Tennessee Loan Commitment Agreement

Description

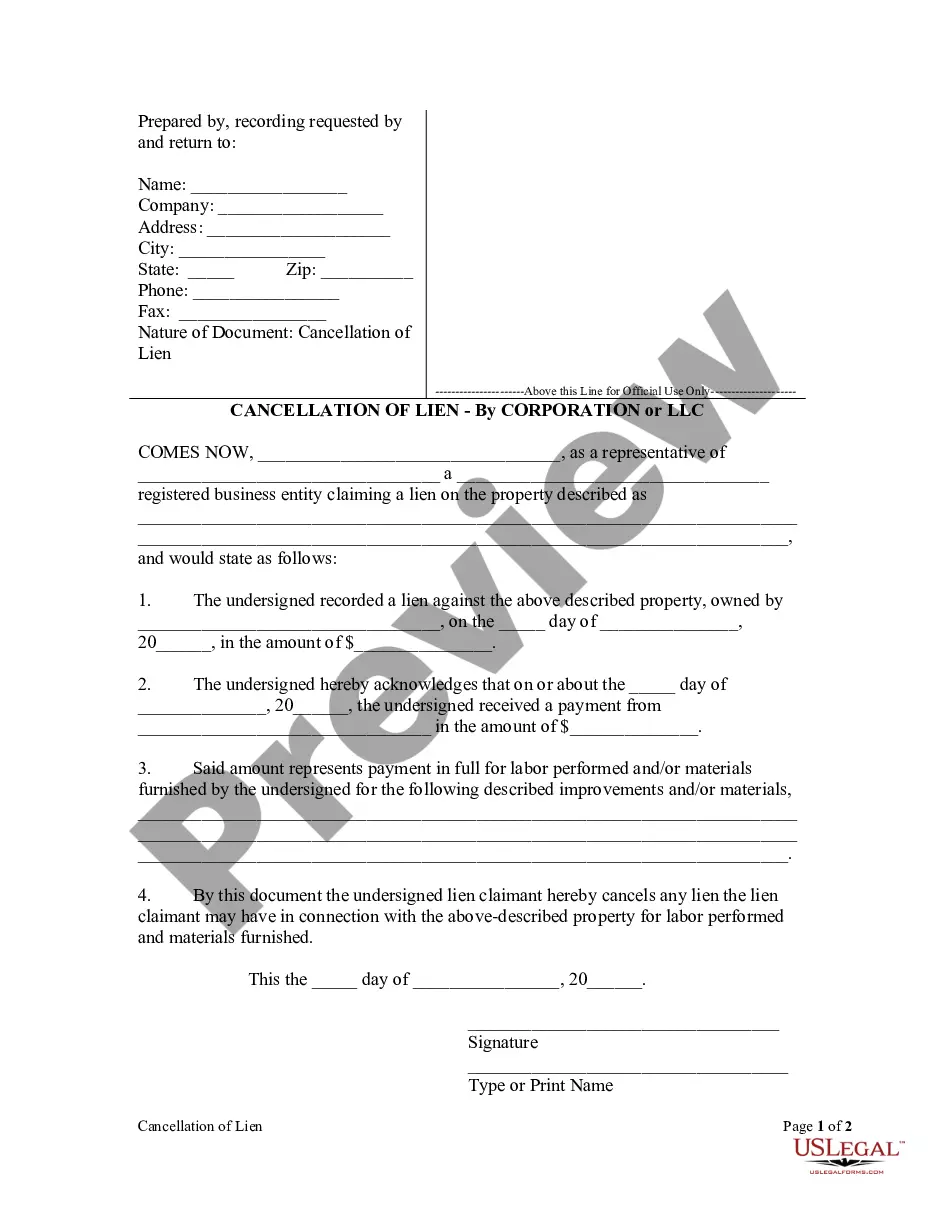

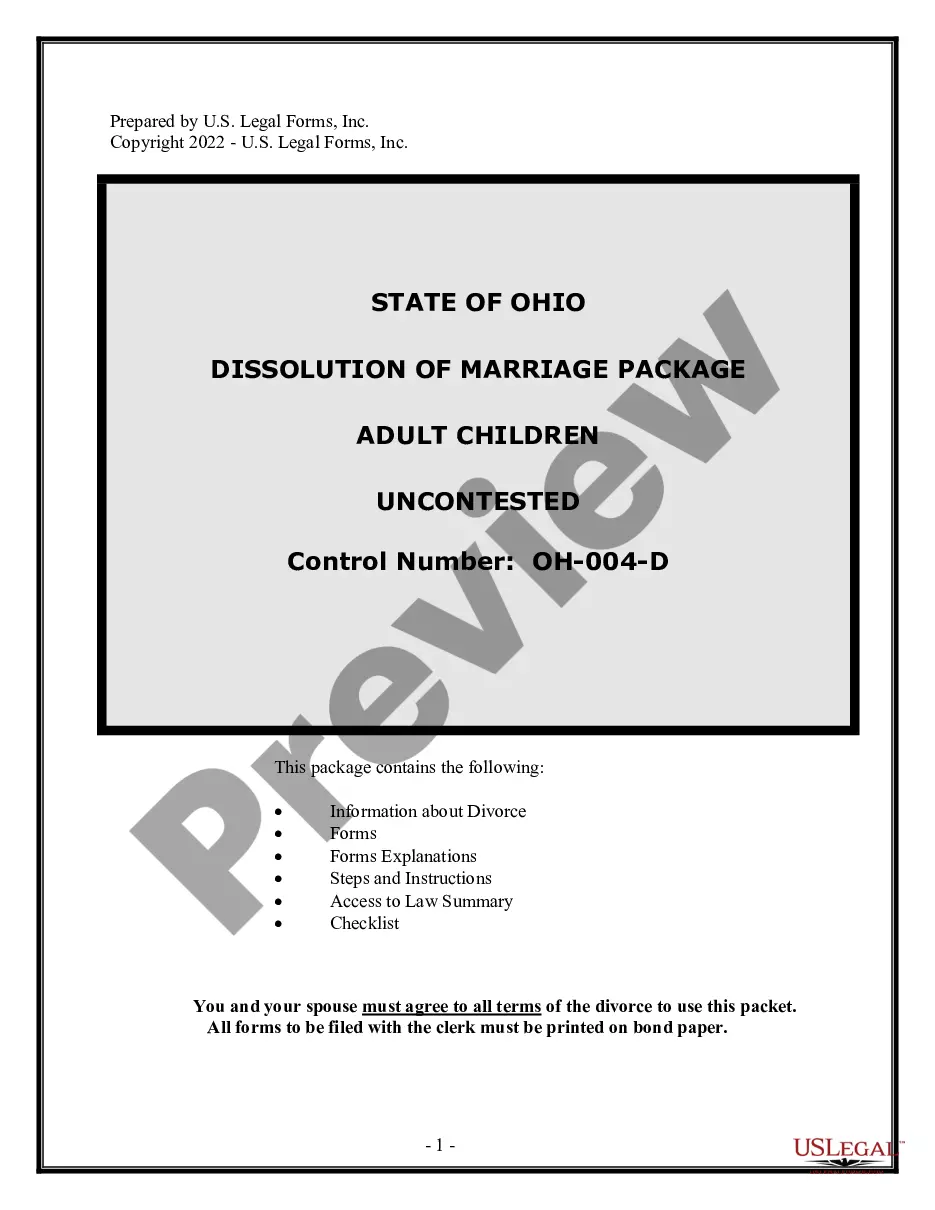

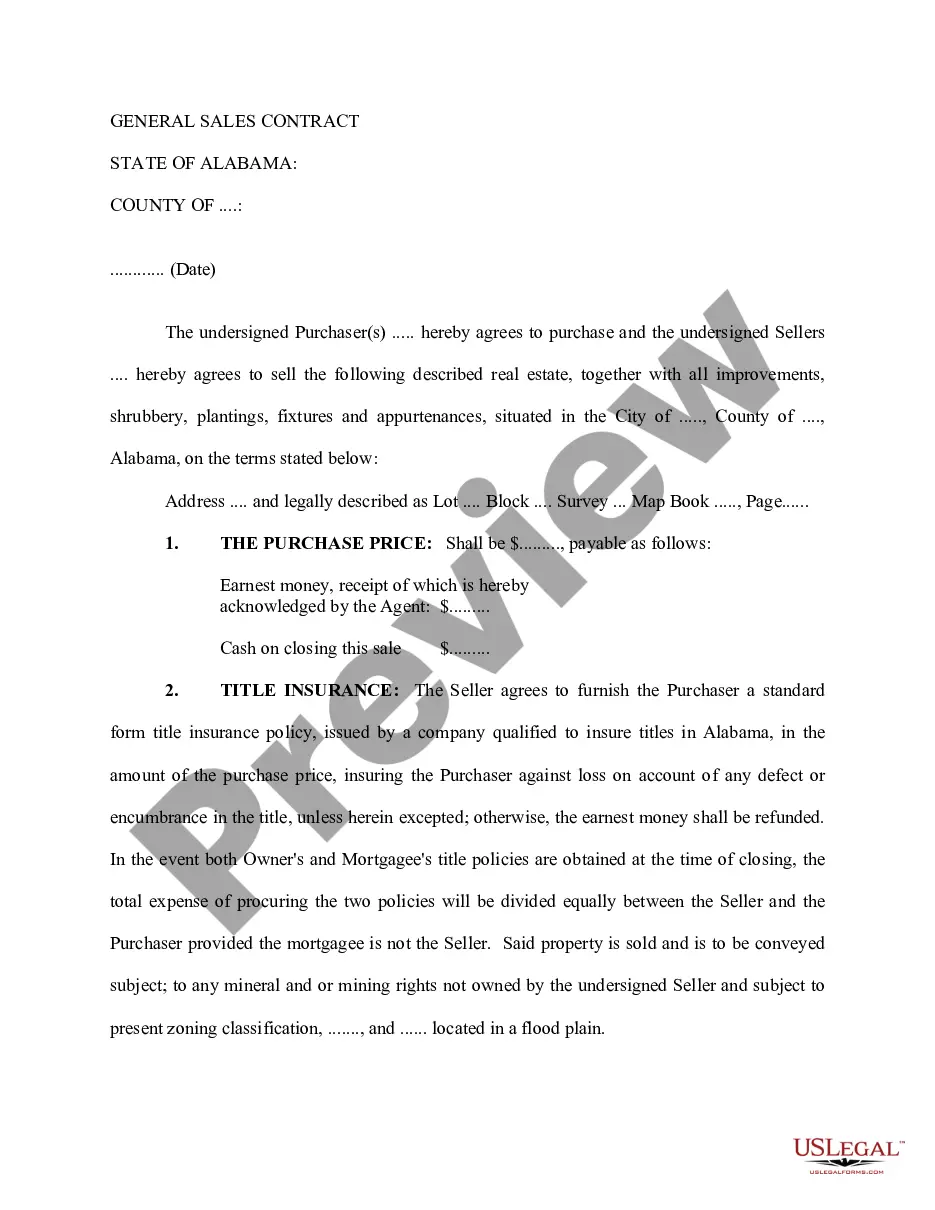

How to fill out Loan Commitment Agreement?

US Legal Forms - one of several biggest libraries of legal kinds in the United States - provides a wide array of legal papers themes you may obtain or produce. Making use of the website, you can find a huge number of kinds for enterprise and specific functions, sorted by types, claims, or search phrases.You can find the most recent variations of kinds much like the Tennessee Loan Commitment Agreement in seconds.

If you already have a registration, log in and obtain Tennessee Loan Commitment Agreement in the US Legal Forms local library. The Download key can look on every kind you see. You have accessibility to all in the past delivered electronically kinds inside the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, allow me to share easy recommendations to help you started:

- Be sure to have selected the best kind for your personal town/region. Go through the Preview key to examine the form`s content material. Look at the kind description to ensure that you have chosen the right kind.

- In case the kind doesn`t satisfy your specifications, utilize the Search area on top of the monitor to discover the one who does.

