Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

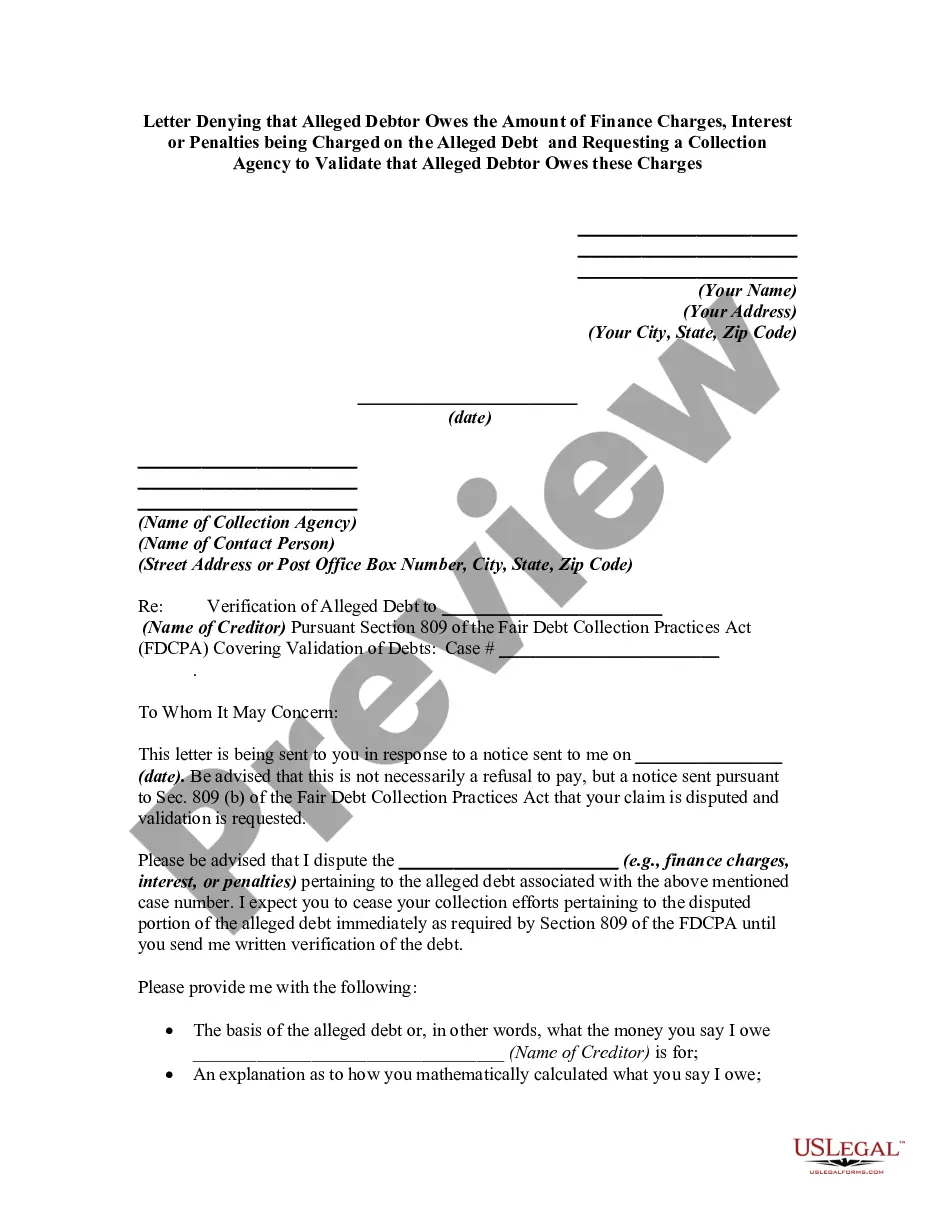

Tennessee Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges

Description

How to fill out Letter Denying That Alleged Debtor Owes The Amount Of Finance Charges, Interest Or Penalties Being Charged On The Alleged Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes These Charges?

US Legal Forms - one of the largest collections of official documents in the USA - provides a broad selection of legitimate document templates that you can download or print.

