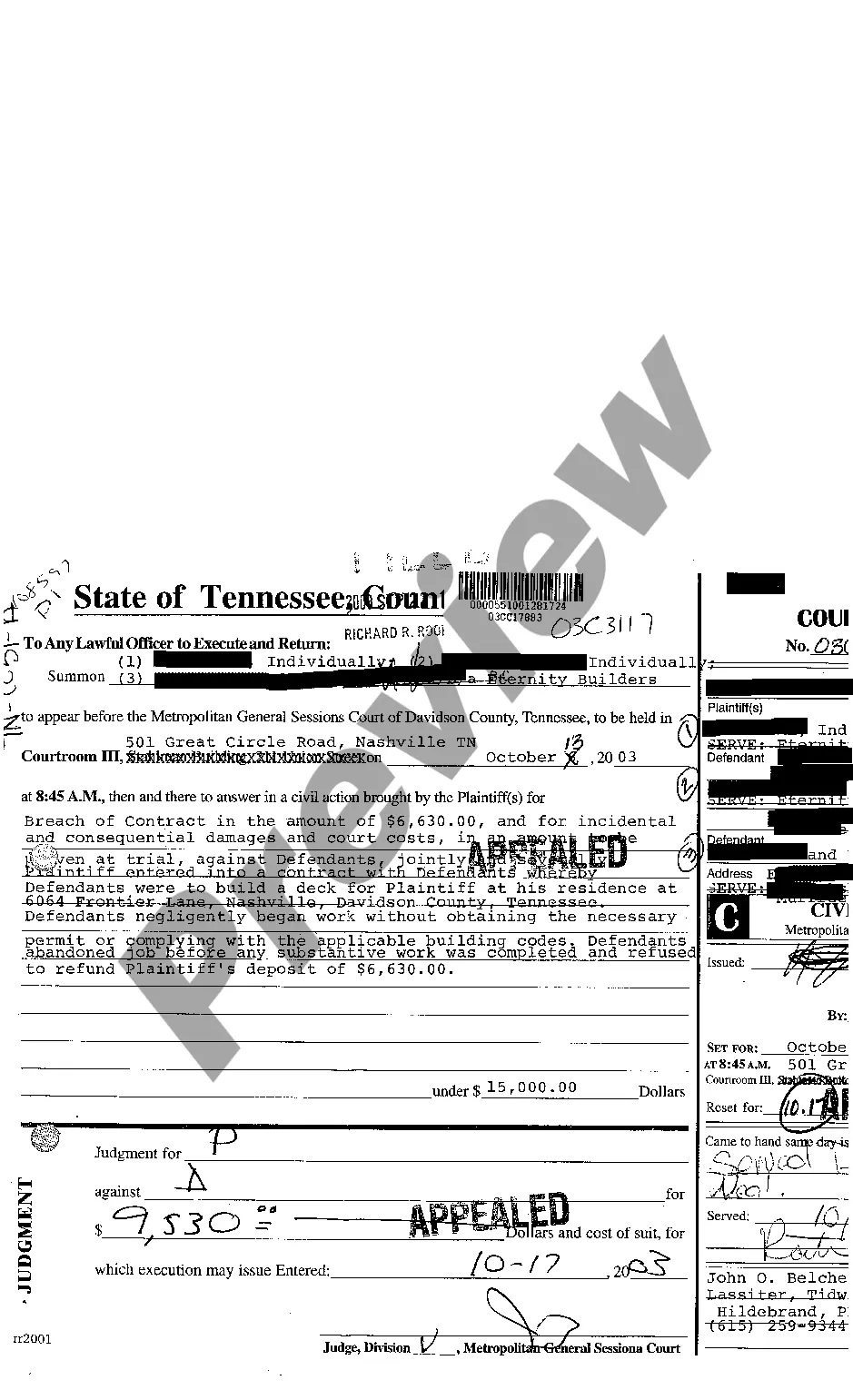

This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Tennessee Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

You are able to spend several hours on the Internet searching for the legitimate document web template which fits the federal and state specifications you will need. US Legal Forms offers a large number of legitimate kinds that happen to be analyzed by pros. It is possible to obtain or printing the Tennessee Option to Renew that Updates the Tenant Operating Expense and Tax Basis from the support.

If you already possess a US Legal Forms profile, you may log in and click on the Acquire key. After that, you may full, modify, printing, or sign the Tennessee Option to Renew that Updates the Tenant Operating Expense and Tax Basis. Each legitimate document web template you get is the one you have for a long time. To have yet another version for any obtained kind, proceed to the My Forms tab and click on the related key.

If you use the US Legal Forms site the very first time, adhere to the easy directions below:

- Initially, make sure that you have chosen the correct document web template to the county/metropolis of your choice. Browse the kind information to ensure you have picked out the appropriate kind. If accessible, use the Review key to appear throughout the document web template too.

- If you would like find yet another version from the kind, use the Search field to obtain the web template that fits your needs and specifications.

- When you have discovered the web template you desire, simply click Purchase now to carry on.

- Select the rates program you desire, enter your qualifications, and sign up for your account on US Legal Forms.

- Full the deal. You can utilize your bank card or PayPal profile to purchase the legitimate kind.

- Select the formatting from the document and obtain it for your device.

- Make adjustments for your document if needed. You are able to full, modify and sign and printing Tennessee Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Acquire and printing a large number of document themes making use of the US Legal Forms web site, which offers the most important selection of legitimate kinds. Use skilled and express-distinct themes to handle your small business or personal requires.

Form popularity

FAQ

The main difference, however, is that a contract extension extends the term of the contract based on the existing contract, while a contract renewal replaces the existing contract with a new one. A contract renewal is essentially a contract extension without a change in the terms of the contract.

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

?Extension? normally refers to a lengthening of time for an existing contract. ?Renewal? normally contemplates an entirely new contract.

up business may, for example, rent an office space for three years. A renewal option would allow the business to renew or extend the lease to remain in the office space beyond the threeyear lease term.

1) Voluntary re-establishment of a legal relationship created by a previously agreed-to but expired contract. That is, renewal is not merely an extension of a previous contract but is effectively the creation of a new contract that recreates the previous and now-renewed contract.

A residential lease is granted for a specific term. At the expiration of this term, the property reverts to the landlord. Once a lease has been granted the term immediately begins to get shorter.

Definitions and Distinctions A renewal is the re-creation of the legal relationship and the replacement of the old lease with a new lease. In an option to extend, the original term of the lease is extended without interruption. This distinction is highlighted in Buckerfields v.

Note: Difference between option to renew and extend ? where the parties agree to ?extend? the existing lease is continued, where the parties ?renew? this creates a new lease.