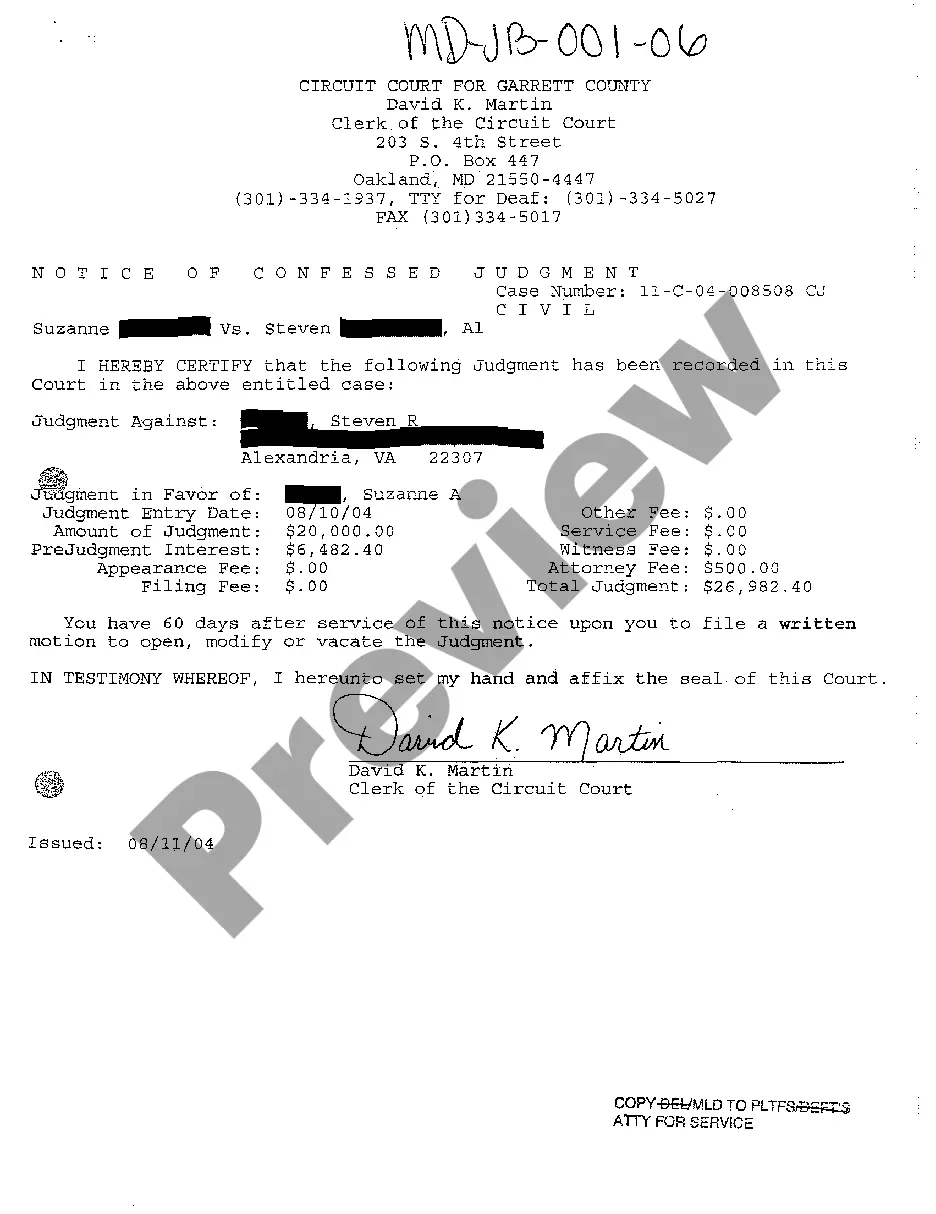

28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

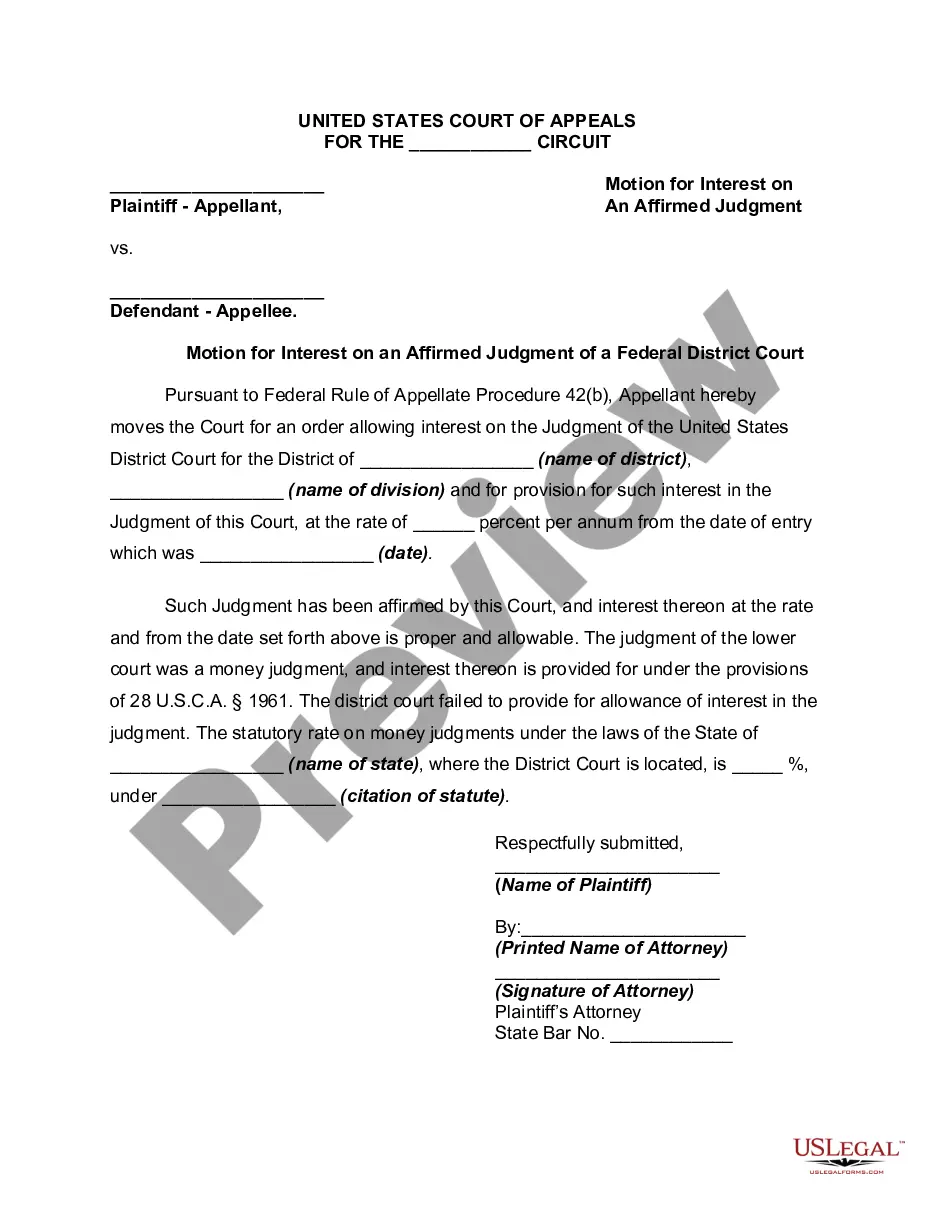

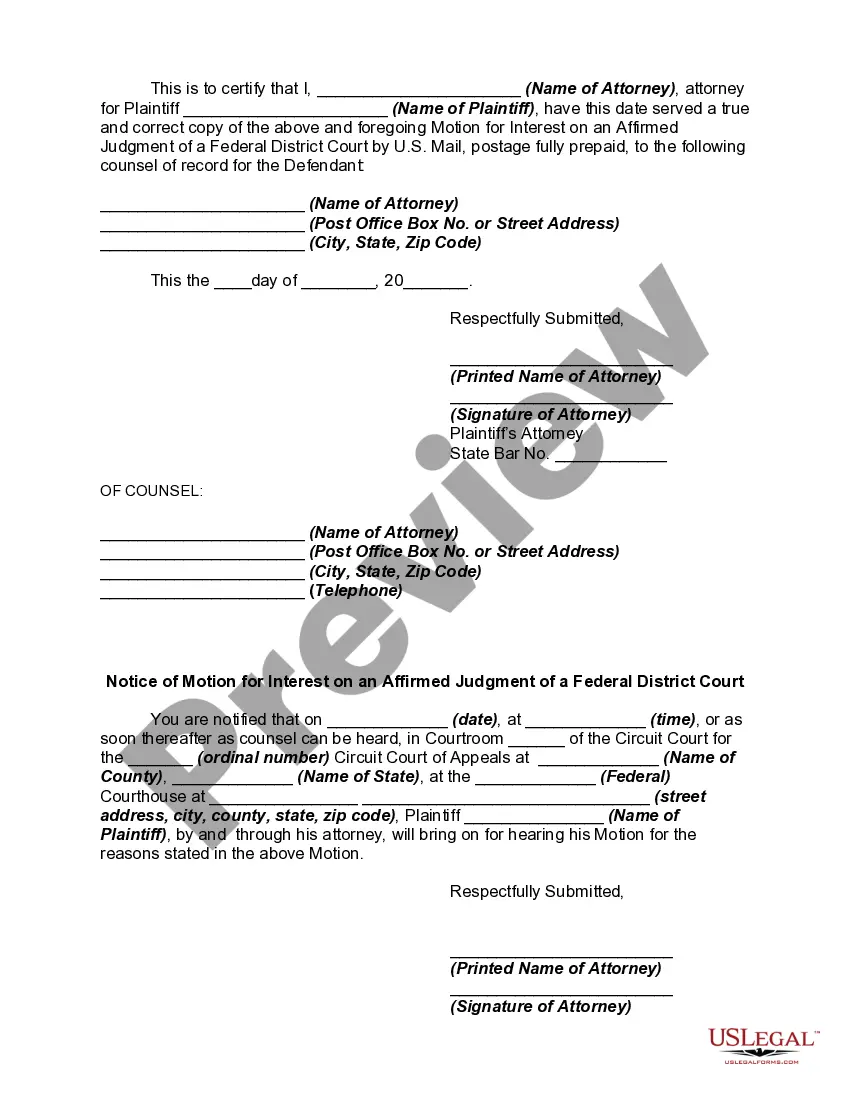

Tennessee Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

You are able to commit time on the Internet trying to find the legitimate file web template which fits the state and federal demands you need. US Legal Forms offers a large number of legitimate forms which are reviewed by experts. You can actually down load or print out the Tennessee Motion for Interest on an Affirmed Judgment of a Federal District Court from our support.

If you have a US Legal Forms profile, you can log in and click the Obtain button. After that, you can full, edit, print out, or indicator the Tennessee Motion for Interest on an Affirmed Judgment of a Federal District Court. Every single legitimate file web template you acquire is your own property forever. To acquire an additional backup of the purchased form, proceed to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms internet site initially, stick to the straightforward directions under:

- Very first, ensure that you have chosen the correct file web template to the county/city of your liking. Read the form description to make sure you have selected the correct form. If available, use the Review button to appear from the file web template as well.

