Tennessee Personal Guaranty - Guarantee of Lease to Corporation

Description

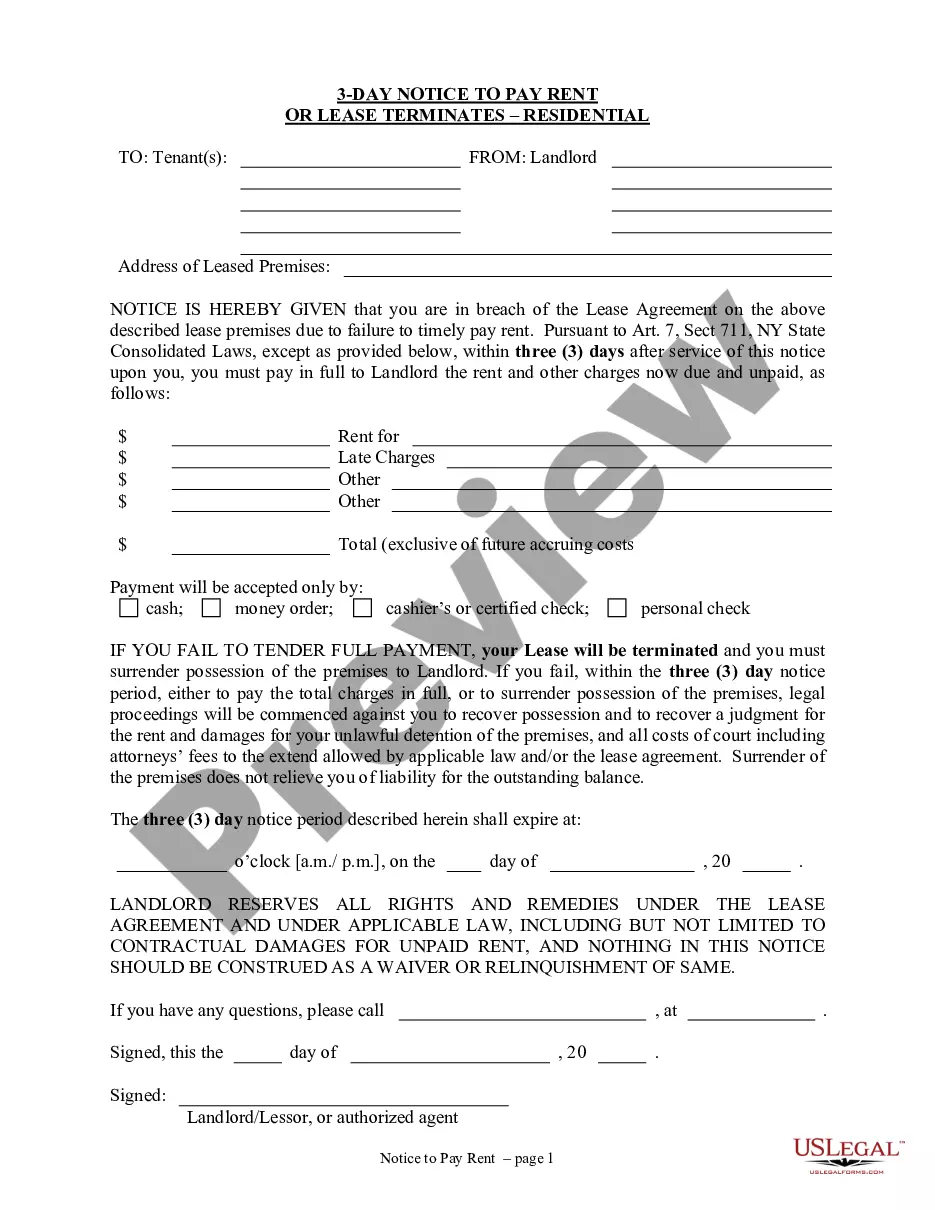

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

Are you presently in a situation where you require paperwork for various organizations or specific objectives almost every day.

There are numerous legal document templates accessible online, but finding reliable ones isn’t straightforward.

US Legal Forms offers a vast array of form templates, including the Tennessee Personal Guaranty - Assurance of Lease to Corporation, designed to comply with federal and state requirements.

Once you find the appropriate form, simply click Purchase now.

Select the pricing plan you prefer, input the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard payment method.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Tennessee Personal Guaranty - Assurance of Lease to Corporation template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and confirm it is for your specific city/region.

- Utilize the Preview feature to examine the form.

- Review the summary to ensure you have selected the correct form.

- If the form isn’t what you're looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

A Guarantor form acts as a legal piece of insurance to typically protect the landlord against rental loss, damages and any ensuing legal fees that is incurred by a tenant. The Guarantor form is a legal contract enforcing the agreement.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

The mutual assent of two or more parties, competency to contract and valuable consideration. An offer to guarantee must be accepted, either by express or implied acceptance. If a surety's assent to a guarantee has been procured by fraud by the person to whom it is given, there is no binding contract.

However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for. To be a guarantor you'll need to be over 21 years old, with a good credit history and financial stability. If you're a homeowner, this will add credibility to the application.

N. a person or entity that agrees to be responsible for another's debt or performance under a contract, if the other fails to pay or perform. ( See: guarantee)

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

A corporate guarantee is a contract between a corporate entity or individual and a debtor. In this contract, the guarantor agrees to take responsibility for the debtor's obligations, such as repaying a debt.

Finally, business owners need to be aware that the personal guarantee may include a right to revoke. Typically, a right to revoke the guarantee does not limit the amount of the guarantor's liability as of the date of the revocation.