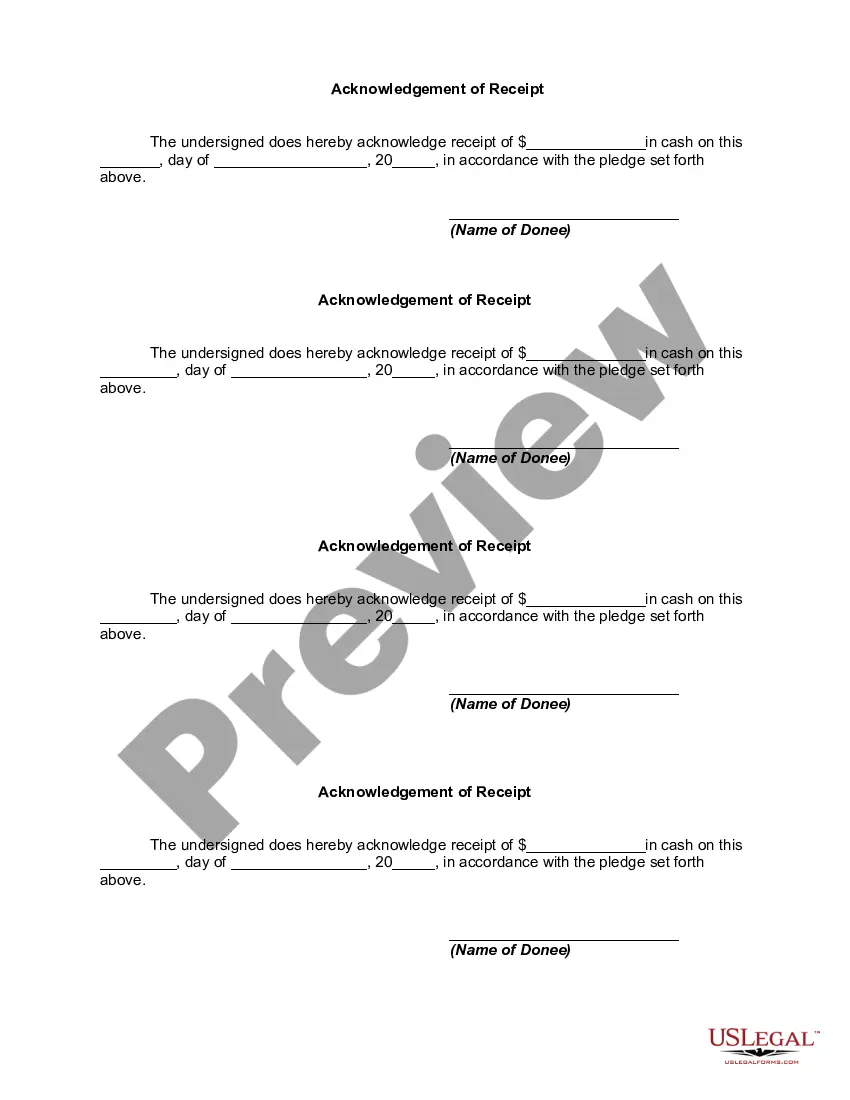

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are many legitimate document templates available on the internet, but finding trustworthy ones is not easy.

US Legal Forms offers a vast array of form templates, such as the Tennessee Declaration of Gift Over Several Year Period, designed to satisfy both state and federal requirements.

Choose a convenient document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can download another copy of the Tennessee Declaration of Gift Over Several Year Period anytime, if needed. Simply click the relevant form to download or print the document template.

Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service provides properly constructed legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Declaration of Gift Over Several Year Period template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct jurisdiction/area.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your needs and requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and finalize the order using your PayPal or credit card.

Form popularity

FAQ

In 1995, the annual gift tax exclusion was set at $10,000. This exclusion allows individuals to gift up to this amount without incurring taxes. As tax laws continue to evolve, knowing the history can help you strategize your gifting plans, making tools like the Tennessee Declaration of Gift Over Several Year Period increasingly valuable.

The estate tax rate has varied greatly over the years, often fluctuating between 18% to 55%, based on legislation. Understanding these changes helps you plan your estate and gifting strategies effectively. Utilizing mechanisms like the Tennessee Declaration of Gift Over Several Year Period can also minimize your tax burdens over time.

While the exact figure for the annual gift tax exclusion in 2025 has not been announced yet, it's expected to increase slightly due to inflation adjustments. Keeping an eye on these updates is important, especially if you plan on making significant gifts. Knowing how to structure gifts through the Tennessee Declaration of Gift Over Several Year Period can keep you informed and financially secure.

Yes, your parents can gift you $100,000, but it may trigger gift tax implications. They can choose to split their gifts and take advantage of the annual exclusion for each of you. Exploring the Tennessee Declaration of Gift Over Several Year Period can also help them manage the tax responsibilities effectively.

If you gift someone more than $15,000 in one year, you may need to file a gift tax return. The amount over $15,000 counts against your lifetime exclusion limit for gifts. However, if you properly utilize the Tennessee Declaration of Gift Over Several Year Period, you can avoid tax implications by distributing large gifts over multiple years.

