Tennessee Self-Employed Drywall Services Contract

Description

How to fill out Self-Employed Drywall Services Contract?

Are you in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn't easy.

US Legal Forms offers a vast array of form templates, including the Tennessee Self-Employed Drywall Services Contract, which are crafted to meet federal and state regulations.

Once you acquire the appropriate form, simply click Acquire now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess your account, simply Log In.

- After that, you can download the Tennessee Self-Employed Drywall Services Contract template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

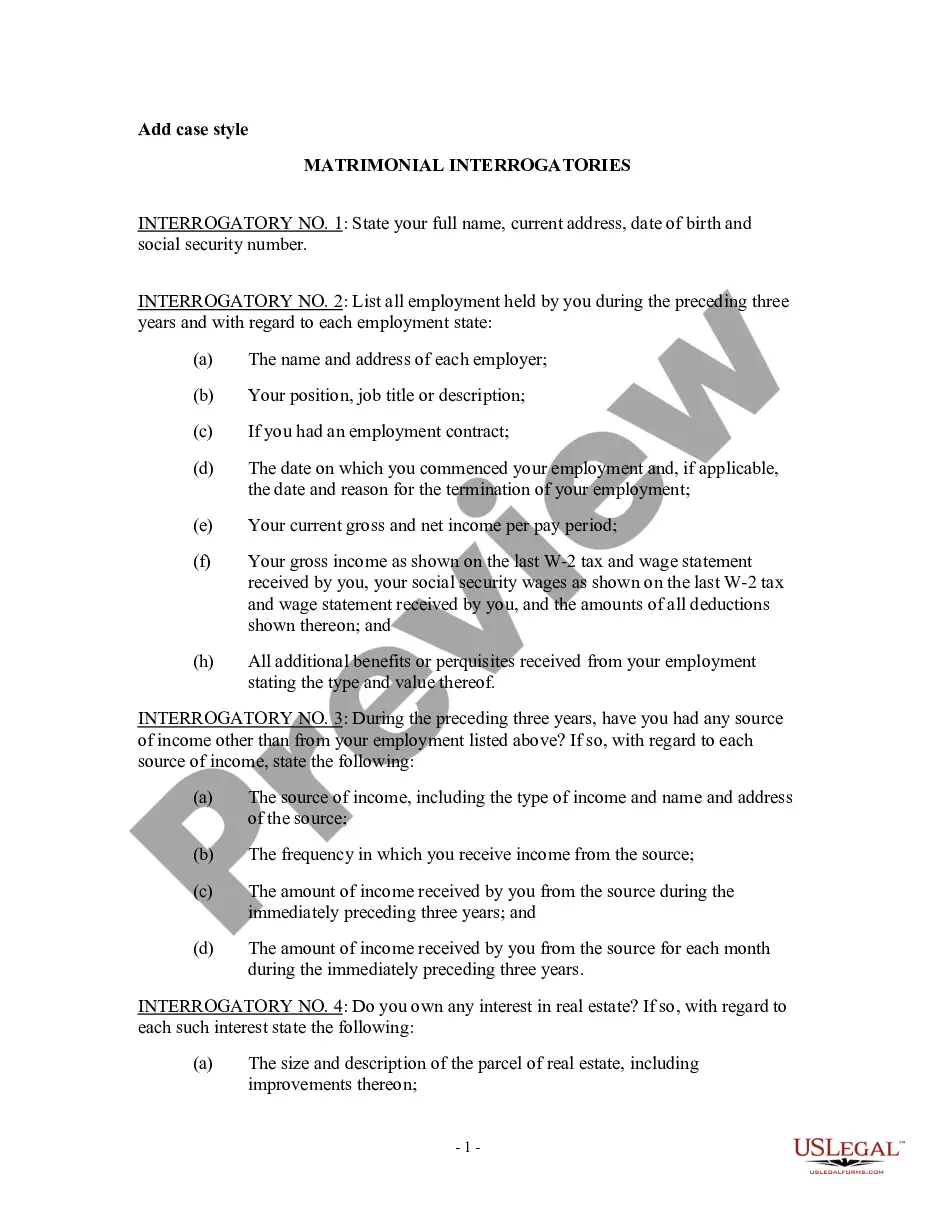

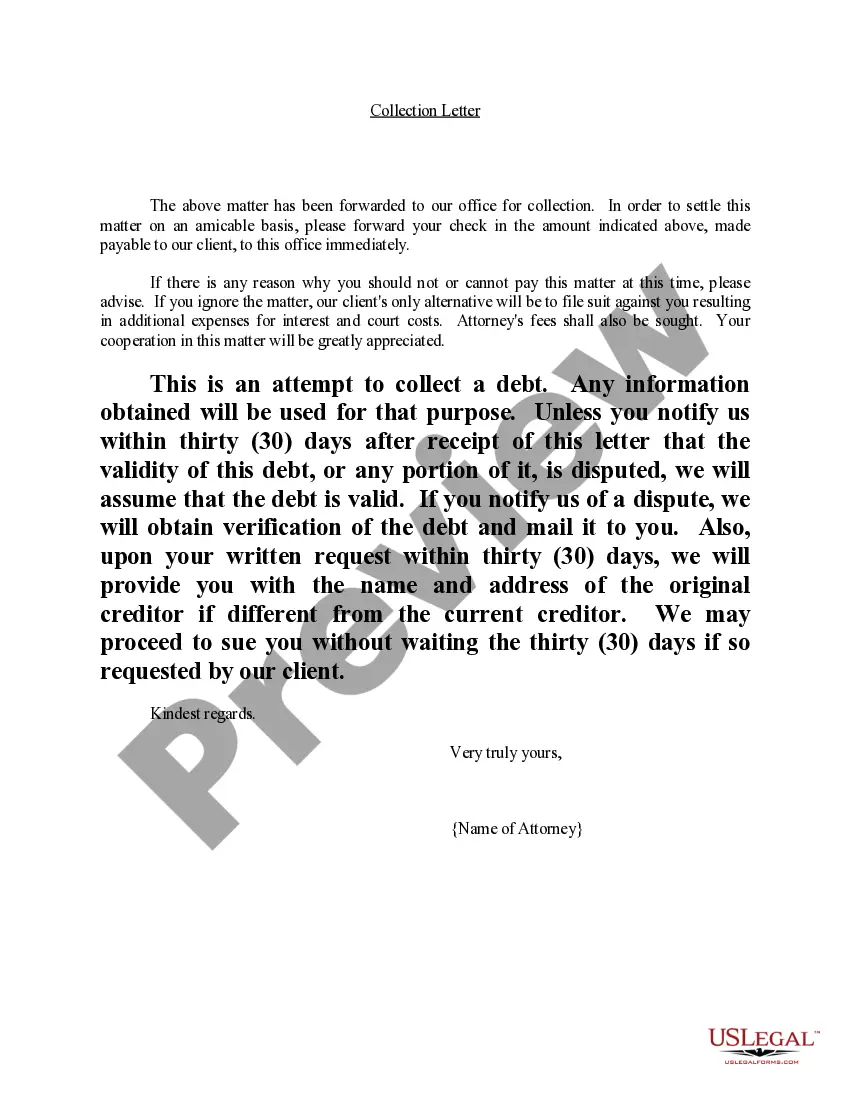

- Utilize the Preview feature to examine the form.

- Review the description to confirm that you have selected the right form.

- If the form isn't what you're looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Yes, starting a drywall company in Tennessee requires obtaining a license. This license is crucial to ensure compliance with state regulations and to validate your expertise in the field. When you utilize a Tennessee Self-Employed Drywall Services Contract, you not only adhere to legal standards but also enhance your business reputation. For assistance in acquiring the right documents, USLegalForms can provide the necessary resources to get you started.

To become an independent contractor in Tennessee, start by deciding the type of services you want to offer. Next, register your business and obtain any necessary licenses, including a Tennessee Self-Employed Drywall Services Contract if you are focusing on drywall work. Creating a solid business plan will help outline your goals and strategies. Additionally, consider using platforms like USLegalForms to access necessary documents and streamline your process.

Yes, in Tennessee, you need a license to operate as a contractor, especially if your projects exceed $25,000. This requirement ensures that contractors meet specific standards and regulations. When you pursue a Tennessee Self-Employed Drywall Services Contract, having the right license not only boosts your credibility but also protects you and your clients. You can check the Tennessee Board for Licensing Contractors for more detailed information.

To fill out an independent contractor agreement, start by entering the contractor's and client's details, including their contact information. Then, outline the project scope, payment structure, and timeline to establish clear expectations. If you’re creating a Tennessee self-employed drywall services contract, make sure to include specific project requirements. US Legal Forms provides easy-to-use templates that can help you complete this agreement accurately.

