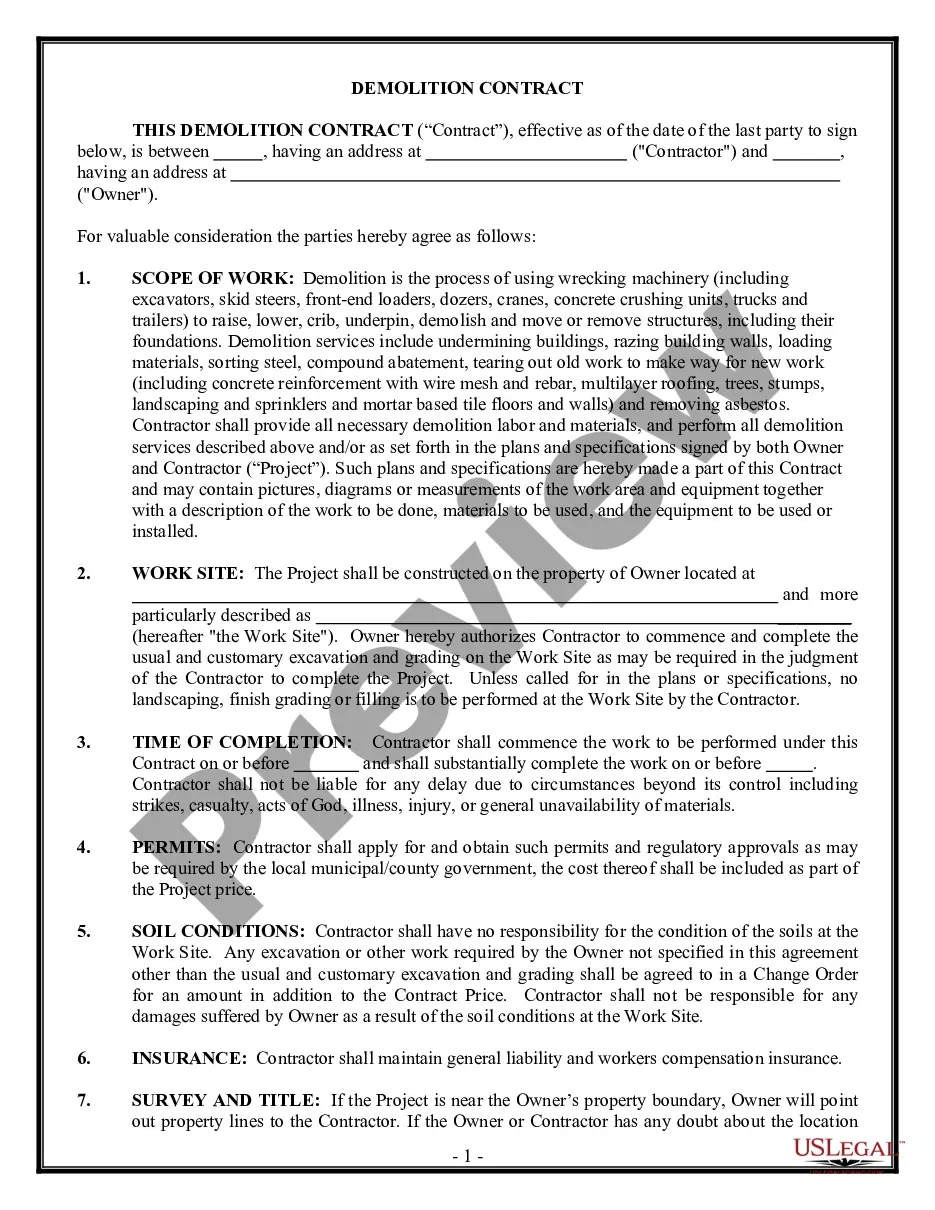

Texas Demolition Contract for Contractor

What is this form?

