Tennessee Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc.

Description

How to fill out Sample Stock Purchase Agreement Between Greystone Funding Corporation And Schick Technologies, Inc.?

Choosing the right authorized document template can be a have a problem. Needless to say, there are a variety of web templates available on the Internet, but how would you find the authorized type you will need? Make use of the US Legal Forms site. The support provides a large number of web templates, including the Tennessee Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc., which you can use for enterprise and private needs. Every one of the forms are checked out by professionals and meet up with federal and state specifications.

If you are already listed, log in to the accounts and click on the Obtain button to obtain the Tennessee Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc.. Make use of your accounts to appear from the authorized forms you might have bought earlier. Check out the My Forms tab of the accounts and acquire yet another copy of the document you will need.

If you are a whole new consumer of US Legal Forms, listed below are straightforward guidelines that you can follow:

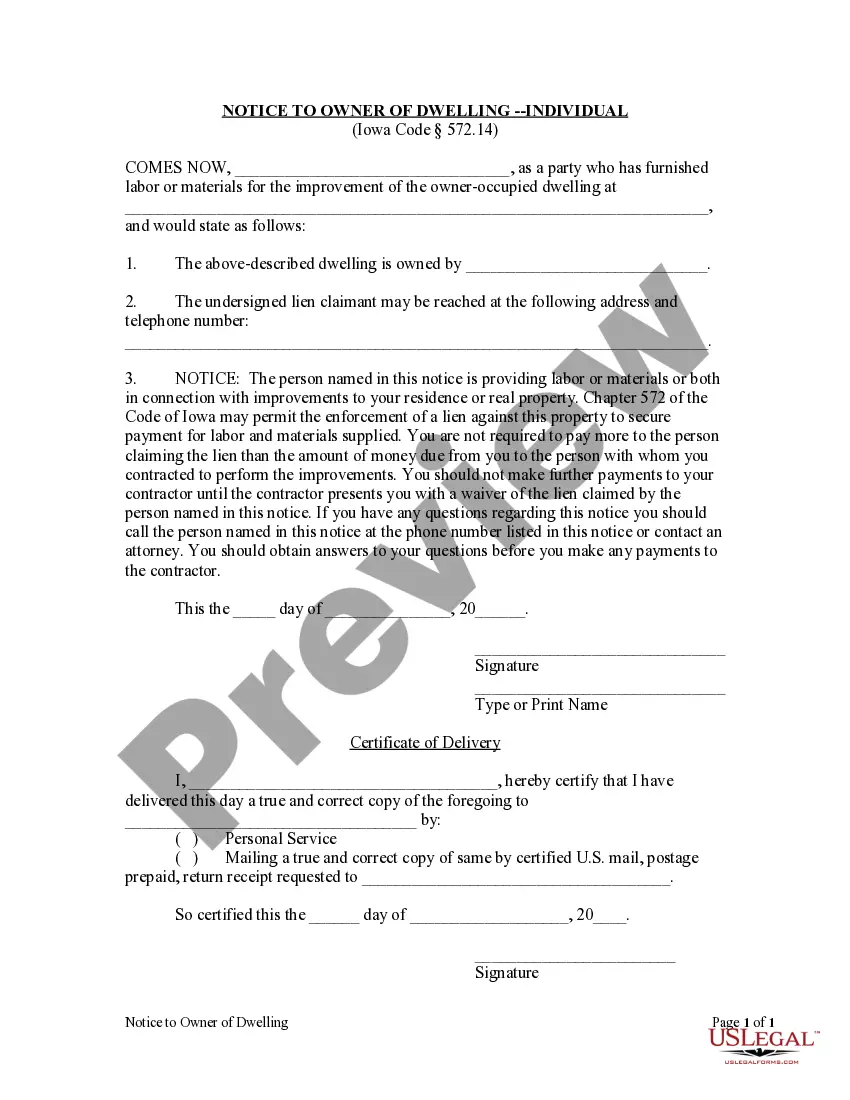

- Initial, make sure you have selected the appropriate type for your personal town/region. You may check out the form utilizing the Review button and read the form description to make sure it will be the right one for you.

- When the type fails to meet up with your preferences, take advantage of the Seach industry to find the proper type.

- Once you are sure that the form would work, select the Buy now button to obtain the type.

- Choose the rates strategy you desire and enter the required information. Build your accounts and purchase an order utilizing your PayPal accounts or charge card.

- Select the submit format and acquire the authorized document template to the device.

- Total, edit and produce and signal the received Tennessee Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc..

US Legal Forms is definitely the greatest library of authorized forms that you can see various document web templates. Make use of the company to acquire skillfully-created papers that follow express specifications.