Tennessee Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

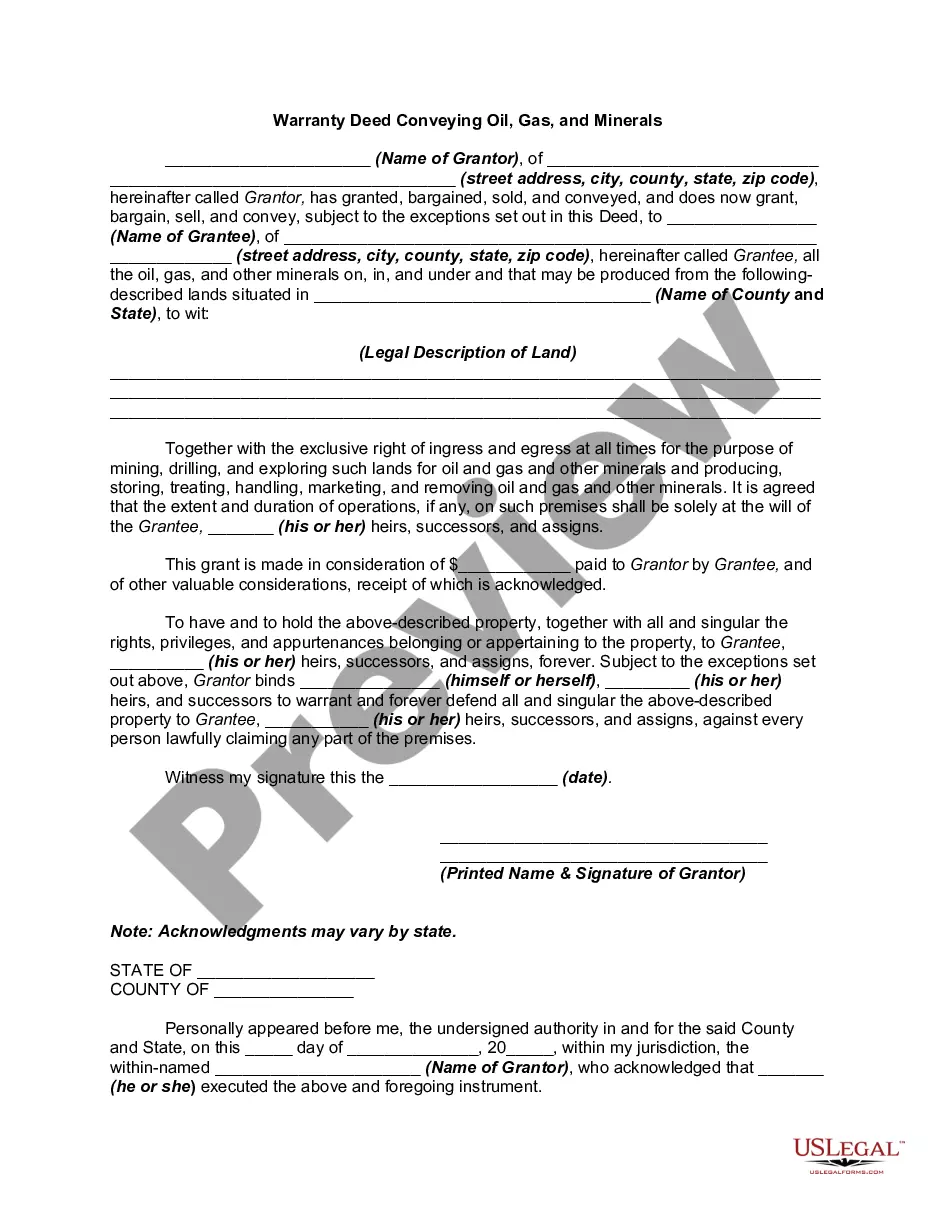

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

If you have to full, obtain, or printing legitimate record layouts, use US Legal Forms, the greatest variety of legitimate kinds, that can be found on the Internet. Make use of the site`s simple and easy handy lookup to find the files you require. Different layouts for enterprise and personal uses are categorized by groups and claims, or search phrases. Use US Legal Forms to find the Tennessee Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer in a couple of clicks.

In case you are currently a US Legal Forms consumer, log in in your profile and click the Acquire button to get the Tennessee Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer. You may also accessibility kinds you earlier delivered electronically inside the My Forms tab of your profile.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for your correct town/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s articles. Never forget to read the information.

- Step 3. In case you are unsatisfied with the type, make use of the Search field towards the top of the monitor to locate other models of the legitimate type template.

- Step 4. Once you have identified the shape you require, select the Purchase now button. Pick the rates prepare you choose and include your accreditations to register for the profile.

