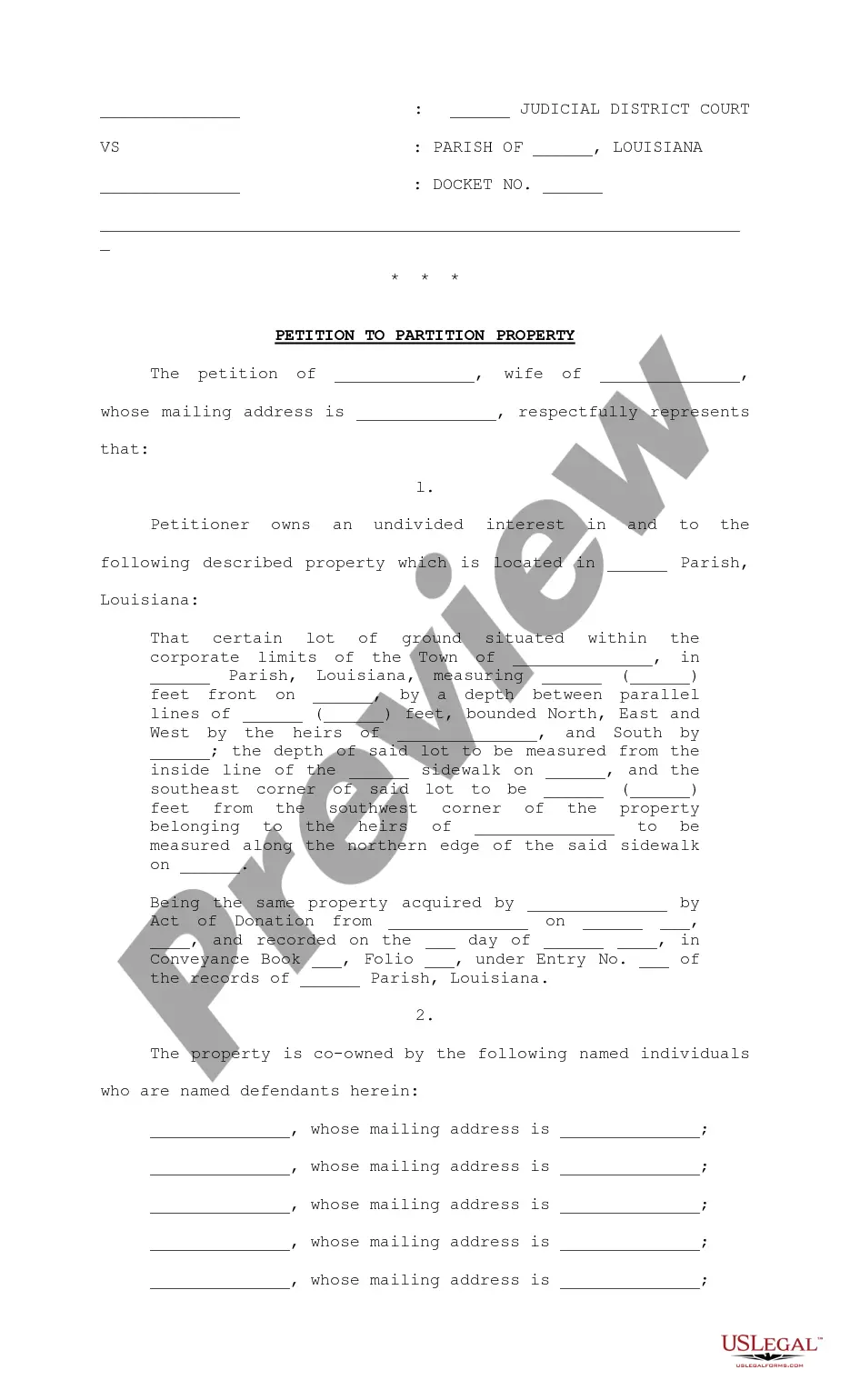

Tennessee Approval of option grant

Description

How to fill out Approval Of Option Grant?

US Legal Forms - one of many biggest libraries of legitimate varieties in the States - provides a variety of legitimate file templates you may obtain or print. Utilizing the web site, you will get 1000s of varieties for enterprise and specific reasons, categorized by categories, says, or search phrases.You will find the latest models of varieties like the Tennessee Approval of option grant within minutes.

If you already have a membership, log in and obtain Tennessee Approval of option grant through the US Legal Forms local library. The Down load option will show up on every single kind you perspective. You get access to all previously acquired varieties inside the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, listed below are basic guidelines to get you started off:

- Make sure you have picked the correct kind for your metropolis/region. Click on the Preview option to analyze the form`s content material. Look at the kind explanation to actually have chosen the right kind.

- In case the kind does not match your needs, use the Research discipline towards the top of the screen to get the one that does.

- In case you are content with the form, validate your choice by clicking on the Acquire now option. Then, pick the rates program you like and give your qualifications to sign up to have an profile.

- Approach the purchase. Use your credit card or PayPal profile to complete the purchase.

- Pick the format and obtain the form on the gadget.

- Make modifications. Complete, modify and print and signal the acquired Tennessee Approval of option grant.

Each web template you added to your account does not have an expiry date and is also your own forever. So, in order to obtain or print one more backup, just go to the My Forms portion and click on about the kind you will need.

Gain access to the Tennessee Approval of option grant with US Legal Forms, probably the most considerable local library of legitimate file templates. Use 1000s of expert and status-distinct templates that meet up with your business or specific requires and needs.

Form popularity

FAQ

Pell Grant Need-based program ? based on FAFSA data. Must be enrolled in degree or approved certificate program. Must be a U.S. citizen or eligible non-citizen. Meet SAP (Satisfactory Academic Progress) Not in default of student loan or owe a federal repayment.

Money for College TN HOPE Scholarship. General Assembly Merit Scholarship. Aspire Award. Wilder-Naifeh Technical Skills Grant. Tennessee HOPE Scholarship - Nontraditional. Dual Enrollment Grant. Middle College Scholarship. Helping Heroes Grant.

Tennessee Student Assistance Award (TSAA) TSAA provides financial assistance to undergraduate students with financial need who are residents of Tennessee. Applicants must be enrolled or accepted for enrollment, at least half time, at a public or an eligible non-public postsecondary institution in Tennessee.

The objective of NSGP is to provide funding for physical and cyber security enhancements and other security-related activities to nonprofit organizations that are at high risk of a terrorist attack.

Application is the FAFSA. The Tennessee Student Assistance Award Program (TSAA) was established to provide non-repayable financial assistance to financially-needy undergraduate students who are residents of Tennessee.

No, students are not required to repay their TN Promise scholarship. However, we strongly encourage students to finish their program. Before stopping, please reach out to someone on our team so we can help you find a solution that includes finishing your program!