members where both parties are married.

Intended users of this form

- Individuals who own property and wish to transfer it to their spouse.

- Couples who are purchasing property together and require a clear deed of ownership.

- Married individuals engaged in estate planning.

Steps to complete this form

- Identify the Grantor and enter their full name.

- Specify the names of the Grantees (husband and wife) in the appropriate fields.

- Fill in the legal description of the property being conveyed.

- Enter the agreed consideration amount, typically ten dollars.

- Have the document signed by the Grantor in the presence of a notary public.

- Ensure the acknowledgement section is correctly completed by the notary.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include a complete legal description of the property.

- Not having the deed notarized, which is crucial for its validity.

- Leaving out tax proration information or failing to clarify tax responsibilities.

- Incorrectly identifying the Grantor or Grantees.

- Not confirming that both spouses are present if the property is part of a homestead.

Advantages of online completion

- Easy access and download, allowing for immediate use.

- User-friendly format that guides you through the completion process.

- Prepared by licensed attorneys to ensure compliance with state laws.

Looking for another form?

Form popularity

FAQ

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

How do I add my spouse to the deed? In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.