Tennessee Sample Letter for Update to Estate Closure

Description

How to fill out Sample Letter For Update To Estate Closure?

Choosing the right authorized record format could be a battle. Of course, there are a variety of layouts accessible on the Internet, but how will you get the authorized develop you will need? Make use of the US Legal Forms website. The assistance gives a large number of layouts, like the Tennessee Sample Letter for Update to Estate Closure, that you can use for company and personal needs. All the kinds are checked by pros and fulfill state and federal needs.

In case you are presently authorized, log in in your account and then click the Download option to obtain the Tennessee Sample Letter for Update to Estate Closure. Make use of account to look from the authorized kinds you have purchased in the past. Visit the My Forms tab of your account and obtain yet another duplicate from the record you will need.

In case you are a whole new end user of US Legal Forms, here are simple instructions that you should comply with:

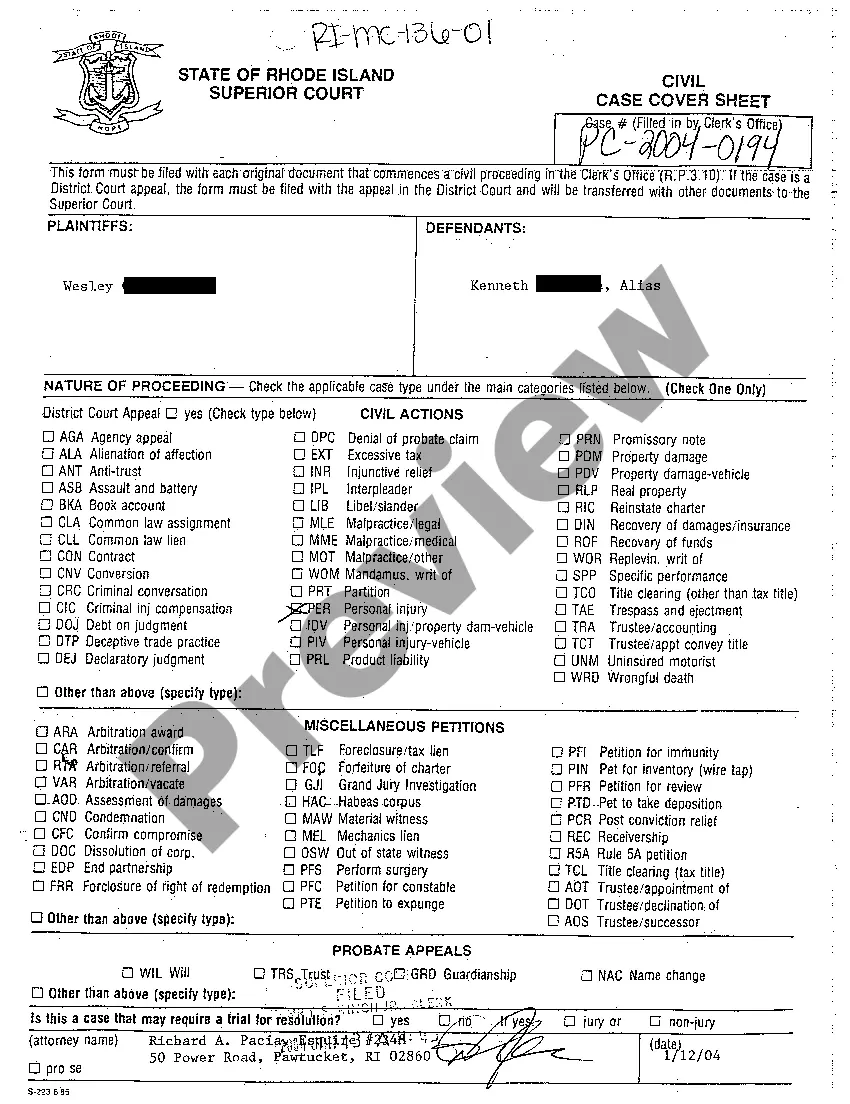

- Initially, make certain you have selected the right develop to your town/state. It is possible to check out the shape using the Preview option and look at the shape outline to make certain this is the right one for you.

- In the event the develop will not fulfill your preferences, utilize the Seach discipline to obtain the right develop.

- Once you are sure that the shape is acceptable, click on the Buy now option to obtain the develop.

- Choose the rates strategy you desire and type in the essential details. Design your account and buy your order utilizing your PayPal account or Visa or Mastercard.

- Opt for the data file structure and down load the authorized record format in your product.

- Total, modify and produce and signal the attained Tennessee Sample Letter for Update to Estate Closure.

US Legal Forms is the largest local library of authorized kinds where you can find different record layouts. Make use of the company to down load professionally-made documents that comply with status needs.

Form popularity

FAQ

To close the estate, the executor must fill out and sign a final accounting form, documenting all payments from the estate. The accounting form is sent to all the beneficiaries named in the will, and if they agree that the information it contains is correct, they must also sign the form.

If the deceased is the only name on the deed, then it will need to go through the probate process, in most cases. Personal property in the deceased's name. This includes boats, motorcycles, cars, and RVs as well as artwork, furniture, and the contents of his or her home. Bank and other financial accounts.

Tennessee law does not give a deadline for submitting a will to probate after someone dies. However, if a will is not submitted to probate, the court will treat the decedent's estate as if a will never existed. The decedent's property gets distributed ing to Tennessee's laws of intestate succession.

How long probate takes in Tennessee varies from estate to estate. Generally, this can take anywhere from six months to a year. Following the deceased's passing, the executor has 60 days to turn in an inventory of the deceased's assets that need to go through probate.

However, if a will is not submitted to probate, the court will treat the decedent's estate as if a will never existed. The decedent's property gets distributed ing to Tennessee's laws of intestate succession. In that case, state law determines who inherits the decedent's property.

In Tennessee, the process begins when the executor, named in the will or an administrator appointed by the court if there's no will, files a petition with the probate court. The court then oversees the entire process ensuring all debts are paid and remaining assets are distributed to the correct heirs or beneficiaries.

Once the executor receives authority to manage the estate, they have 60 days to file an inventory of the estate with the probate court. Creditors then have up to 12 months to enter their claims on the record.

As per the law in Tennessee, the executor of an estate where there is a last will and testament is issued Letters Testamentary and the estate administrator of an estate without a will is issued Letters of Administration from the probate court in the county or city in which the decedent resided.