Tennessee Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Have you been inside a situation in which you require documents for possibly business or person functions virtually every day? There are tons of legal file templates available on the net, but discovering versions you can depend on is not easy. US Legal Forms delivers a huge number of form templates, just like the Tennessee Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, which can be published to fulfill federal and state needs.

When you are previously knowledgeable about US Legal Forms web site and get your account, simply log in. After that, it is possible to download the Tennessee Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form web template.

If you do not offer an bank account and wish to begin using US Legal Forms, follow these steps:

- Find the form you want and make sure it is for the appropriate metropolis/area.

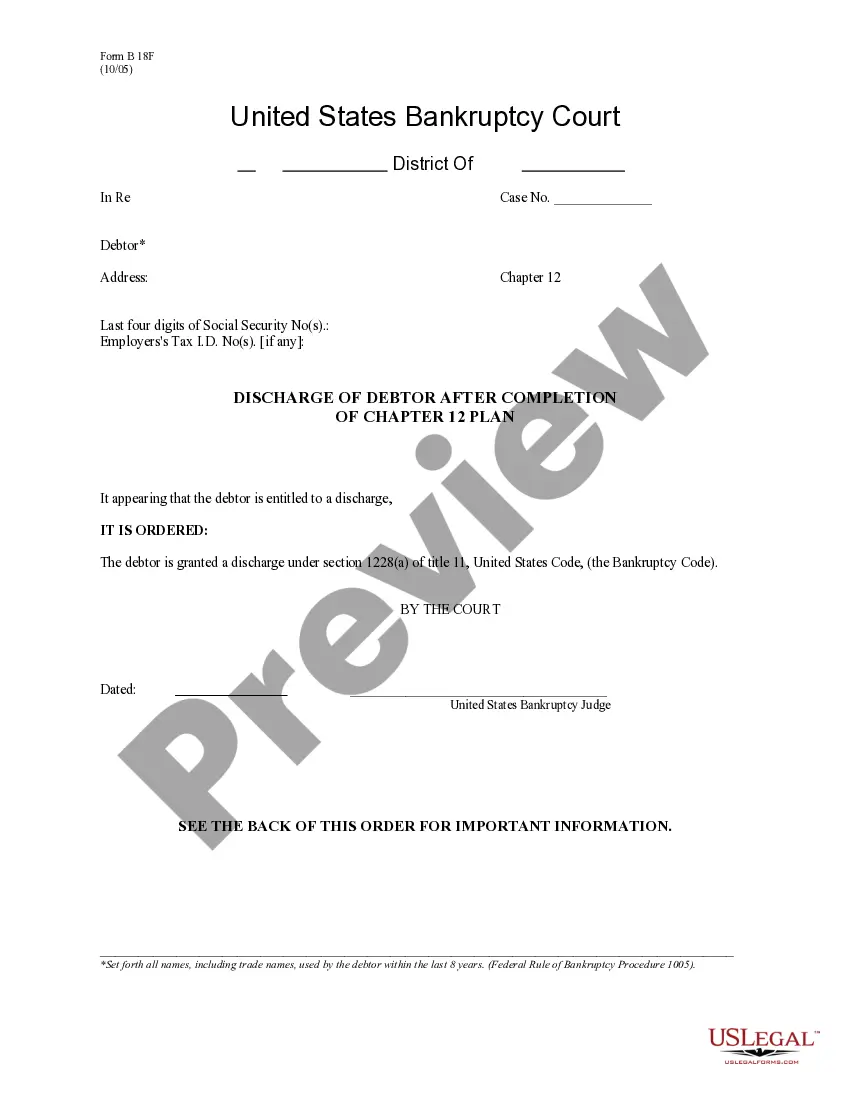

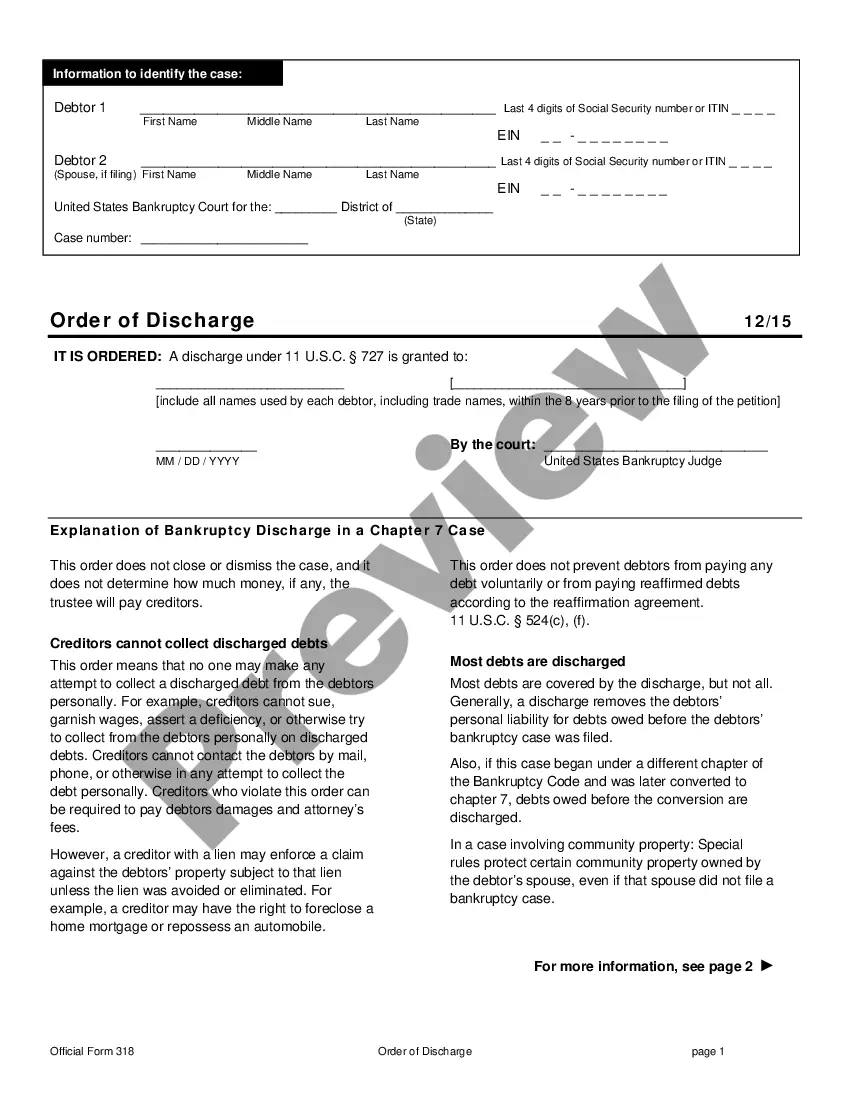

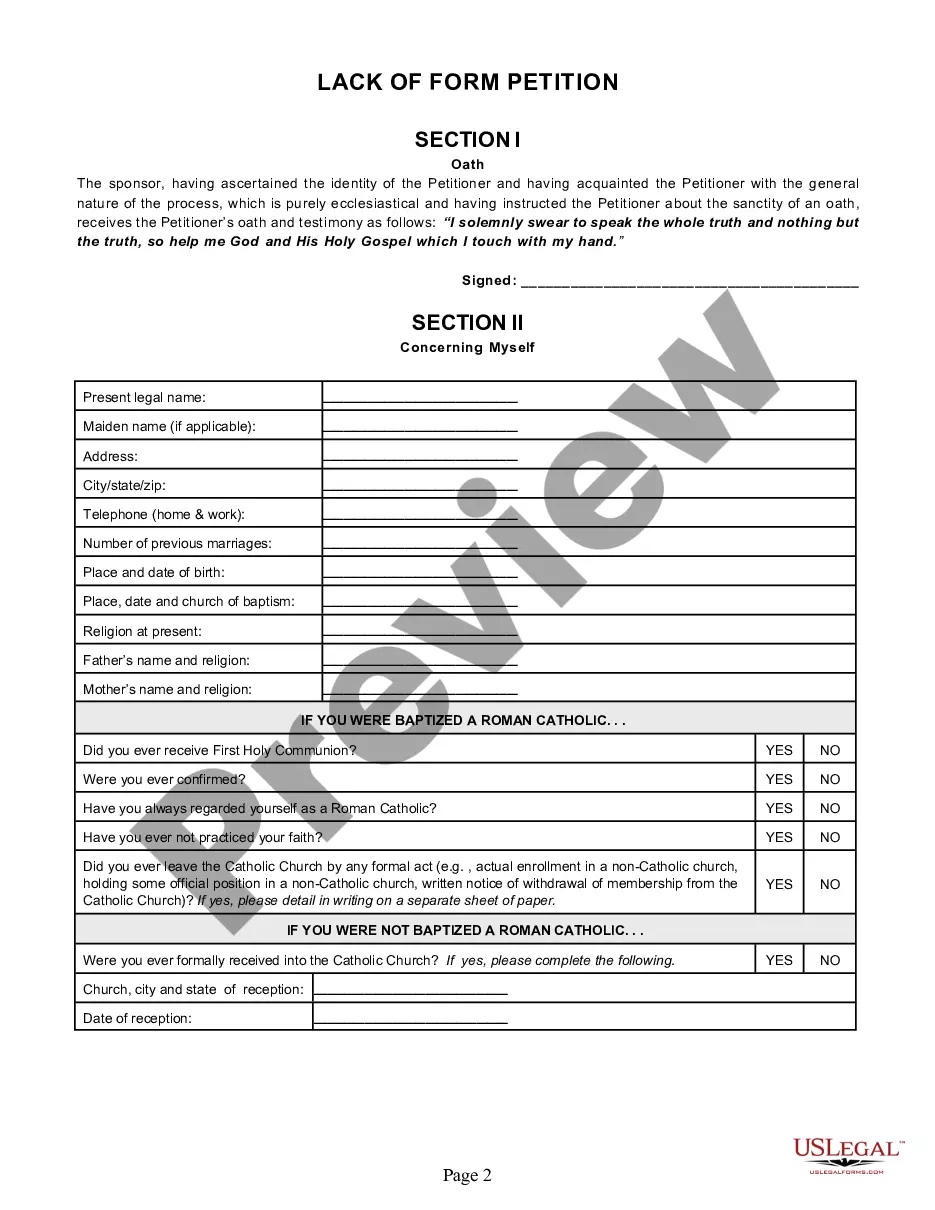

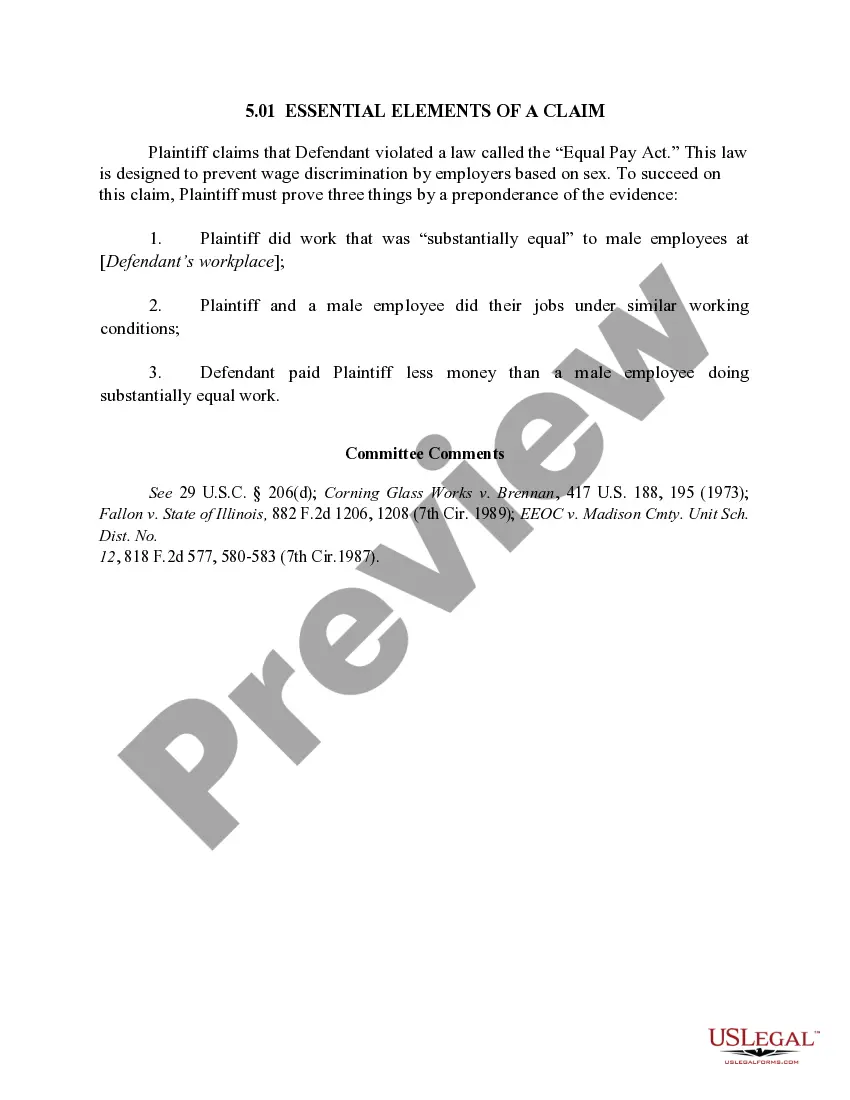

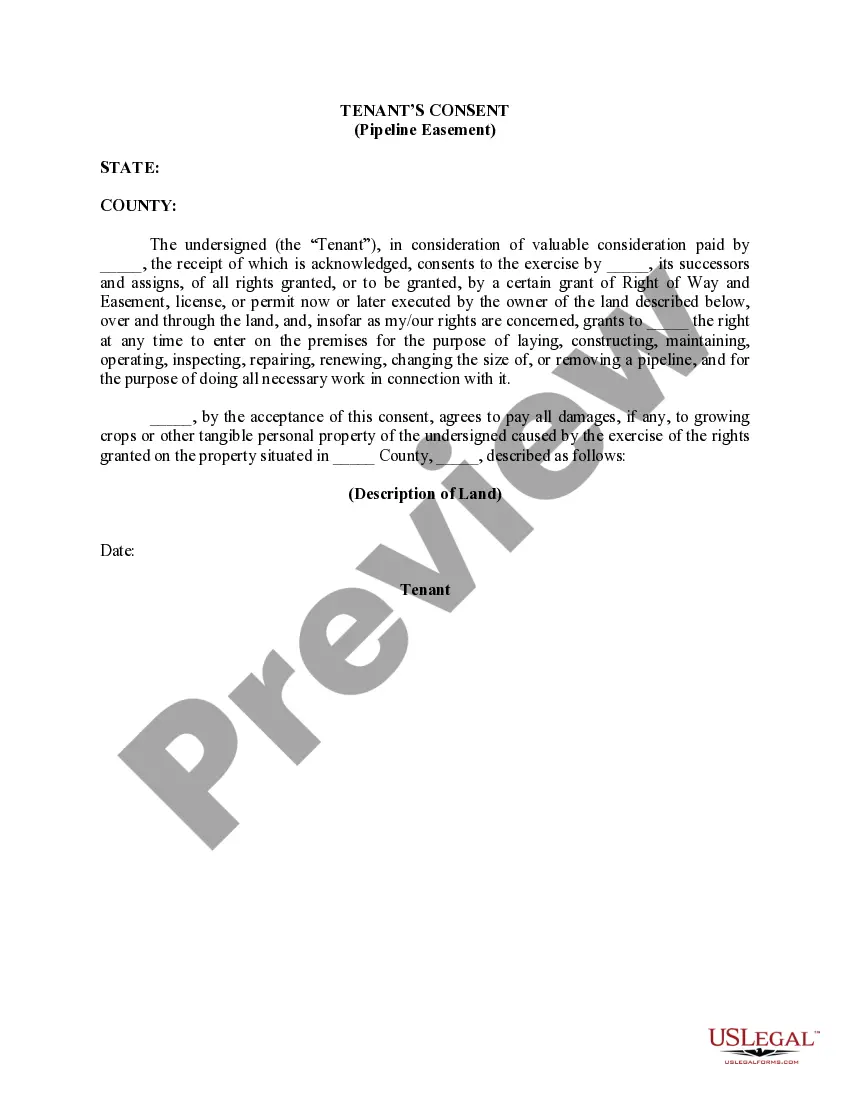

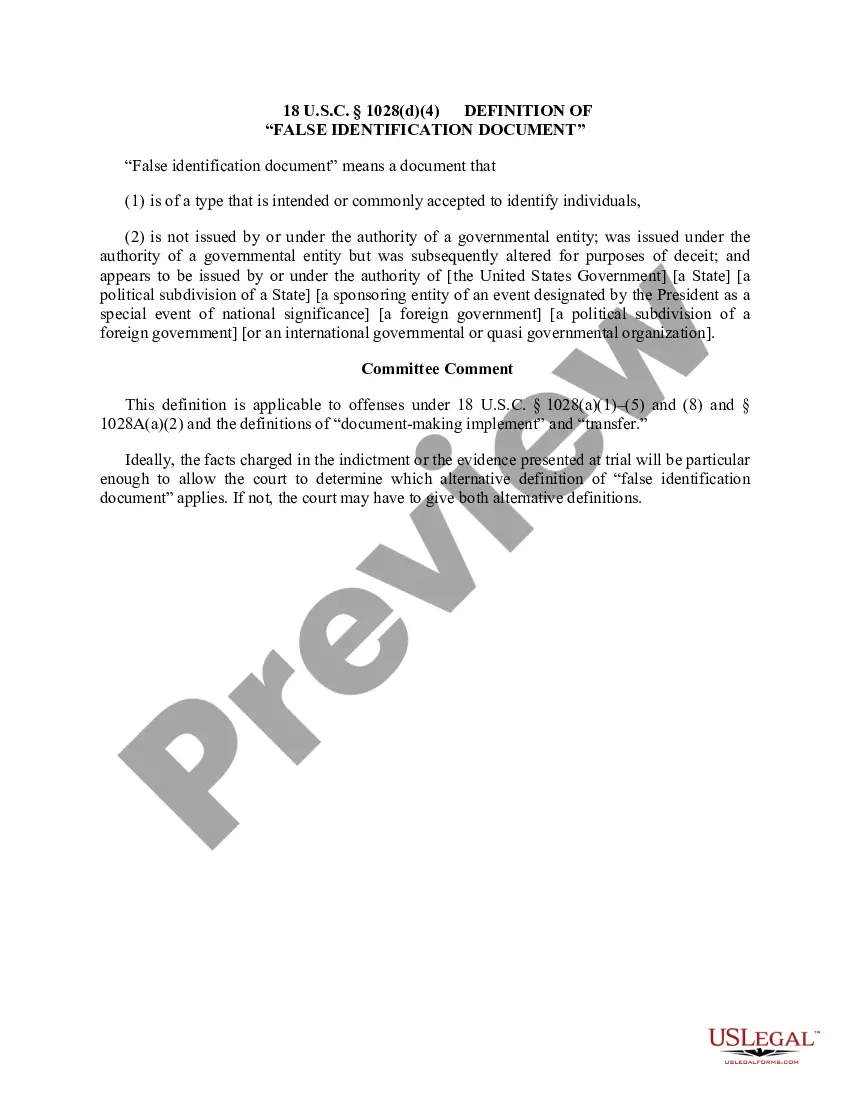

- Make use of the Review button to check the form.

- Look at the explanation to actually have selected the correct form.

- In case the form is not what you`re seeking, take advantage of the Search area to get the form that suits you and needs.

- If you find the appropriate form, just click Get now.

- Opt for the rates plan you desire, fill in the desired info to create your money, and pay money for the order making use of your PayPal or credit card.

- Choose a hassle-free file file format and download your version.

