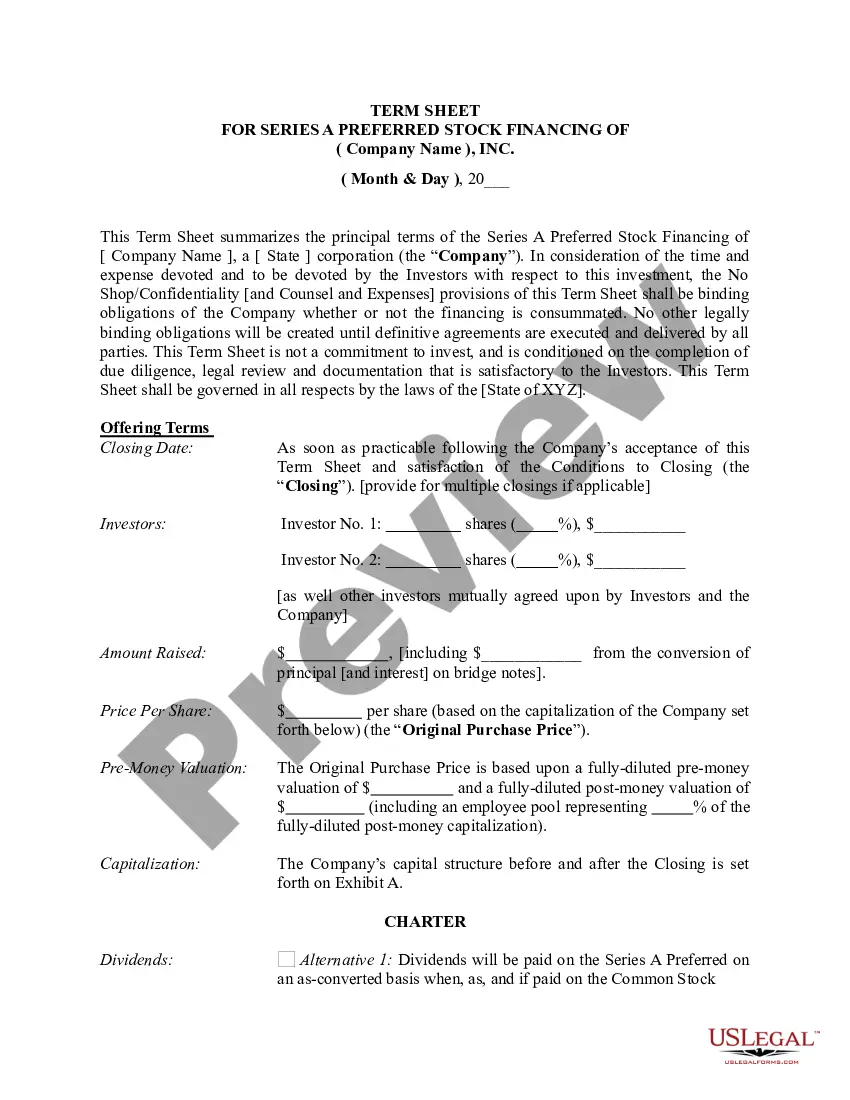

Tennessee Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

US Legal Forms - one of the largest libraries of legal varieties in the United States - delivers a wide array of legal papers templates it is possible to obtain or produce. Making use of the web site, you can get a huge number of varieties for organization and personal reasons, sorted by types, claims, or keywords and phrases.You can get the latest variations of varieties just like the Tennessee Term Sheet - Series A Preferred Stock Financing of a Company within minutes.

If you have a monthly subscription, log in and obtain Tennessee Term Sheet - Series A Preferred Stock Financing of a Company from the US Legal Forms collection. The Obtain option will show up on each type you look at. You get access to all formerly downloaded varieties from the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed below are straightforward directions to help you started off:

- Be sure you have picked out the best type for the area/state. Select the Review option to review the form`s information. Browse the type description to ensure that you have chosen the correct type.