- Step 5. Process the deal. You can utilize your charge card or PayPal profile to finish the deal.

- Step 6. Pick the file format of the legitimate type and obtain it on your device.

- Step 7. Full, edit and printing or sign the Tennessee Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

Every legitimate record template you get is your own permanently. You may have acces to every type you delivered electronically inside your acccount. Click the My Forms portion and select a type to printing or obtain again.

Contend and obtain, and printing the Tennessee Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer with US Legal Forms. There are millions of specialist and status-particular kinds you may use to your enterprise or personal demands.

Form popularity

FAQ

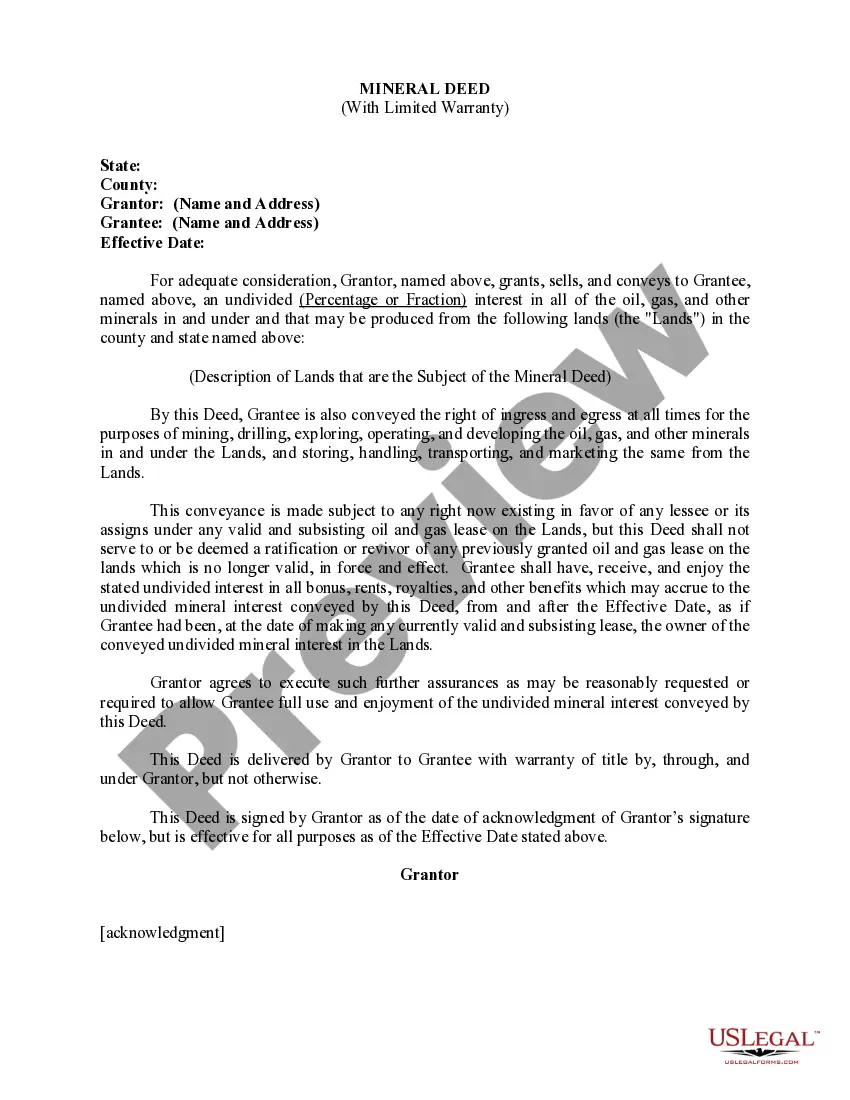

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

County Records and Tax Assessor's Office and Documents It gives you a clear indication of the direction to search for mineral ownership rights. The deed contains the description of the property, rights-of-way, oil and gas liens, mineral rights and easements.

Generally minerals are held in private ownership, and information on mineral rights, where available, is held by the Land Registry together with details of land surface ownership.

Mineral rights convey means to change the ownership of your mineral rights and transfer it to someone else. You can convey or transfer mineral rights using a will, a deed, or a lease. However, the process you choose determines what you intend to do with your rights.

The mineral owner's interest in the spacing unit is calculated by dividing the number of acres owned by the mineral owner within the unit by the total number of acres in the unit (Acres Owned / Total Acres in Unit). This will result in a decimal.

Royalty income from an oil and gas lease will be paid so long as a product is produced from the lease. Royalties are a proportionate part of the revenue received from the sale of oil, gas or other materials from a well or lease and paid to the royalty owners based on a lease agreement or other contract.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.