Tennessee Appraisal Agreement - Self-Employed Independent Contractor

Description

How to fill out Appraisal Agreement - Self-Employed Independent Contractor?

Have you ever found yourself in a situation where you need documents for business or specific objectives on a regular basis.

There are numerous legitimate document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides thousands of template options, such as the Tennessee Appraisal Agreement - Self-Employed Independent Contractor, which can be tailored to meet both state and federal requirements.

Once you find the right template, simply click Purchase now.

Select the pricing plan you prefer, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Tennessee Appraisal Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct area/county.

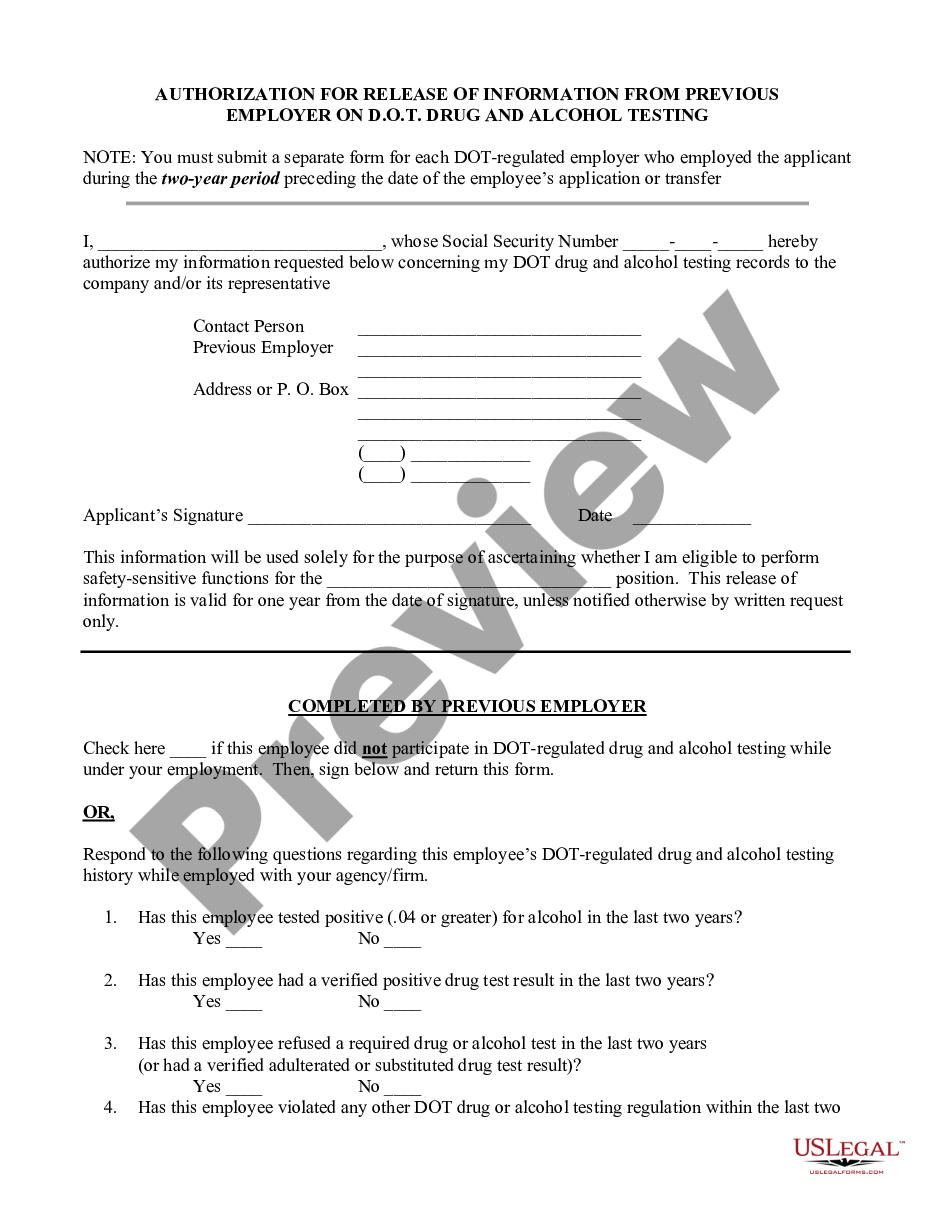

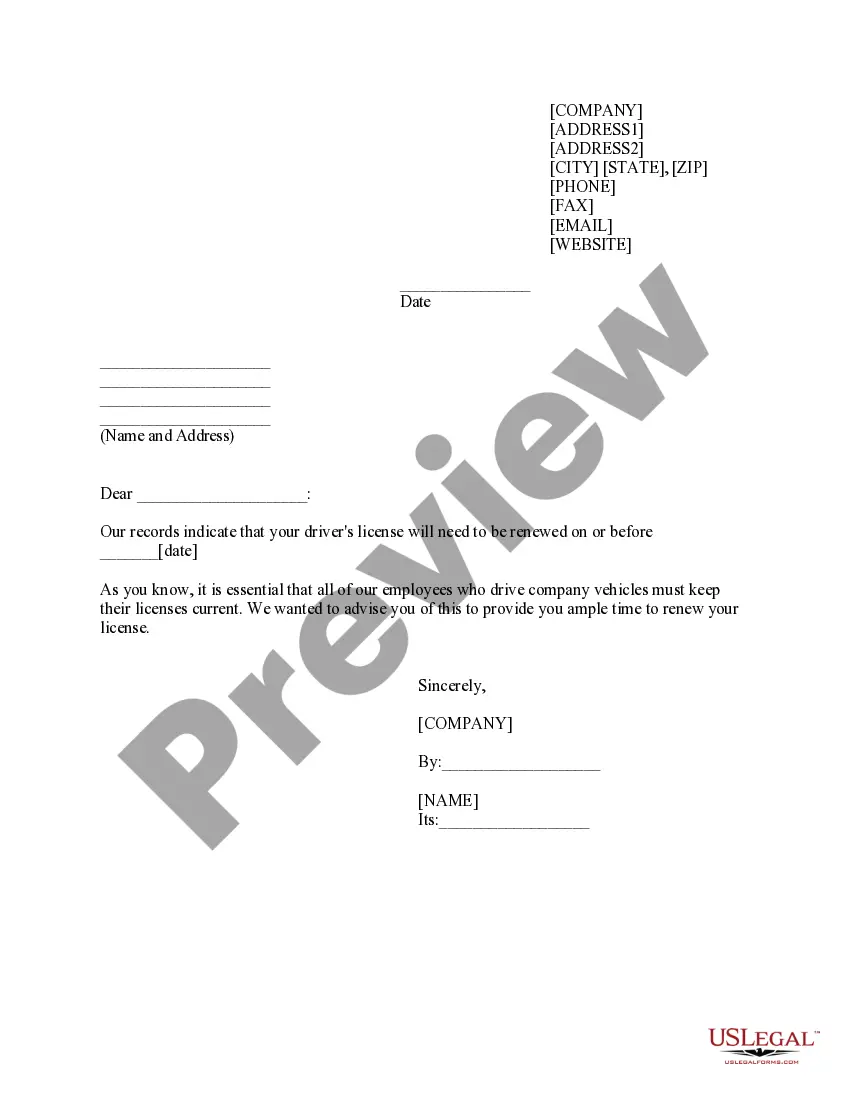

- Utilize the Review option to inspect the form.

- Check the details to ensure you have selected the correct template.

- If the template is not what you are looking for, use the Research field to locate the template that suits your needs.

Form popularity

FAQ

To prove your status as an independent contractor, you need to maintain documentation such as your Tennessee Appraisal Agreement - Self-Employed Independent Contractor, invoices, and tax records. These documents clearly demonstrate your independent relationship with clients and show that you control how you perform your work. Having this proof is crucial for meeting tax requirements and clarifying your legal standing. Additionally, platforms like uslegalforms can help you generate the necessary agreements and documentation to support your independent status.

Yes, an independent contractor is indeed classified as self-employed. When you operate under a Tennessee Appraisal Agreement - Self-Employed Independent Contractor, you essentially work for yourself, offering services in exchange for payment. It is important to understand this distinction, as your tax obligations and legal responsibilities will differ from those of a traditional employee. This classification can provide flexibility in how you conduct your business and manage your finances.

To create an independent contractor agreement, begin by outlining the specific terms of the work relationship. Include details such as payment terms, project timelines, and the scope of services. It is essential to specify that this is a Tennessee Appraisal Agreement - Self-Employed Independent Contractor to clarify the nature of the engagement. Using a reliable platform like US Legal Forms can simplify this process by providing customizable templates that ensure all necessary components are covered.