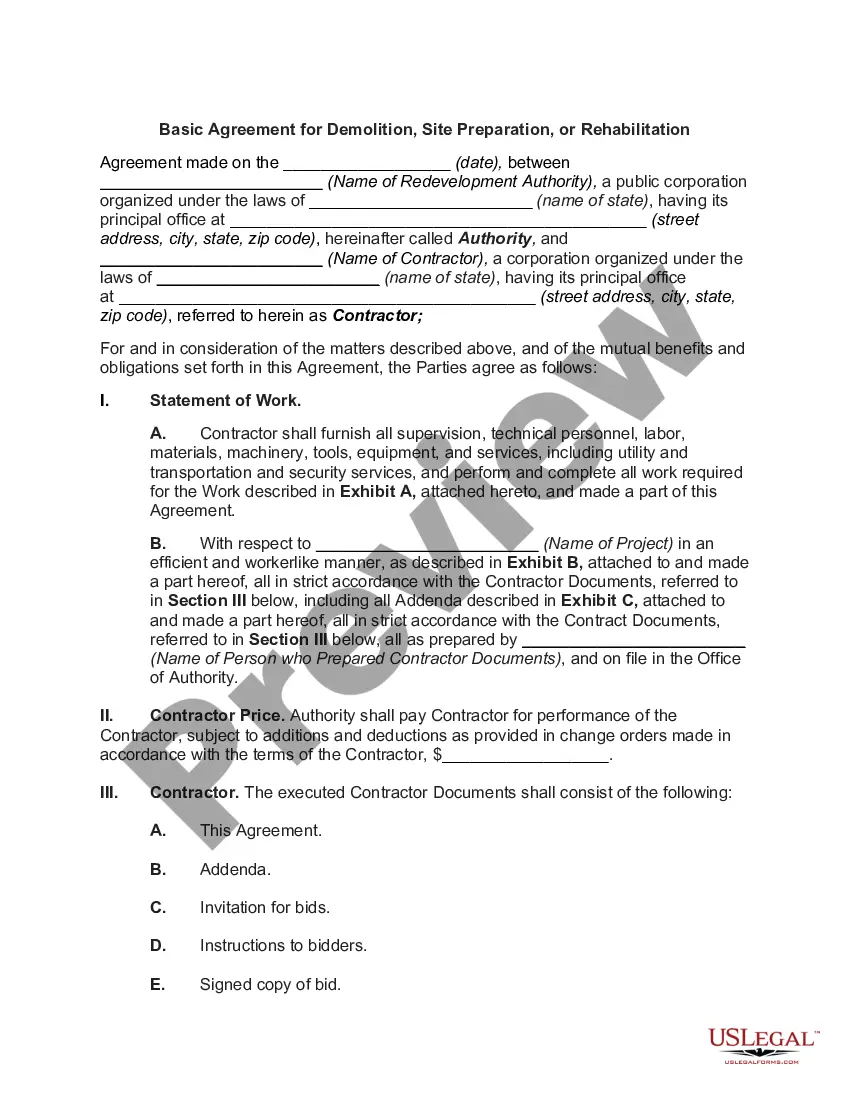

The Demolition Contract for Contractor is a legal document designed to establish an agreement between demolition contractors and property owners. This contract delineates the terms of the demolition work to be performed, including payment structures, responsibilities for permits, and handling of soil conditions. It is tailored to comply with the laws of Texas, making it essential for anyone engaging in demolition projects within the state.

