Tennessee Seller's Affidavit of Nonforeign Status

Description

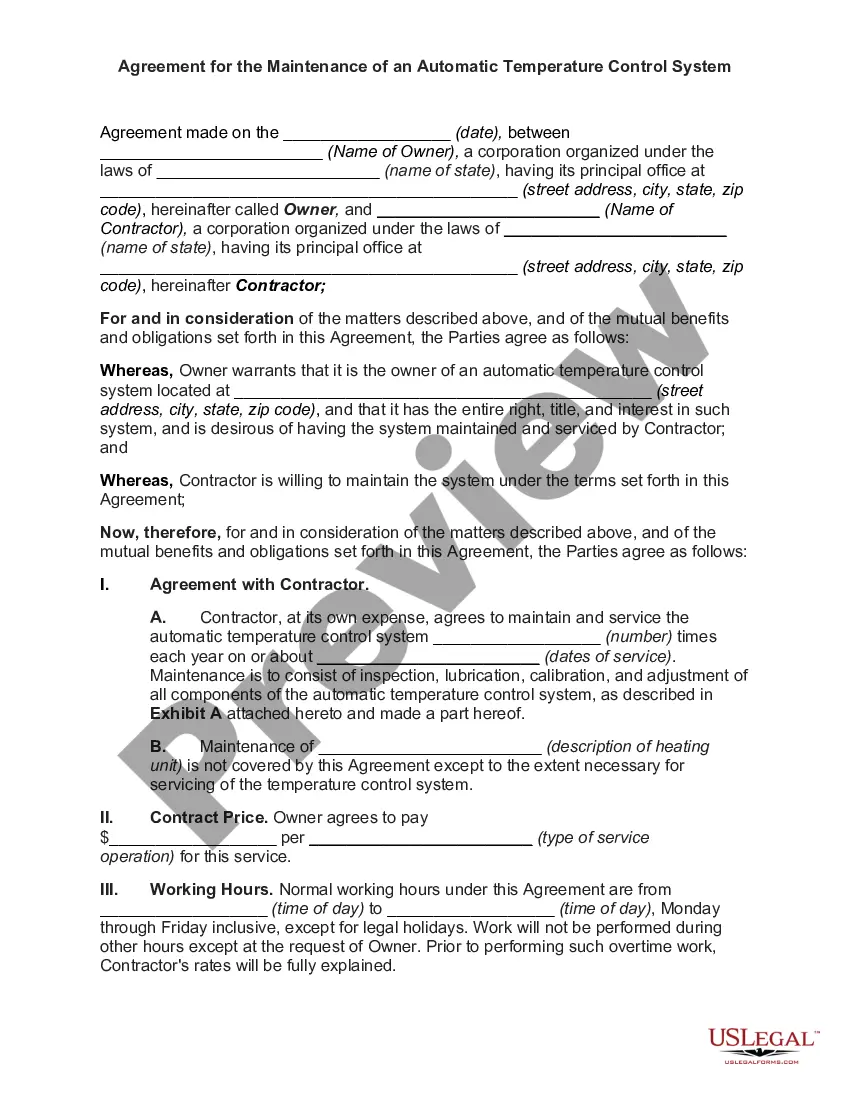

How to fill out Seller's Affidavit Of Nonforeign Status?

Are you within a placement in which you need to have files for both organization or specific purposes just about every time? There are tons of authorized record layouts accessible on the Internet, but discovering versions you can trust is not simple. US Legal Forms offers a large number of form layouts, much like the Tennessee Seller's Affidavit of Nonforeign Status, which are composed to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms web site and also have a free account, basically log in. Afterward, you can obtain the Tennessee Seller's Affidavit of Nonforeign Status template.

If you do not offer an accounts and need to begin to use US Legal Forms, abide by these steps:

- Find the form you require and make sure it is for the correct city/region.

- Make use of the Preview button to check the shape.

- See the information to actually have chosen the appropriate form.

- If the form is not what you are trying to find, utilize the Lookup field to find the form that meets your requirements and demands.

- When you get the correct form, click on Acquire now.

- Select the costs plan you need, submit the required details to create your bank account, and buy the transaction using your PayPal or Visa or Mastercard.

- Pick a handy data file format and obtain your version.

Get each of the record layouts you might have bought in the My Forms menu. You can obtain a more version of Tennessee Seller's Affidavit of Nonforeign Status anytime, if needed. Just click the necessary form to obtain or print out the record template.

Use US Legal Forms, the most comprehensive variety of authorized forms, to save lots of efforts and avoid faults. The service offers expertly made authorized record layouts which can be used for an array of purposes. Generate a free account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

FIRPTA Certificate: A FIRPTA certificate is used to to notify the IRS that the seller of real estate is not a foreign-person. When a foreign person sells real estate, the IRS wants to know about it. Even though some capital gains income tax is exempt to foreign persons, real estate is not exempt.

What Is a FIRPTA Affidavit? The Affidavit is the form that is used by the seller to certify under Penalty of Perjury that the seller is not a foreign seller. Generally, the escrow company or agents involved in the underlying sale will be responsible for facilitating the signatures.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.