Tennessee Special Improvement Project and Assessment

Description

How to fill out Special Improvement Project And Assessment?

US Legal Forms - one of many greatest libraries of lawful types in the United States - offers an array of lawful document layouts you may obtain or print. Using the site, you can find a huge number of types for enterprise and person uses, sorted by classes, claims, or key phrases.You can find the most up-to-date types of types such as the Tennessee Special Improvement Project and Assessment within minutes.

If you currently have a monthly subscription, log in and obtain Tennessee Special Improvement Project and Assessment in the US Legal Forms local library. The Down load key will appear on every single type you see. You get access to all previously saved types within the My Forms tab of your respective bank account.

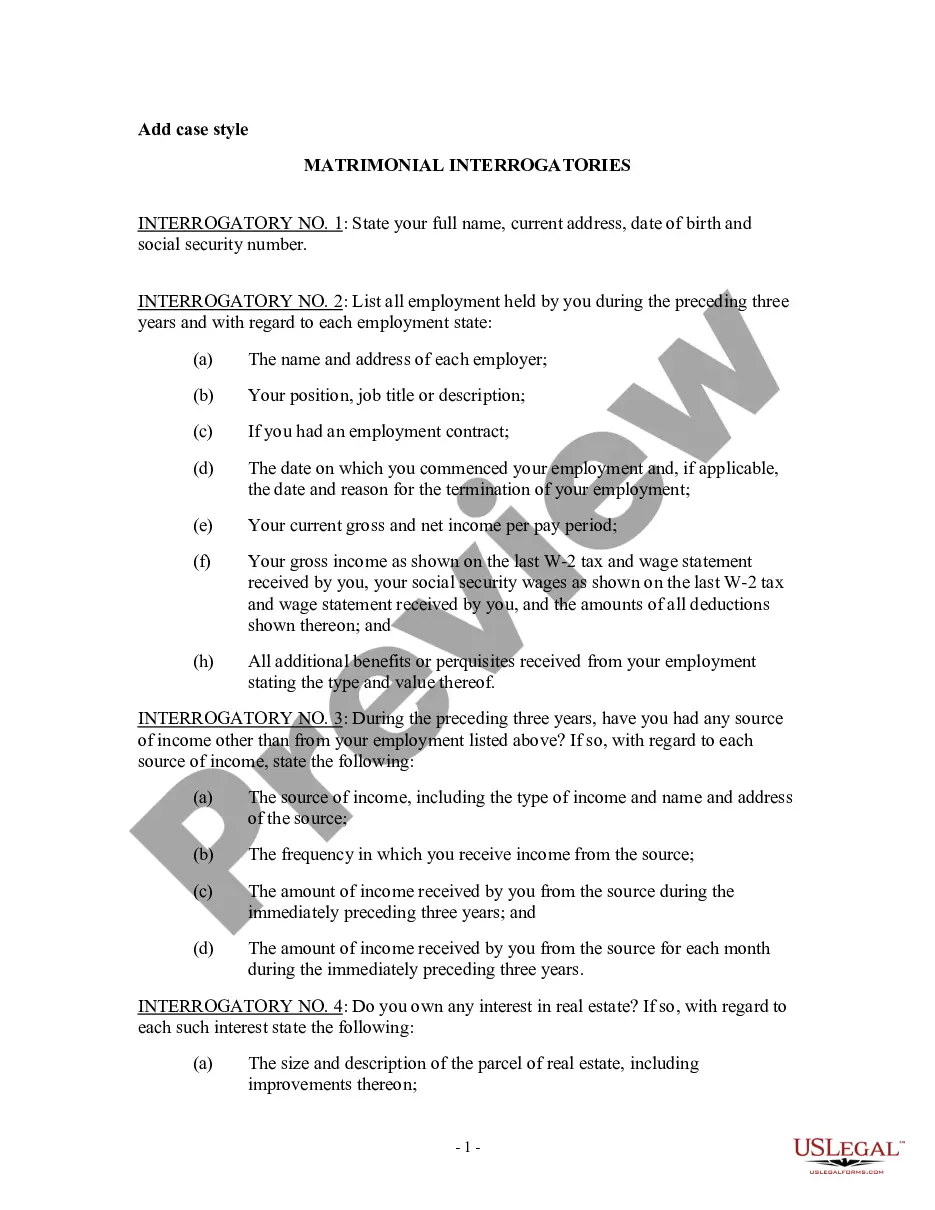

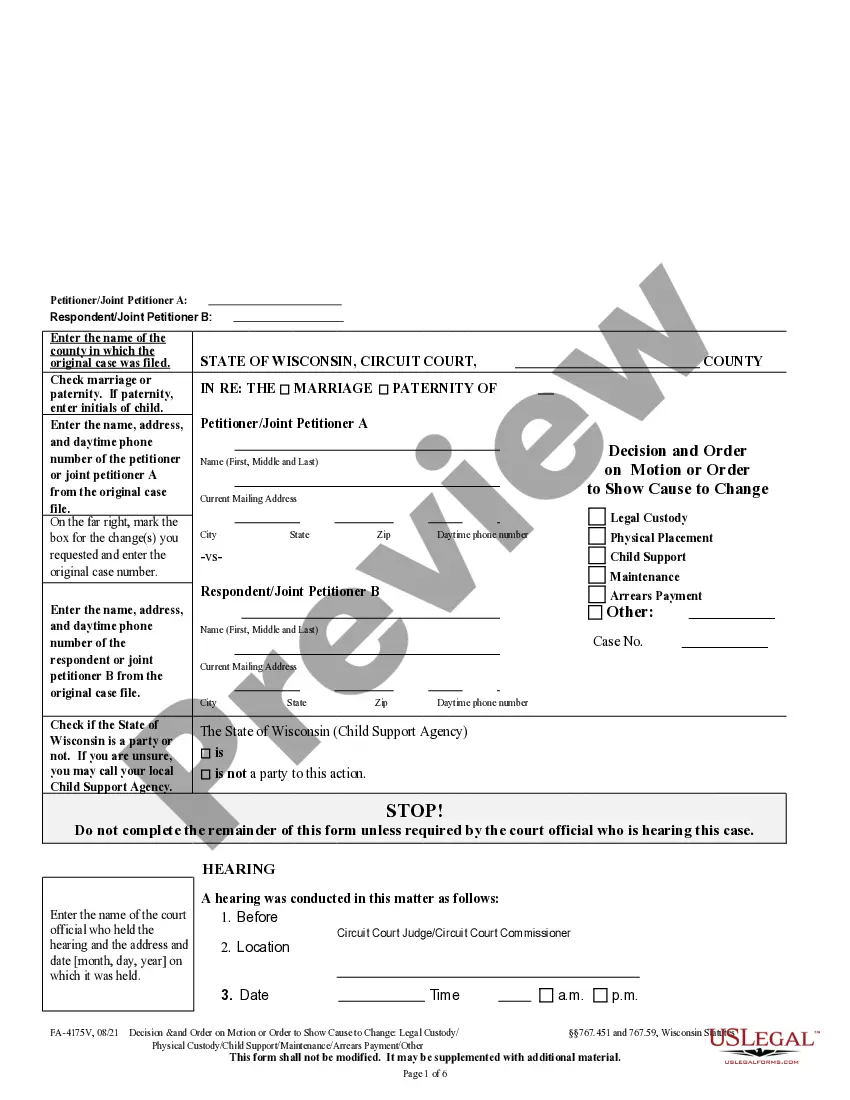

If you wish to use US Legal Forms the first time, here are straightforward instructions to help you get started:

- Be sure you have selected the proper type for your area/area. Go through the Review key to analyze the form`s content material. Read the type description to ensure that you have selected the proper type.

- In case the type doesn`t satisfy your specifications, use the Search industry near the top of the screen to discover the the one that does.

- Should you be happy with the form, validate your selection by clicking the Get now key. Then, choose the rates strategy you favor and provide your accreditations to sign up for an bank account.

- Method the transaction. Use your charge card or PayPal bank account to accomplish the transaction.

- Pick the format and obtain the form on your product.

- Make changes. Complete, modify and print and sign the saved Tennessee Special Improvement Project and Assessment.

Each format you included with your bank account lacks an expiration date which is yours for a long time. So, in order to obtain or print another backup, just proceed to the My Forms segment and click about the type you require.

