Tennessee Ratification of Operating Agreement

Description

How to fill out Ratification Of Operating Agreement?

Are you in a situation that you require documents for both organization or individual functions just about every time? There are tons of lawful papers web templates available on the Internet, but locating types you can rely is not simple. US Legal Forms gives thousands of kind web templates, such as the Tennessee Ratification of Operating Agreement, that are written to satisfy federal and state specifications.

Should you be already acquainted with US Legal Forms site and possess an account, basically log in. After that, you can download the Tennessee Ratification of Operating Agreement format.

If you do not offer an accounts and wish to start using US Legal Forms, adopt these measures:

- Obtain the kind you need and make sure it is for your right area/area.

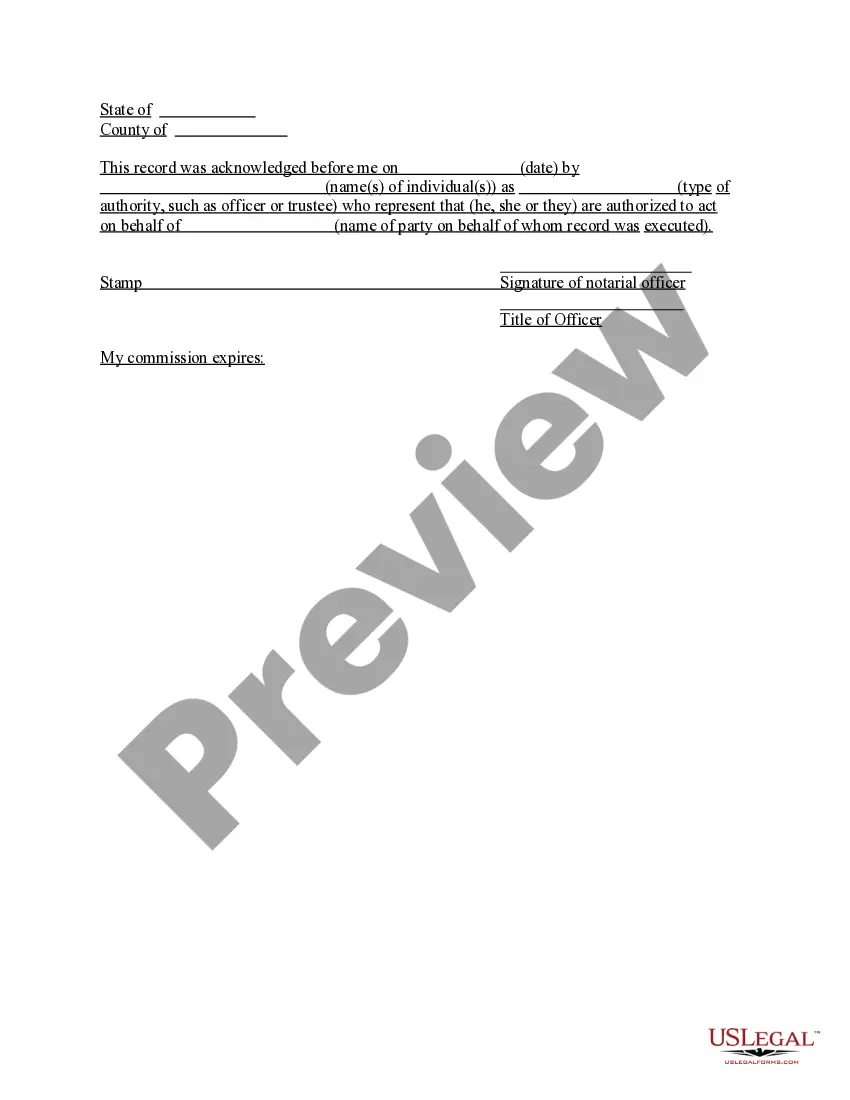

- Take advantage of the Review key to examine the shape.

- Read the information to actually have selected the appropriate kind.

- When the kind is not what you are looking for, utilize the Research industry to get the kind that fits your needs and specifications.

- Whenever you discover the right kind, click Purchase now.

- Choose the costs prepare you need, fill out the specified info to generate your account, and pay money for the transaction making use of your PayPal or charge card.

- Select a handy file format and download your version.

Discover all of the papers web templates you might have bought in the My Forms menus. You can obtain a additional version of Tennessee Ratification of Operating Agreement anytime, if possible. Just select the required kind to download or printing the papers format.

Use US Legal Forms, probably the most extensive collection of lawful types, in order to save some time and steer clear of errors. The assistance gives skillfully made lawful papers web templates which can be used for a range of functions. Produce an account on US Legal Forms and commence creating your lifestyle a little easier.

Form popularity

FAQ

Does a series LLC need its own EIN? Yes. If a state treats each business under a series LLC as a separate entity, then that's how the IRS will treat them as well. That means each one will need a unique EIN. Series LLC - StateRequirement staterequirement.com ? llc ? series-llc staterequirement.com ? llc ? series-llc

Starting an LLC in Tennessee will include the following steps: #1: Choose a Name for Your Tennessee LLC. #2: Name a Registered Agent for Your Tennessee LLC. #3: File Articles of Organization for Your Tennessee LLC. #4: Secure an IRS Employer Identification Number. #5: Prepare Your Business for Operations. How to Start a Tennessee LLC in 2023 - MarketWatch marketwatch.com ? guides ? business ? start... marketwatch.com ? guides ? business ? start...

Tennessee has a pro-business environment that features some of the lowest state and local tax burdens in the U.S. and no personal income tax. If you're wondering how to start an LLC in Tennessee, this guide will provide you with the basic information you'll need.

A series LLC owner will file federal taxes in the same way that an LLC does. The series LLC will file a single tax return as the main LLC. All income from the LLCs in the series will be included on the Schedule E portion of the owner's personal tax return. How Are Series LLCs Taxed? Everything You Need to Know - Incfile incfile.com ? blog ? how-are-series-llcs-taxed incfile.com ? blog ? how-are-series-llcs-taxed

Alabama, Delaware, the District of Columbia, Illinois, Indiana, Iowa, Kansas, Missouri, Montana, Nevada, North Dakota, Oklahoma, Puerto Rico, Tennessee, Texas, Utah, Wisconsin, and Wyoming all allow some form of the series LLC. California does not form domestic series LLCs, but a series LLC formed elsewhere can ... Defining the Series LLC - SCORE.org score.org ? resource ? article ? defining-seri... score.org ? resource ? article ? defining-seri...

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

Yes. Because each series within the Series LLC acts as its own independent company, all series must file and pay the Tennessee Franchise and Excise tax.

The state of Tennessee does not require an LLC Operating Agreement, but it may still be recommended for many LLCs. Without an Operating Agreement, disputes are governed by the default LLC operating rules outlined in Tennessee law (Tenn. Code Tit. §§ 48-201-101 through 48-250-115).