Tennessee Equipment Lease - Detailed

Description

How to fill out Equipment Lease - Detailed?

Are you presently in the circumstance where you require documents for either a business or particular purposes nearly every workday? There are numerous lawful document templates obtainable online, but finding ones you can trust isn't simple.

US Legal Forms presents a vast array of template documents, such as the Tennessee Equipment Lease - Detailed, which can be tailored to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Subsequently, you can download the Tennessee Equipment Lease - Detailed template.

- Acquire the document you need and verify it is for the correct city/state.

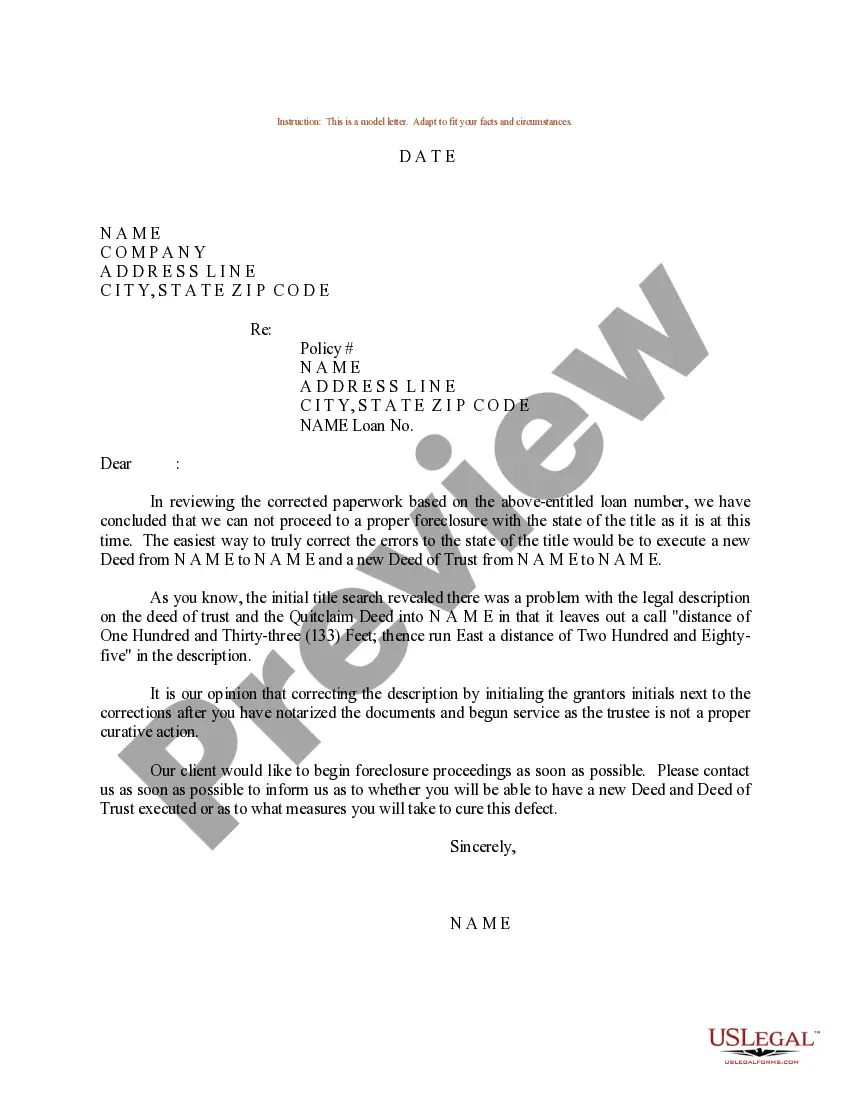

- Utilize the Preview feature to review the form.

- Examine the description to ensure you have selected the appropriate document.

- If the document isn’t what you are searching for, use the Search area to find the template that matches your requirements and specifications.

- Once you find the suitable document, click on Purchase now.

- Choose the pricing plan you prefer, provide the necessary details to process your payment, and complete your purchase using PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

In most cases, the lease payments are fully tax deductible, especially in the case of an operating lease. However, with a Tennessee Equipment Lease - Detailed, certain conditions need to be met for full deductibility. It's crucial to understand what qualifies as an operating lease and to consult with a tax expert to ensure you maximize your tax benefits. Accurate documentation will also make the process smoother.

Leases are typically classified as either operating leases or capital leases for tax purposes. A Tennessee Equipment Lease - Detailed might fall into either category based on its specific terms. Operating leases allow you to write off payments as expenses, while capital leases may require you to capitalize the leased asset. Knowing this distinction is vital for accurate financial reporting and tax compliance.

Yes, equipment rentals are generally subject to sales tax in Tennessee. When you decide to enter a Tennessee Equipment Lease - Detailed, it is important to factor in the tax implications. Depending on the nature of the equipment and its use, different tax rates may apply. Understanding these details ensures you remain compliant with state regulations.

Yes, leasing equipment can be tax deductible. When you enter a Tennessee Equipment Lease - Detailed, you can typically write off the lease payments as a business expense. This deduction helps to lower your taxable income, making it a beneficial option for many businesses. However, always consult with a tax professional to understand specific implications for your situation.

In Tennessee, it is not typically required for a lease to be notarized. However, having a notarized Tennessee Equipment Lease - Detailed can provide additional legal assurance and protection for both parties involved. It’s always wise to consult with a legal expert to ensure your lease meets any necessary requirements.

A lease on equipment works through a contractual agreement that allows you to use the equipment for a defined time while making periodic payments. The lessee maintains operational control, but ownership remains with the lessor. Understanding the specifics of a Tennessee Equipment Lease - Detailed will help you maximize the use of the equipment while staying compliant with your commitments.

Yes, Tennessee does have laws governing leases, including equipment leases. These laws outline the rights and responsibilities of both lessees and lessors. To ensure compliance with Tennessee laws and to protect your interests, consider using a Tennessee Equipment Lease - Detailed that aligns with state regulations.

An equipment lease operates as a contractual arrangement between you and the lessor where you can use the equipment for a specified period in exchange for regular payments. The lessor maintains ownership of the equipment, while you get the benefit of using it without the high upfront costs. When you enter into a Tennessee Equipment Lease - Detailed, your payment structure and duration will be clearly outlined in the contract.

Leased equipment is usually considered an expense for tax purposes, possibly allowing deductions on your tax return. Be sure to track your payments and document the lease terms thoroughly. For comprehensive guidance, explore our Tennessee Equipment Lease - Detailed resources, designed to assist you with tax implications.

Setting up an equipment lease involves defining key terms such as duration, payment amounts, and usage conditions. Using a structured template can simplify the process. Our Tennessee Equipment Lease - Detailed templates provide a user-friendly framework to ensure you cover all necessary points.