No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

Tennessee Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

If you wish to total, acquire, or print out lawful papers layouts, use US Legal Forms, the largest collection of lawful types, that can be found on the Internet. Make use of the site`s basic and hassle-free search to discover the papers you will need. A variety of layouts for organization and specific uses are categorized by classes and states, or search phrases. Use US Legal Forms to discover the Tennessee Report to Creditor by Collection Agency Regarding Judgment Against Debtor in a few click throughs.

In case you are presently a US Legal Forms customer, log in in your account and click the Download option to obtain the Tennessee Report to Creditor by Collection Agency Regarding Judgment Against Debtor. You may also gain access to types you formerly saved inside the My Forms tab of your respective account.

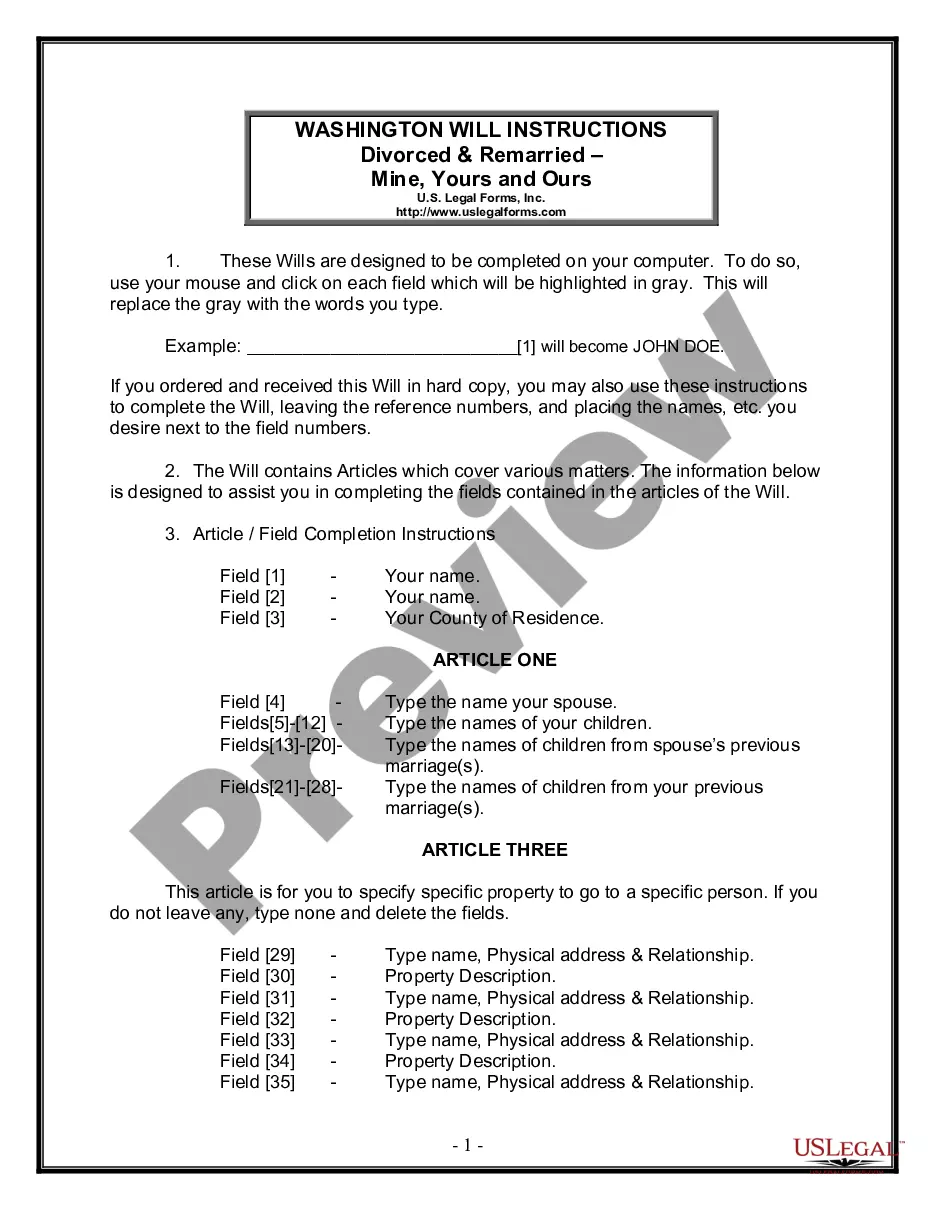

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your proper city/country.

- Step 2. Use the Review method to look over the form`s content. Do not forget about to see the explanation.

- Step 3. In case you are not satisfied with the form, utilize the Research industry at the top of the display to get other versions from the lawful form format.

- Step 4. When you have located the form you will need, click on the Acquire now option. Opt for the pricing plan you prefer and include your references to register to have an account.

- Step 5. Process the purchase. You may use your bank card or PayPal account to finish the purchase.

- Step 6. Find the structure from the lawful form and acquire it on the product.

- Step 7. Complete, revise and print out or sign the Tennessee Report to Creditor by Collection Agency Regarding Judgment Against Debtor.

Each and every lawful papers format you buy is the one you have eternally. You may have acces to every form you saved inside your acccount. Click the My Forms area and select a form to print out or acquire again.

