Tennessee Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

You are able to invest hours on-line looking for the legitimate document web template that meets the federal and state demands you need. US Legal Forms offers thousands of legitimate varieties which are evaluated by pros. It is simple to obtain or produce the Tennessee Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 from our support.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Acquire switch. Afterward, it is possible to full, modify, produce, or signal the Tennessee Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005. Each legitimate document web template you buy is yours for a long time. To have yet another backup for any purchased develop, check out the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms site for the first time, keep to the simple recommendations beneath:

- Initial, ensure that you have chosen the best document web template for your state/area that you pick. Look at the develop information to make sure you have picked out the proper develop. If offered, take advantage of the Preview switch to search through the document web template at the same time.

- In order to locate yet another edition of your develop, take advantage of the Lookup industry to discover the web template that meets your requirements and demands.

- Once you have identified the web template you need, simply click Buy now to continue.

- Find the rates strategy you need, type in your qualifications, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legitimate develop.

- Find the structure of your document and obtain it for your product.

- Make modifications for your document if possible. You are able to full, modify and signal and produce Tennessee Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

Acquire and produce thousands of document templates using the US Legal Forms Internet site, which offers the biggest assortment of legitimate varieties. Use specialist and state-particular templates to tackle your business or personal requires.

Form popularity

FAQ

? income can vary month to month, and the means test finds the average. Your figure should include not only your wages, but also rental income, child support, alimony, pension or other regular monthly income. Social Security income does not count.

While no specific cash exemption is listed in the federal bankruptcy exemptions, a wildcard exemption allows you to protect up to $1,325 in any property and use up to $12,575 of any unused portion of a homestead exemption to protect money.

Filing for Chapter 7 bankruptcy will wipe out your mortgage obligation. Still, if you aren't willing to pay the mortgage, you'll have to give up the home because your lender's right to foreclose doesn't go away when you file for Chapter 7.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

The Tennessee homestead exemption allows you to keep the home you are living in as long as you don't have too much equity in it. Using a homestead exemption allows you to keep your real estate so that the bankruptcy trustee can't sell it to pay off your debts.

In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations. 11 U.S.C. § 727(a)(1). Although an individual chapter 7 case usually results in a discharge of debts, the right to a discharge is not absolute, and some types of debts are not discharged.

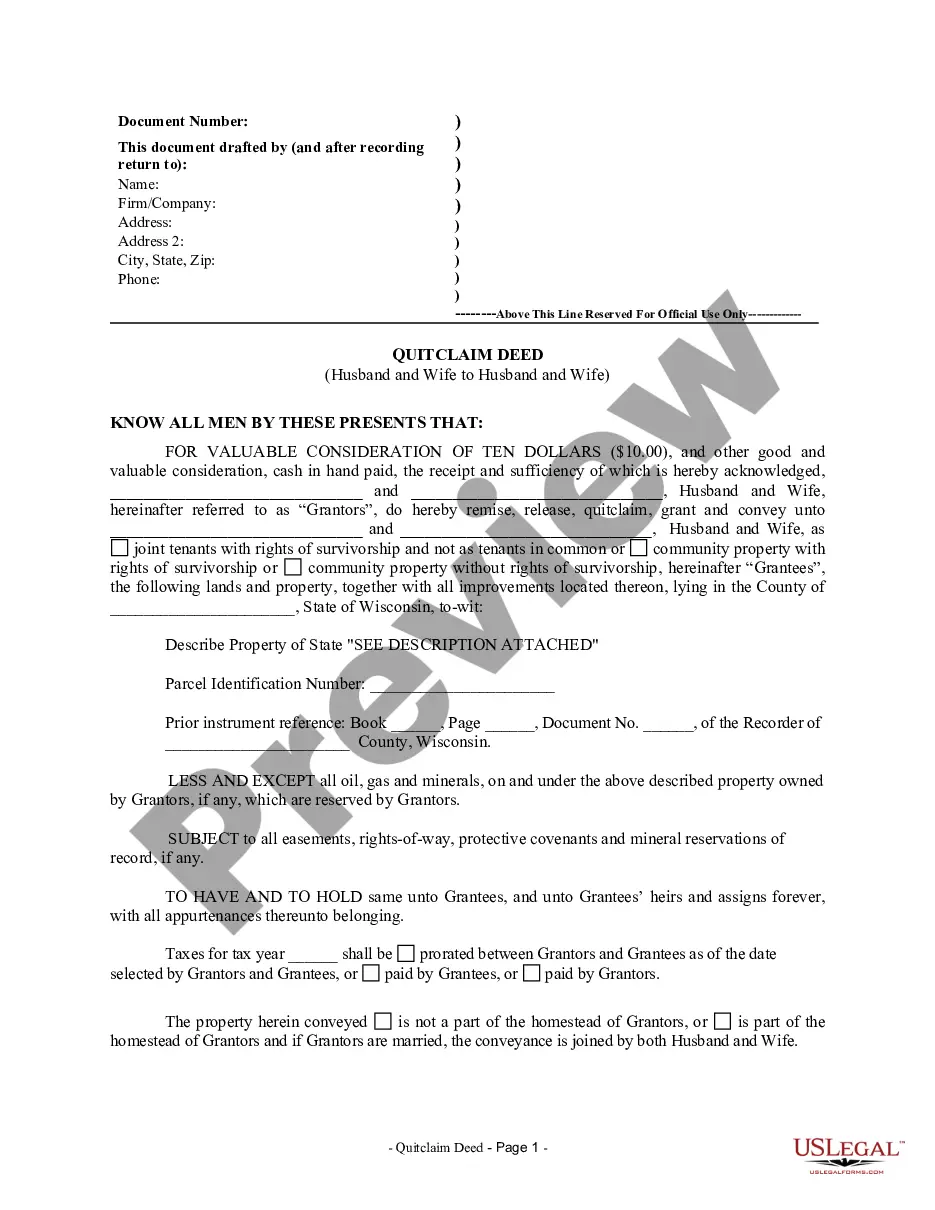

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.