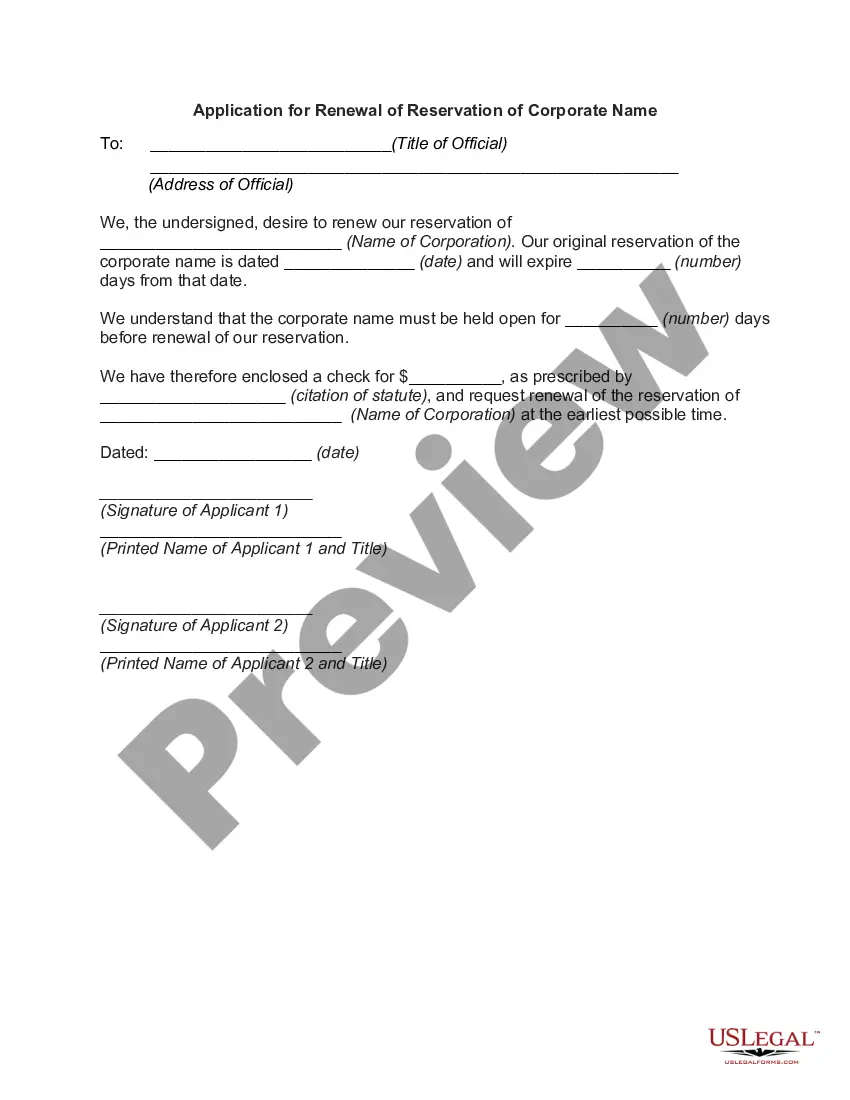

Tennessee Application for Extension of Time Period for Reservation of Corporate Name