Writing an independent contractor agreement involves specifying the nature of the work and the expectations for both parties. Include essential elements such as payment terms, confidentiality clauses, and termination conditions. For a Tennessee self-employed drywall services contract, ensure you detail the specific tasks and materials involved in the project. Platforms like US Legal Forms offer customizable templates that can make this task easier.

To write a simple contract agreement, begin by defining the parties involved, including their roles and responsibilities. Clearly outline the work to be performed, payment terms, and deadlines to avoid misunderstandings. When dealing with a Tennessee self-employed drywall services contract, it’s crucial to be specific about the project details. Consider using US Legal Forms for a straightforward template that can guide you through the drafting process.

Filling out an independent contractor form starts with gathering essential details such as your name, address, and business information. Next, include the scope of work, payment terms, and deadlines to ensure clarity. For Tennessee self-employed drywall services, you might want to reference specific tasks or materials in the form. Utilizing platforms like US Legal Forms can streamline this process by providing templates tailored to your needs.

Yes, subcontractors in Tennessee typically require a license, depending on the scope of their work. Even if you are operating under a Tennessee Self-Employed Drywall Services Contract, it's essential for any subcontractors you hire to be properly licensed. This ensures compliance with state regulations and protects all parties involved.

Certain services are considered non-taxable in Tennessee, including some labor services and repairs. For example, if a service directly enhances the property without adding value, it may fall under the non-taxable category. Understanding these nuances can help you craft a precise Tennessee Self-Employed Drywall Services Contract that aligns with tax regulations.

Yes, construction services are generally taxable in Tennessee. This includes most services related to construction and renovation projects. To avoid any tax-related issues, it’s essential to understand the implications when creating a Tennessee Self-Employed Drywall Services Contract.