An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

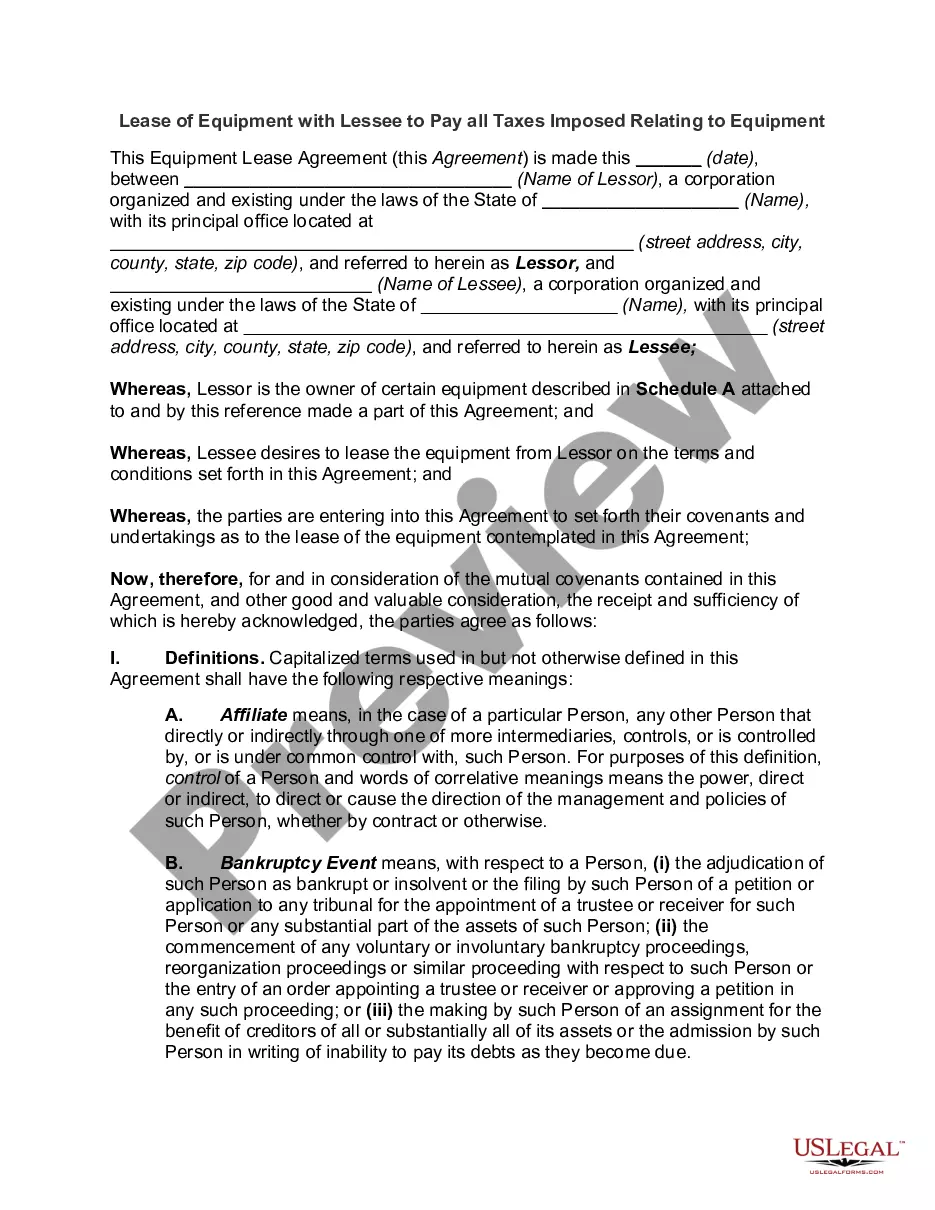

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.