Tennessee Letter to Foreclosure Attorney - Payment Dispute

Description

How to fill out Letter To Foreclosure Attorney - Payment Dispute?

Discovering the right lawful record design could be a battle. Needless to say, there are a lot of themes available online, but how would you obtain the lawful type you want? Take advantage of the US Legal Forms web site. The service gives a large number of themes, for example the Tennessee Letter to Foreclosure Attorney - Payment Dispute, that you can use for business and private requires. All the forms are checked out by specialists and meet up with state and federal specifications.

If you are already listed, log in to the account and then click the Download switch to get the Tennessee Letter to Foreclosure Attorney - Payment Dispute. Use your account to appear through the lawful forms you have bought earlier. Visit the My Forms tab of your account and have another backup of the record you want.

If you are a fresh customer of US Legal Forms, here are easy directions for you to follow:

- Initial, make certain you have selected the correct type for the city/region. You may check out the form while using Preview switch and read the form information to ensure this is basically the right one for you.

- When the type does not meet up with your needs, make use of the Seach area to get the right type.

- When you are sure that the form is acceptable, click on the Acquire now switch to get the type.

- Select the rates strategy you desire and enter the necessary details. Create your account and pay money for the order utilizing your PayPal account or credit card.

- Choose the document format and acquire the lawful record design to the system.

- Complete, change and produce and sign the received Tennessee Letter to Foreclosure Attorney - Payment Dispute.

US Legal Forms will be the most significant local library of lawful forms that you will find different record themes. Take advantage of the company to acquire professionally-manufactured paperwork that follow state specifications.

Form popularity

FAQ

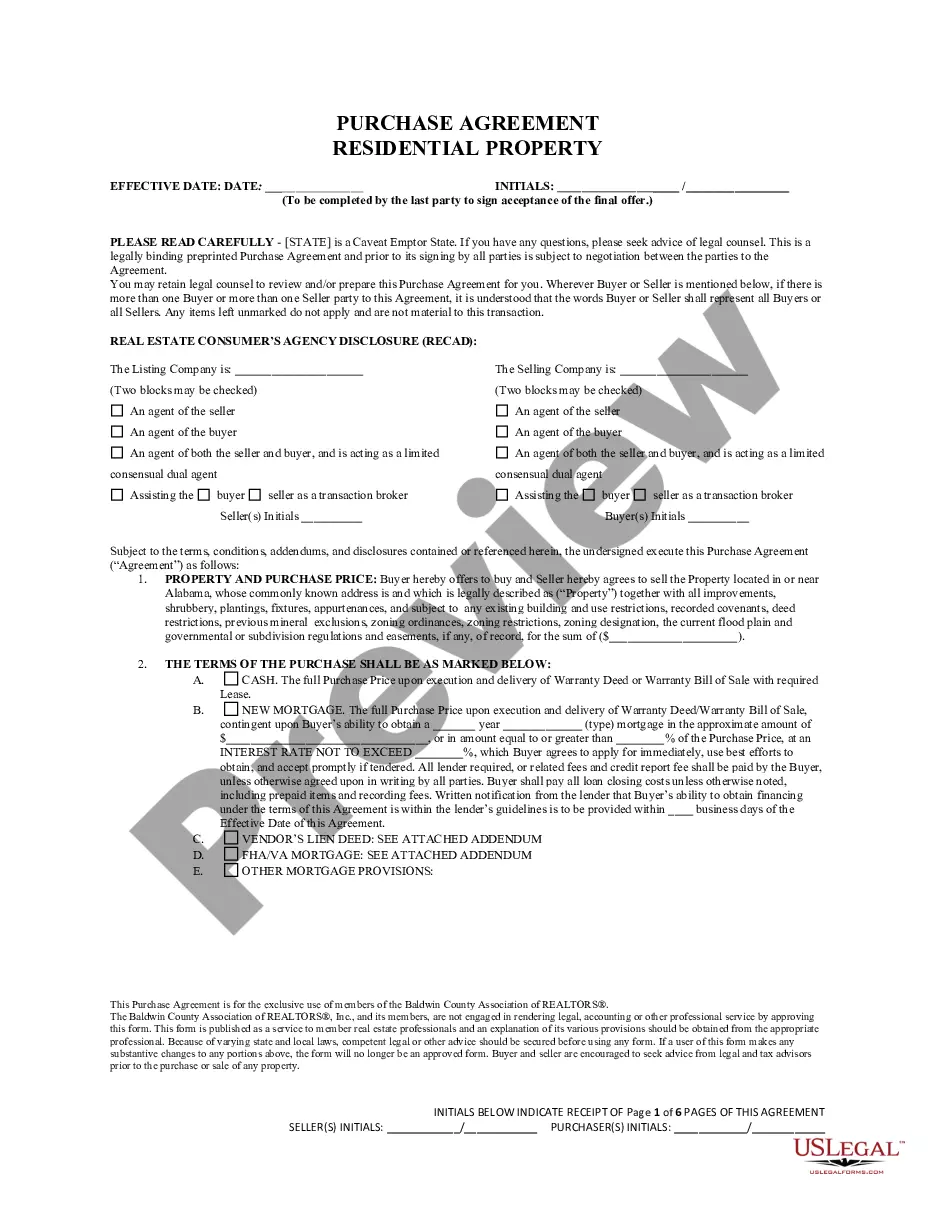

Alabama is a non-judicial foreclosure state, which means that a mortgage holder doesn't have to take the homeowner to court to reclaim the home if the mortgage falls behind. There are still steps the mortgage holder has to take to foreclose on the home.

Alabama is a non-judicial foreclosure state, which means that a mortgage holder doesn't have to take the homeowner to court to reclaim the home if the mortgage falls behind. There are still steps the mortgage holder has to take to foreclose on the home.

What Is the Foreclosure Process in Minnesota? If you default on your mortgage payments in Minnesota, the lender may foreclose using a judicial or nonjudicial method.

Once the notice is served, your right to redeem the property under Alabama law is terminated. The statutory notice period for the initial written notice to vacate the property is 10 days. At the expiration of 10 days, the lienholder can then file the ejectment action in Circuit Court, where the property is located.

In Alabama, lenders do not have to sue you in court first in order to foreclose on your property. Lenders do have to publish the foreclosure date in a local newspaper for three consecutive weeks prior to the foreclosure sale. You may also receive a letter from your lender advising you of their intentions.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

Right of Redemption After Foreclosure in Alabama Former owners are given the opportunity to repurchase their home after a foreclosure sale. This is called the right of redemption. To redeem the property, former owners must pay the Purchaser the purchase price paid, plus other charges such as: Interest.

Foreclosure in Tennessee In the State of Tennessee, the minimum time a debt on a property has to be unpaid in order for the mortgage holder to enter foreclosure proceedings is six months. Foreclosure also cannot be initiated over any debt less than 200 dollars.