Tennessee Sample Stock Purchase and Investor Rights Agreement of Xiox Corp.

Description

How to fill out Sample Stock Purchase And Investor Rights Agreement Of Xiox Corp.?

Choosing the best lawful papers template might be a battle. Obviously, there are a variety of themes available on the net, but how would you find the lawful type you need? Make use of the US Legal Forms website. The assistance gives thousands of themes, like the Tennessee Sample Stock Purchase and Investor Rights Agreement of Xiox Corp., that you can use for organization and private requires. Every one of the types are inspected by specialists and satisfy state and federal demands.

If you are presently registered, log in in your bank account and then click the Acquire key to get the Tennessee Sample Stock Purchase and Investor Rights Agreement of Xiox Corp.. Make use of bank account to check throughout the lawful types you might have purchased formerly. Proceed to the My Forms tab of your respective bank account and have yet another version of your papers you need.

If you are a new end user of US Legal Forms, here are easy recommendations so that you can adhere to:

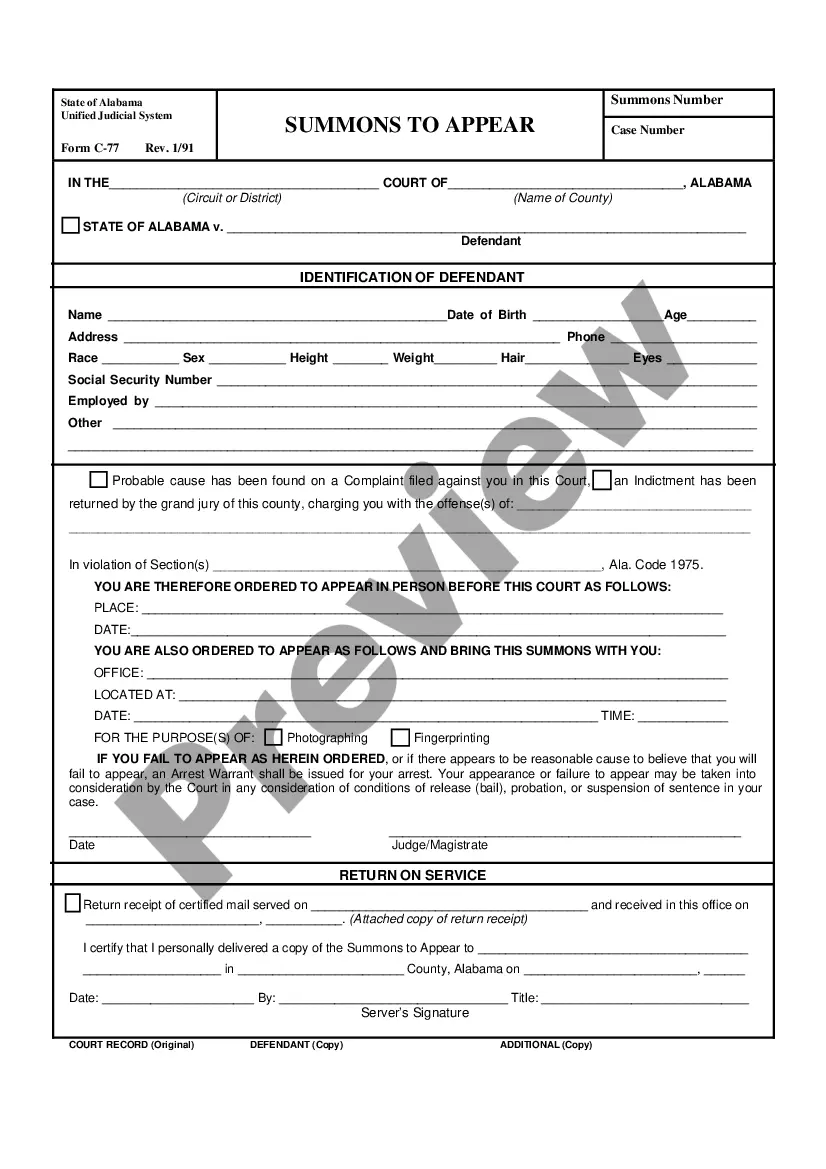

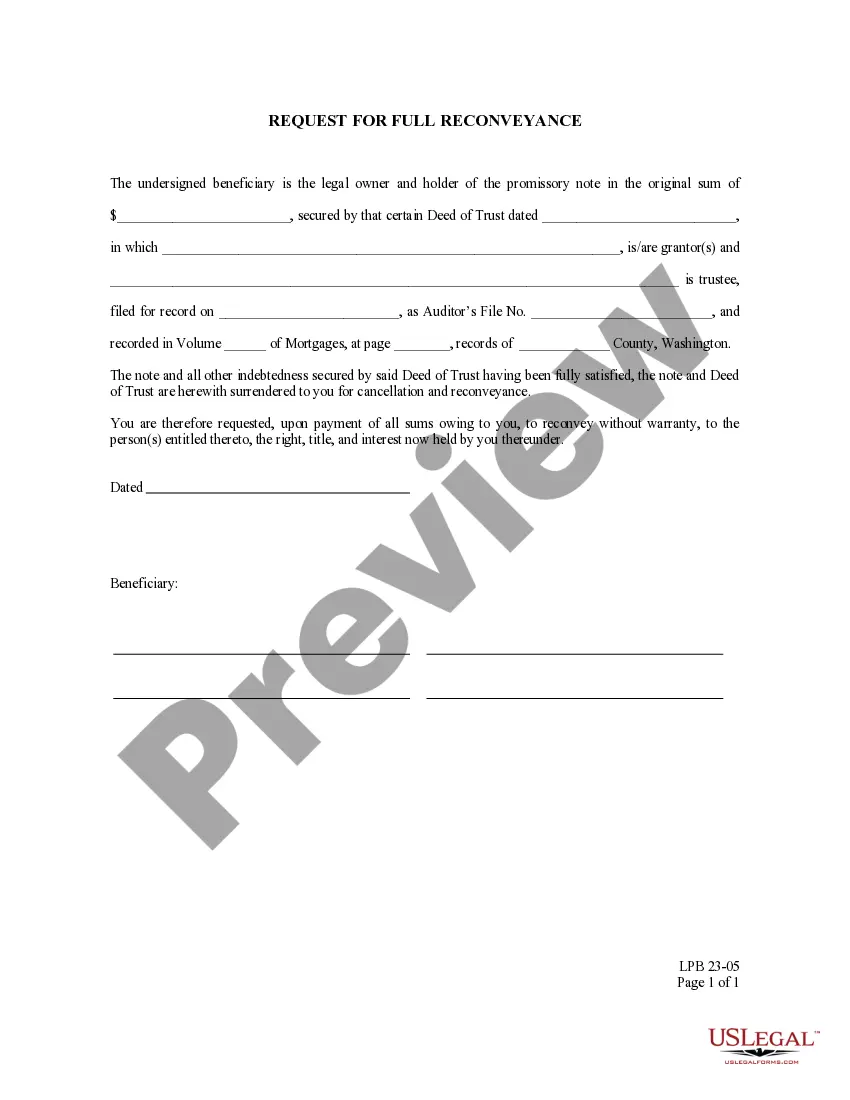

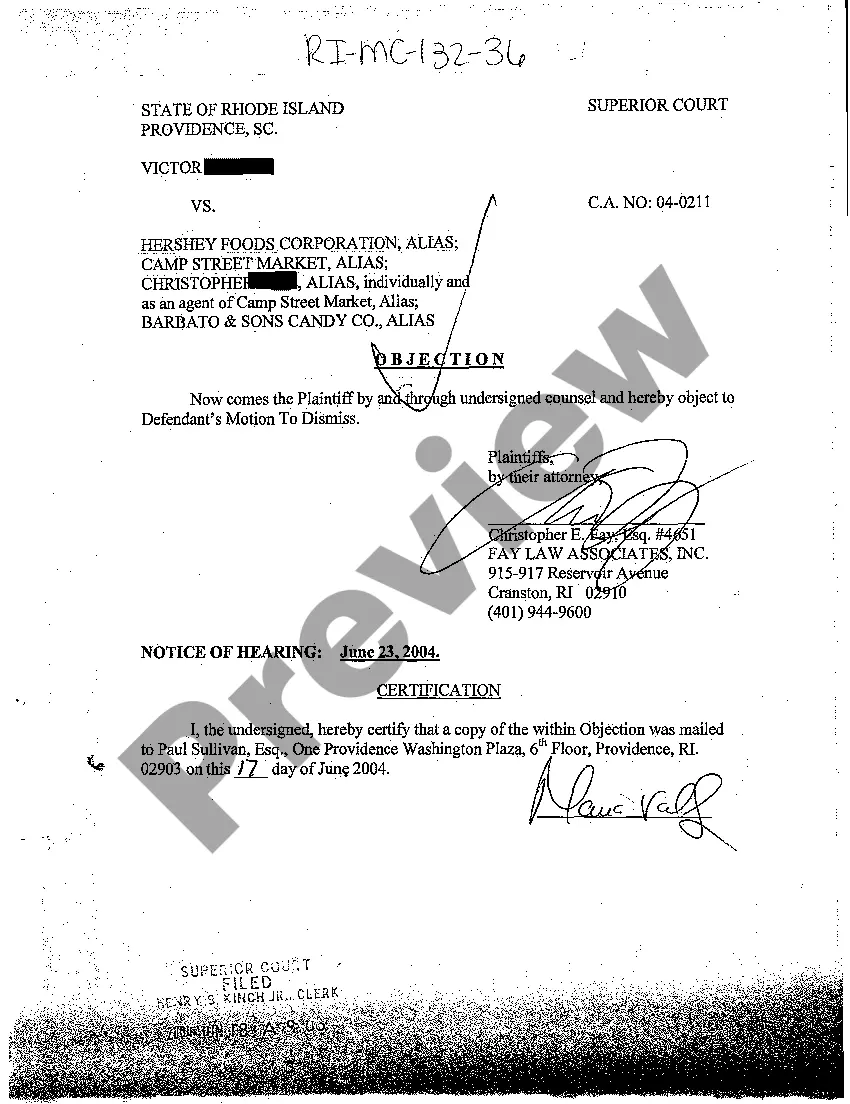