Compete and acquire, and print out the Tennessee Report to Creditor by Collection Agency Regarding Judgment Against Debtor with US Legal Forms. There are thousands of professional and express-certain types you can use to your organization or specific requirements.

Form popularity

FAQ

Here, then, are ten of the best-kept collection secrets. The More You Pay, the More They Earn. ... Payment Deadlines Are Phony. ... They Don't Need a 'Financial Statement' ... The Threats Are Inflated. ... You Can Stop Their Calls. ... They Can Find Out How Much You Have in the Bank. ... If You're Out of State, They're Out of Luck.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

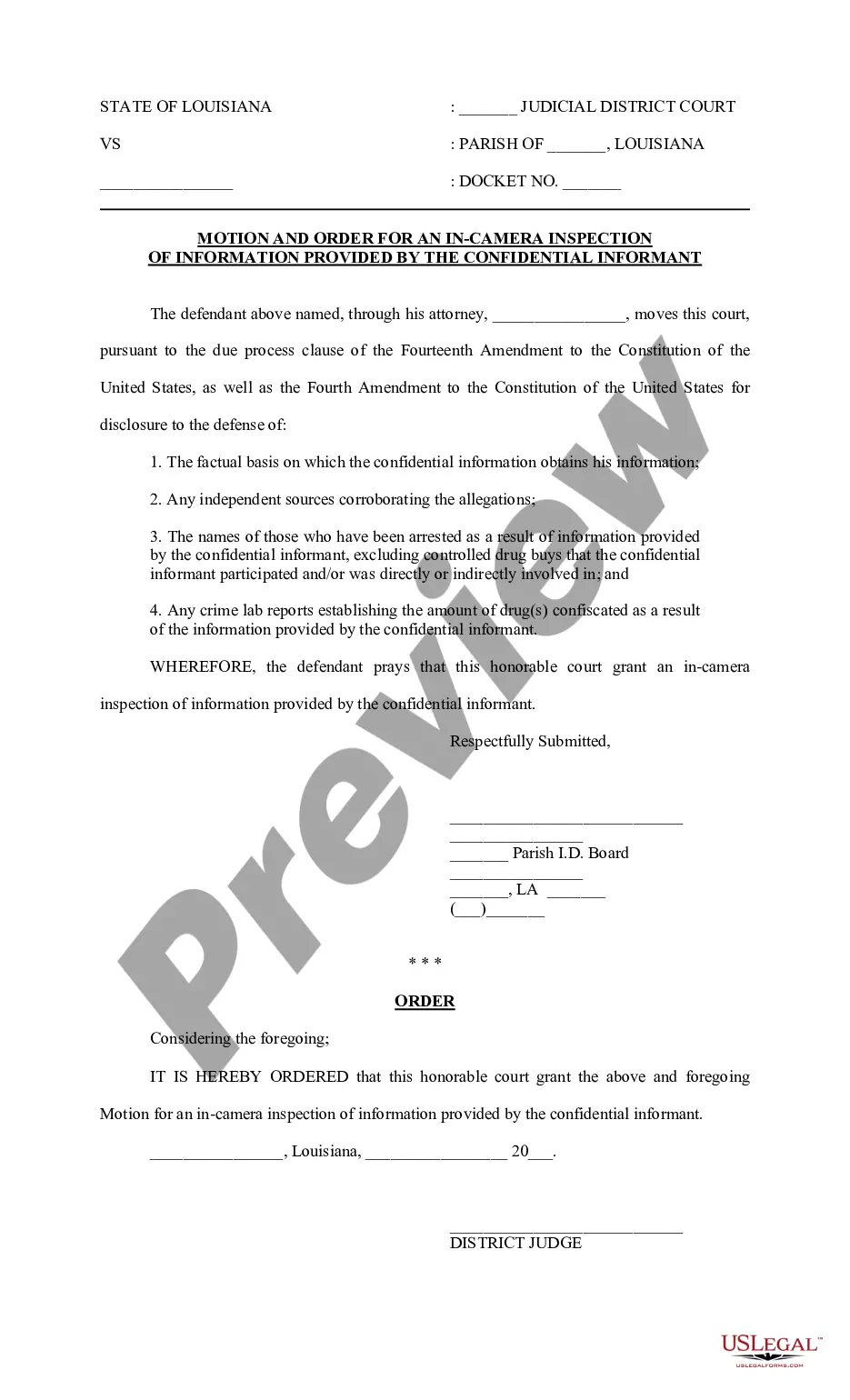

A judgment is a court order stating that you owe the debt collector money because of a lawsuit. You may have received a judgment because the court decided in favor of the debt collector in a trial, or because you did not respond to a lawsuit that was filed against you.

Collecting a Judgment in Tennessee Wage Garnishment. If you can discover the defendant's employer, you should file their employment information with the court. ... Bank Levy. If you know where the defendant has money in a bank account, you can also file this information with the court. ... Property Liens.

A debt collector can't harass you Harassment can include: using threatening, intimidating, or profane language. exerting excessive or unreasonable pressure. publishing or threatening to publish your failure to pay.

In the state of Tennessee, the statute of limitations is six years. Once the six years is up, the lender legally cannot sue to collect the debt. This does not mean that if you do not pay your debt in six years that you are free from creditors.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.