What’s included in this form

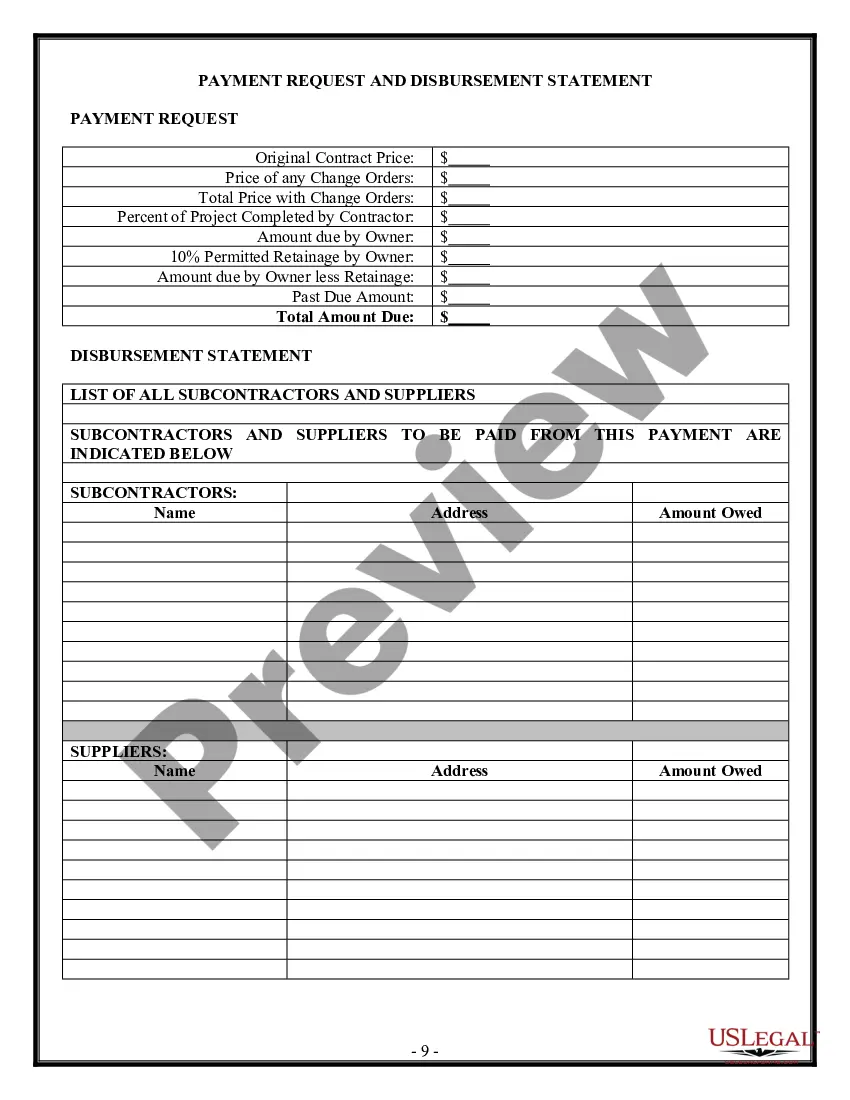

- Permits: Outlines the contractor's responsibility to obtain necessary permits for the project.

- Soil Conditions: Clarifies that the contractor is not liable for any unforeseen soil issues at the work site.

- Insurance: Specifies the contractor's obligation to maintain general liability and workers' compensation insurance.

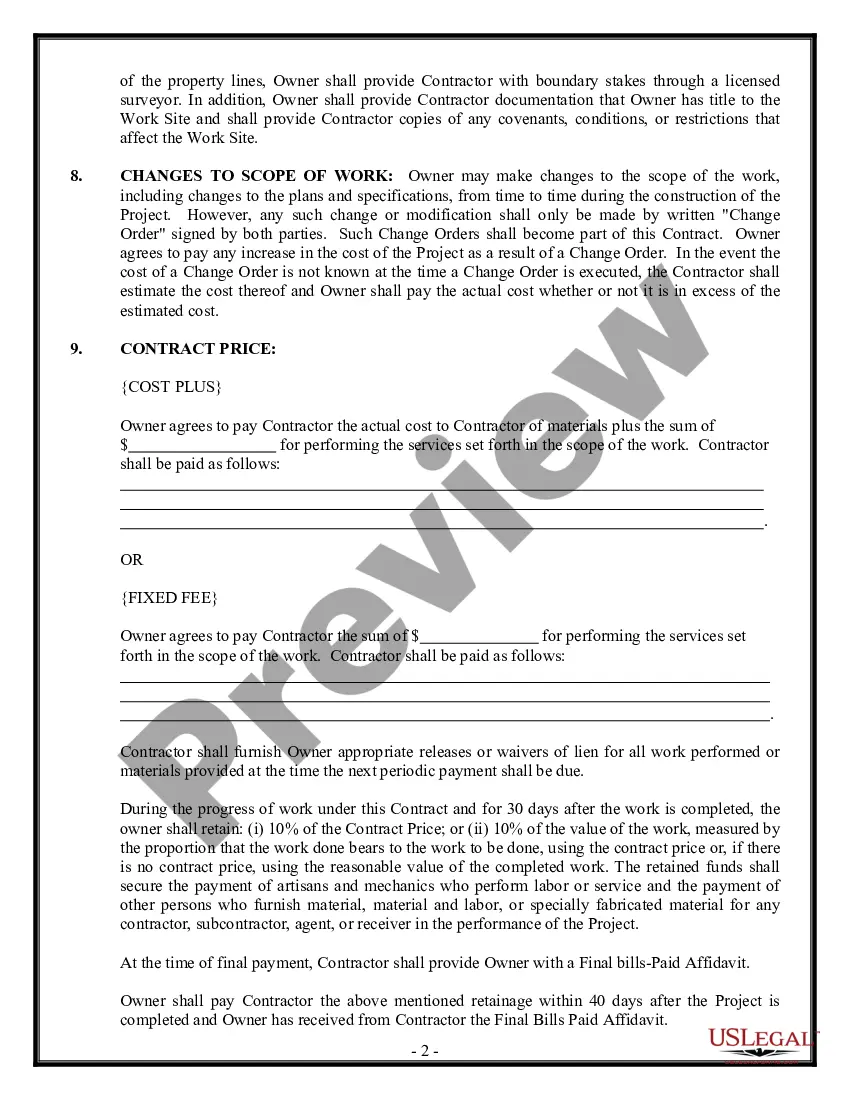

- Change Orders: Describes the protocol for making changes to the scope of work and associated costs.

