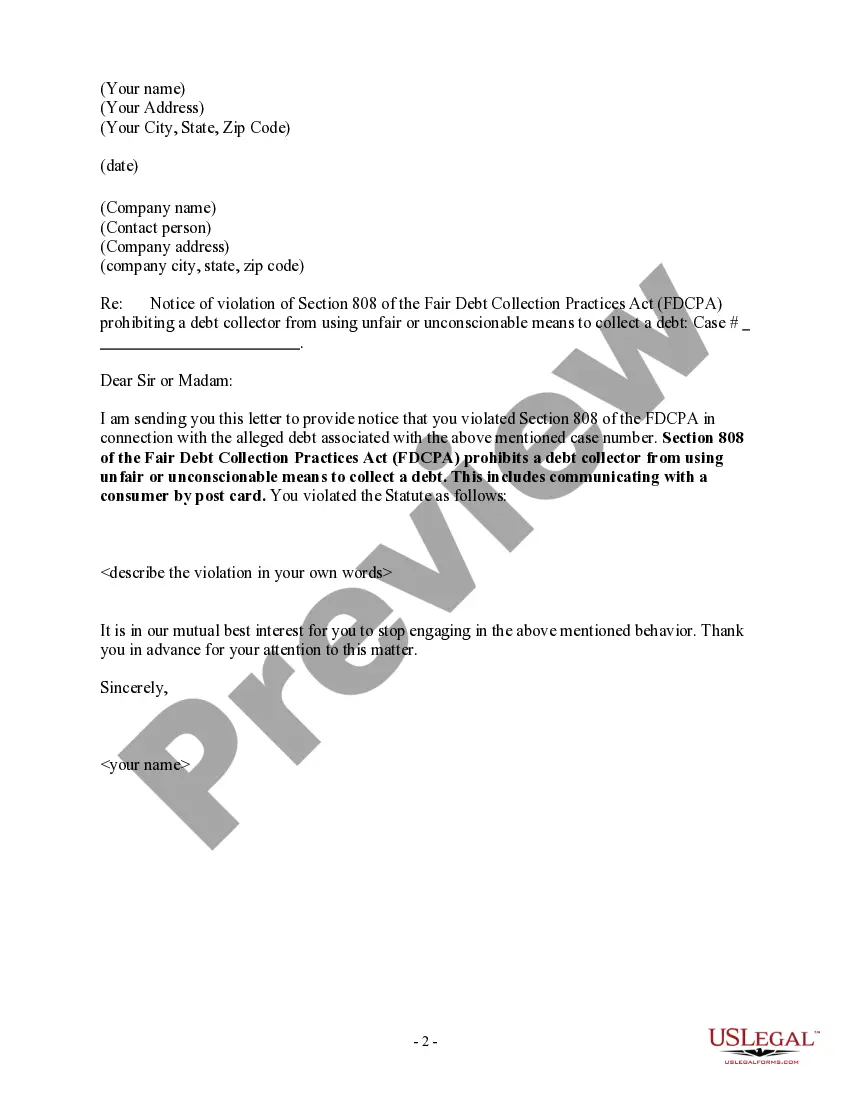

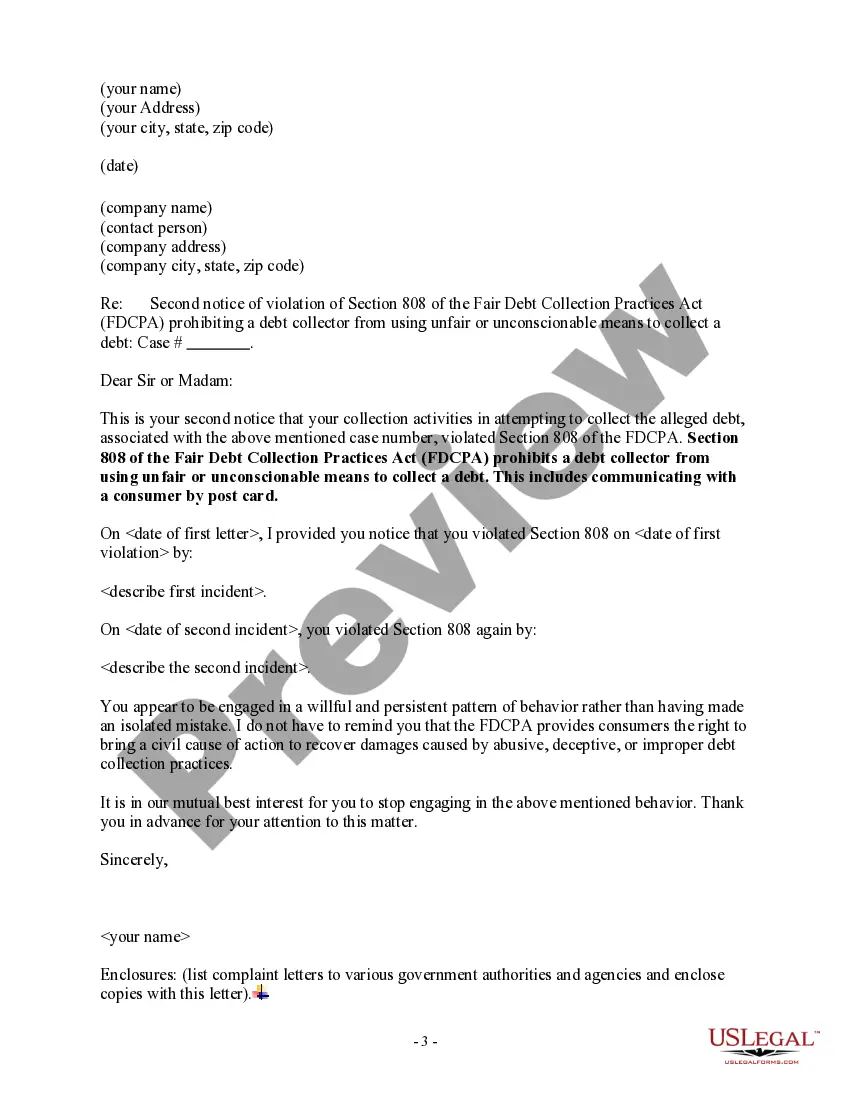

Tennessee Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

Are you in a situation where you require documents for either commercial or personal reasons nearly every day.

There is a range of legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast selection of form templates, such as the Tennessee Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard, which are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Tennessee Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard at any time if needed. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/area.

- Utilize the Preview button to examine the form.

- Review the description to confirm you have selected the right form.

- If the form does not match what you’re looking for, use the Search section to find the template that fulfills your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you want, fill in the necessary details to create your order, and pay by using your PayPal or credit card.

Form popularity

FAQ

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.