An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

Are you currently in a place the place you require papers for possibly business or individual functions just about every day? There are a lot of lawful file web templates available online, but finding ones you can depend on isn`t simple. US Legal Forms delivers thousands of develop web templates, much like the Tennessee Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage, which are composed in order to meet federal and state specifications.

In case you are currently knowledgeable about US Legal Forms web site and also have a free account, merely log in. Following that, you are able to down load the Tennessee Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage template.

Unless you provide an profile and want to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for that correct city/county.

- Take advantage of the Review key to check the shape.

- See the description to actually have chosen the correct develop.

- In the event the develop isn`t what you are searching for, use the Look for industry to obtain the develop that meets your requirements and specifications.

- Once you get the correct develop, click on Acquire now.

- Choose the pricing program you need, submit the required information and facts to produce your bank account, and purchase an order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free file file format and down load your version.

Locate all the file web templates you possess purchased in the My Forms food list. You can aquire a additional version of Tennessee Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage at any time, if possible. Just go through the required develop to down load or print the file template.

Use US Legal Forms, probably the most considerable assortment of lawful varieties, to conserve time and stay away from mistakes. The services delivers expertly produced lawful file web templates that can be used for a variety of functions. Produce a free account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

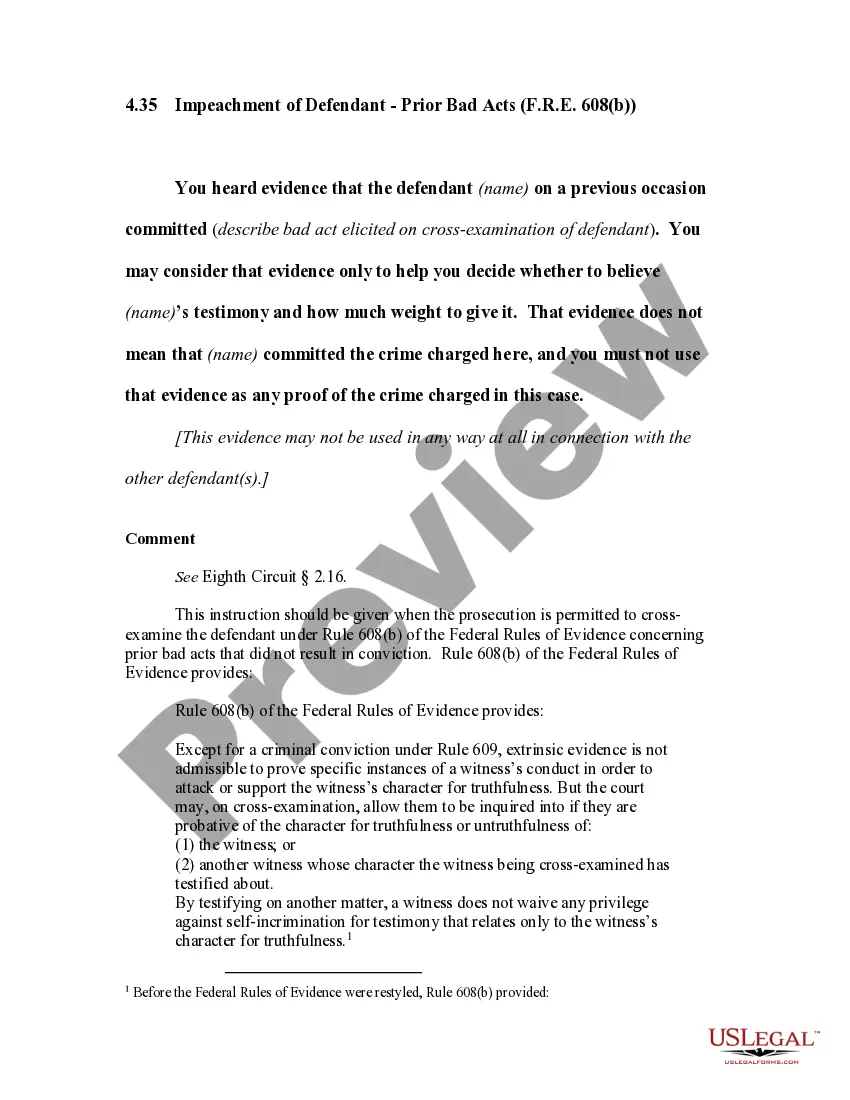

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

A borrower usually must sign a promissory note along with the mortgage. The promissory note gives legal protections to the lender if the borrower defaults on the debt and provides clarification to the borrower so that they understand their repayment obligations.

What Is Loan Modification? Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

The lender keeps the original promissory note until you have fulfilled all obligations, i.e., paid off, your mortgage. A promissory note will generally contain the following information: The total amount of money borrowed; Your interest rate (either fixed or adjustable);

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

Borrower's promise to pay is secured by a mortgage, deed of trust or similar security instrument that is dated the same date as this Note and called the ?Security Instrument.? The Security Instrument protects the Lender from losses, which might result if Borrower defaults under this Note.

The mortgage ? known as a deed of trust in some states ? is the document that secures the loan, giving your mortgage lender or servicer the right to take possession of your home and sell it should you fail to repay it as bound by the note.

Mortgage Note: --is a type of promissory note that is secured by a mortgage loan. --provides security for the loan held by the promissory note. --agreements between the borrower and lender that allow the lender to demand full repayment of a loan should the borrower default on the loan.