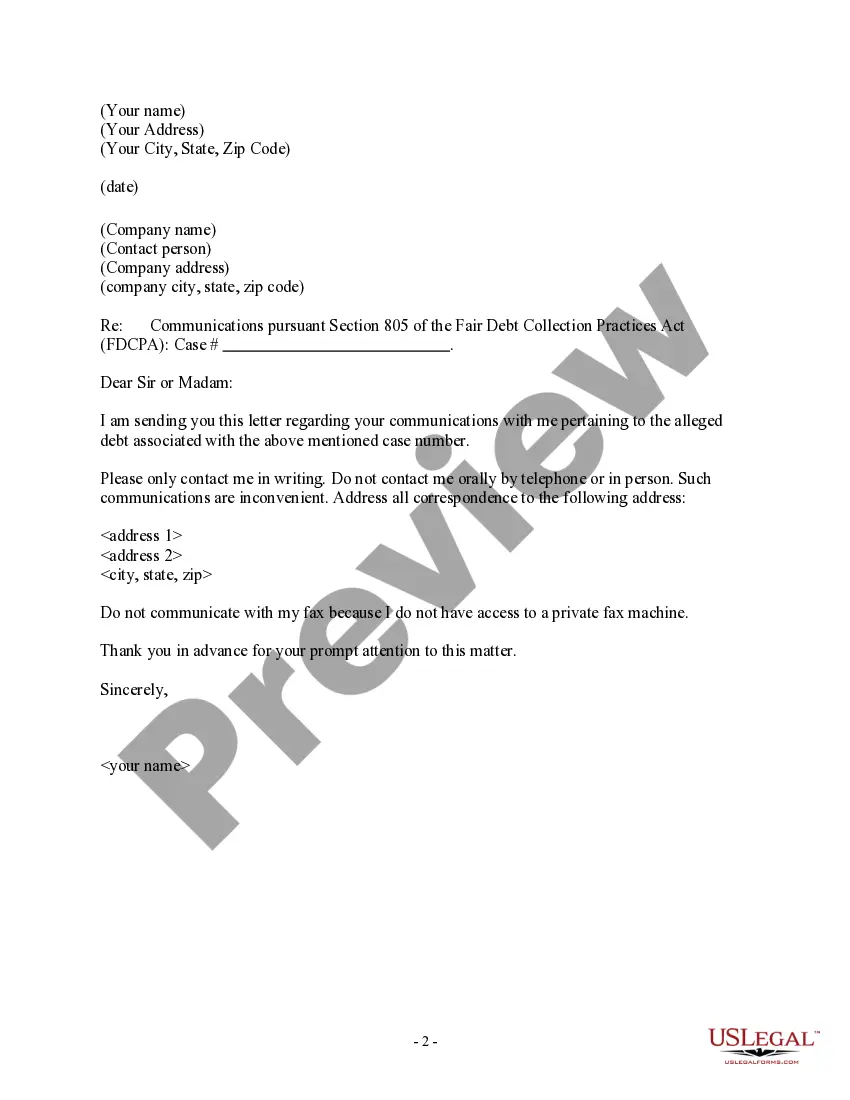

Tennessee Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

Are you currently in a situation where you require documents for either business or personal purposes almost every day? There are numerous legal document templates accessible online, but finding trustworthy versions can be challenging. US Legal Forms offers a vast array of templates, including the Tennessee Letter to Debt Collector - Only Contact Me In Writing, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Tennessee Letter to Debt Collector - Only Contact Me In Writing template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Obtain the form you need and ensure it is for your specific city/county. Utilize the Preview button to inspect the form. Review the outline to confirm that you have selected the correct form. If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements. If you locate the suitable form, just click Purchase now. Select the payment plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy.

- View all of the document templates you have purchased in the My documents menu.

- You can obtain an additional copy of Tennessee Letter to Debt Collector - Only Contact Me In Writing at any time, if needed.

- Simply access the necessary form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service offers well-crafted legal document templates that you can use for a variety of purposes.

- Create an account on US Legal Forms and begin making your life a little more manageable.