- If the type does not fit your needs, make use of the Look for industry near the top of the screen to obtain the the one that does.

- In case you are pleased with the shape, validate your decision by clicking on the Get now option. Then, opt for the rates plan you like and supply your credentials to register for the accounts.

- Approach the financial transaction. Make use of bank card or PayPal accounts to accomplish the financial transaction.

- Pick the file format and obtain the shape on your own system.

- Make alterations. Complete, change and produce and indicator the downloaded Tennessee Term Sheet - Series A Preferred Stock Financing of a Company.

Each and every format you added to your money lacks an expiry time and is the one you have permanently. So, if you wish to obtain or produce an additional copy, just visit the My Forms section and then click around the type you want.

Get access to the Tennessee Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms, one of the most extensive collection of legal papers templates. Use a huge number of skilled and express-particular templates that satisfy your organization or personal requirements and needs.

Form popularity

FAQ

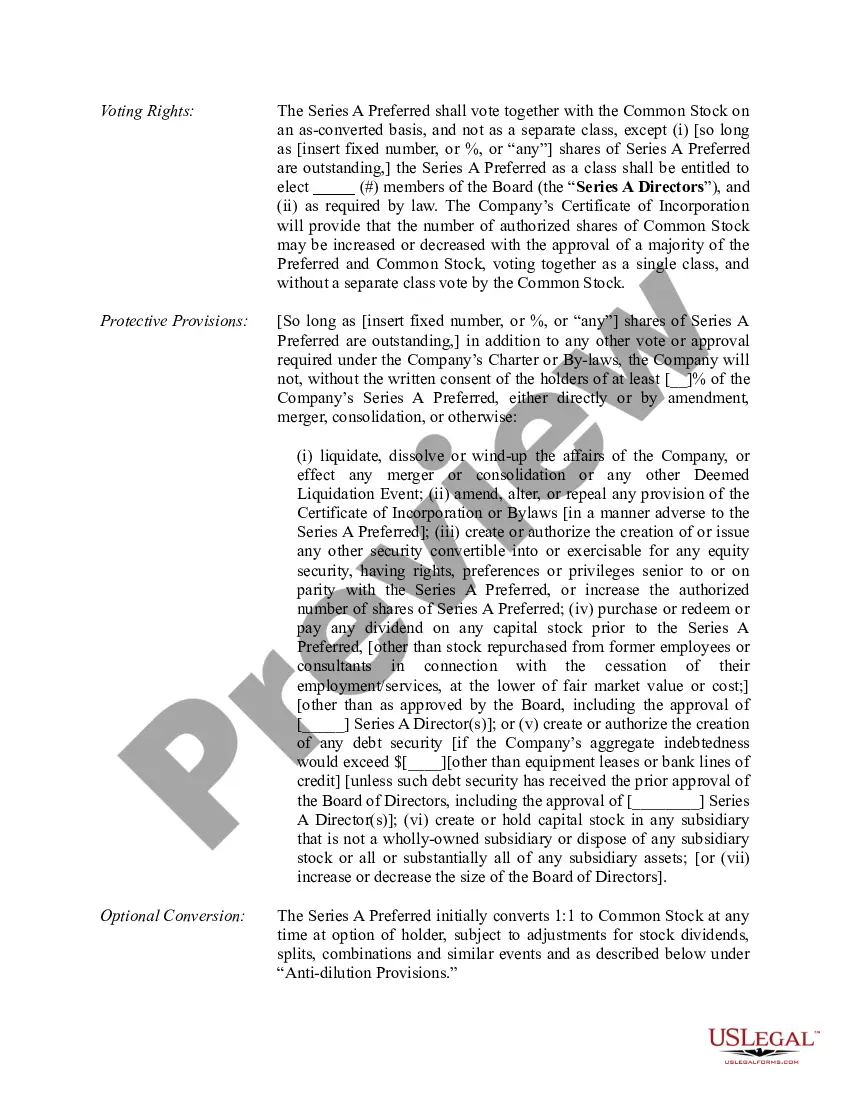

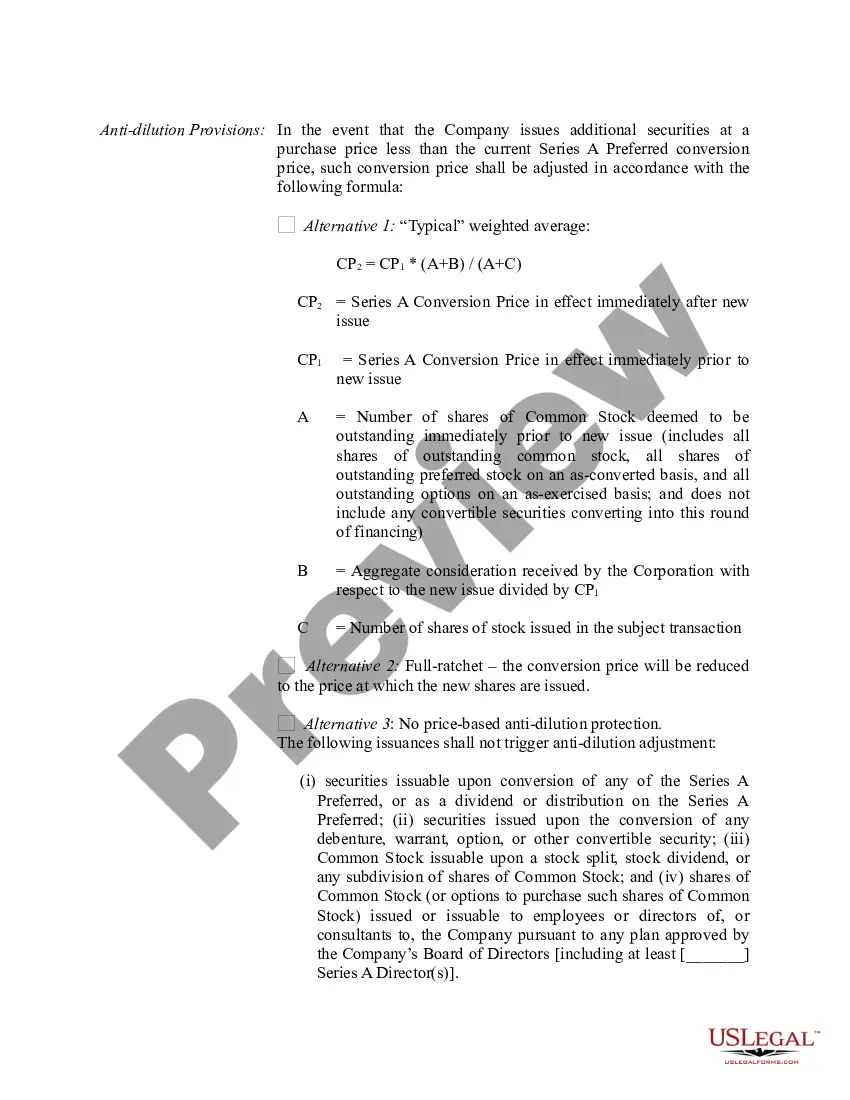