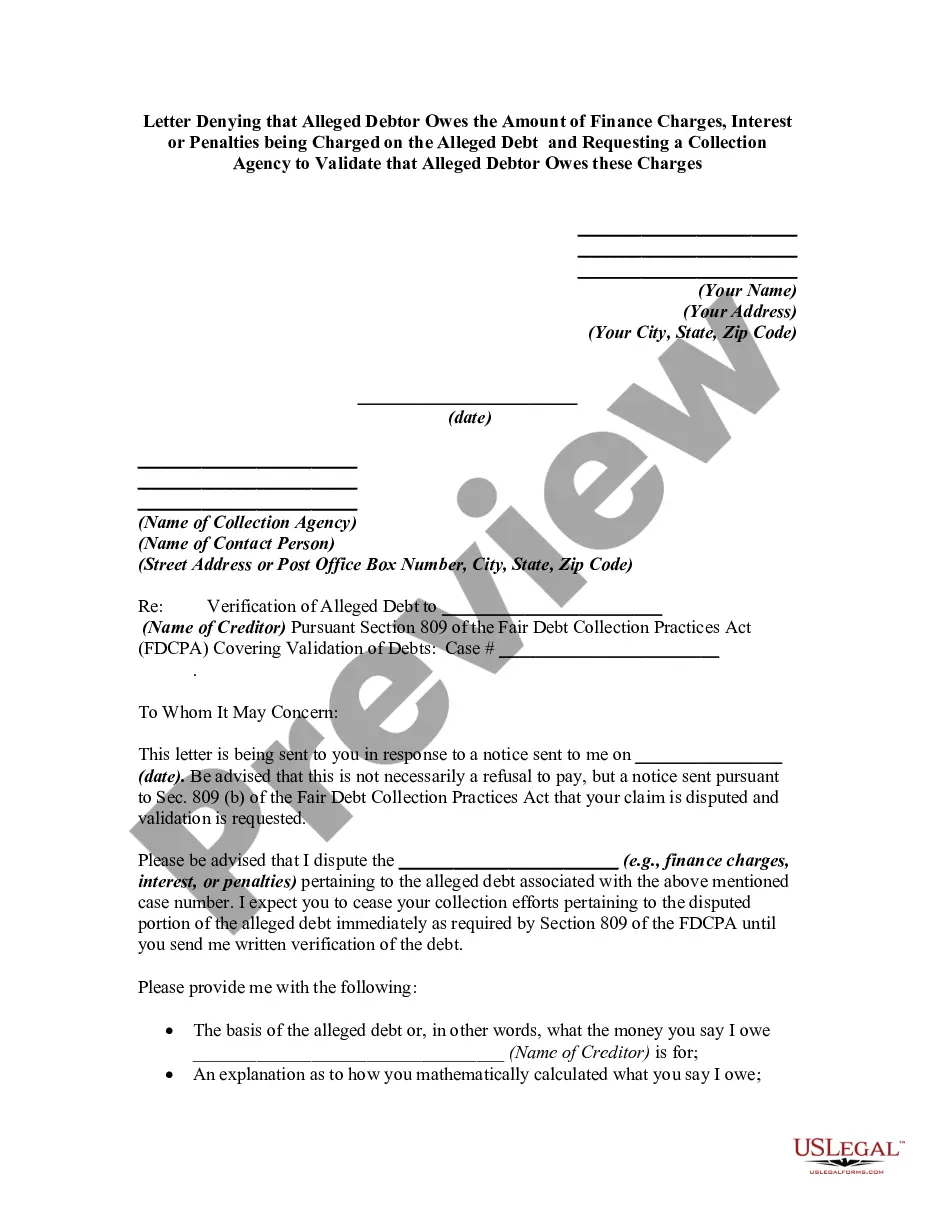

To report your lifetime gift exemption, you need to file IRS Form 709 for the year in which the gift was made. This is especially important when dealing with a Tennessee Declaration of Gift Over Several Year Period, as it tracks your exempt amounts and ensures compliance with federal guidelines. It's beneficial to work with tax professionals or platforms like US Legal Forms to prepare this form accurately. Proper reporting helps you maintain a clear record for future reference and potential estate planning.

The carryover rule allows certain gifts to be treated as if they were made in the year they are reported. Essentially, when you exceed the annual exclusion amount in a given year, the excess can be carried forward to future years, which benefits those following a Tennessee Declaration of Gift Over Several Year Period. This rule helps manage your tax liabilities more efficiently and leverages your lifetime exemption strategically. Understanding this rule is essential for anyone looking to maximize their estate planning.

Carryover gifts refer to gifts that are not fully utilized within the annual gift exclusion limits. In the context of a Tennessee Declaration of Gift Over Several Year Period, these gifts can be carried over to subsequent years, allowing you to take advantage of your lifetime gift exemption. This means that if a part of your gift exceeds the annual limit, you can allocate the excess amount to future years. Proper documentation is crucial to ensure compliance with IRS regulations.

A gift tax audit can be triggered by various factors, including discrepancies in reporting, excessive gifts that exceed the allowable exclusions, or random selection by the IRS. High-value gifts typically attract scrutiny, and it’s essential to maintain accurate records and documentation. If you're planning your gifts in line with the Tennessee Declaration of Gift Over Several Year Period, ensure everything is well-documented and compliant to avoid audits.

The annual gift exclusion is the amount you can gift to an individual each year without having to report it to the IRS. This exclusion amount has generally increased over the years and is $15,000 per recipient for 2021 and $16,000 for 2022. Understanding these amounts is crucial when utilizing the Tennessee Declaration of Gift Over Several Year Period in your financial planning.