Tennessee Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

You can devote hours online trying to locate the legal document template that fulfills the federal and state requirements you seek.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can easily download or print the Tennessee Notice of Default on Promissory Note Installment from our service.

First, ensure you have selected the correct document template for the state/city of your choosing. Check the form details to confirm you have chosen the right form. If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Tennessee Notice of Default on Promissory Note Installment.

- Every legal document template you obtain is yours indefinitely.

- To acquire another copy of any obtained form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

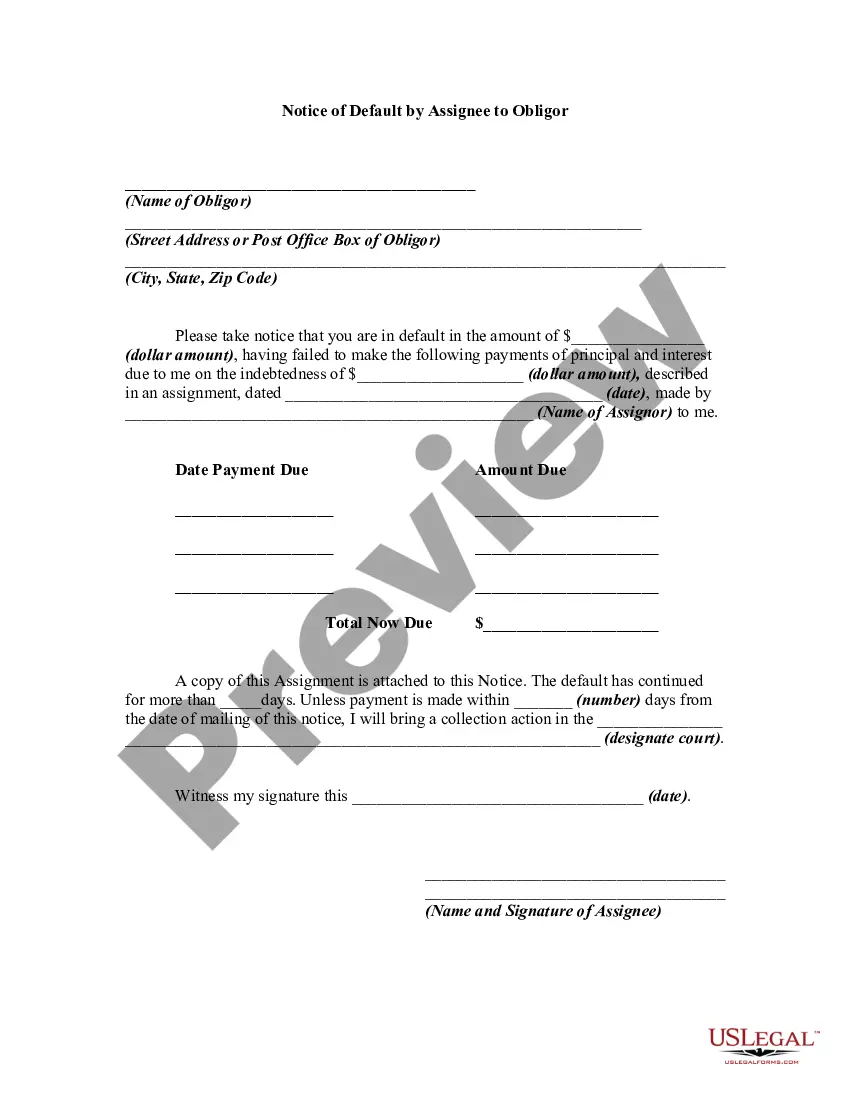

Writing a notice of default involves clearly stating the breach and specifying the terms of the promissory note. Ensure to include essential details such as the borrower’s name, the amount due, and any deadlines for correction. A properly drafted Tennessee Notice of Default on Promissory Note Installment should follow legal guidelines to ensure it is recognized in a court. If you're unsure about the process, turning to resources like UsLegalForms can help you create an effective notice.

Receiving a default notice indicates that a lender views you as failing to meet your payment obligations. A Tennessee Notice of Default on Promissory Note Installment will typically provide you with specific details about the missed payments and your options moving forward. It’s advisable to take this notice seriously and consider your next steps carefully, which may include reaching out to the lender. Addressing the situation proactively can help you find a resolution and prevent escalation.

If someone defaults on a promissory note, the first step is to communicate with the borrower to discuss the reasons for the default. You may also consider sending a Tennessee Notice of Default on Promissory Note Installment as a formal reminder of their obligations. Depending on the situation, renegotiating the terms or referring them to legal advice might be prudent. Acting quickly can help you explore options for recovery.

When someone defaults on a promissory note, it means they have failed to meet their payment terms as outlined in the agreement. The lender may initiate collection actions, which could include a Tennessee Notice of Default on Promissory Note Installment, signifying the formal recognition of this default. Ultimately, unresolved issues may lead to legal proceedings or even loss of collateral tied to the note. Taking action early can help mitigate these consequences.

Receiving a Tennessee Notice of Default on Promissory Note Installment signals that you have fallen behind on your payment obligations. This notice typically outlines the specifics of your default and details the amount needed to rectify the situation. It’s essential to address this promptly to avoid further legal consequences or potential foreclosure. Ignoring the notice may lead to more serious actions from the lender.

Yes, it is possible to default on a promissory note if the borrower fails to meet the payment terms. A default may occur when payments are late or missed, leading to potential legal consequences. Understanding the implications of the Tennessee Notice of Default on Promissory Note Installment is crucial for both lenders and borrowers. If you're uncertain about your situation, consider consulting with a legal expert or using US Legal Forms for guidance.

An example of a default notice might begin with the date and the lender's information, followed by the borrower's details. The content would emphasize that the Tennessee Notice of Default on Promissory Note Installment is due to non-payment, specifying exact amounts owed and a deadline for resolution. This document should clearly outline the next steps for the borrower, making the situation easy to understand.

A notice of default typically includes key details such as the borrower's name, the property's address, and the specific amounts owed. The Tennessee Notice of Default on Promissory Note Installment should also highlight specific terms of the promissory note and any outstanding payments. The document usually concludes with a clear statement about potential consequences if the default is not cured.

Issuing a default notice involves drafting the document and then delivering it to the borrower. You can send it via certified mail to ensure the recipient receives it. Additionally, when preparing the Tennessee Notice of Default on Promissory Note Installment, it's wise to keep a copy for your records. Consider using platforms like US Legal Forms for templates that simplify the process.

To write a default notice, start by clearly stating the issue at hand. Include the date, the recipient's name, and the specific terms of the Tennessee Notice of Default on Promissory Note Installment. You should also specify the amount due and any actions required to remedy the situation. Finally, deliver the notice through a method that confirms receipt.