This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Tennessee Letter of Dispute - Complete Balance

Description

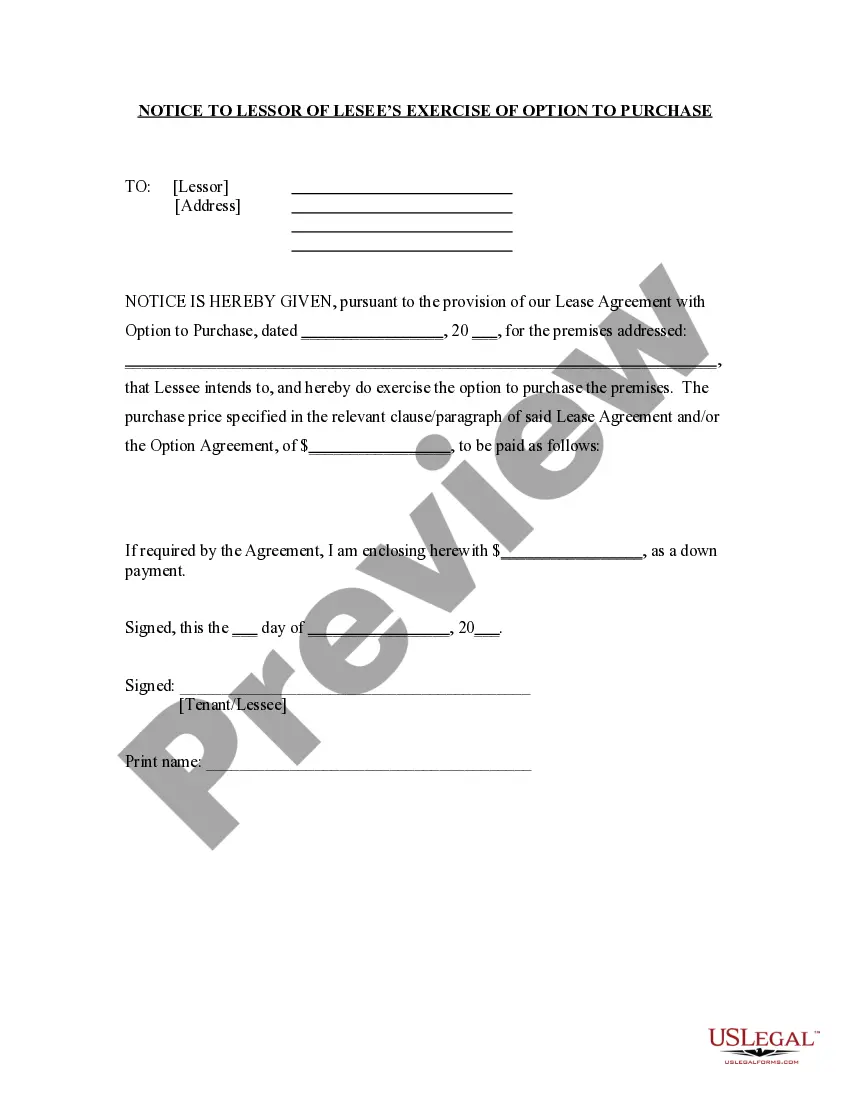

How to fill out Letter Of Dispute - Complete Balance?

If you need to obtain, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms available online. Take advantage of the site’s straightforward and convenient search feature to find the documents you require. Various templates for business and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to locate the Tennessee Letter of Dispute - Complete Balance with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to find the Tennessee Letter of Dispute - Complete Balance. You can also access forms you previously downloaded from the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have chosen the form for the correct area/region. Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal form template. Step 4. Once you have identified the form you need, click on the Download now button. Choose the pricing plan you prefer and provide your details to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Tennessee Letter of Dispute - Complete Balance.

- Every legal document template you purchase is yours permanently.

- You have access to every form you downloaded within your account.

- Navigate to the My documents section and choose a form to print or download again.

- Act quickly and download, and print the Tennessee Letter of Dispute - Complete Balance with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

In Tennessee, most debts become uncollectible after six years due to the statute of limitations. This means that if you have not made any payments or acknowledged the debt during this time, you have legal grounds to dispute any collection efforts. Utilizing a Tennessee Letter of Dispute - Complete Balance can help you assert your rights effectively, ensuring that you communicate your position clearly to the debt collector.

A debt becomes uncollectible once the statute of limitations expires, which is usually six years for most debts in Tennessee. After this period, creditors can no longer take legal action to collect the debt. If a debt collector attempts to collect after this time, you can effectively use a Tennessee Letter of Dispute - Complete Balance to assert your rights and clarify that the debt is no longer legally collectible.

Writing a letter disputing a debt involves a few key steps. Start by clearly stating your name, address, and account details, then explain the reason for your dispute in a concise manner. Finally, include the phrase 'Tennessee Letter of Dispute - Complete Balance' to emphasize your intention, and send it to the debt collector via certified mail for proof of delivery. This process ensures that your dispute is formally acknowledged.

In Tennessee, the statute of limitations for most debts is six years. This means that a debt collector can legally pursue old debt for up to six years from the date of the last payment or acknowledgment of the debt. After this period, the debt becomes time-barred, and you can use a Tennessee Letter of Dispute - Complete Balance to formally challenge any ongoing collection efforts.

Legally disputing a bill involves notifying the billing party of your concerns in writing. Clearly state your account details, the nature of the dispute, and any evidence that supports your claim. It's important to follow up if you do not receive a timely response. A Tennessee Letter of Dispute - Complete Balance from uslegalforms can provide you with the necessary framework to ensure your legal rights are protected.

To write a successful dispute letter, start with a clear and direct introduction of your issue. Make sure to include all relevant facts, such as dates, amounts, and any supporting evidence. Maintain a respectful tone throughout the letter, and clearly state what resolution you seek. Consider using a Tennessee Letter of Dispute - Complete Balance as a structured guide to improve your chances of success.

In your payment dispute letter, clearly identify yourself and your account. Describe the payment issue, including the date and amount in question. Be direct in stating your reasons for the dispute, and provide any relevant documentation. For added effectiveness, use a Tennessee Letter of Dispute - Complete Balance from uslegalforms to ensure your letter is comprehensive.

Writing a billing dispute letter involves outlining your concerns with clarity. Start by mentioning your account details and the specific billing issue you are facing. Provide a concise explanation of why you believe the bill is incorrect and attach any supporting documents. A Tennessee Letter of Dispute - Complete Balance template from uslegalforms can help you format your letter correctly.

To write a dispute effectively, start by clearly stating the reason for your dispute. Include relevant details like dates, amounts, and any supporting documentation. Use a formal tone and keep your letter concise. For a comprehensive approach, consider using a Tennessee Letter of Dispute - Complete Balance template from uslegalforms, which can guide you through the process.

Balance billing, also known as surprise billing, is regulated in Tennessee but not entirely illegal. Under certain conditions, providers can bill patients for the difference between their charges and what insurance pays. If you receive a bill that seems excessive or unexpected, a Tennessee Letter of Dispute - Complete Balance can help you address the issue. It's important to know your rights and seek assistance to navigate this complex situation effectively.