Tennessee Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you want to accumulate, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's straightforward and user-friendly search to find the forms you need.

An array of templates for business and personal purposes is categorized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your information to register for the account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Tennessee Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Tennessee Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you're using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

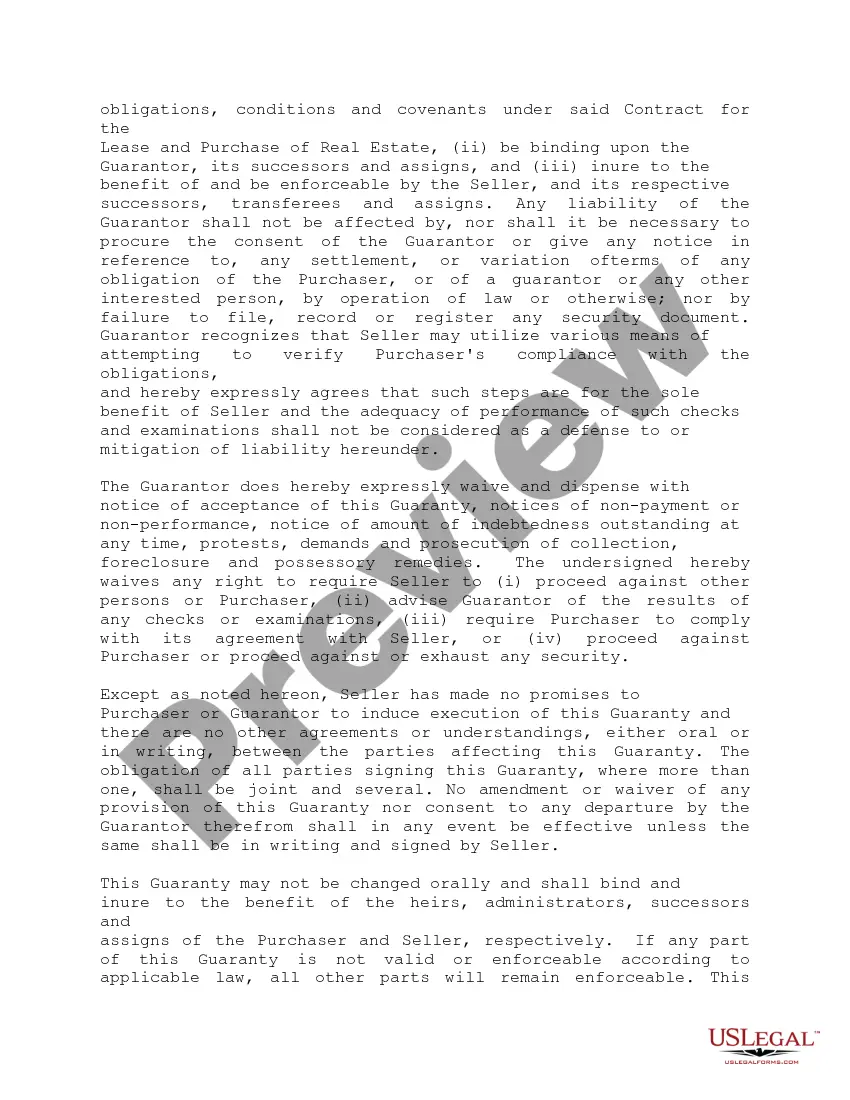

- Step 2. Use the Review option to browse the form's content. Don't forget to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate other types of your legal document format.

