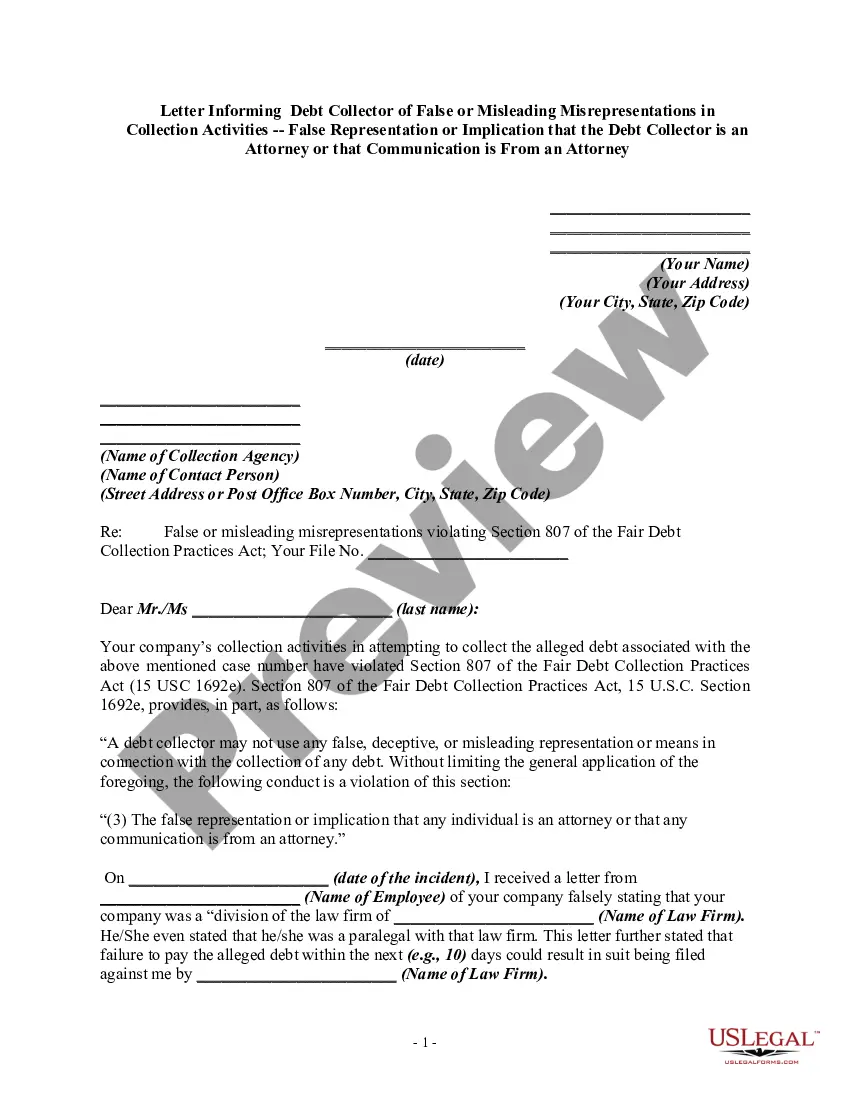

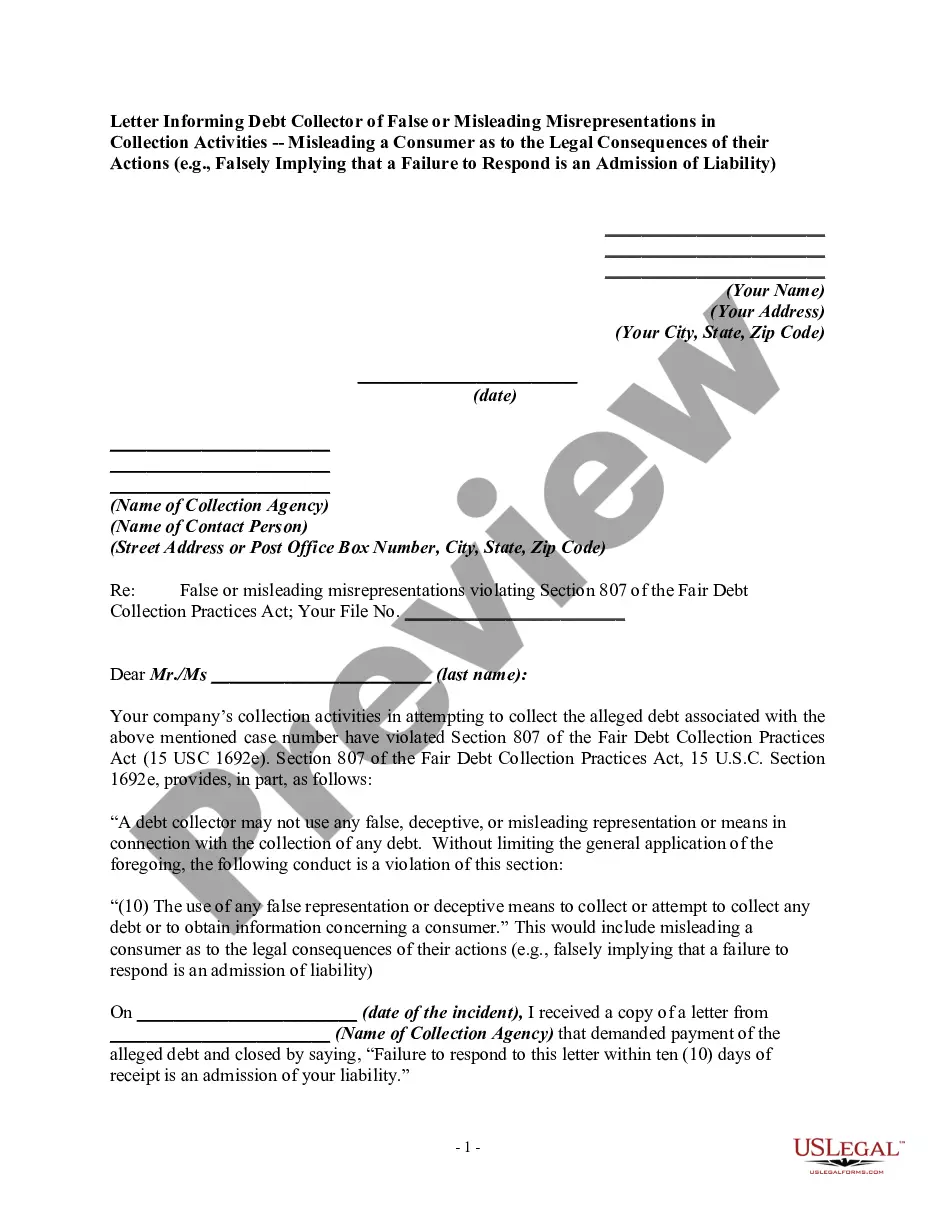

If you need to comprehensive, down load, or print out authorized record layouts, use US Legal Forms, the largest assortment of authorized varieties, that can be found on the Internet. Use the site`s simple and easy hassle-free research to get the papers you will need. A variety of layouts for business and person functions are categorized by classes and says, or key phrases. Use US Legal Forms to get the Tennessee Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - False Representation or Implication that the Debt Collector is an Attorney or that Communication is From an Attorney in a couple of mouse clicks.

Should you be already a US Legal Forms client, log in to your account and click the Acquire option to get the Tennessee Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - False Representation or Implication that the Debt Collector is an Attorney or that Communication is From an Attorney. You can even gain access to varieties you previously delivered electronically inside the My Forms tab of your account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for the appropriate metropolis/nation.

- Step 2. Make use of the Preview solution to check out the form`s articles. Never neglect to see the explanation.

- Step 3. Should you be unsatisfied using the develop, use the Research industry towards the top of the monitor to discover other versions from the authorized develop design.

- Step 4. Once you have identified the form you will need, click the Purchase now option. Pick the pricing prepare you like and add your credentials to sign up for the account.

- Step 5. Procedure the purchase. You may use your charge card or PayPal account to perform the purchase.

- Step 6. Find the format from the authorized develop and down load it on the device.

- Step 7. Full, modify and print out or signal the Tennessee Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - False Representation or Implication that the Debt Collector is an Attorney or that Communication is From an Attorney.

Each and every authorized record design you buy is your own property for a long time. You may have acces to each and every develop you delivered electronically inside your acccount. Click the My Forms section and pick a develop to print out or down load yet again.

Remain competitive and down load, and print out the Tennessee Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - False Representation or Implication that the Debt Collector is an Attorney or that Communication is From an Attorney with US Legal Forms. There are millions of specialist and state-certain varieties you can utilize for the business or person needs.