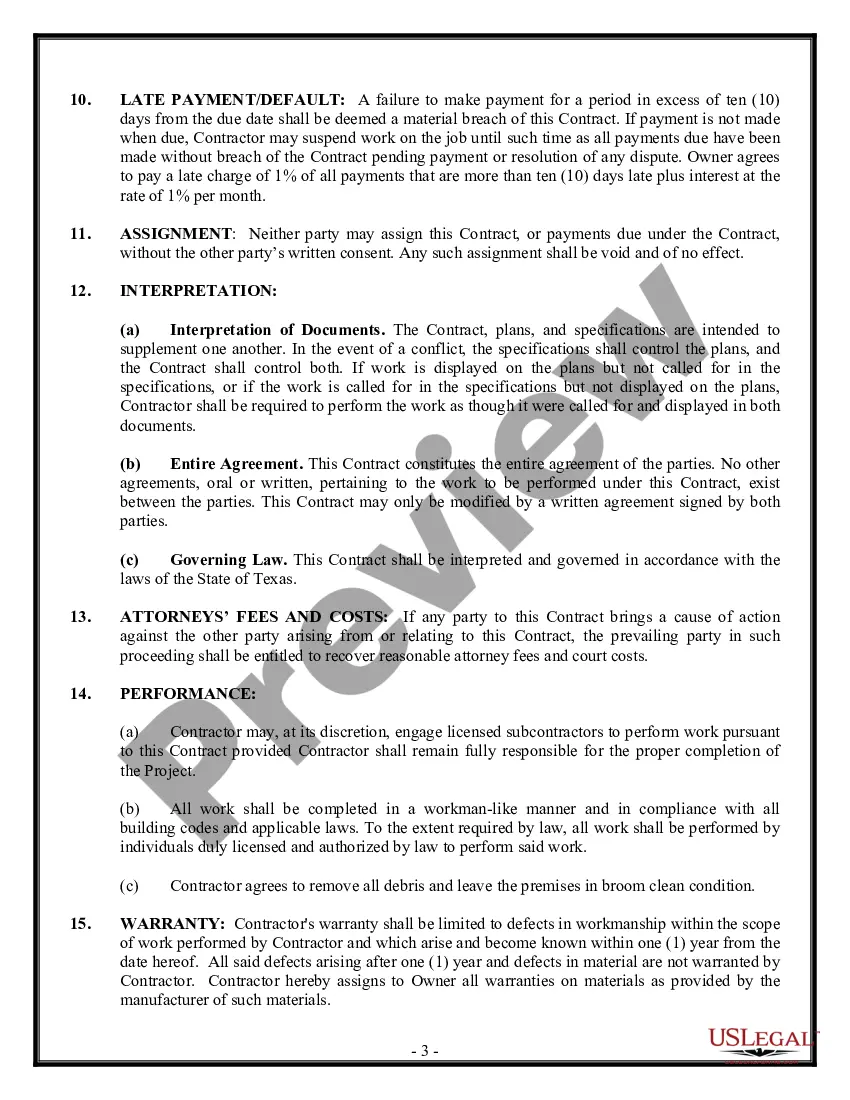

- Late Payment: Details penalties for late payments and the contractor's rights in case of default.

- Warranty: Limits the contractor's warranty to defects in workmanship for one year.

When to use this form

This demolition contract should be used whenever a property owner engages a contractor for demolition services. It is particularly useful when entering into a cost plus or fixed fee arrangement and covers critical aspects of the agreement, such as payment terms, responsibilities, and procedures for addressing changes or issues that arise during the project. This contract is especially pertinent for projects governed by Texas laws.

Intended users of this form

- Property owners planning a demolition project.

- Demolition contractors seeking to establish clear terms with clients.

- Individuals or businesses involved in property development or renovation in Texas.