Find each of the file templates you possess purchased in the My Forms menu. You can get a extra version of Tennessee Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form anytime, if possible. Just click the needed form to download or produce the file web template.

Use US Legal Forms, the most comprehensive collection of legal varieties, in order to save time and steer clear of mistakes. The service delivers appropriately made legal file templates that you can use for a range of functions. Generate your account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Form 122A-2. This form, titled the ?Chapter 7 Means Test Calculation,? is the one you fill out if your income is higher than the state median. You will use this form to deduct allowable expenses and see how much income you have left over. This will help determine whether you might qualify for Chapter 7 or Chapter 13. What Is The Bankruptcy Means Test For Chapter 7? bensonlawfirms.com ? chapter-7-bankruptcy-mea... bensonlawfirms.com ? chapter-7-bankruptcy-mea...

You'll add all income earned from all sources during the full six months immediately before filing and multiply the amount by two. Here are examples of the types of income you'll include: gross wages, salary, tips, bonuses, overtime, and commissions. alimony and maintenance payments. Expenses That Can Help You Pass the Means Test for Chapter 7 - Nolo nolo.com ? legal-encyclopedia ? expenses-h... nolo.com ? legal-encyclopedia ? expenses-h...

While no specific cash exemption is listed in the federal bankruptcy exemptions, a wildcard exemption allows you to protect up to $1,325 in any property and use up to $12,575 of any unused portion of a homestead exemption to protect money. How Much Cash Can You Keep In a Chapter 7 Bankruptcy? chapter13bankruptcyhelp.com ? post ? how... chapter13bankruptcyhelp.com ? post ? how...

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

If a filer qualifies for an exception to the means test, they will file Form 122A-1Supp. You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person. The Means Test & Legal Eligibility for Chapter 7 Bankruptcy - Justia justia.com ? bankruptcy ? means-test justia.com ? bankruptcy ? means-test

Receive your bankruptcy discharge: If you have completed all necessary steps and duties, you will automatically be discharged from your remaining debts at the 9- or 21-month mark (with minor exceptions). Some remaining steps may be required, as set out in your court order.

Basic Exemption. An individual, whether a head of family or not, shall be entitled to a homestead exemption upon real property which is owned by the individual and used by the individual or the individual's spouse or dependent, as a principal place of residence.