Get access to the Tennessee Special Improvement Project and Assessment with US Legal Forms, the most comprehensive local library of lawful document layouts. Use a huge number of specialist and condition-certain layouts that meet up with your company or person requirements and specifications.

Form popularity

FAQ

Be 65 years of age or older by the end of the year in which the application is filed. Have an income from all sources that does not exceed the county income limit established for that tax year.

In Tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for public utility property. One of the most common components used to differentiate ?personal property? from ?real property? is whether it is moveable (personal) or affixed (real).

Every public school student in Tennessee with special needs is required, by federal law, to have an Individualized Education Program, or IEP. The IEP is the framework around which a student can learn: it outlines what the specific needs and disabilities are, and how the school will accommodate those needs.

In Tennessee, all children must go to school from age 6 to age 18. But IDEA law says children with disabilities can get services from birth until age 22.

Tennessee law requires every county to undergo a countywide revaluation of all real property on a 4-, 5-, or 6-year reappraisal cycle. The assessor of property is responsible for the cyclical revaluation with some assistance and oversight from the Comptroller's Division of Property Assessments.

Tennessee law requires every county to undergo a countywide revaluation of all real property on a 4-, 5-, or 6-year reappraisal cycle. The assessor of property is responsible for the cyclical revaluation with some assistance and oversight from the Comptroller's Division of Property Assessments.

Assessment Residential real property25%Farm real property25%Commercial and industrial real property40%Public utility real and personal property55%Business personal property30%1 more row

The ASSESSMENT RATIO for the different classes of property is established by state law (residential and farm @ 25% of appraised value, commercial/industrial @ 40% of appraised value and personalty @ 30% of appraised value). The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.