Tennessee Consulting Contract Questionnaire - Self-Employed

Description

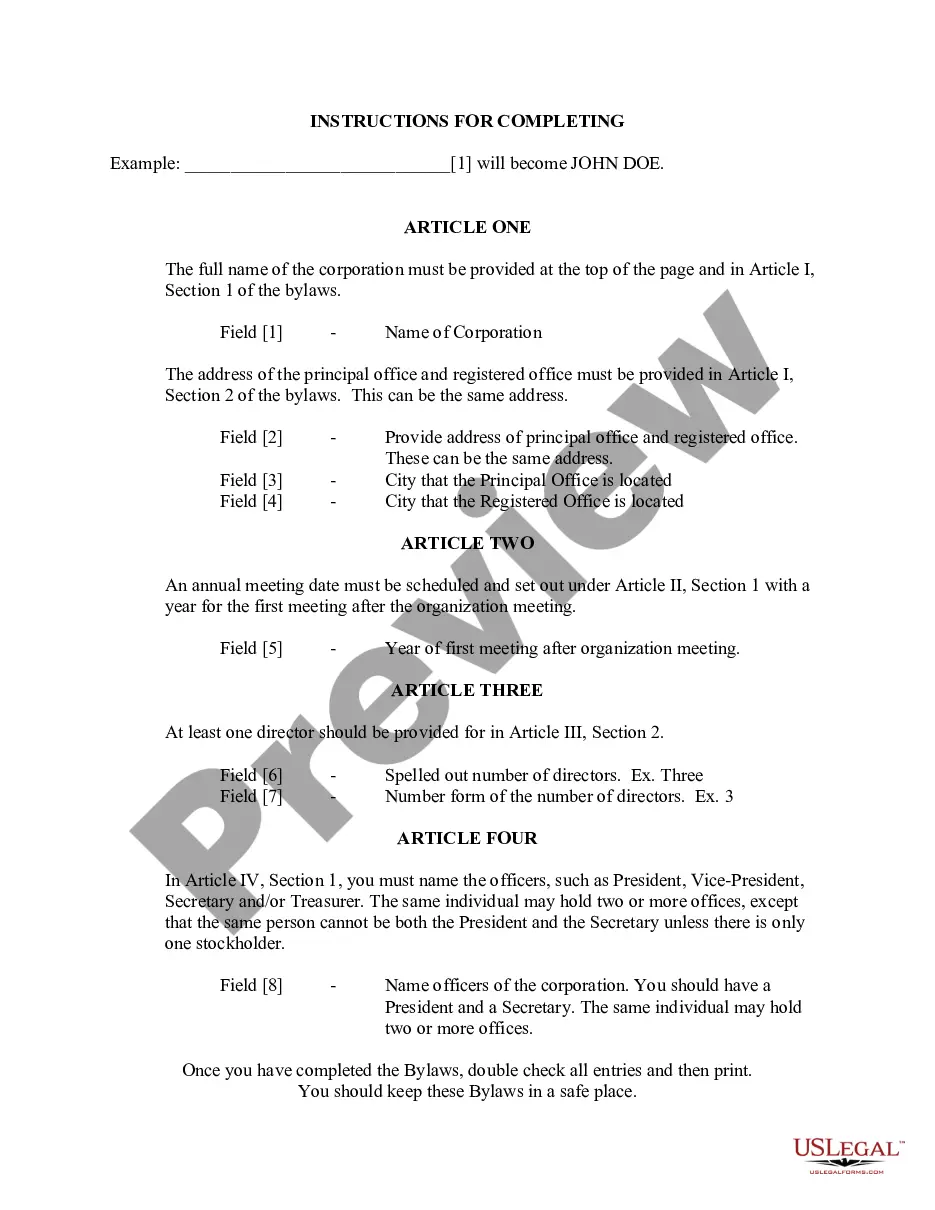

How to fill out Consulting Contract Questionnaire - Self-Employed?

Are you presently in a situation where you need documents for potential business or personal purposes almost every day.