- Should you be content with the shape, verify your selection by visiting the Buy now key. Then, pick the rates prepare you want and give your qualifications to sign up for the bank account.

- Method the deal. Use your Visa or Mastercard or PayPal bank account to perform the deal.

- Find the file format and obtain the shape on your product.

- Make adjustments. Fill out, modify and produce and signal the delivered electronically Tennessee Loan Commitment Agreement.

Each format you added to your bank account lacks an expiry day and it is your own for a long time. So, if you would like obtain or produce yet another duplicate, just go to the My Forms area and click on about the kind you need.

Obtain access to the Tennessee Loan Commitment Agreement with US Legal Forms, the most comprehensive local library of legal papers themes. Use a huge number of specialist and condition-specific themes that satisfy your company or specific needs and specifications.

Form popularity

FAQ

in or rate lock on a mortgage loan means that your interest rate won't change between the offer and closing, as long as you close within the specified time frame and there are no changes to your application. Mortgage interest rates can change daily, sometimes hourly.

A loan commitment is like any other contract: a binding agreement enforceable in ance with its terms. A borrower often relies heavily on the lender's funding commitment.

Most lenders offer rate locks for 30, 45 or 60 days, ing to the Consumer Financial Protection Bureau. However, you may find some lender with shorter term locks (as low as 15 days for purchase loans) or as long as 90 or 120 days if you're willing to pay an upfront fee.

Because commitment letters are legally binding agreements, terms should be precise and detailed and include all material terms. Any ambiguity in the terms outlined in the commitment letter will often be construed against the lender.

But what if you lock a mortgage and then rates fall? Unfortunately, you can't just unlock your rate to avoid paying higher interest. Your best option is to ask your lender about a rate ?float down,? although this will cost you an additional fee. Switching lenders last minute is also an option for refinancers.

Lock-in agreement means a written agreement between a mortgage lender, or a mortgage broker acting on behalf of a mortgage lender, and an applicant for a mortgage loan which that establishes and sets an interest rate and the points to be charged in connection with a mortgage loan that is closed within the time period ...

Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met. If there are no loose ends, you should be approved.

04 - LOCK-IN AGREEMENT (1) A lock-in agreement shall include, but not necessarily be limited to, the following: (a) The interest rate and discount points to be paid by the applicant on the residential mortgage loan, and if the residential mortgage loan has an adjustable interest rate, the initial interest rate to be ...