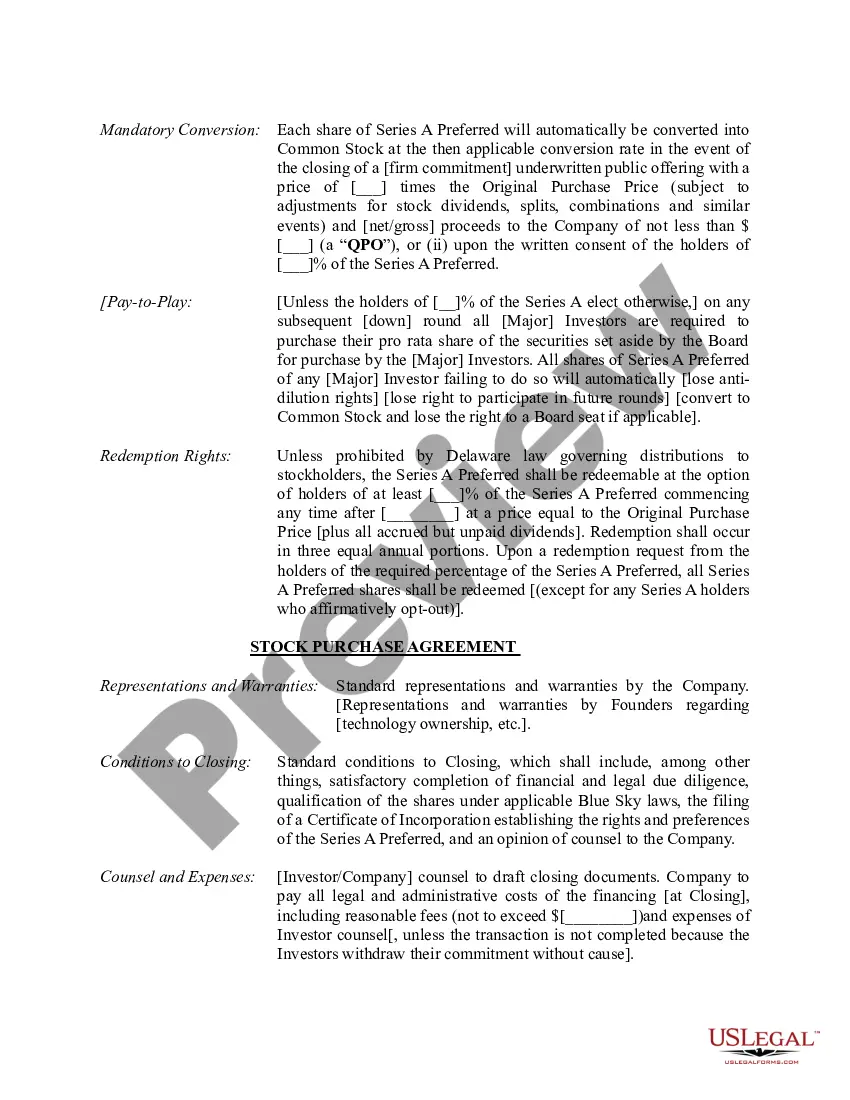

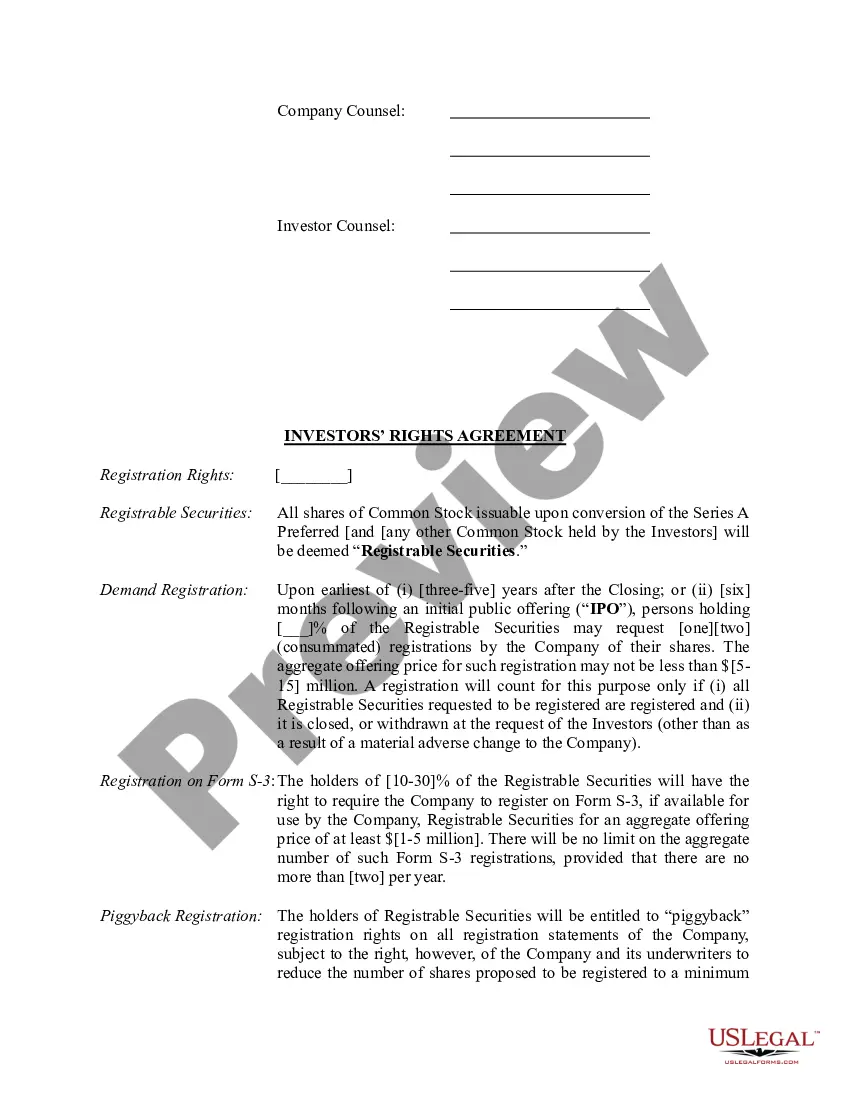

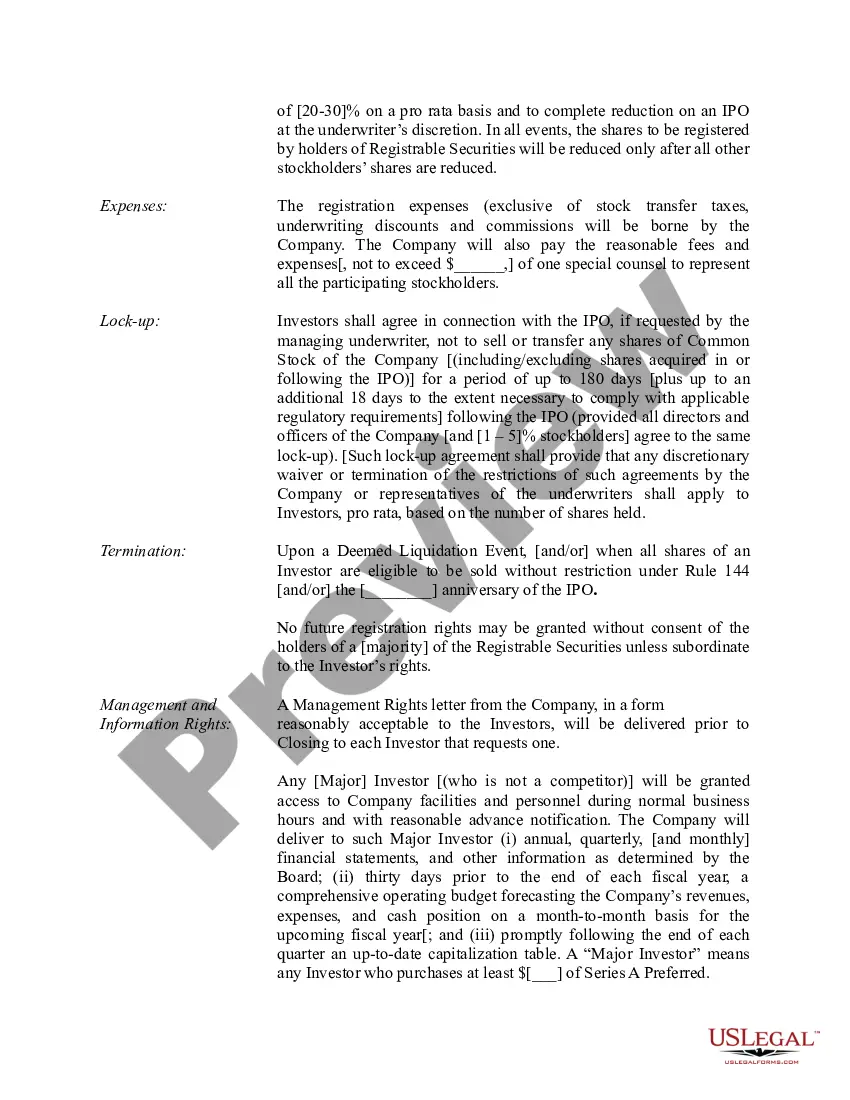

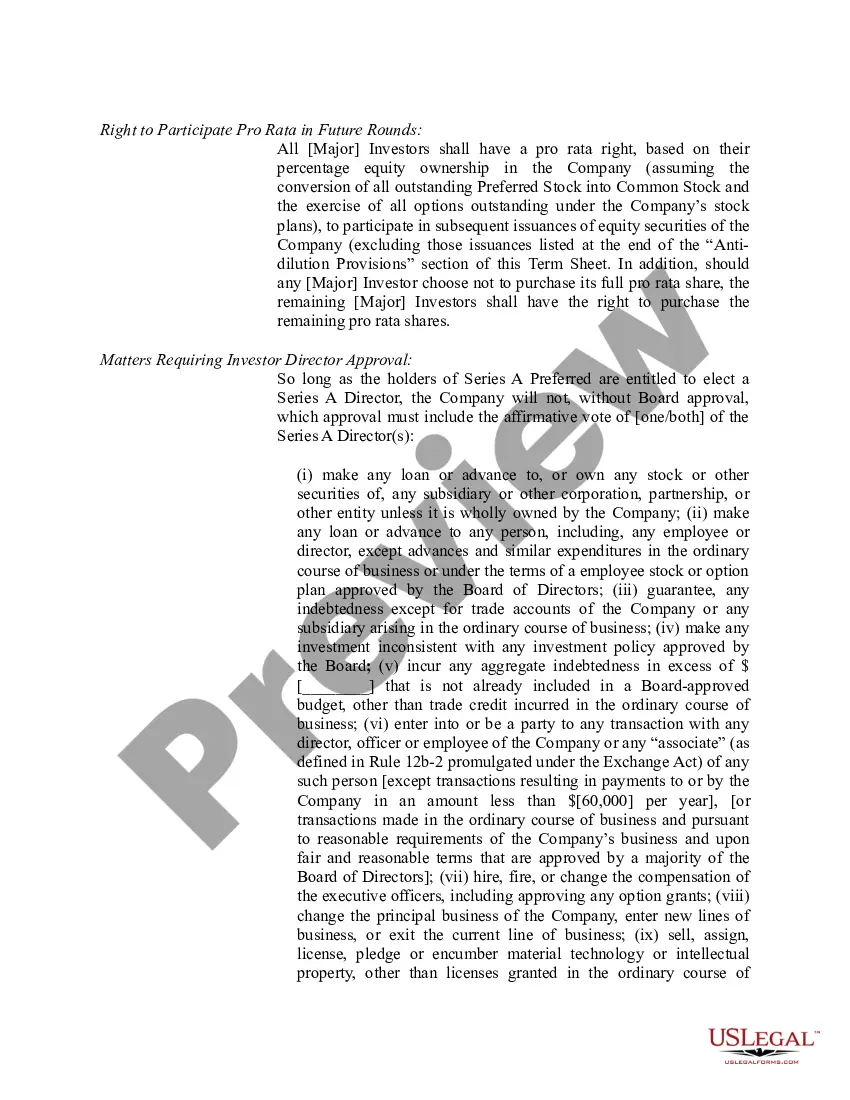

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options. The cost of preferred stock is also used to calculate the Weighted Average Cost of Capital.