Form popularity

FAQ

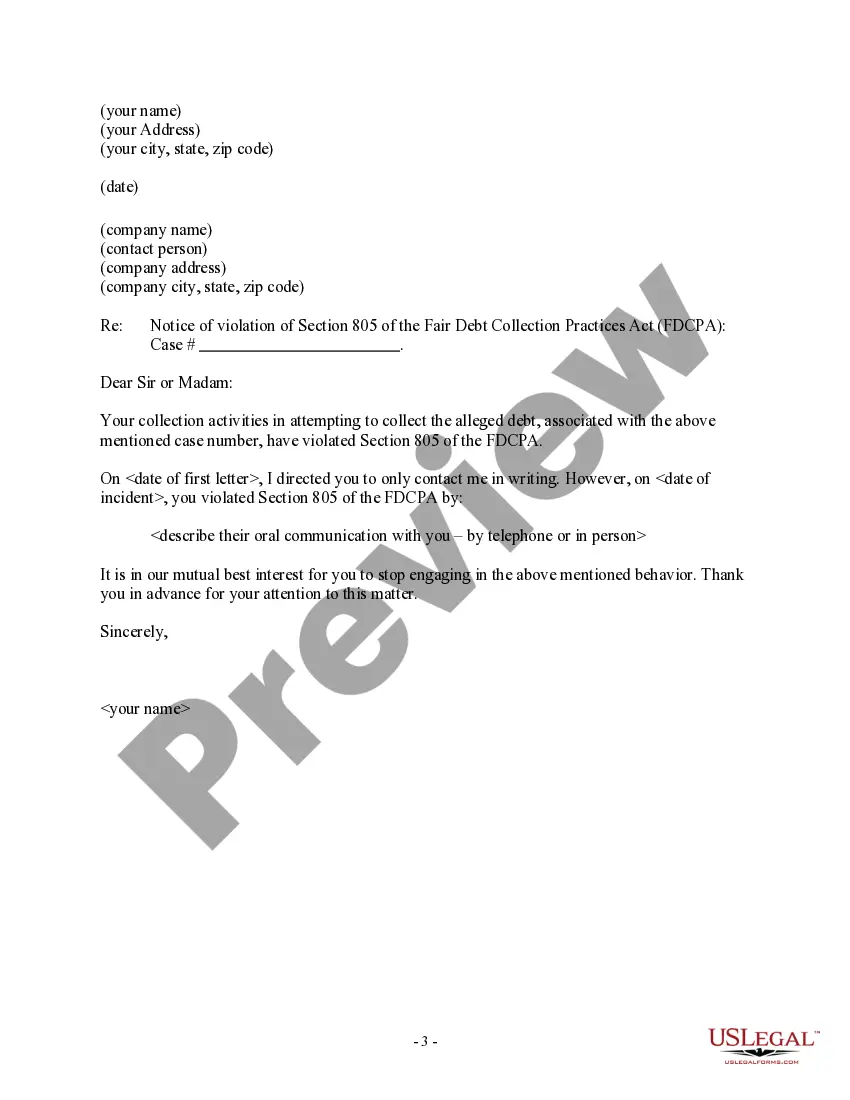

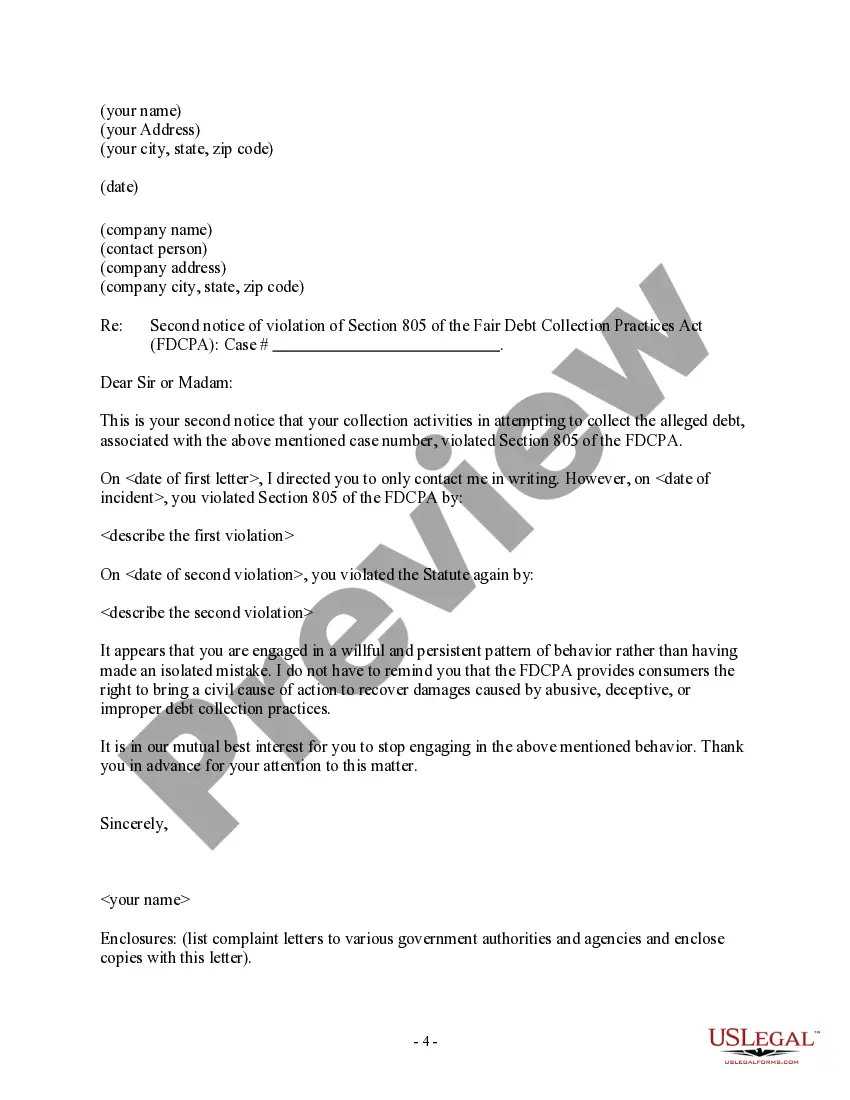

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Tennessee judgments are good for 10 years. Rule 69.04, amended by the Tennessee Supreme Court in 2016, makes the process now even easier to extend the life of a judgment.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

There is a statute of limitations on debt in Tennessee which is 6 years. This means that if the debt does not get closed out in six years, a lender is not eligible to sue the person to collect the debt.

If you make a payment (even as small as $5), the debt collector will be given the right to sue you again, leading to possible wage garnishment. In Tennessee the statute of limitations on debt is as follows: Mortgage debt: 6 years. Medical debt: 6 years.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.