There are numerous legal document templates available online, but finding those that you can trust is not straightforward.

US Legal Forms offers a vast selection of template forms, such as the Tennessee Consulting Contract Questionnaire - Self-Employed, which are designed to comply with state and federal regulations.

Once you find the right form, simply click Get now.

Select the pricing plan you prefer, provide the required information to create your account, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy. You can access all the templates you have purchased in the My documents section. You may acquire an additional copy of the Tennessee Consulting Contract Questionnaire - Self-Employed at any time, if needed. Just click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Tennessee Consulting Contract Questionnaire - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it matches your area/state.

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the form that suits your needs.

Form popularity

FAQ

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Independent Contractor Interview Questions:Why did you choose to become an independent contractor?Can you tell me about the project that you are proudest of?Have you ever had difficulty meeting deadlines?How do you track your performance?What would you do if you encountered unexpected difficulties on a project?

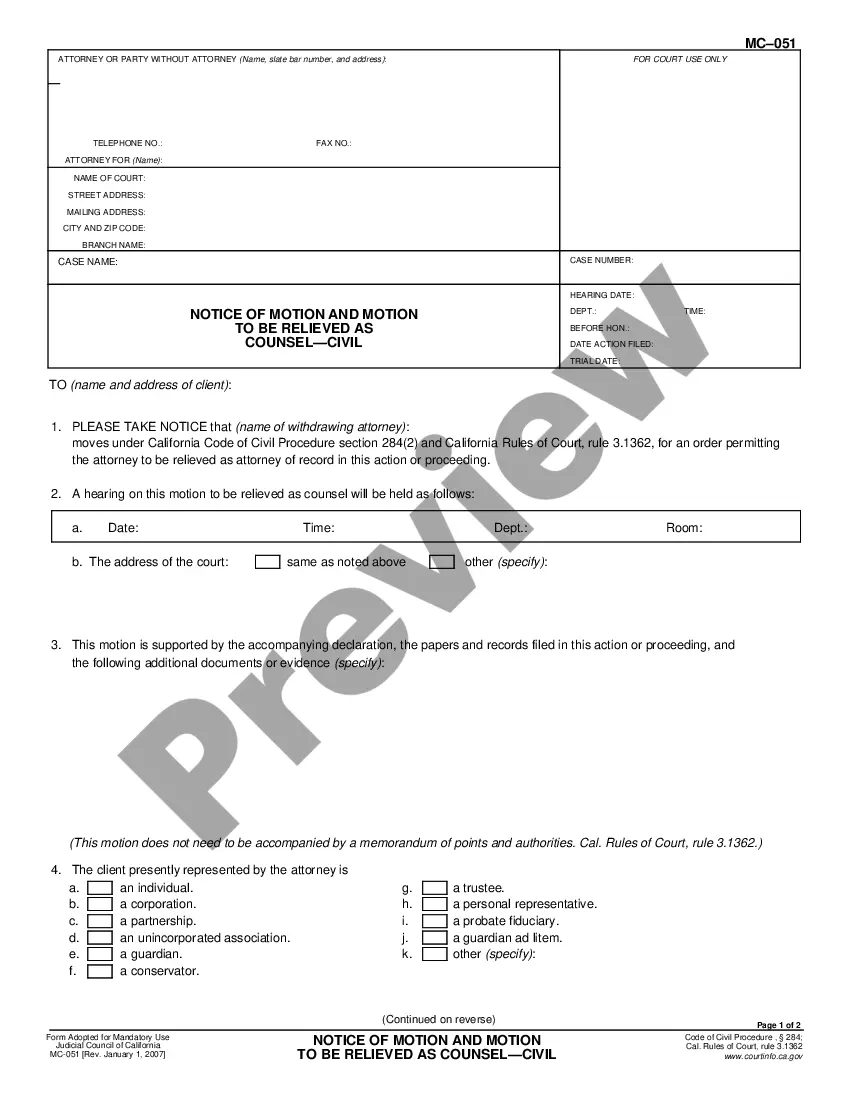

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...