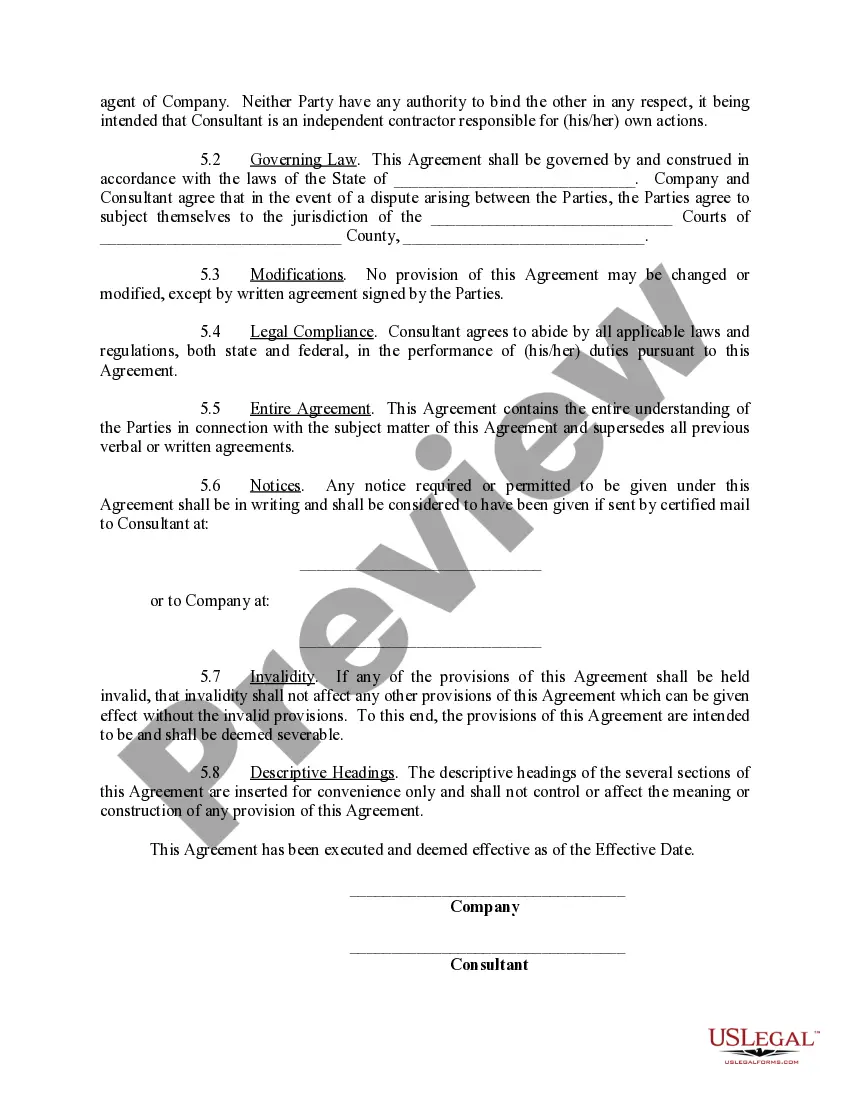

This forms is an agreement between a company and a former employee. Included in this agreement are terms, services and compensation information.

Tennessee Consulting Agreement with Former Employee

Description

How to fill out Consulting Agreement With Former Employee?

If you need to finalize, obtain, or produce valid document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site's simple and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Tennessee Consulting Agreement with Former Employee in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Get button to locate the Tennessee Consulting Agreement with Former Employee. You can also access forms you previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Be sure to read the instructions. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format. Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to create an account. Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Tennessee Consulting Agreement with Former Employee.

- Each legal document template you purchase is yours permanently.

- You have access to every form you saved in your account.

- Click the My documents section and select a form to print or download again.

- Stay competitive and acquire and print the Tennessee Consulting Agreement with Former Employee with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Yes, employment contracts are enforceable in Tennessee, provided they meet legal requirements. These contracts must be clear, mutually agreed upon, and involve consideration. If you are exploring a Tennessee Consulting Agreement with Former Employee, ensure that the contract follows state laws to guarantee enforceability and protect your interests.

Consulting does not typically count as employment, as consultants operate independently. They provide services based on a contract rather than an employment agreement, which includes specific job duties and benefits. If you’re considering a Tennessee Consulting Agreement with Former Employee, it’s important to establish this distinction to clarify roles and expectations.

Yes, a consulting agreement is a type of contract. It is a legally binding document that details the terms of the consulting relationship, including services provided, payment, and duration. For those navigating a Tennessee Consulting Agreement with Former Employee, understanding that this is a formal contract is crucial to ensuring compliance and protecting both parties' interests.

A consultancy agreement is a contract for services provided by a consultant, while an employment agreement establishes an employer-employee relationship. With a consultancy agreement, the consultant retains independence and flexibility in how they complete their work. In contrast, an employment agreement typically includes benefits and obligations, which are not present in a Tennessee Consulting Agreement with Former Employee.

An independent contractor agreement in Tennessee outlines the terms between a business and a contractor who provides services. This agreement specifies the nature of the work, payment terms, and confidentiality obligations. Importantly, it distinguishes the contractor from an employee, protecting both parties. When dealing with a Tennessee Consulting Agreement with Former Employee, it's essential to clarify the nature of the relationship to avoid legal complications.

In Tennessee, many professional services are subject to sales tax, including consulting services. If you are entering into a Tennessee Consulting Agreement with Former Employee, be prepared to handle the tax implications associated with your fees. Understanding the specifics of what services are taxable will help you avoid unexpected costs. For clarity, consider consulting legal and tax experts or using dedicated platforms like uslegalforms.

Yes, Tennessee imposes taxes on most consulting services. When you engage in a Tennessee Consulting Agreement with Former Employee, it's crucial to understand that your consulting fees may be subject to sales tax. Keeping accurate records and understanding your tax responsibilities will help you manage compliance effectively. Utilizing resources like uslegalforms can assist in navigating these tax requirements.

In Tennessee, certain services are exempt from sales tax, including some professional services like legal and medical services. However, consulting services usually fall outside this exemption. When drafting a Tennessee Consulting Agreement with Former Employee, you should specify the services being provided to ensure clarity on tax implications. Always verify with a tax advisor to confirm service classifications.

Yes, consulting services are generally taxable in Tennessee. When you enter into a Tennessee Consulting Agreement with Former Employee, you should be aware that the state considers these services as taxable transactions. It's important to calculate and collect the appropriate sales tax to remain compliant with state tax laws. Consulting a tax professional can help clarify your obligations.

Creating a consulting agreement involves outlining the scope of services, payment terms, and duration of the engagement. A well-structured Tennessee Consulting Agreement with Former Employee should include confidentiality clauses and non-compete provisions to protect sensitive information. You can streamline this process by using templates available on platforms like uslegalforms, which provide comprehensive guidance and legal compliance.