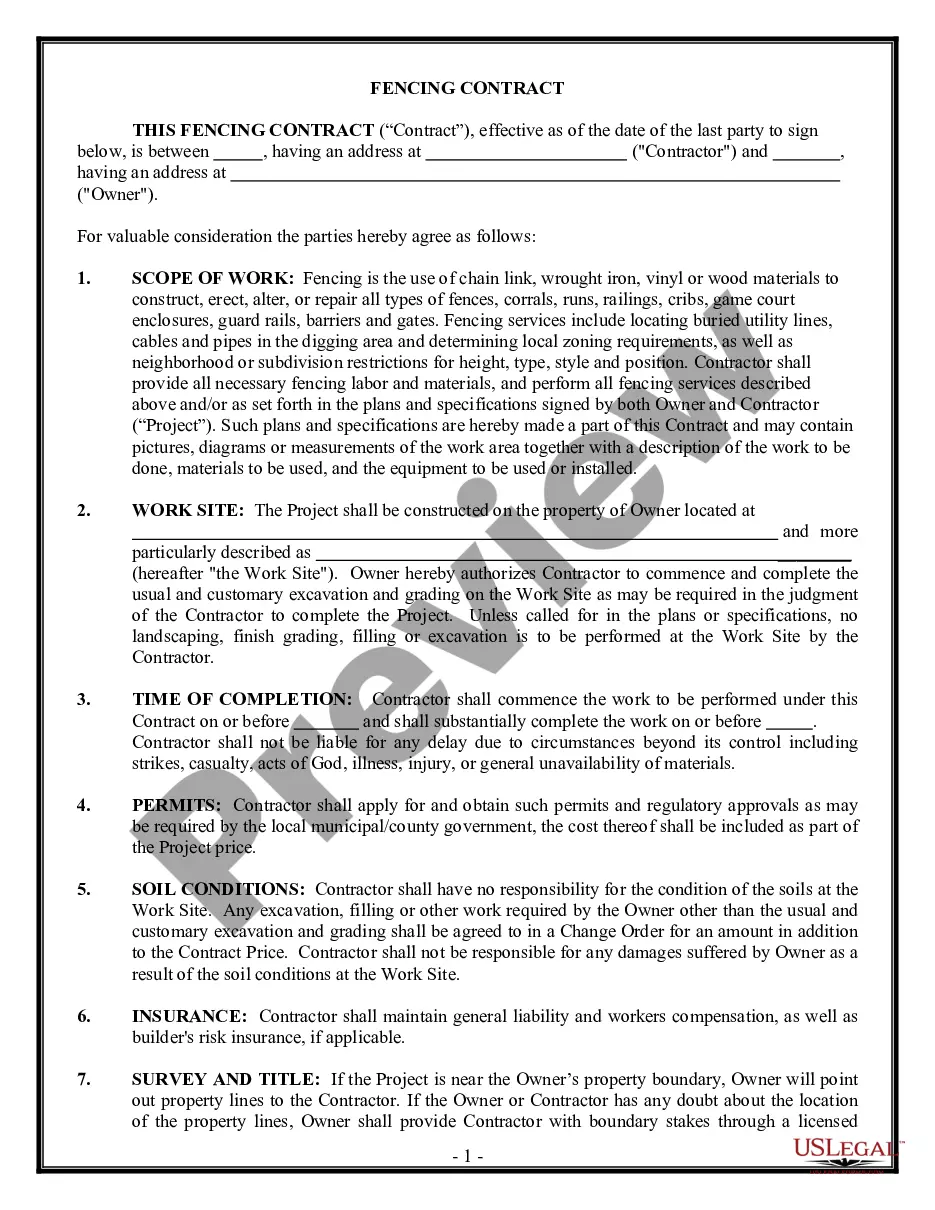

Tennessee Self-Employed Steel Services Contract

Description

How to fill out Self-Employed Steel Services Contract?

US Legal Forms - one of the largest collections of legal documents in the U.S. - offers a variety of legal form templates that you can download or create. By utilizing the website, you can discover thousands of forms for business and personal needs, categorized by type, state, or keywords. You can find the latest versions of forms such as the Tennessee Self-Employed Steel Services Contract in just a few minutes.

If you already have a subscription, Log In and download the Tennessee Self-Employed Steel Services Contract from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get you started: Ensure you have chosen the correct form for your city/state. Click the Review button to examine the form's content. Check the form summary to confirm that you have selected the correct form. If the form does not meet your requirements, utilize the Search field at the top of the page to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Tennessee Self-Employed Steel Services Contract. Every template you add to your account does not expire and is yours indefinitely. So, to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Tennessee Self-Employed Steel Services Contract with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

In Tennessee, a contractor can typically ask for an upfront payment of around 10% to 30% of the total contract amount. This upfront payment serves as a deposit to secure the services and materials needed for the project. For a Tennessee Self-Employed Steel Services Contract, it is essential to outline payment terms clearly in the agreement to avoid misunderstandings. Utilizing a platform like US Legal Forms can help you create a solid contract that adheres to state guidelines.

An independent contractor agreement in Tennessee is a legal document that defines the working relationship between a contractor and a client. This agreement details the responsibilities, payment structure, and project timelines. By utilizing a Tennessee Self-Employed Steel Services Contract, you can create a comprehensive agreement that meets state requirements and protects your rights.

An independent contractor must earn $600 or more from a single client within a calendar year to receive a 1099 form. This form reports the payments made to the contractor for tax purposes. It is essential to keep track of your earnings and have a Tennessee Self-Employed Steel Services Contract in place to ensure accurate reporting.

The new federal rule for independent contractors focuses on clarifying the classification of workers. It emphasizes the importance of understanding the nature of the work relationship and the degree of control exerted by the employer. Having a solid Tennessee Self-Employed Steel Services Contract can help you navigate these changes and ensure compliance with the latest regulations.

For a contract to be legally binding in Tennessee, it must include mutual consent, a lawful object, and consideration. Both parties should agree to the terms, and the contract must not violate any laws. A well-drafted Tennessee Self-Employed Steel Services Contract can help ensure all these elements are satisfied, providing peace of mind for both parties.

In Tennessee, independent contractors must meet specific legal requirements, including proper tax classifications and adherence to state regulations. They should also ensure compliance with local business licenses and permits relevant to their services. Utilizing a Tennessee Self-Employed Steel Services Contract helps ensure that you meet these requirements and avoid potential legal issues.

The primary purpose of an independent contractor agreement is to outline the terms and conditions between the contractor and the client. This agreement clarifies the scope of work, payment terms, and timelines, fostering a clear understanding. By using a Tennessee Self-Employed Steel Services Contract, you protect both parties' interests and establish a professional relationship.

To determine if you need a business license in Tennessee, start by checking with your local county or city government. They provide specific guidelines based on your business type and location. If you're unsure, seeking professional advice can be beneficial. A Tennessee Self-Employed Steel Services Contract can serve as a helpful resource in clarifying your licensing needs.

Yes, subcontractors generally need a license to operate legally in Tennessee. This requirement protects both the subcontractor and the clients they serve. It is important to verify the licensing requirements for your specific trade. A Tennessee Self-Employed Steel Services Contract can help you navigate these regulations effectively.

Yes, as a sole proprietor in Tennessee, you typically need a business license. This requirement ensures that you meet local business regulations and tax obligations. Make sure to research the specific requirements for your county. A Tennessee Self-Employed Steel Services Contract can provide the necessary information to help you stay compliant.