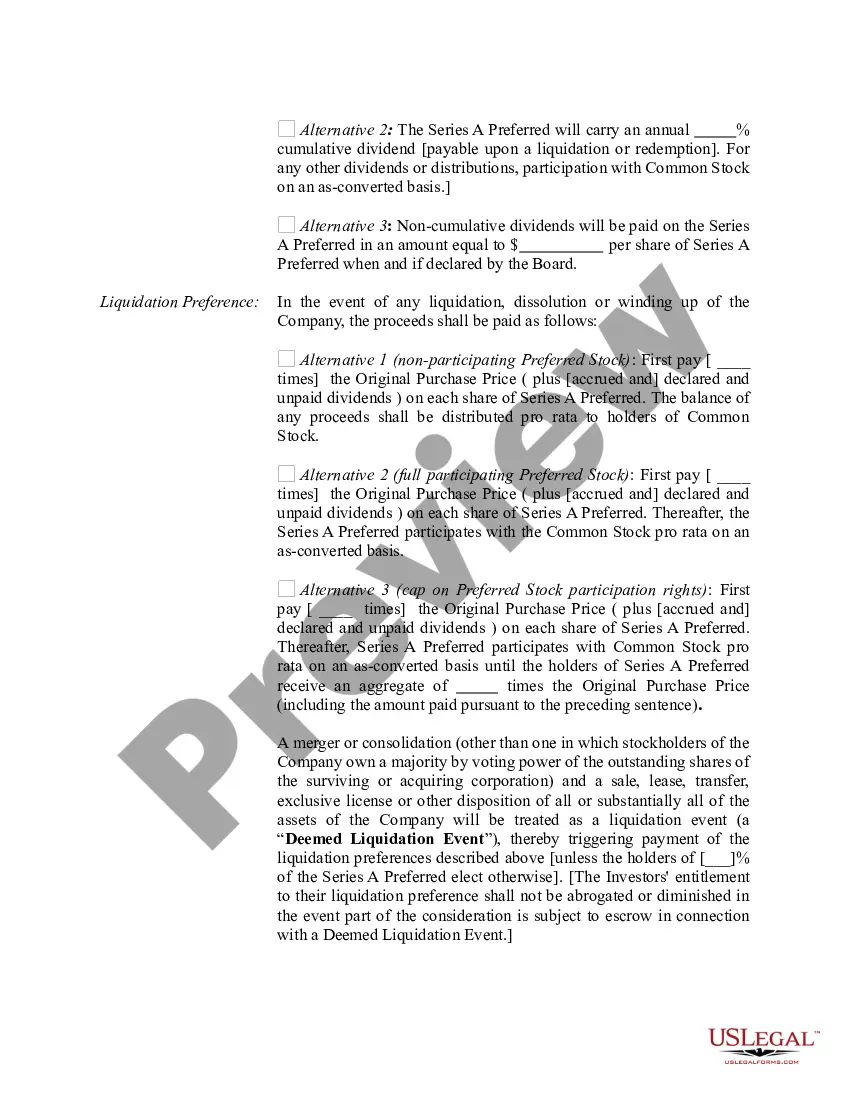

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

Redeemable preferred stock is a type of preferred stock that includes a provision allowing the issuer to buy it back at a specific price and retire it. Also known as callable preferred stock, redeemable preferred stock can be advantageous for issuers because it gives them more financial flexibility.

Preferred stock is a type of stock that has characteristics of both stocks and bonds. Like bonds, preferred shares make cash payouts, often at a higher yield than bonds, while offering higher dividend returns and less risk than common stock.

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

A Preference Shares Investment Term Sheet also sets out the parties' preliminary thoughts on certain provisions to be included in a Shareholders' Agreement, which will be executed at completion of the investment and which will protect the company's or the shareholder's interests.