By utilizing the website, you will have access to thousands of documents for business and personal purposes, categorized by types, states, or keywords.

You can acquire the most recent versions of documents such as the Tennessee Letter Contesting that Alleged Debtor Owes the Amount of Finance Fees, Interest, or Penalties Being Applied to the Alleged Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes these Fees in a matter of seconds.

If the form does not meet your requirements, use the Search box at the top of the screen to find a suitable one.

If you are satisfied with the form, confirm your choice by clicking the Purchase Now button. Then, select the pricing plan you prefer and enter your details to create an account.

- If you already hold a subscription, Log In and download the Tennessee Letter Contesting that Alleged Debtor Owes the Amount of Finance Fees, Interest, or Penalties Being Applied to the Alleged Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes these Fees from the US Legal Forms library.

- The Download button will be visible on each form you encounter.

- You can access all previously obtained documents from the My documents section of your profile.

- To begin using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for the city/region.

- Click the Preview button to review the form's content.

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted. Ask for the debt collector's mailing address at this time as well, in case you decide to request a debt verification letter.

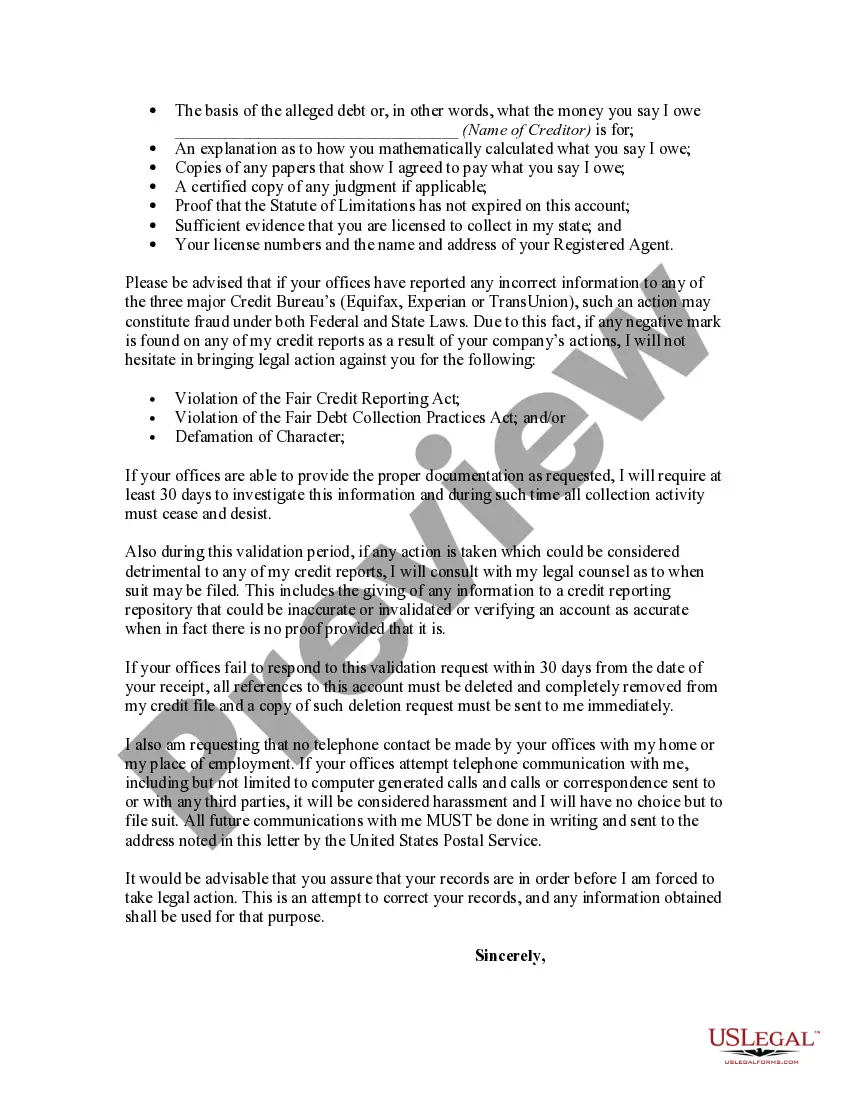

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.