Form popularity

FAQ

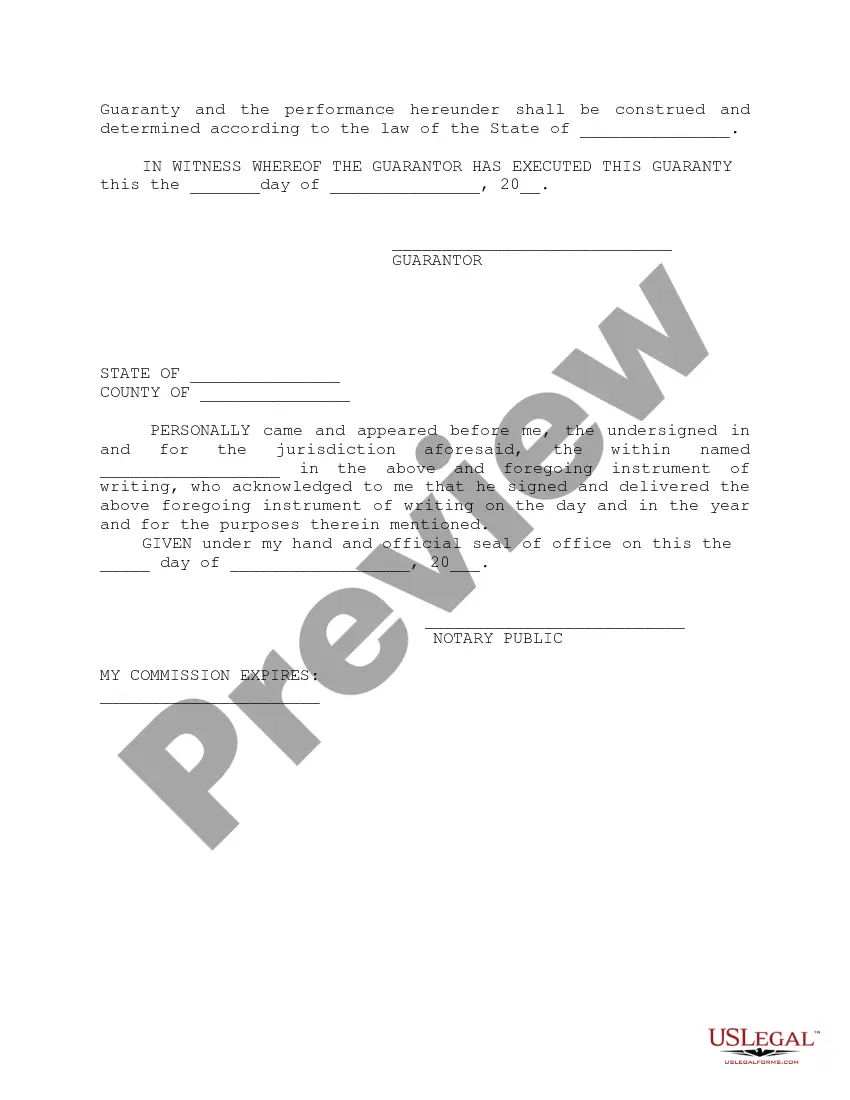

To fill out a personal guarantee, begin by providing your personal information alongside the relevant details of the lease and purchase agreement. Be sure to read the entire agreement to understand your obligations fully. It's essential to acknowledge that, by signing, you accept responsibility for the contract's terms. Visit US Legal Forms for reliable resources and templates that simplify filling out your personal guarantee.

Filling out a personal guaranty requires attention to detail. First, clearly state your name and the person or business whose obligation you are guaranteeing. Next, specify the nature of the contract for the lease and purchase of real estate you are supporting. By using US Legal Forms, you can access templates that guide you step-by-step in completing this important document accurately.

A guaranty contract is a legal agreement where one party promises to answer for the debt or obligation of another party. This type of contract is essential for financing in real estate transactions, especially in Tennessee. When you enter a personal guaranty related to the lease and purchase of real estate, you take on significant responsibility. Explore our US Legal Forms to find templates that clearly outline the terms and conditions of such contracts.

A personal guarantee typically does not need to be notarized; however, notarization can add an extra layer of security. In Tennessee, a personal guaranty associated with a contract for the lease and purchase of real estate may benefit from being notarized to ensure its authenticity. This practice can help prevent disputes by providing proof of the signer's identity. Consider consulting our US Legal Forms platform for templates that guide you through the notarization process.

To obtain a surety bond in Tennessee, you typically need to follow a straightforward process. First, gather necessary documentation related to your business and financial history, as this helps in assessing risk. Next, approach a surety bond provider or an insurance agent who can guide you through the application. A surety bond is important in the context of the Tennessee Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, as it provides an additional layer of security in transactions.

In Tennessee, a contractor must file a lien within a certain time frame to secure their rights. Specifically, they have 90 days after the work is completed or materials are provided. This is essential for those involved in real estate transactions, as it safeguards their investments. Understanding the timeline related to the Tennessee Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is crucial for both contractors and property owners.

In construction lending, a Carry Guaranty is a standard and typical requirement whereby a Guarantor will guaranty the payment by Borrower of all costs incurred in connection with the operation, maintenance and management of the Property (or some subset of the same) for the term of the Loan (or, if the Property is

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.