Description

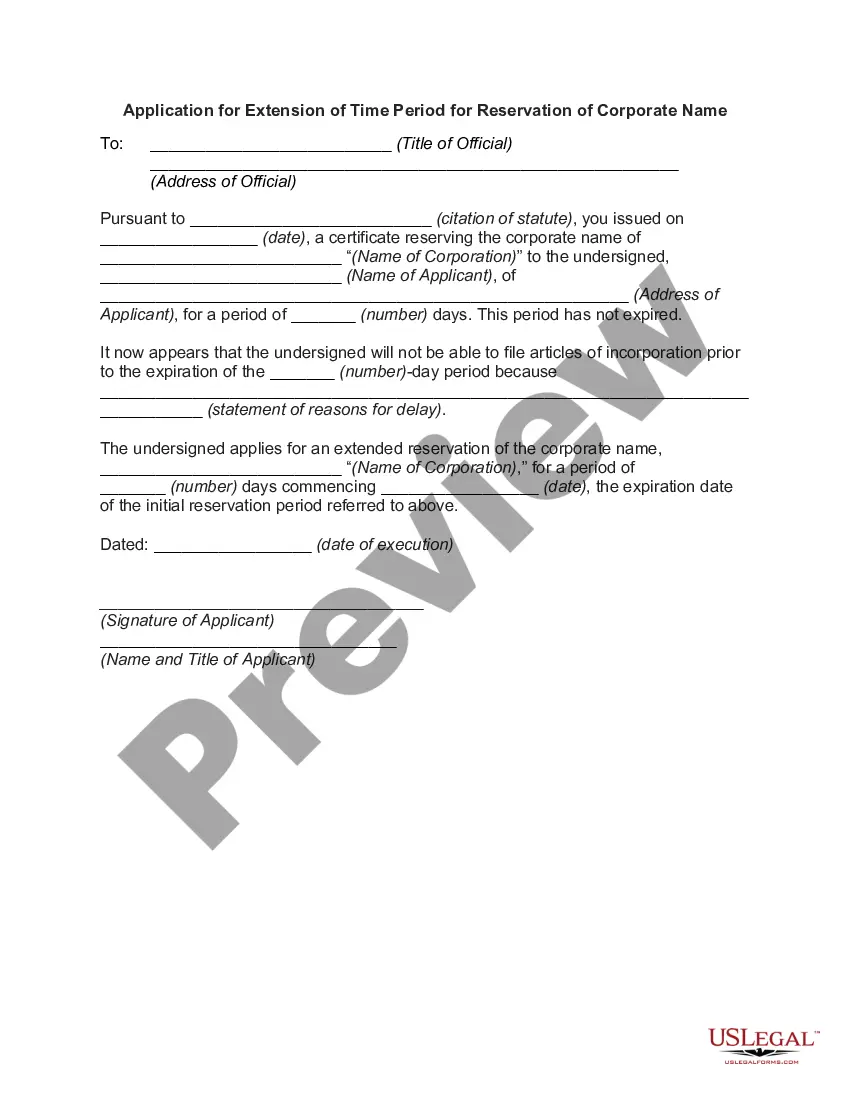

How to fill out Application For Extension Of Time Period For Reservation Of Corporate Name?

You are able to devote hours on the Internet attempting to find the lawful document template that meets the federal and state demands you will need. US Legal Forms offers a large number of lawful varieties which are evaluated by professionals. You can actually download or print out the Tennessee Application for Extension of Time Period for Reservation of Corporate Name from my support.

If you already have a US Legal Forms bank account, you are able to log in and then click the Obtain button. Following that, you are able to complete, change, print out, or sign the Tennessee Application for Extension of Time Period for Reservation of Corporate Name. Every single lawful document template you buy is your own eternally. To have yet another copy of the bought form, proceed to the My Forms tab and then click the related button.

If you use the US Legal Forms site the first time, keep to the straightforward recommendations listed below:

- Initially, make sure that you have selected the proper document template to the county/city of your liking. Browse the form outline to ensure you have chosen the proper form. If available, take advantage of the Review button to check throughout the document template at the same time.

- In order to locate yet another edition of your form, take advantage of the Research discipline to find the template that meets your needs and demands.

- Upon having found the template you desire, click on Buy now to proceed.

- Pick the rates prepare you desire, key in your qualifications, and sign up for a free account on US Legal Forms.

- Total the transaction. You may use your Visa or Mastercard or PayPal bank account to purchase the lawful form.

- Pick the structure of your document and download it for your product.

- Make changes for your document if required. You are able to complete, change and sign and print out Tennessee Application for Extension of Time Period for Reservation of Corporate Name.

Obtain and print out a large number of document layouts making use of the US Legal Forms web site, that provides the largest variety of lawful varieties. Use specialist and express-particular layouts to tackle your organization or specific demands.

Form popularity

FAQ

Tennessee automatically grants 7 months extensions on filing income tax returns with the filing of Form FAE 173, Application for Extension of Time to File Franchise and Excise Tax Return.

1040 State: Extension overview StateAccepts federal extension?Payment options and form to fileHawaiiNoOnline or check with Form N-200VIowaNoOnline or check with voucher IA 1040-VIdahoNoEFT, online or check with voucher 51IllinoisNoOnline or check with voucher IL-505-I58 more rows

Tennessee automatically grants 7 months extensions on filing income tax returns with the filing of Form FAE 173, Application for Extension of Time to File Franchise and Excise Tax Return.

Extended Deadline with Tennessee Tax Extension: Tennessee offers a 6-month extension, which moves the individual filing deadline from April 15 to October 15 (for calendar year filers). Tennessee Tax Extension Form: To request a Tennessee extension, file Form INC-251 by the original due date of your return.

If you have a valid Federal extension (IRS Form 7004) and you owe zero state tax, you will automatically be granted a Tennessee tax extension.

Tennessee Requires: Businesses to file Federal Form 7004 to request an extension with the state rather than requesting an extension using the state extension Form. Businesses to file Form FAE 173 to Request an Extension to File Franchise and Excise Tax Returns Form FAE170 and Form FAE174.

Business Extensions The Franchise & Excise Tax extension request is filed on Form FAE 173. The Franchise & Excise Tax return can be extended for six months, provided the taxpayer has paid at least 90 percent of the current year's tax liability, or 100 percent of the prior year's liability, by the original due date.