Tennessee Shoring Services Contract - Self-Employed

Description

How to fill out Shoring Services Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal templates in the United States - offers a broad selection of legal document templates that you can download or print.

Through the site, you can acquire thousands of forms for business and personal purposes, organized by type, state, or keywords. You can find the most recent versions of documents like the Tennessee Shoring Services Contract - Self-Employed in just a few minutes.

If you already have a monthly subscription, Log In and access the Tennessee Shoring Services Contract - Self-Employed from your US Legal Forms collection. The Download option will appear for each template you view. You have access to all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make changes. Fill, edit, print, and sign the saved Tennessee Shoring Services Contract - Self-Employed. Every template you add to your account has no expiration date and is yours permanently. Thus, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the desired template. Gain access to the Tennessee Shoring Services Contract - Self-Employed with US Legal Forms, the largest collection of legal document templates. Use thousands of professional and state-specific templates that meet your business or personal requirements.

- To begin using US Legal Forms for the first time, here are simple steps to help you get started.

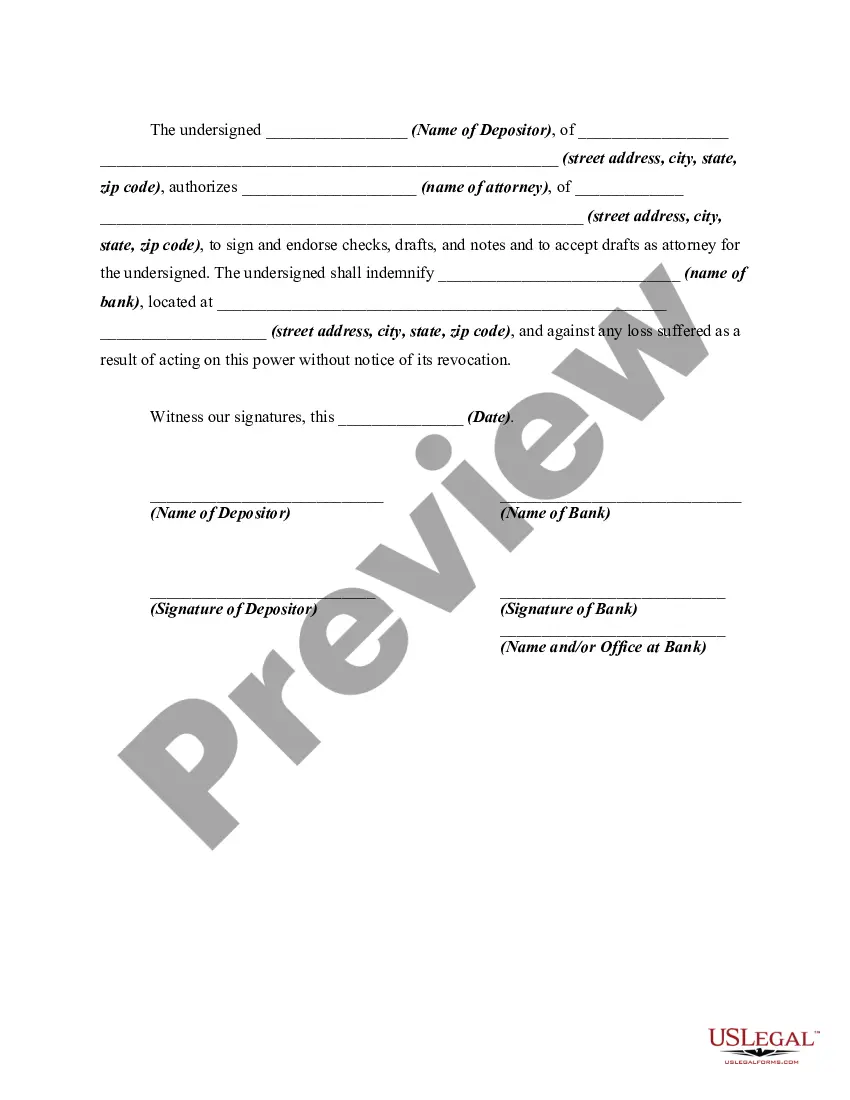

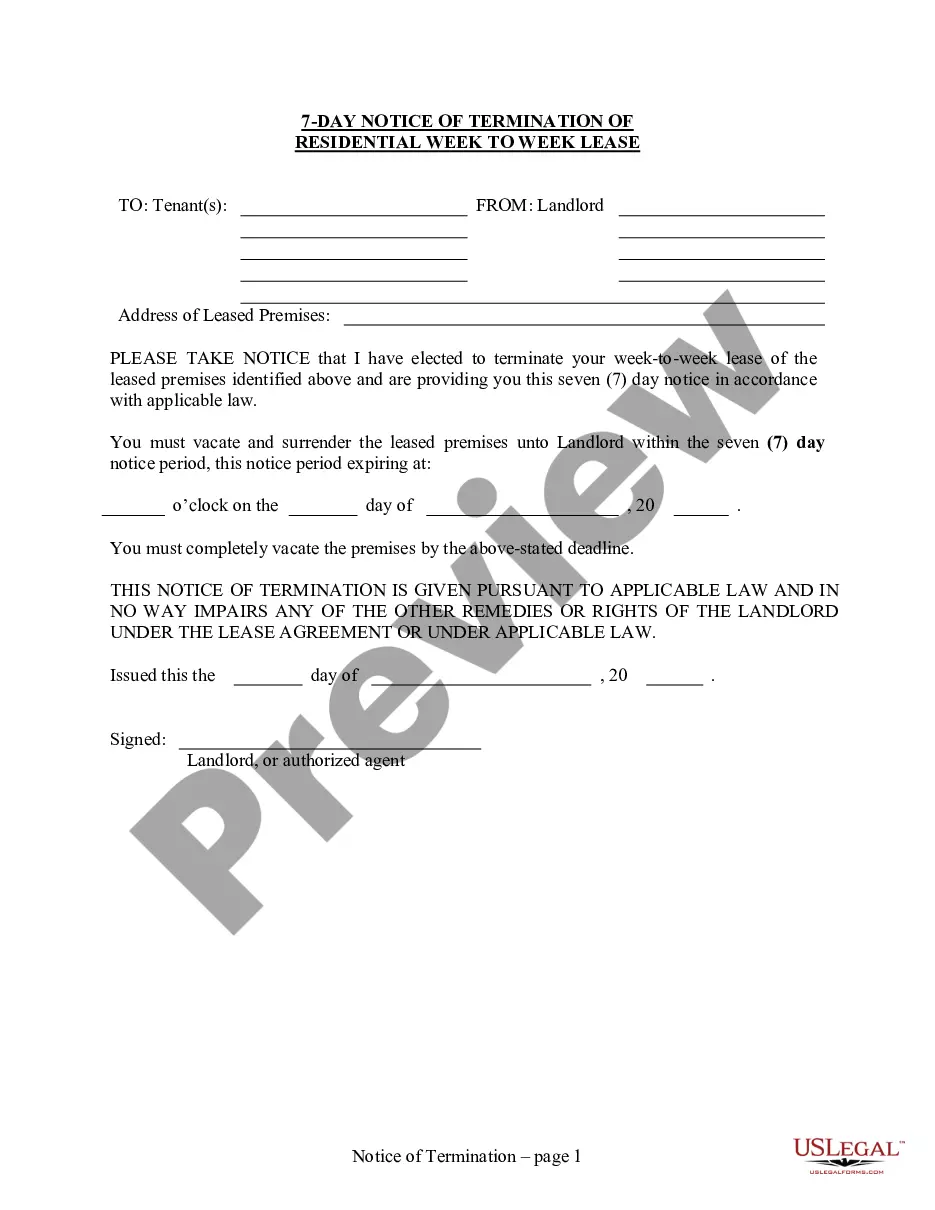

- Ensure you select the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form description to confirm you have selected the right template.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Yes, contract workers are generally considered self-employed. This classification means they are responsible for their own taxes and benefits, unlike traditional employees. Being self-employed allows for greater flexibility and control over working conditions. Hence, securing a Tennessee Shoring Services Contract - Self-Employed is crucial for establishing clear terms of engagement.

