Tennessee Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

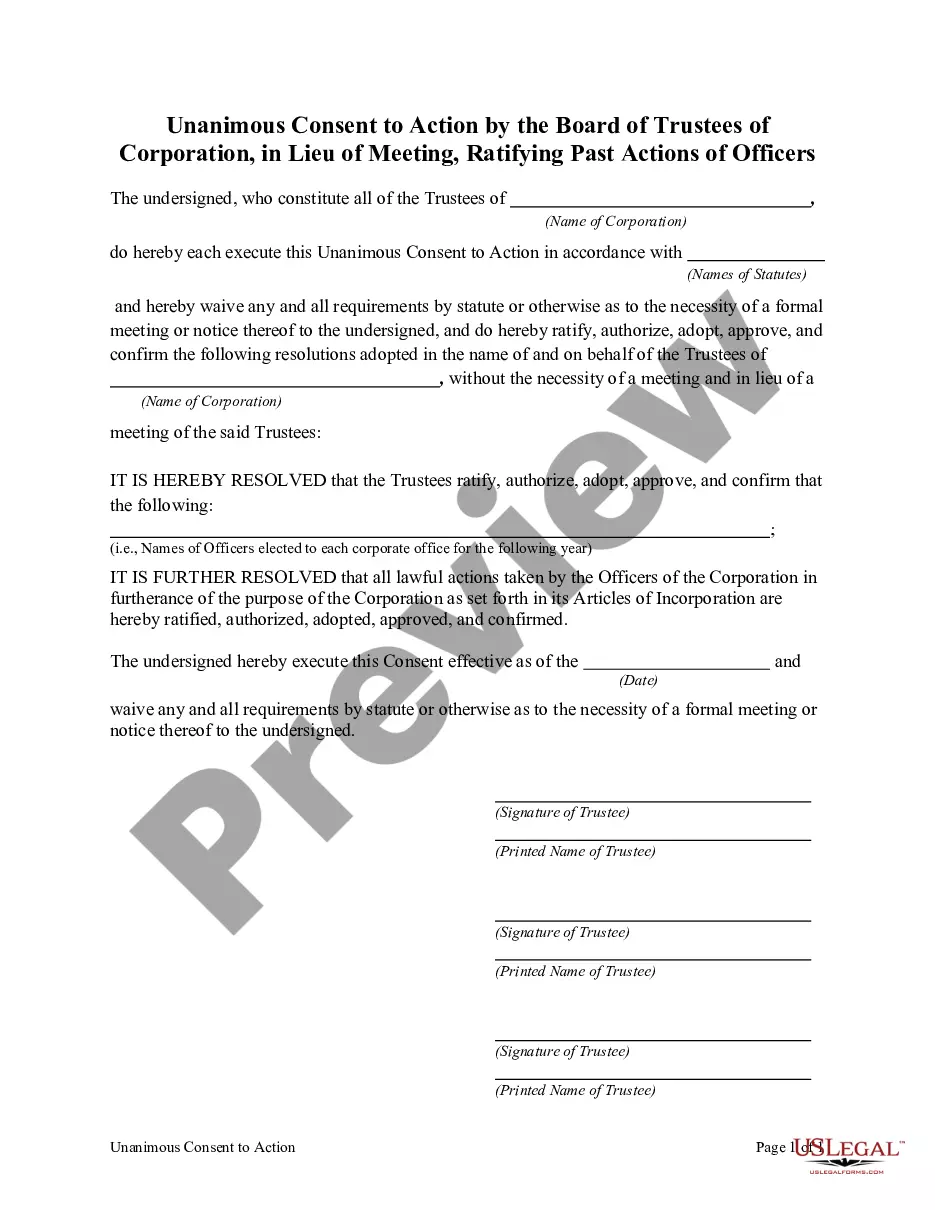

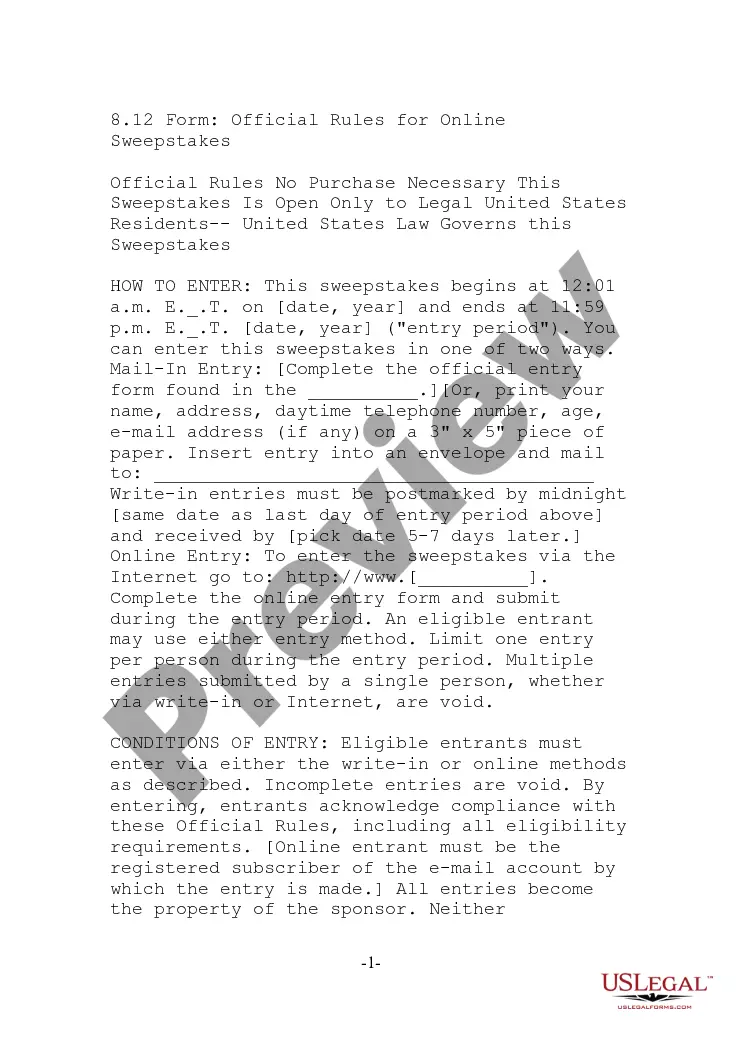

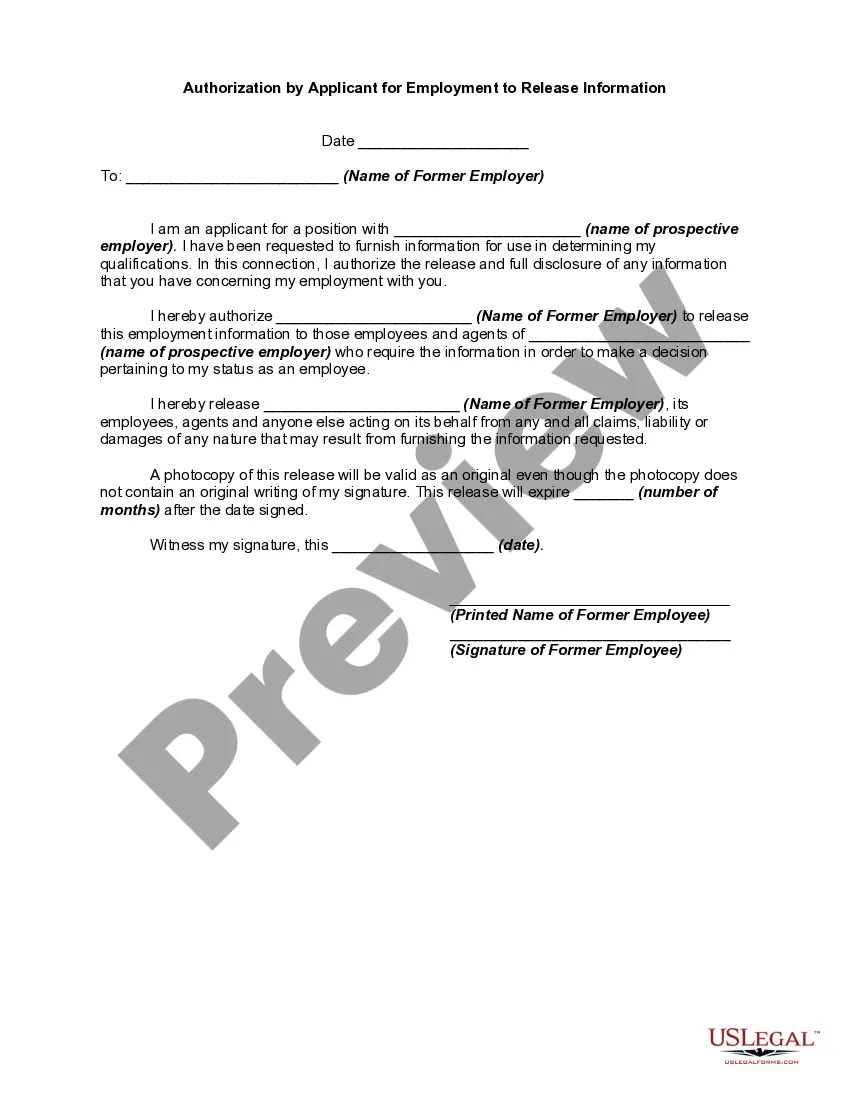

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

If you wish to full, down load, or print out legal document layouts, use US Legal Forms, the greatest collection of legal kinds, that can be found on the web. Take advantage of the site`s basic and practical lookup to obtain the paperwork you require. Various layouts for enterprise and individual uses are sorted by categories and says, or key phrases. Use US Legal Forms to obtain the Tennessee Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease within a handful of click throughs.

When you are currently a US Legal Forms customer, log in for your account and click on the Obtain option to find the Tennessee Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. You may also gain access to kinds you formerly delivered electronically in the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for your correct area/land.

- Step 2. Use the Review solution to examine the form`s content material. Don`t forget to learn the information.

- Step 3. When you are not happy with the type, make use of the Lookup field on top of the display to find other versions from the legal type template.

- Step 4. When you have identified the shape you require, click on the Purchase now option. Opt for the rates prepare you prefer and put your references to sign up to have an account.

- Step 5. Method the deal. You should use your bank card or PayPal account to complete the deal.

- Step 6. Pick the structure from the legal type and down load it on the product.

- Step 7. Complete, edit and print out or signal the Tennessee Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Every legal document template you buy is yours permanently. You might have acces to every type you delivered electronically inside your acccount. Select the My Forms segment and select a type to print out or down load yet again.

Contend and down load, and print out the Tennessee Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms. There are many specialist and condition-distinct kinds you can utilize for the enterprise or individual requirements.

Form popularity

FAQ

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.