Completing this form step by step

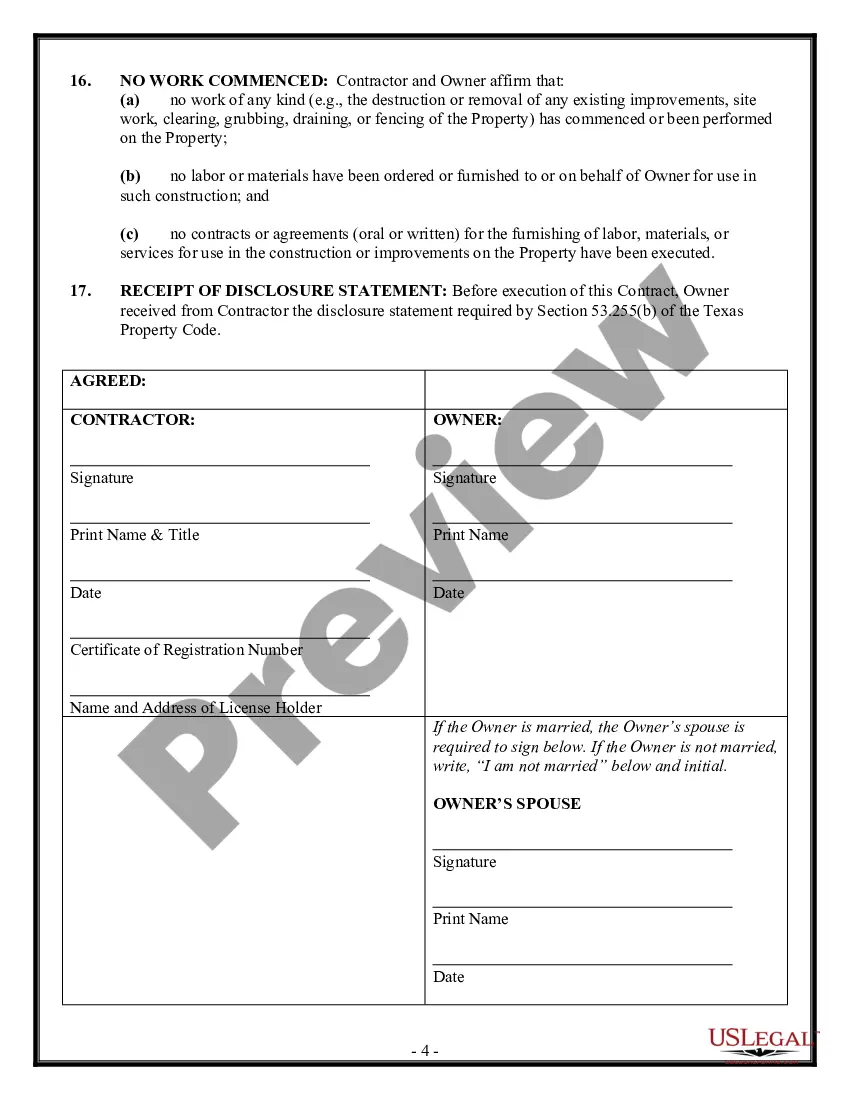

- Identify the parties involved, ensuring that both the contractor and property owner sign the agreement.

- Specify the project details, including the work site address and scope of demolition.

- Detail the payment structure, indicating whether it will be a cost plus or fixed fee arrangement.

- Include provisions regarding permits, insurance, and warranties as required by the project.

- Review and sign the contract, ensuring both parties have a copy for their records.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify the exact scope of work, leading to potential misunderstandings later.

- Neglecting to discuss and document payment terms or change order processes.

- Not ensuring the form is signed by both parties, which can lead to enforceability issues.

Benefits of using this form online

- Convenience of completing and downloading the form at any time without appointments.

- Editable templates that allow for specific project details to be tailored accordingly.

- Access to attorney-drafted content that ensures compliance with Texas laws.

Looking for another form?

Form popularity

FAQ

See Rule 3.295, Natural Gas and Electricity. Taxable Labor Photographers, Draftsmen, Artists, Tailors, Etc. In addition to the taxable services noted above, other types of sales that may commonly be considered "services" are taxable as the sale, processing or remodeling of tangible personal property.

About Texas Foundation Repair Contractor Licenses: As of 2019, foundation repair contractors in Texas are not required to have a license. Several years back, Texas House Bill 613 was introduced to require foundation repair contractors to become licensed, but the motion failed.

You shouldn't pay more than 10 percent of the estimated contract price upfront, according to the Contractors State License Board.

The Comptroller, by rule, defines new construction as all new improvements to real property, including initial finish-out work to the interior or exterior of the improvement.16 New construction also includes the addition of new, usable square footage to an existing structure.

Demolition of an improvement to real property is not taxable. For example, if an improvement to realty, such as a building, parking lot or sidewalk, is totally demolished and another improvement to realty is built on the same site, the demolition and rebuilding is treated as new construction labor.

Typically, pay no more than 1/3rd up front. completed 1/3rd of the job. to your satisfaction. Don't sign your insurance check over to a contractor.

For example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to Texas sales and use tax. Tax is due, however, on non-food items such as paper, pet, beauty and hygiene products; clothing; books; and certain edible items.

You don't charge your customer tax.You then collect state sales tax, plus any local tax, from your customer on the amount you charge for the materials and those services. Your charge for the materials must be at least as much as you paid for them. The construction labor charge is not taxable.