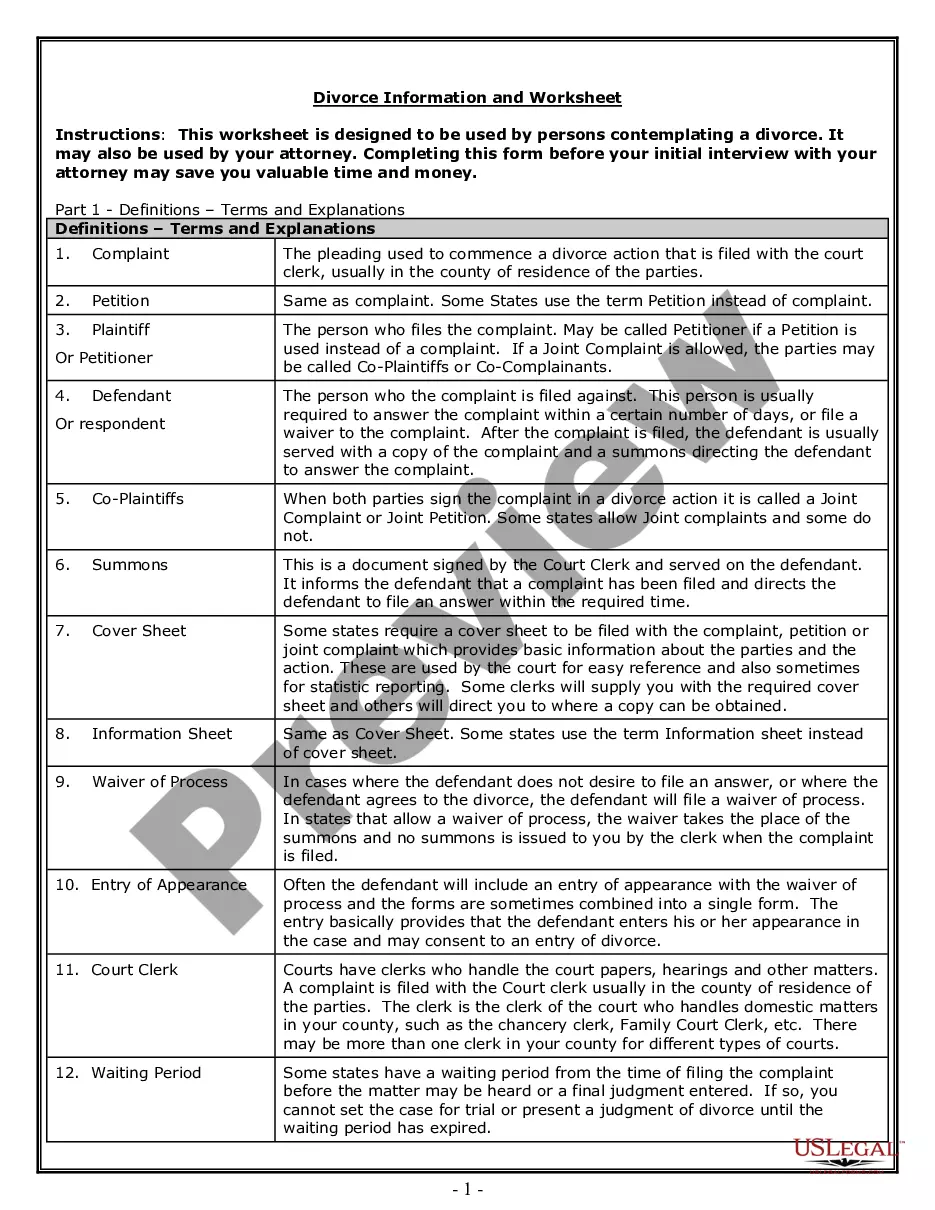

An independent contractor agreement in Tennessee is a legal document that outlines the terms of work between a contractor and a client. This agreement defines project specifics, payment terms, and responsibilities. It serves to protect both parties and ensures clarity in the contract relationship. Using a Tennessee Shoring Services Contract - Self-Employed can help streamline this documentation process.

In Tennessee, certain individuals may be exempt from obtaining a business license. For example, those who work as casual workers or operate under specific thresholds of income may not need one. Always consult local guidelines, as exemptions can depend on various factors. Understanding the legal landscape through a Tennessee Shoring Services Contract - Self-Employed can clarify your obligations.

Yes, it is important to register your business as an independent contractor in Tennessee. This not only formalizes your business operations, but also protects your rights as a contractor. Registration ensures you have access to various benefits and legal protections. A Tennessee Shoring Services Contract - Self-Employed can assist in this process by providing a framework for your business dealings.

As an independent contractor in Tennessee, you often need a business license to operate legally. This requirement helps establish your business as a recognized entity. The specific licensing requirements can vary by county, so it is wise to check local regulations. Utilizing a Tennessee Shoring Services Contract - Self-Employed can also ensure you comply with all necessary paperwork.

Yes, if you are self-employed in Tennessee, you generally need to obtain a business license. Each city or county may have its own requirements and fees, so it's essential to check local regulations. Obtaining this license helps formalize your business and shows you are operating within the law. This step is particularly pertinent when dealing with your Tennessee Shoring Services Contract - Self-Employed.

No, you do not need to establish an LLC to work as a contractor in Tennessee. However, forming an LLC can provide liability protection and separate your personal assets from business liabilities. It can also enhance your professionalism in the market. As you navigate your Tennessee Shoring Services Contract - Self-Employed, consider whether forming an LLC could align with your business goals.

If you contract without a license in Tennessee, you may face fines and potential legal repercussions. Operating without the required license can lead to suspension of your business operations. It's crucial to follow licensing laws to protect your work and reputation. Ensure your Tennessee Shoring Services Contract - Self-Employed complies with these regulations to avoid penalties.

Without a contractor's license, you can build structures such as small sheds, fences, or decks that fall within the $25,000 limit. Additionally, you can also handle minor repairs and maintenance work. However, for larger projects or comprehensive renovations, you need a license. Make sure to review the Tennessee Shoring Services Contract - Self-Employed to grasp your legal responsibilities.

In Tennessee, you can perform work valued up to $25,000 without a contractor's license. This includes both labor and materials. However, if you plan to take on larger projects, you must consider obtaining the necessary license. It's essential to understand these limits to avoid issues in managing your Tennessee Shoring Services Contract - Self-Employed.