Assignment is the act of transferring power or rights to another, such as contractual rights. Accounts may be characterized as accounts payable, which is money that is owed to be paid to another, or accounts receivable, which is money owed for products or services to a provider of the same. This generic form is assignment of a particular account receivable.

Tennessee Assignment of Particular Account

Description

How to fill out Assignment Of Particular Account?

Are you currently within a position the place you need paperwork for both enterprise or individual reasons virtually every day time? There are a lot of legitimate document layouts accessible on the Internet, but getting types you can rely isn`t effortless. US Legal Forms gives thousands of develop layouts, such as the Tennessee Assignment of Particular Account, which are written to meet federal and state demands.

If you are previously acquainted with US Legal Forms website and get an account, simply log in. Following that, it is possible to download the Tennessee Assignment of Particular Account format.

Should you not have an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the develop you want and ensure it is for your appropriate metropolis/state.

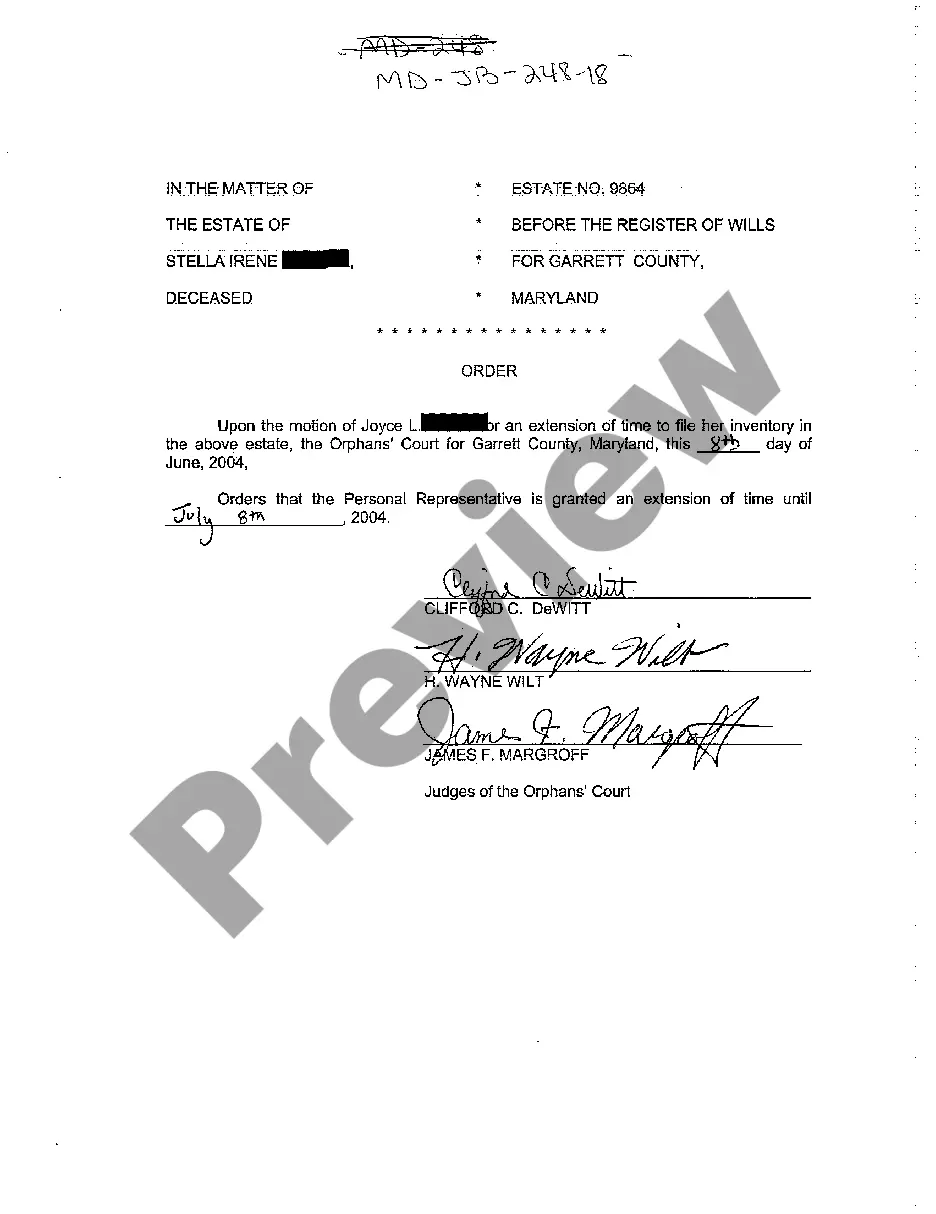

- Use the Review button to examine the form.

- Browse the outline to ensure that you have chosen the proper develop.

- In the event the develop isn`t what you`re searching for, utilize the Look for discipline to get the develop that suits you and demands.

- Whenever you obtain the appropriate develop, click Buy now.

- Choose the rates prepare you desire, fill in the necessary information and facts to make your bank account, and pay for the order utilizing your PayPal or credit card.

- Decide on a convenient paper file format and download your copy.

Get every one of the document layouts you possess bought in the My Forms menus. You can get a further copy of Tennessee Assignment of Particular Account whenever, if required. Just select the required develop to download or printing the document format.

Use US Legal Forms, by far the most comprehensive variety of legitimate varieties, to save lots of time and stay away from errors. The support gives skillfully produced legitimate document layouts that you can use for a variety of reasons. Produce an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Assignment and Assumption Agreement and Optional Novation (TN) An agreement to be used when a party transfers specified contracts to another party, including an assignment of all of its contractual rights and delegation of all of its contractual duties under Tennessee law.

When Is a Contract Assignment Valid? Contract rights and benefits can lawfully be assigned so long as no prior agreement prohibits an assignment. All required is for the assigning party (the assignor) to agree with the assignee (the third party recipient) that they will be transmitting their rights to them.

The transfer of a right from one party to another. For example, a party to a contract (the assignor) may, as a general rule and subject to the express terms of a contract, assign its rights under the contract to a third party (the assignee) without the consent of the party against whom those rights are held.

Generally speaking, contracts can be freely assigned to third parties. Non-assignment provisions are designed so that contracts cannot be as freely assigned to third parties; or at least, not without first obtaining the contracting counterparty's consent.

Exceptions Where a Contract Cannot be Assigned Unenforceable assignments include the following: a personal services agreement, changing the contract duties, changing the material provisions of the agreement (e.g. time, amount, location, etc.).