Tennessee Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

You can spend hours online searching for the authentic document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of authentic forms that have been vetted by professionals.

You can download or print the Tennessee Assignment of Contract as Security for Loan from our platform.

If available, use the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, edit, print, or sign the Tennessee Assignment of Contract as Security for Loan.

- Every legal document template you purchase is yours permanently.

- To retrieve another copy of a purchased form, visit the My documents section and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your chosen county/region.

- Read the form description to confirm that you have selected the correct one.

Form popularity

FAQ

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

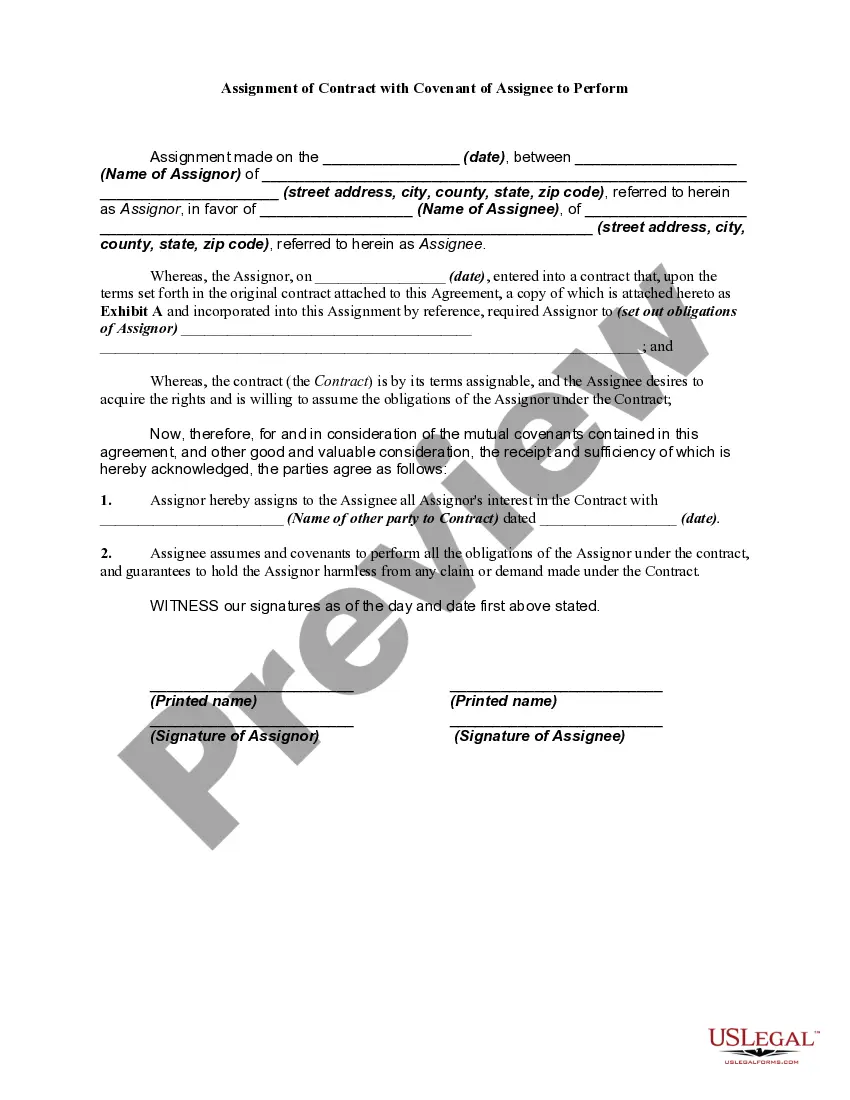

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

What is an Assignment Of Loan? Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee).

Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

Assignment by way of security is a concept that comes up on many construction projects; typically as a condition of providing finance a funder will require an assignment by way of security of key construction documents, including building contracts and appointments, with the intention that if the borrower defaults on

Companies that operate by contractually agreeing to provide services or products for a specific project or event can use the contract as collateral to secure necessary funding.