Tennessee Promissory Note with Payments Amortized for a Certain Number of Years

Description

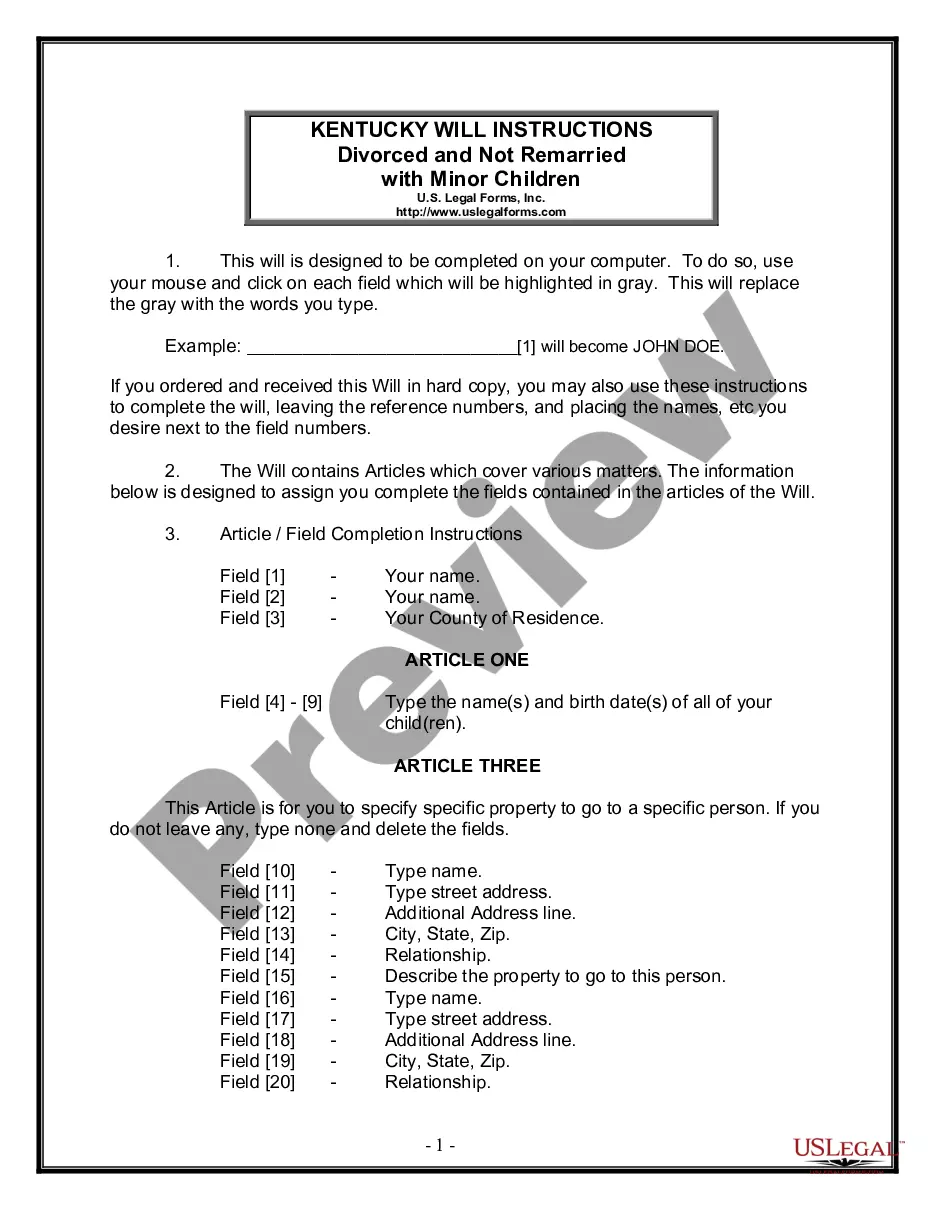

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

If you intend to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After finding the form you want, click the Download Now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to get the Tennessee Promissory Note with Payments Amortized for a Specific Number of Years in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Tennessee Promissory Note with Payments Amortized for a Specific Number of Years.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate area/state.

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Promissory notes have limitations, such as the risk of default and the potential for higher interest rates. Additionally, a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years may not cover all circumstances surrounding repayment. Always consult with legal professionals to understand these limitations.

Yes, a properly executed promissory note generally holds up in a court of law, making it a binding agreement. In the event of a dispute, a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years can serve as vital evidence in court. Make sure the note is well-drafted to protect your interests.

One potential disadvantage of a promissory note is that it may carry a higher interest rate than traditional bank loans. Additionally, if you default on a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years, it may negatively impact your credit score. It's essential to review all terms carefully before signing.

Promissory notes can indeed be long-term if they are structured accordingly. A Tennessee Promissory Note with Payments Amortized for a Certain Number of Years usually specifies a longer repayment period, which provides a predictable payment schedule. Understanding these terms can help borrowers plan their financial futures effectively.

The duration of a promissory note varies based on the specifics of the agreement. Typically, a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years will last for the agreed-upon period outlined in the document. It is essential to clarify these terms to ensure all parties understand their commitments.

A promissory note can be either short-term or long-term, depending on the agreement between the parties involved. In the case of a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years, the duration is typically set to reflect the amortization schedule, which can span several years. It's important to define the terms clearly to avoid confusion.

In Tennessee, a debt generally becomes uncollectible after six years, aligning with the statute of limitations for promissory notes. This timeframe applies to various types of debts, including those outlined in a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years. Understanding this can help you and your debtors manage financial expectations.

In Tennessee, the statute of limitations on a promissory note is typically six years. This means that a creditor has six years from the date of default to file a lawsuit to collect the debt. If you are dealing with a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years, it's crucial to be aware of this timeline to protect your rights.

Yes, in Tennessee, a notarized promissory note is generally considered legally binding. The notarization process helps to authenticate the document, ensuring that both parties understand the terms. When drafting a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years, utilizing a platform like US Legal Forms can provide templates and guidance for creating a solid and binding agreement.

There is no specific maximum amount set by Tennessee law for a promissory note. The total value usually depends on the agreement between the borrower and the lender. When creating a Tennessee Promissory Note with Payments Amortized for a Certain Number of Years, ensure that the amount reflects the financial realities and repayment capabilities of both parties.