- If you would like locate an additional edition in the form, use the Look for industry to obtain the web template that fits your needs and demands.

- After you have located the web template you need, just click Get now to carry on.

- Pick the costs prepare you need, type in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal profile to pay for the legitimate form.

- Pick the format in the file and down load it in your system.

- Make changes in your file if possible. You are able to full, edit and indicator and print out Tennessee Motion for Interest on an Affirmed Judgment of a Federal District Court.

Obtain and print out a large number of file web templates while using US Legal Forms site, which provides the most important selection of legitimate forms. Use expert and state-specific web templates to tackle your small business or personal requirements.

Form popularity

FAQ

The interest that a creditor, usually a plaintiff in the case, is entitled to collect, derived from the amount of a judgment, which compensates the creditor for an injury which occurred before the judgment.

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

The Law. Pre-judgment interest is interest that is added to a plaintiff's monetary award in respect of past losses suffered prior to the date judgment is pronounced. Pre-judgment interest may be awarded by statute.

It does not apply to judgments awarded in federal court ? even where the underlying substance of the lawsuit is governed by California law. The effects of this distinction can be substantial.

Interest accrues on an unpaid judgment amount at the legal rate of 10% per year (7% if the judgment debtor is a state or local government entity) generally from the date of entry of the judgment.

This is because prejudgment interest can add up, particularly as cases can often take a year or two or longer to get through trial. For example, a one million dollar judgment would accrue $100,000 in interest every year at the "legal rate" of 10%.

Specifically, Rule 69.04 of the Tennessee Rules of Civil Procedure provides that: Within ten years from the entry of a judgment, the creditor whose judgment remains unsatisfied may file a motion to extend the judgment for another ten years.

?It is well settled that prejudgment interest is a substantive aspect of a plaintiff?s claim, rather than a merely procedural mechanism.? In re Exxon Valdez, 484 F.