To fill out a declaration of independent contractor status form, start by providing your personal details, such as your name and address. Next, include your business information, if applicable, and ensure you clearly define the nature of your work as a self-employed independent contractor. Be sure to reference the specific terms of the Tennessee Appraisal Agreement - Self-Employed Independent Contractor, as this will help clarify your status. If you're uncertain about any sections, consider using resources from USLegalForms to guide you through the process, ensuring accuracy and compliance.

A basic independent contractor agreement serves as a foundational document that outlines the relationship between the contractor and the client. It typically includes sections on services provided, payment arrangements, and confidentiality. Implementing a Tennessee Appraisal Agreement - Self-Employed Independent Contractor as part of your business structure can enhance your professional image and protect your interests.

In Tennessee, the amount of work you can perform without a contractor license varies based on the type of work. Generally, independent contractors can complete projects valued under a certain threshold without needing a license. However, this limitation should be clearly understood, particularly when drafting a Tennessee Appraisal Agreement - Self-Employed Independent Contractor, to avoid legal complications.

Yes, many real estate appraisers operate as independent contractors. They usually enter into agreements with real estate firms or other entities to provide appraisal services on a contractual basis. This setup enables them to maintain flexibility while fulfilling the stipulations of a Tennessee Appraisal Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement is straightforward. First, gather all necessary information, such as the names of the parties involved, payment terms, and the scope of work. Clearly define the roles and responsibilities to avoid misunderstandings. A well-structured Tennessee Appraisal Agreement - Self-Employed Independent Contractor ensures that both parties are on the same page.

In Tennessee, independent contractors must meet specific legal requirements to ensure compliance with state laws. These requirements often include obtaining any necessary licenses, adhering to tax regulations, and fulfilling contractual obligations outlined in the Tennessee Appraisal Agreement - Self-Employed Independent Contractor. Understanding these legalities helps protect your rights and responsibilities in the working relationship.

An independent contractor agreement in Tennessee outlines the working relationship between a business and an independent contractor. This document specifies the conditions under which the contractor will operate, including the scope of work, payment terms, and responsibilities. When crafted correctly, a Tennessee Appraisal Agreement - Self-Employed Independent Contractor can protect both parties and clarify expectations.