Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor

Description

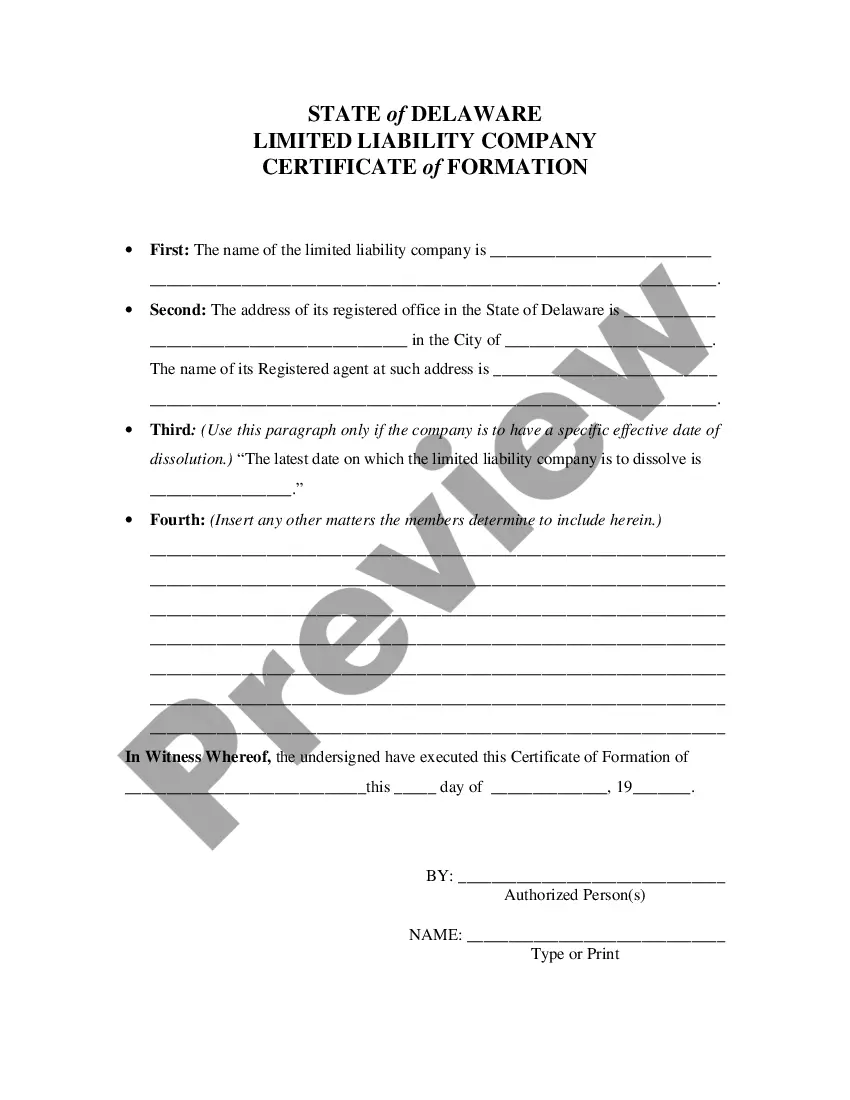

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide variety of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the most recent versions of forms such as the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor in moments.

If you already have an account, Log In and download the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will be visible on each form you view. You can access all previously obtained forms in the My documents section of your profile.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have chosen the correct form for your city/state. Click on the Review button to examine the form's content. Review the form summary to confirm that you have selected the right document. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make modifications. Fill out, alter, print, and sign the acquired Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Each template you added to your account has no expiration date and belongs to you indefinitely.

- Therefore, to download or print an additional copy, simply go to the My documents section and click on the form you desire.

- Access the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and any confidentiality clauses. You can start by drafting a document that clearly states these terms. For ease, you can utilize platforms like US Legal Forms, which offer templates specifically designed for a Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor. This simplifies the creation process while ensuring you cover all necessary legal aspects.

Legal requirements for independent contractors vary by state but generally include tax obligations and compliance with local laws. In Tennessee, contractors must ensure they maintain proper licensing and insurance as applicable. The Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor should address these requirements to avoid potential legal issues. Utilizing resources like US Legal Forms can guide you through the necessary stipulations.

A basic independent contractor agreement establishes a working relationship between the contractor and the client. It specifies the services to be provided, payment terms, and deadlines. This agreement protects both parties by clarifying their rights and responsibilities. You can find templates for the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor on platforms like US Legal Forms.

Typically, the hiring party or business owner writes the independent contractor agreement. They outline the terms and conditions that govern the relationship with the contractor. However, it is wise for contractors to review and negotiate the agreement. Using a platform like US Legal Forms can help both parties create a legally sound Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor form effectively, you need to gather relevant details such as your business information and the nature of your services. The Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor must include specifics about the project and payment structure. Utilize tools available on USLegalForms to access templates that guide you through the necessary fields. Accuracy in completion is crucial for successful compliance.

The independent contractor agreement in Tennessee is a legal document that outlines the terms of work between a contractor and a client. The Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor serves as a foundational tool for this relationship, detailing duties, compensation, and timelines. Having a well-defined agreement protects both parties and clarifies expectations. Ensure you understand Tennessee regulations while crafting your agreement.

Writing an independent contractor agreement starts with defining the key terms of the relationship. Be sure to include specifics such as deliverables, compensation, and deadlines distinctively within the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor. To aid in crafting a professional document, consider using templates from reputable sources like USLegalForms. Clear writing reduces the chance of misunderstandings down the line.

Filling out an independent contractor agreement involves detailing the scope of work, payment terms, and timeline. Specifically, the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor should include responsibilities, confidentiality clauses, and provisions for termination. You can access user-friendly templates on platforms like USLegalForms to simplify this process. Remember to review the agreement thoroughly before signing.

Independent contractors must complete various forms to establish their working relationship. The primary document is the Tennessee Contract Administrator Agreement - Self-Employed Independent Contractor, which outlines the terms of engagement. Additionally, they may need to fill out tax forms like the W-9 to provide their taxpayer identification information. Ensure all documents are clear and signed for legal protection.