- Initial, make certain you have chosen the proper type to your town/region. It is possible to check out the form utilizing the Preview key and read the form description to ensure it is the best for you.

- When the type will not satisfy your preferences, make use of the Seach industry to get the correct type.

- When you are certain that the form would work, select the Purchase now key to get the type.

- Choose the prices prepare you desire and enter the needed info. Design your bank account and buy the transaction utilizing your PayPal bank account or credit card.

- Select the document structure and acquire the lawful papers template in your gadget.

- Comprehensive, change and produce and indicator the attained Tennessee Sample Stock Purchase and Investor Rights Agreement of Xiox Corp..

US Legal Forms is definitely the greatest collection of lawful types where you can discover a variety of papers themes. Make use of the company to acquire professionally-manufactured documents that adhere to condition demands.

Form popularity

FAQ

Buying a Stock Investment: Stock purchases are when investors buy ownership of the shares of a company. The investor's purchase price is called the cost basis. The goal is to sell the stock at a higher price and realize a profit. A buy order is an instruction to a stockbroker to buy a security.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

A share purchase agreement typically covers the following key areas: Purchase Price: The price the buyer will pay for the shares. Payment Terms: How and when the buyer will pay for the shares. Representations and Warranties: Statements made by the seller about the company's financial, legal, and operational status.

Investor rights are the rights granted to shareholders in the corporation. Those rights include: The right to attend the annual general meeting (AGM) and any other called meetings. The right to vote on resolutions, both ordinary and special. The right to propose your own resolutions.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

SPAs are used in M&A activity. The basic terms of the deal are the seller's and buyer's legal names, the number of stocks being purchased and at what price, and the closing date. An SPA ? much like a contract ? should spell out all expectations, warranties, legal stipulations, and so on.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

An investment agreement will set out the company's obligations and warranties to the investor in return for the funding. The investor will not usually have any input into the company's affairs unless they are also becoming a shareholder.

What Is Registration Right? A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.