Tennessee Non-Disclosure Agreement for Potential Investors

Description

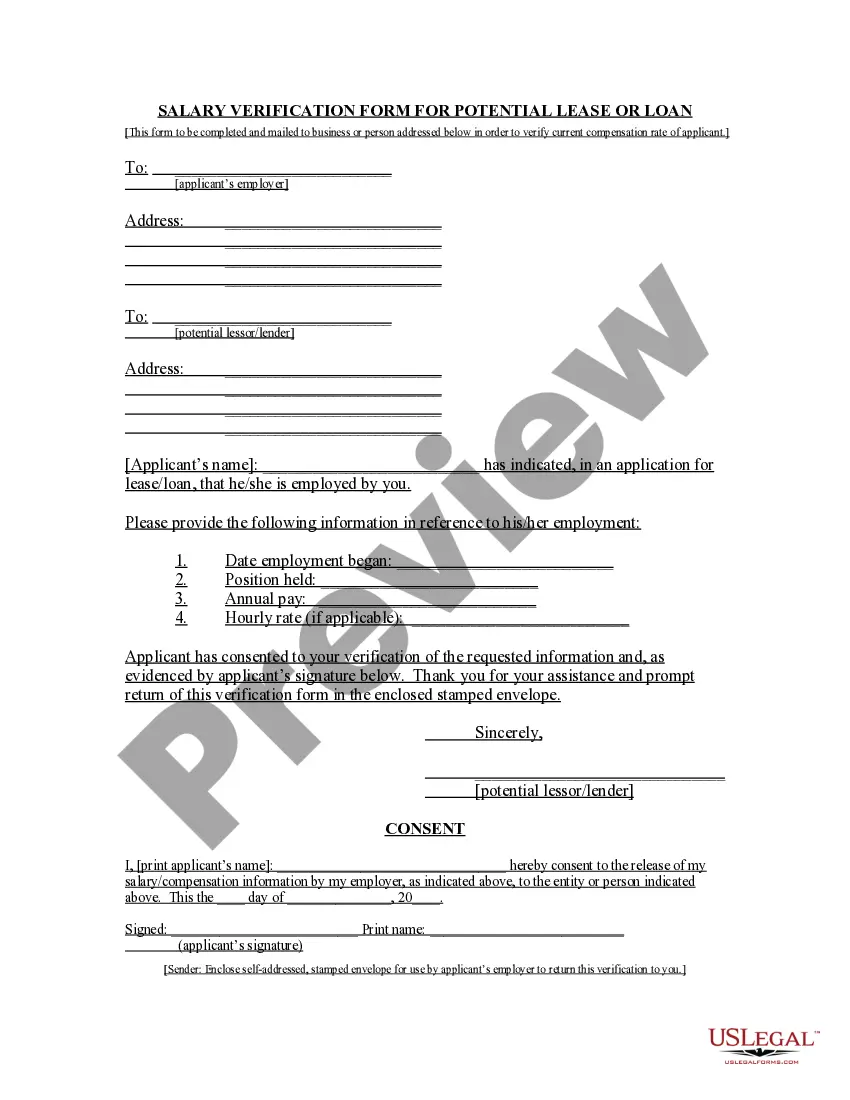

How to fill out Non-Disclosure Agreement For Potential Investors?

Selecting the appropriate official document format can be a challenge.

Indeed, there are numerous templates accessible online, but how can you obtain the official form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some easy steps to follow: First, make sure you select the appropriate form for your city/region. You can examine the document using the Preview button and review the document outline to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the right form. Once you are confident that the document is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and finalize the purchase using your PayPal account or credit card. Select the download format and retrieve the official document format to your device. Complete, modify, print, and sign the acquired Tennessee Non-Disclosure Agreement for Potential Investors. US Legal Forms boasts the largest collection of official templates, providing an array of expertly-prepared documents that comply with state requirements.

- The platform provides thousands of templates, including the Tennessee Non-Disclosure Agreement meant for Potential Investors, which can be utilized for both business and personal purposes.

- All the documents are reviewed by professionals and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to acquire the Tennessee Non-Disclosure Agreement for Potential Investors.

- Use your account to browse the official forms you might have obtained in the past.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

The risks of not having a Tennessee Non-Disclosure Agreement for Potential Investors are significant. You expose yourself to the possibility of information theft, which can jeopardize your business plans and investor relations. Moreover, without an NDA, pursuing legal action against a breach becomes complicated. Protecting your intellectual property and business strategies through an NDA is an essential step in safeguarding your interests.

If there is no Tennessee Non-Disclosure Agreement for Potential Investors in place, you risk unauthorized sharing of your sensitive information. Investors may use your proprietary ideas or business strategies without your consent, leading to potential financial losses and market disadvantages. Without an NDA, you may find it challenging to enforce your rights should disputes arise. Therefore, securing an NDA is vital for your protection.

A Tennessee Non-Disclosure Agreement for Potential Investors is a legal document that protects confidential information shared between parties during investment discussions. This agreement establishes trust by ensuring that sensitive details about your business ideas or financials remain confidential. By using an NDA, you create a structure that safeguards your interests while fostering an environment for genuine investment dialogue. It is a crucial tool in the investment process.

While a Tennessee Non-Disclosure Agreement for Potential Investors is often beneficial, there are scenarios where it may not be necessary. For instance, if the information is already public knowledge or if the relationship is built on mutual trust without the risk of sharing sensitive data, an NDA may be redundant. Understanding when to forgo an NDA can save you time and maintain open communication with your investors. Consider your specific situation carefully.

Yes, you can create your own Tennessee Non-Disclosure Agreement for Potential Investors. However, it is essential to ensure that the agreement includes key elements such as definitions, obligations, and termination clauses. Using a template from a reliable source like US Legal Forms can simplify the process and help you avoid potential legal pitfalls. A well-drafted NDA safeguards your sensitive information as you seek potential investors.

The three types of disclosure usually discussed in NDAs are voluntary disclosure, involuntary disclosure, and statutory disclosure. Voluntary disclosure occurs when a party willingly shares information, while involuntary disclosure happens due to circumstances beyond the party's control. Statutory disclosure refers to information that must be disclosed according to laws or regulations. Utilizing a Tennessee Non-Disclosure Agreement for Potential Investors can help define these disclosure types clearly.

The primary difference lies in the protection offered. A mutual NDA allows both parties to share confidential information while ensuring both are protected. In contrast, a one-way NDA restricts protection to just one party's information. For Tennessee Non-Disclosure Agreements for Potential Investors, understanding this distinction aids in crafting an agreement that meets your specific needs.

Typically, a Non-Disclosure Agreement consists of three main parts: the definition of confidential information, the obligations of the receiving party, and the term of the agreement. The definition section clarifies what qualifies as confidential information. The obligations section outlines what the receiving party must do to protect this information. Finally, the term specifies how long the NDA remains in effect, critical for any Tennessee Non-Disclosure Agreement for Potential Investors.

The three most common types of Non-Disclosure Agreements are mutual NDAs, one-way NDAs, and multilateral NDAs. A mutual NDA involves two parties protecting each other's information. A one-way NDA protects only one party's disclosures, while a multilateral NDA involves multiple parties, ensuring all shared information remains confidential. Understanding these options is vital when drafting a Tennessee Non-Disclosure Agreement for Potential Investors.

There are generally two types of Non-Disclosure Agreements: mutual NDAs and one-way NDAs. A mutual NDA protects both parties by ensuring that any shared information remains confidential. In contrast, a one-way NDA provides protection exclusively for one party's information. For Tennessee Non-Disclosure Agreements for Potential Investors, choosing the right type depends on the nature of the business relationship.