This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

It is feasible to spend several hours online looking for the legal document format that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are evaluated by professionals.

You can easily obtain or generate the Tennessee Agreement Terminating Business Interest in Relation to Specific Real Property from their service.

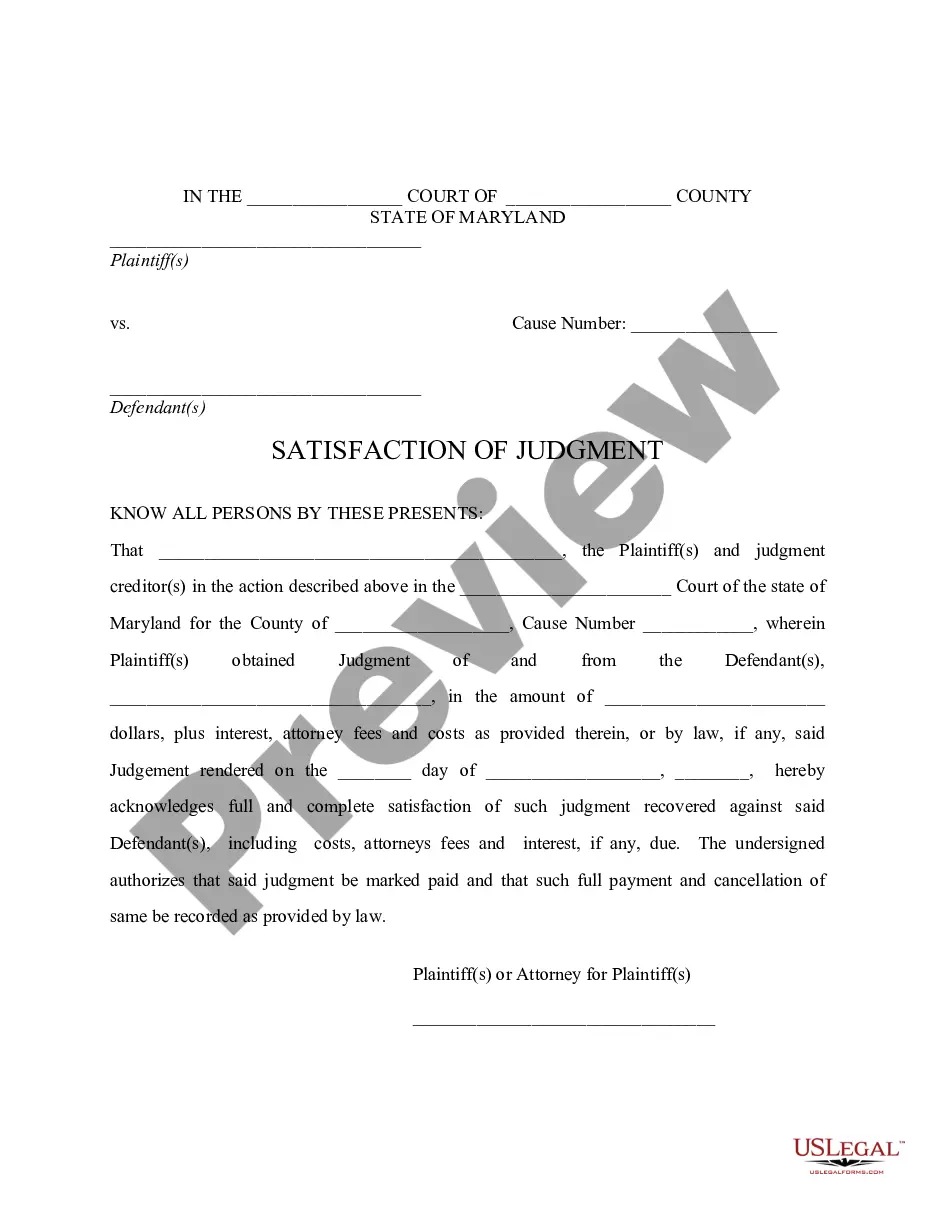

If available, use the Preview button to review the document format as well.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- Afterward, you can fill out, modify, print, or sign the Tennessee Agreement Terminating Business Interest in Relation to Specific Real Property.

- Every legal document template you acquire is yours permanently.

- To get an additional copy of a purchased form, go to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/city of your choice.

- Read the form description to confirm you have selected the appropriate template.

Form popularity

FAQ

Yes, when you close your business, you must notify the IRS. You will need to file a final tax return and report the closure to ensure that everything is settled properly. Additionally, if the Tennessee Agreement Dissolving Business Interest in Connection with Certain Real Property affects your tax obligations, it’s essential to consider this during your closure. Keeping the IRS informed helps avoid future complications.

If you want to shut down a business, first review the agreements in place, particularly the Tennessee Agreement Dissolving Business Interest in Connection with Certain Real Property. Then, follow the appropriate legal procedures to file for dissolution. It's wise to consult with a legal professional to handle any complications that may arise during the shutdown process. By taking these steps, you can effectively close your business.

To dissolve a business in Tennessee, start by gathering the necessary documents, including the Tennessee Agreement Dissolving Business Interest in Connection with Certain Real Property. You need to file a formal dissolution with the Tennessee Secretary of State. Additionally, settle any financial obligations, and make sure to notify partners and stakeholders. This process ensures a smooth transition and compliance with state regulations.

How to Close a Corporation in TennesseeHave a board of directors' meeting.Have a shareholders' meeting in order to approve the motion to dissolve the corporation.Submit a written Consent to Dissolution to the Tennessee Secretary of State.Submit any required annual reports to the Tennessee Secretary of State.More items...

The first step in dissolving a corporation usually involves having your board of directors and shareholders vote to approve the dissolution. Under most state rules, you start by holding a meeting of the board of directors to vote on a resolution to approve the dissolution of the corporation.

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

What Does It Mean to Dissolve a Corporation?Hold a board of directors meeting and formally move to dissolve your corporation.Fill out and file the appropriate dissolution documents with the Tennessee Secretary of State.Fulfill all tax obligations with the state of Tennessee, as well as with the IRS.More items...?

Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State. Pay off any outstanding business debts. Pay any outstanding taxes and administrative fees.

Closing a BusinessStandard Business Licensea final Business Tax Return must be filed with the Tennessee Department of Revenue within 15 days of closing.Minimal Activity Business Licenseyou only need to notify the County Clerk's Office at 423-209-6500 or email BusinessLicense@HamiltonTN.gov.More items...