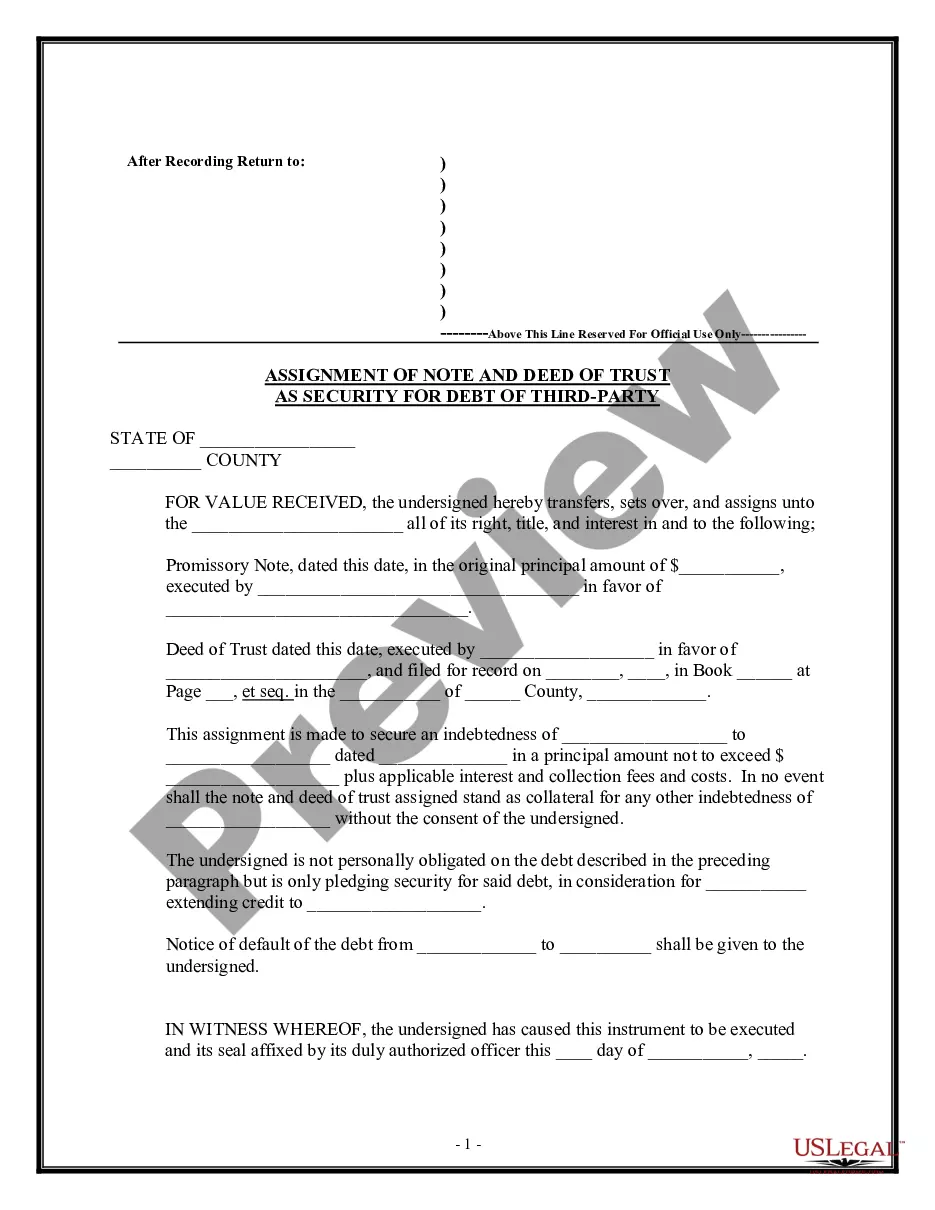

Tennessee Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

US Legal Forms - one of several greatest libraries of lawful types in the USA - gives an array of lawful file templates you may obtain or printing. Utilizing the internet site, you can find a huge number of types for business and person reasons, categorized by categories, states, or keywords.You will discover the most up-to-date variations of types like the Tennessee Assignment of Note and Deed of Trust as Security for Debt of Third Party in seconds.

If you currently have a membership, log in and obtain Tennessee Assignment of Note and Deed of Trust as Security for Debt of Third Party from the US Legal Forms catalogue. The Download key will appear on each and every kind you see. You gain access to all earlier downloaded types within the My Forms tab of your own account.

If you want to use US Legal Forms for the first time, listed below are simple instructions to help you get started off:

- Ensure you have chosen the correct kind to your town/region. Click the Preview key to analyze the form`s information. Look at the kind description to actually have selected the correct kind.

- When the kind does not suit your specifications, use the Look for industry at the top of the screen to find the one who does.

- If you are happy with the shape, affirm your decision by visiting the Purchase now key. Then, opt for the costs plan you favor and provide your accreditations to register to have an account.

- Method the deal. Use your Visa or Mastercard or PayPal account to perform the deal.

- Choose the structure and obtain the shape on your own device.

- Make modifications. Load, revise and printing and sign the downloaded Tennessee Assignment of Note and Deed of Trust as Security for Debt of Third Party.

Every single web template you added to your bank account lacks an expiration day and it is your own permanently. So, if you want to obtain or printing an additional version, just proceed to the My Forms portion and then click in the kind you want.

Gain access to the Tennessee Assignment of Note and Deed of Trust as Security for Debt of Third Party with US Legal Forms, the most comprehensive catalogue of lawful file templates. Use a huge number of skilled and status-distinct templates that satisfy your organization or person requires and specifications.

Form popularity

FAQ

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage. A deed of trust is a deed that transfers a legal interest in a piece of real property owned by the lendee to the lender, or trustee, in order to secure the debt owed on the loan.

The Mortgage or Deed of Trust Creates the Security Interest in the Property. With a mortgage or deed of trust, you give the lender a security interest in the home?that is, the home becomes collateral for the loan. The lender records the mortgage or deed of trust in the land records to create a lien on the property.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

A deed of trust is a type of secured real estate transaction that some states use instead of mortgages. There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.