Tennessee Farm Hand Services Contract - Self-Employed

Description

How to fill out Farm Hand Services Contract - Self-Employed?

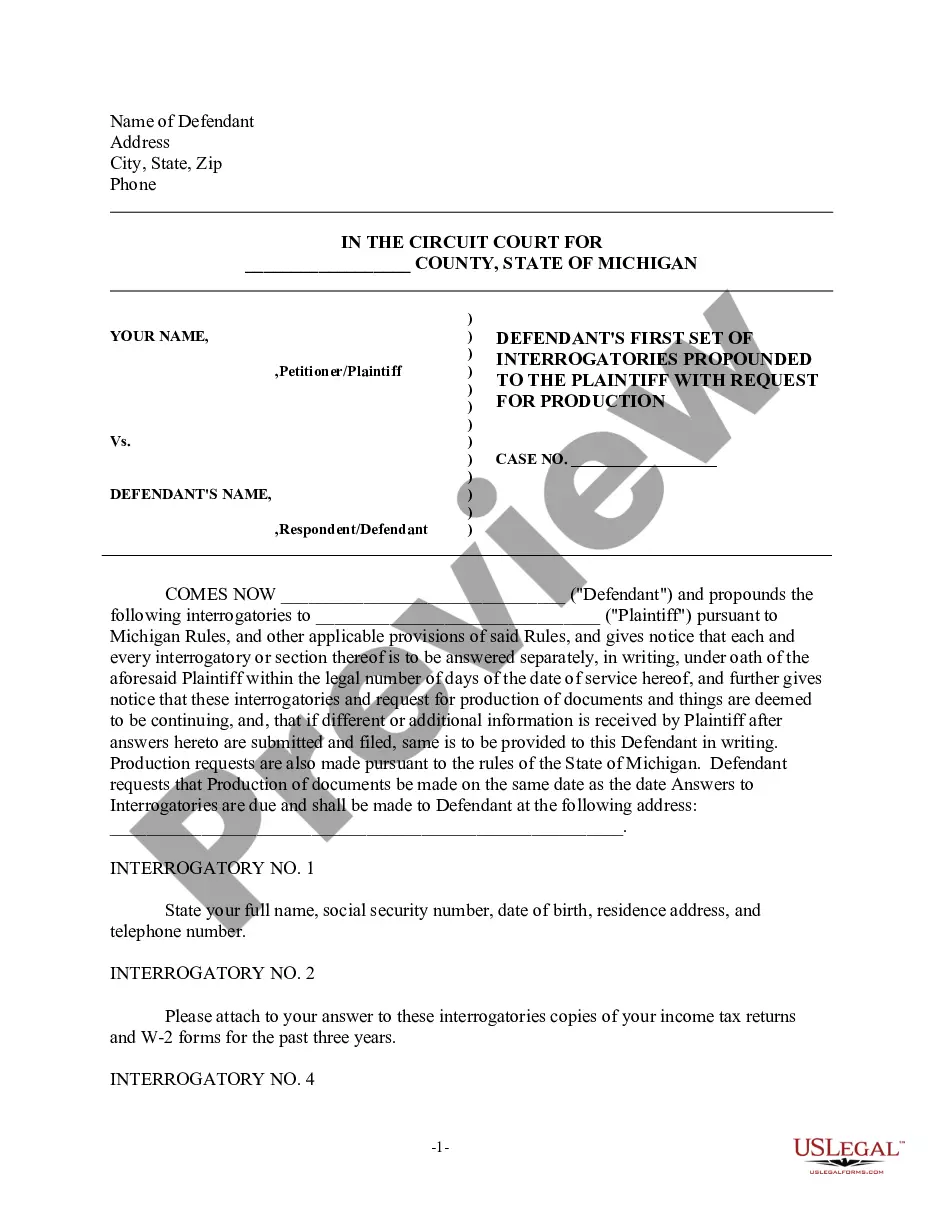

Are you in a position where you frequently require documents for business or specific purposes? There are numerous authentic document templates accessible online, but finding reliable versions is not easy. US Legal Forms offers a vast array of form templates, including the Tennessee Farm Hand Services Contract - Self-Employed, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Tennessee Farm Hand Services Contract - Self-Employed template.

If you do not have an account and wish to begin using US Legal Forms, follow these steps: Obtain the form you require and ensure it is for the correct city/region. Utilize the Review feature to examine the form. Check the description to confirm that you have selected the right document. If the form isn’t what you are looking for, use the Search field to find the form that suits your needs and requirements. Once you locate the correct form, click on Purchase now. Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Tennessee Farm Hand Services Contract - Self-Employed at any time, if needed. Just select the desired form to download or print the document template.

- Utilize US Legal Forms, one of the most comprehensive collections of legitimate forms, to save time and avoid errors. The service provides correctly crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

To qualify as an independent contractor in Tennessee, you must meet certain criteria set by the IRS and state laws. Typically, you need to show that you control the work you do, manage your business expenses, and operate without direction from clients. Drafting a solid Tennessee Farm Hand Services Contract - Self-Employed can also help demonstrate your independent status.

In Tennessee, the amount of work you can perform without a contractor license varies based on the type of service. For farm hand services, a license may not be required if you are self-employed and work on smaller projects. It’s advisable to consult local regulations and review your Tennessee Farm Hand Services Contract - Self-Employed for clarity.

Both terms convey a similar meaning, but using 'self-employed' emphasizes your overall status as a business owner. If you specifically work under contracts, 'independent contractor' may be more precise. Either way, if you operate under a Tennessee Farm Hand Services Contract - Self-Employed, you clearly define your role in the marketplace.

Contract work is indeed considered self-employment. When you provide services under a Tennessee Farm Hand Services Contract - Self-Employed, you operate independently. This means you control your work schedule, set your rates, and manage your client relationships, all key characteristics of self-employment.

Yes, having a contract is crucial when you are self-employed. A Tennessee Farm Hand Services Contract - Self-Employed not only protects your rights but also clarifies the expectations of the services you provide. This legal documentation helps prevent misunderstandings and provides a clear framework for your business relationship.

New rules for self-employed individuals often include changes in tax laws and health insurance options. In Tennessee, it’s important to stay updated on local regulations that may affect your Tennessee Farm Hand Services Contract - Self-Employed. As regulations evolve, make sure to check resources like USLegalForms for guidance on compliance and best practices.

Becoming an independent contractor in Tennessee involves several steps. First, you'll need to decide on the services you'll provide, such as Tennessee Farm Hand Services. Next, register your business and obtain any necessary permits. Finally, create a Tennessee Farm Hand Services Contract - Self-Employed to outline your terms and establish clear expectations with your clients.

Farmers can sometimes be considered independent contractors if they sell their goods directly and operate their own business. However, this classification may vary based on the working relationship with others. It is essential to have a clear Tennessee Farm Hand Services Contract - Self-Employed to define the nature of the relationship appropriately.

A farm hand typically refers to someone engaged in various tasks on a farm, possibly as an independent contractor, while a farm worker is often an employee who works under direct supervision. The distinction can affect labor laws and contractual obligations. Clarity in a Tennessee Farm Hand Services Contract - Self-Employed can reinforce these differences.

Employment contract law in Tennessee outlines the rights and responsibilities of both employers and employees or independent contractors. It encompasses agreements, terminations, and compliance with labor laws. For those utilizing a Tennessee Farm Hand Services Contract - Self-Employed, understanding this law is vital for maintaining legal integrity in farming operations.